The Scottish Play: Luck or judgement?

Three topics this week: has Sunak’s luck changed? Has India’s bull run ended, and where is this much-discussed recession?

The Art of the Possible

Image from Wikemedia - by Neide José Paixão

Looking at Absolute Return – Can it be Done?

A wise old hand once told me that all investors want is protection from inflation; do that, earn your fees and your job’s done. Read more

All Clear? REITs and Private Equity

When do we go back to property (REITs) and private equity (PE)? We look closely at these two areas, as there appears to be nothing new to see or say on interest rates or inflation.

Macro is dull just now

Neither the Fed nor the Bank of England, nor indeed the ECB meet this month. So, the default is to assume a half point rise all round. Which should mean Western central banks are broadly aligned for a while, so by implication are currencies.

Clipped from this site – downloadable from source.

Recessions lag rate rises, so are not due yet either, although clearly one is coming.

Inflation will probably drift lower, but the employment markets stay strong, as the shuddering readjustment out of COVID continues to keep churn elevated. In person service hires roughly balance stay-at-home sector losses for now.

Basic food commodities, which have driven much of the recent inflation surge, will stay elevated until the current crops/stock are harvested and replanted late in the spring. Energy is possibly oversupplied for this winter. So not that much change in those two inflation drivers yet.

REITs

So, when is it safe to go back into risky assets? We look at two contrasting stories, firstly REITS which are seen as bond proxies, so cannot properly bounce until rates top out. This seems to need a couple of months at “no change” from the Central Banks. We are less sure about quantitative tightening ending, but most of the market gets spooked by that too. We think it matters little, because masses of global liquidity make what US banks hold somewhat irrelevant.

Nor do we see why REIT assets held on 7–8-year leases with typical debt fixed for half that term, should oscillate so violently over a few months, but that’s life, they just do.

Does property matter?

Institutional interest is not high, we know that, and most institutions need daily liquidity before all else, which lumpy property can’t give. Plus, for boring old REITS a lot has changed for the worse.

Who knows where retail space settles? It remains over supplied (and overtaxed), likewise probably office space, with the added wrinkle of retrofitting for carbon neutrality. COVID created an excess of new storage and warehousing, which also needs to be worked through, so that’s not safe either. While no institution wants the grief (or bad publicity) of dealing with individual tenants and homeowners, so we have long thought if you want to play the residential market, buy high street banks, as a kind of proxy. Mortgage lending is about all they do now.

It is private investors who still love property as a tangible asset; most are over invested in property and have been over rewarded for being so. Habit really. But if they had that habit before, they are still keen to know when to step back in, at bargain basement prices.

Private equity

Now PE, is a bit different. Yes, private investors like it (like hedge funds) but trust it about as much. Never sure why you would buy a car with just an accelerator pedal, and only forward gear, but most investors buy just that: no shorting, long only for ever. Must be nice to have a mind wedded to constantly rising prices (which long only implies).

PE is just that, so you are buying for management endlessly improving, but adding into the mix a belief in high gearing. You also believe that the managers will constantly be selling and buying investments at a profit. So, you must endlessly mark up your stock, to shift it too.

Can it really work like that?

Markets do not agree.

So, while there are many eye-wateringly deep discounts in PE, markets expect debt to blow a few things up and prices to sell stock to be cut back hard. With some reason, big banks have a shed-load of deal related debt stuck on their balance sheets, probably a fair bit of equity too, and no one is underwriting an IPO, if there is a scintilla of risk left involved. So, unless it is marked down, we have a stand-off, a buyers’ strike.

And in tech, the flaky stuff (AIM etc) is back down below pre-COVID levels, and possibly still falling, which is logical. The better stuff, but with an FX impact, bottomed out a while back, possibly in June? The big “portfolio” quoted holders did so in October, when discounts maxed out around 50% and the FX (i.e., dollar) tailwind was keeping asset values rising.

NASDAQ - a proxy for private equity

However, the NASDAQ hit a new low on 28th December, and that looks much less like a clear bottom, more a long base from October. It is a tough call; NASDAQ multiples drive PE valuations, so that is not helping. Investments with three year’s money a year ago, now have two year’s cash and judging by the speed of layoffs, know that when that drops to one year, funding lines either dry up, or get super pricey. And I don’t see FX helping much this year.

So yes, massive discounts, but also yes, huge lags and the normal discount implied for firms that mark their own homework on the valuation side. Audit firms may also be growing more supine (or getting sacked if they ask the real questions).

