Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

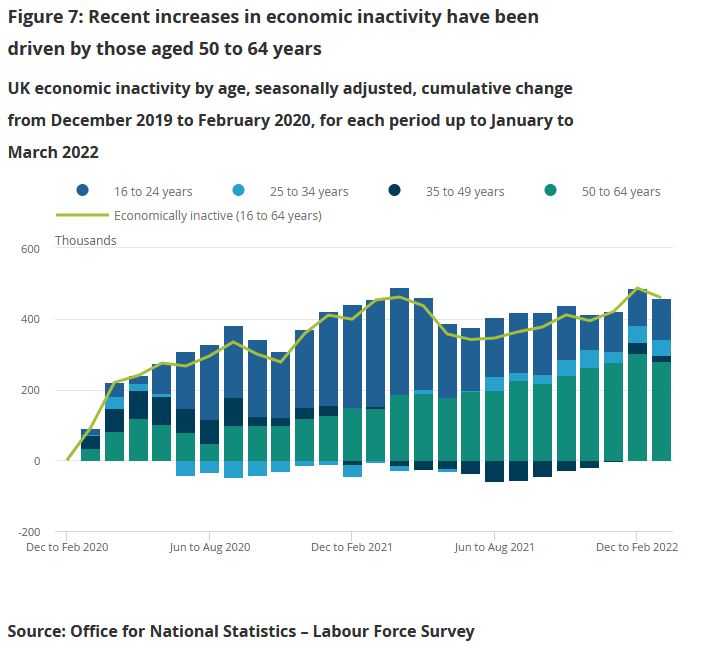

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

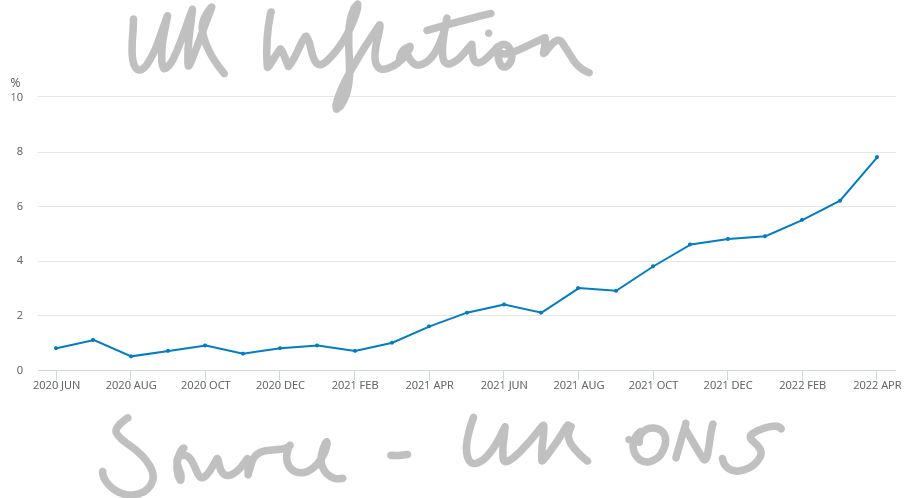

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.

INDIA : ‘OUTER CHINA ‘CROST THE BAY’?

Is India really rising?

For much of last year India was the top major stock market, and remains the best on a twelve-month basis, the main index up +9%: not bad, we look at why. While less exotically the lags in global markets, when the macro picture is changing rapidly, are getting tough to navigate. Too many fund managers and Wall Street analysts simply don’t change, when the facts do.

Indian Stock Market rises to 4th largest, globally

First to India, in Premier Modi’s time in office it has gone from the tenth largest global economy to knocking on fifth, which is now predicted for 2027.

If true it will have overtaken a lot of Europe on the way. It is also already the fourth largest global stock market.

Welfare - and Highways in India

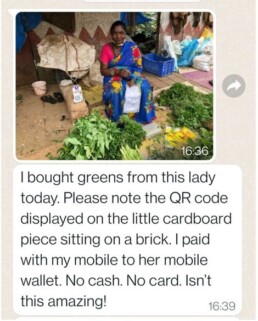

It has done it in part by two great leaps, firstly to take the millions of poor onto a national database for the direct distribution of welfare, creating the fastest monetisation of a society in history: the type of simple, big scale computerisation that works. It allows vast, complex, nimble schemes, both for welfare and tax, to be executed without a morass of red tape and civil servants milking them. The cash, meanwhile, gets right to the app of the men (or importantly as often) women who need it. Secondly it has taken a once Federal system, at least in commerce terms and unified it, creating a true single market. Neither seem that big, but both were critical steps. Remember how fond we were of the European Single Market? This one is twice the size.

While on the ground, the highway network has expanded by 50% since 2014 and in the air the number of domestic air travellers has doubled, air freight is almost as fast growing. A great deal of this is built on the IT sector, which has doubled in the last decade, and was already pretty big.

India seems to have achieved all of that while cutting oil consumption (per unit of GDP), and while racing ahead with the renewables it is so well suited for. It is also as we now know, one of the world’s big grain, especially wheat, exporters.