So, on a five-year view the sector is fine, even cheap, but on a five month or five-day view? The jury is still out.

While the PE sector is still looking better than REITS in terms of recent prices, it is still, in our view, the one that has yet to base out. If the reason for revival is a flourishing IPO market, that feels more like three years away; by contrast the stability in interest rates that REITs need will probably arrive this year.

So, we stay in touch with both areas, but by no means all in - not just yet anyway. But nor given the performance and yield they give, can they be ignored for ever.

Welcome to 2023.

Charles Gillams

Into Broad, Sunlit Uplands?

This week has included a major but baffling fixed interest event in London. And we include some thoughts on the novelty of a conservative prime minister for the Conservative party - but first, the shape of the coming recession.

Who Survives in the Coming Recession?

It may help to see this recession, as just the reversal of the COVID boom, paid for with debt and deeply inflationary; in which case what should it look like? The ultimate aim will be to unlock labour markets, where we said (in our newsletter of 20-3-21) that COVID would do most harm.

Unlike traded goods or commodities or liquid assets, there is no simple snap back available without pain, because labour pricing is inflexible downwards. Indeed organised labour has worked hard to embed that inflexibility, notably in minimum wage laws, and the crippling of the hated gig economy.

Certain capital assets too are stranded and inflexible, but probably not most commercial (or residential) rents. Large single purpose buildings may be vulnerable and we feel, so is quite a lot of owner occupied residential property, whereby recent unearned gains will now need reversing.

Labour costs have two available paths. Either the 40% of working age adults who have now withdrawn from the labour market must (in some measure) return. It is their ongoing withdrawal post COVID that has hurt most. While COVID has also created (mainly in the public sector) a lot of extra staffing that is hard to step back from, especially in healthcare, which further depletes the available labour pool, and must also be reversed. Reducing labour taxes also helps.

Possible business failures

If not, there may instead need to be widespread private sector business failures. The third option, a speeding up of capital investment to substitute for labour, has somehow failed to be either fast enough or effective enough. It seems just too hard for businesses to predict demand paths, to commit to such expenditure. Cap ex is all about confidence, which is absent.

How then to measure if this labour reset finally happens? Well it looks as if job creation will need to go into reverse, with a net two quarters (at least) of contraction. There are plenty of businesses to fail, speculative and derivative loss making tech for a start, retailers of goods who over extended in the supply chain inspired boom, service sector spaces, where the current surge has drawn in capacity well in excess of long run demand, will all get hit.

As will everyday businesses, that have net margins that can’t withstand the double figure interest rates demanded of sub prime (i.e. now most SME) borrowers.

Paint that template over where the most savage equity falls have already happened, it fits quite well. But it is by no means universal, if IP, not labour matters, or labour can be off-shored, it is in a better place.

Although as jobs disappear, so the strain reaches further into total consumption and demand.

Fixed or Floating.

What of fixed income? Well we took the view early this year that you can’t stand in the way of an avalanche, unless you hope to surf it. So we kept clear, and still are.

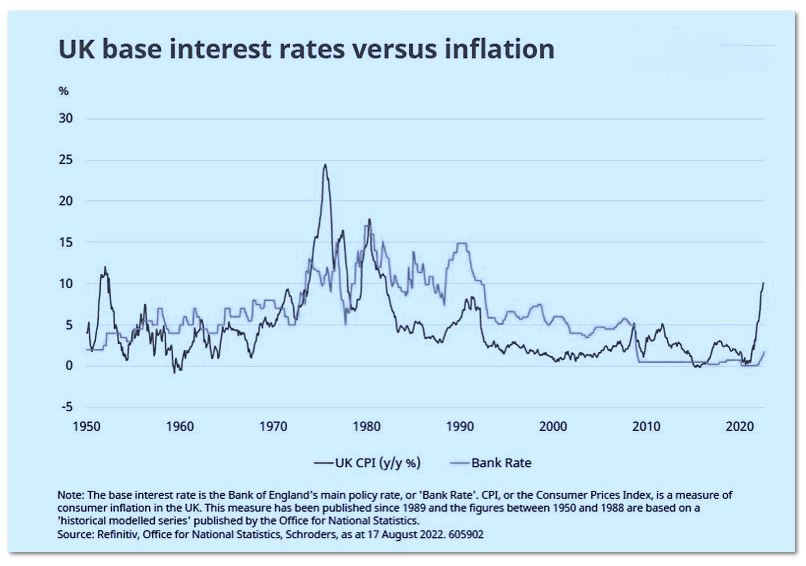

Source : this page

It was a very well attended fixed income conference in London this week, so credit is clearly back into portfolios, big time. My worry was the Table Mountain (or Brecon Beacons or Grand Canyon) graphs. All of which were steep sided, but flat topped, and on all of which, just now, is the exact point when lungs bursting, you climb the last butte, to see a vast sunlight upland.

Really? Why? No idea, but somehow the collective belief is rates top out circa 4% and then fall.

Certainly not if they mirror the inflation path (see above), that gap is now vast twixt interest rates and inflation; it will close - it has to. However we see more rises, not a near term peak and also far slower falls, than the market does. Reason? It is labour inflation that now drives it, and it won’t roll over soon.

Unless that is, the rate rises so far have done real damage and rates are then cut to mitigate a severe recession. If that’s the expectation (and it may be) you really don’t want equities at all, not even energy, the year’s bright spot.

So the question is, are high yield bonds now cheap?

Well yes, and quite attractive; defaults at the rate now implied, are unheard of. But if that odd plateau graph of rates is wrong, everything has yet to get even cheaper. That’s the rub. And that is why, for now, bar floating rate, secured, we are still not going into credit. And also because global interest rates must eventually align, so the dollar’s ongoing strength is a bad sign, as that will have to reverse too. This makes dollar assets themselves now dangerous.

The same dilemma is true for equities, yes, high quality, mid-size companies look cheap, the FTSE 250 is down some 20% in a year, almost as bad as the NASDAQ, whereas the FTSE 100 is modestly up (a distinction shared only with the Nifty 50). But again, we thought that value was emerging in the summer, but sadly not so; the market still sees a viscous earnings contraction ahead.

Which brings us back to employment, either it must fall, or participation must rise, and I fear we expect a fall, which seems more likely. This cycle, in the all important labour markets, still feels a long way from done.

New Broom

As for Truss, well talk of growth at the inept and hidebound Treasury is a nice change. As is that of getting the country working (spot on). This is core free market stuff. Has she the votes? Pretty sure she has, it was odd for the left wing of the party to eject Boris, who his actions showed was one of theirs. To unseat another leader would guarantee oblivion, so they must back her.

Worrying about fiscal rectitude, for a two year government, seems oddly implausible too. Yet she still fell prey to the old belief that governments (and higher tax) solve everything with her energy package, least of all can that solve demand based inflation. That is for Central Banks to do, and as ever, they are getting no help from the rest of government.

Does this suggest a big US rate hike this week? Not sure, we are much more seeing the end point as rather higher, than faster near term rises. We kind of think the Fed has made their point already.

Boris finally quits, and 'Quality Growth'

Boris finally quits: the loss of his Chancellor clearly made this inevitable. We also reflect on the London Quality Growth Conference, held in Westminster last month. It implies a very US bias, driven by two US universities, that seem to dominate much of UK investing and indeed public policy.

First as tragedy, then as farce

So, it is over. The absurd repetition of the same error and the same apology passed from tragedy to farce.

Clearly the belief that you fight inflation and unpopularity, by bankrupting the country with printing money, had also simply become too much for Sunak. That was the fatal blow. Let us hope the next leader is less of a deranged populist. In the real world what is popular seldom overlaps with what is right.

We will skip the look backward, over his flawed career, skip the look forward over the seven dwarves, and fervently hope for a different set of economic policies by his successor. It sounds as if there is plenty of time for a long summer of speculation. The likely candidates are less than attractive, let us say.

How might the UK market respond?

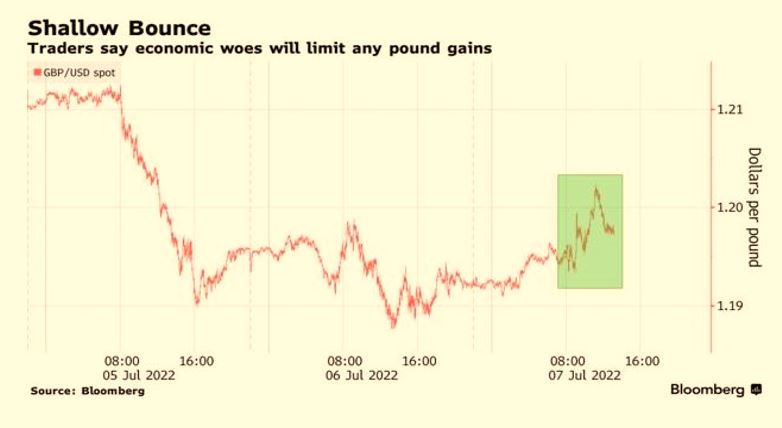

Nor can I fathom a market response to a change of leader in London: bullish that it is over? Or could it be bearish as we don’t know what comes next, or indeed bearish in that it surely strengthens the opposition?

While we felt the Old Lady moved far earlier than others (late in 2021) because of UK fiscal laxity, we see no reason yet for them to back off their August rate hike. Politically it is hard to stop and start interest rate moves, while just repeating a previous measure in mid-summer will look innocuous. I suspect that’s true for September too, but that feels a long way off. And I do note, that as we predicted, the great spike in corn and wheat prices has taken just one growing season to unravel, as farmers react quickly, by adjusting cropping patterns, knocking out another justification for any more price rises.

A weak pound is also importing inflation, and the Bank has to make a stand somewhere, but 1.19 to the dollar feels too early, 1.09? Pressure will start.

Alchemy Unchained?

We turn now to ‘Quality Growth’, an excellent conference and well presented with a dozen first rate managers from the US, UK, Europe presenting.

But it led me to ask about the underlying assumptions of the ‘Quality Growth’ model.

Firstly, there is the Santa Fe school, which speaks of the ultimate failure of nearly all quoted companies. This is the old ‘99% of the S&P 500 stocks contribute nothing to returns’ case. Allied to that is the Columbia (New York) mantra that some companies can beat the pack for ever, so the theory is find those “compounders” with their ‘deep moats’ and your investors will win for ever.

It was surprising how much of current fund management practice is wedded to those two assumptions. They look remarkably shaky to me, but if believed by enough of the industry, are likely to become self-fulfilling.

Which adds to another oddity: we know active managers seldom beat index investing. But this year should be showing the exact opposite. Passive long only funds are destroying wealth at a terrifying speed. So true active managers should do well too, but oddly (and absurdly) perhaps because of this “a few chosen winners” theory, they too seem to willingly forget about valuation.

True Believers

You see these few companies are (after exhaustive analysis) the nailed-on winners, so if the market halves, they will still outperform - just hold on and they will come good, the fundamental long-term analysis says so. You will recognise Cathie Wood, Scottish Mortgage are, in some measure, exponents of this too.

What is not to like? Well, self-reinforcing buying propelling valuation is dangerous; ask the Woodward investors about that one. But we also get odd clusters (identified as the winners, or the winning group, or amongst which will be winners; choose your terminology, like Tesla or Palantir or Netflix), which cut loose from sane valuations, becoming for a while mere intellectual Ponzi schemes, moving only upward, fed by endless new money.

Until they don’t.

And every time ‘buying the dip’ gets burnt, there is less fuel for the next attempt, and less appetite to try.

Too narrow a view?

I am not wholly convinced by the ‘only a few stocks matter’ theory; for a start, you have to be very lucky with your baseline, even if you can spot the gems.

But even less do I believe that you can really thread the needle to identify the great companies, and secretly buy them, without shifting their prices and then hold them, in public portfolios. If you are right (and success requires you to be right) then everyone else piles in, and valuations simply become a function of overall liquidity.

The belief that having found them, you can leave them in your portfolio for decades, feels somewhat quaint. There are some giants that do perform year on year, but we all know of plenty of giants that rise and stumble (see above), and many that have multi-year slumbers (most oil and bank stocks).

Fashion or Momentum?

So, at the conference, we had a hall of great fund managers, but also the odd IFA pleading to be told about current performance, which was simply shrugged off. Our clients are always keen to be told about our recent performance, I am sure in truth so are theirs.

Given the structure of the market, now may be the perfect time to buy Quality Growth, but that bigger question about rates and inflation trumps all. And investing, we know, is about fashion, that’s why momentum (usually) works.

I do like some of these funds, and respect their hard-working managers, but feel investing needs a hybrid approach, quality, yes, growth yes, but critically valuation and momentum too.

It seems like public policy has also increasingly drifted in the direction of this “picking winners” theory and backing what are believed to be high yield, clean, desirable industries, rather irrespective of their viability.

Public Policy implications

Once you accept fund managers can spot these, you perhaps accept governments can also nurture them and scatter tax breaks around them. This will, at the same time, destroy the rest of the commercial ecosystem, in part, oddly to fund the hoped for predictable and desirable elite. Look at what Tesla (again) has done, extensively subsidised by exchequers round the world.

Does real life work like that? I doubt it - but investing theory has clearly now tainted public policy too.

Charles Gillams

Monogram Capital Management Ltd