Some patches of India excel, others not so much

Stock market performance has been good over that time too. I went to kick the irrigation pipes in Modi’s Gujarat, before he got the top job. I liked what I saw; they were colossal and the vision to take them far inland, well away from current irrigation, spoke of a great ambition. The co-ordination and mechanisation spoke of good (and rather un-Indian) execution. It was a shock, when in Bengal at that time, I felt it was mired in politics, with too many huddled and piteous masses, inhabiting another century. But the West and South of the country were different; Bangalore was already aping Silicon Valley, albeit with traffic congestion to match.

That has kept going, tough reforms, enacted on a big scale were needed, and have been provided. But for markets, especially for the ex-colonial power, it has not been easy. Modi is a populist, he tore up the Mauritius tax treaty, introducing CGT to offshore investors, re-wrote the tax law to force Vodafone India into a billion-dollar insolvency, and had to have national assets embarrassingly repossessed, before paying Cairn back an unlawful billion-dollar tax heist.

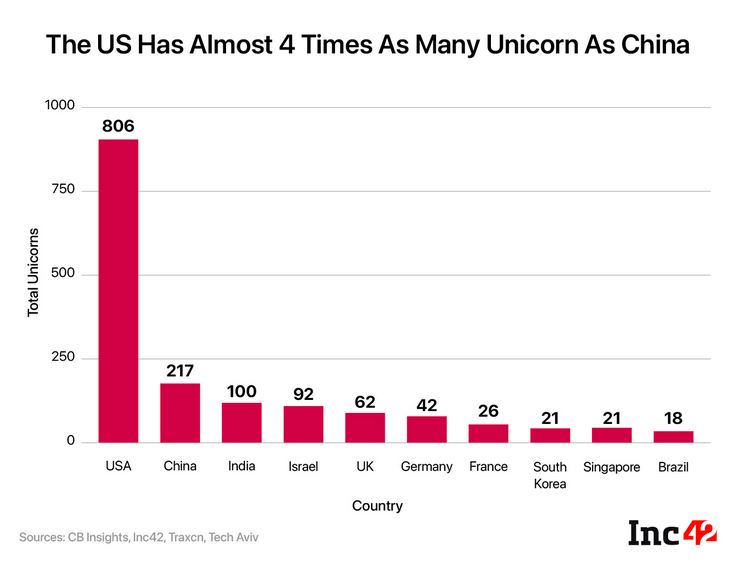

The other big risk was that the park was overrun by unicorns, and it was (and is) hard to know which will flourish, exploiting this vast unified fast-growing market (the OECD say the fastest growing large economy this year) and which will get foot rot in the monsoon floods.

While some of that was also funk money from Silicon Valley, which may now return to base, as the NASDAQ valuations fold, and indeed from China, which still remains in a different universe.

The history of jumping on (or falling under) Indian juggernauts, is not that great either. Racy IPO valuations falling to earth, have been painfully apparent.

But perhaps India will indeed come up like thunder, outer China, ‘crost the bay*.

Now to Stock Markets - in a word, Horrible.

We are having the normal churn, as a lot of vested interests and ‘long term holds’ get destroyed and no one seems to know where the lags are, in either debt or equity markets; a toxic mix. Certainly not company management, and therefore not the big lines of “analysts” often printing corporate client forecasts on fancy notepaper. Odd how so many research teams think the FD they diligently talk to has a clue. They do eventually (one hopes) but day to day, week by week, not really.

The finance team in companies

The finance team sits at the end of long and confused reporting lines, stuffed with dud AI (especially on inventory), and with no handle on returns, credits or sudden weather spikes. Knowledge? No, not much. While on top of erratic demand, their supply chains are like using a rubber band to pick a lock - all over the place and unpredictable, and remarkably elastic. Trouble is what you ordered, the currency, the freight costs and arrival dates are all plus or minus quite a lot. Fine if you can sell all you land, at any price, not so good when others have too much stock too.

Try picking a reliable single digit margin, out of that morass.

So, when rates and demand shift fast, forecasts simply melt away. Valuations don’t really change of course, but market prices do, and that’s when you need to clearly know fundamental values. The rest is froth, just crypto analysis, not the real thing.

So, markets that rely on earnings forecasts quarter by quarter, could go just about anywhere, because no one knows.

For me, now is the time to buy cheap quality, with a yield, but otherwise just watch the spectacle from the sidelines.

Hard Landings?

Local elections tell us remarkably little about national ones. We reflect on those. Meanwhile US equity markets are in turmoil, and some big numbers are changing very fast - some further musings.

Do English local elections count ?

We start with the UK, or rather English local elections, the devolved governments (oddly) have a rather greater read through from local to national. But overall, nothing in the results changed our view that Boris will probably survive, unless the Tory party unites around an alternative, which is pretty near impossible: it has too many splits.

Nor has our long-standing opinion that all Keir needs to do is keep his head down and he will be the next Prime Minister changed. Although if Labour starts to believe it is a shoo in, and can pick who it likes as leader, it will also self-destruct. Which is just about the only chance the Liberal Democrats have of being relevant.

Just how politically marginal local elections are, is shown by the surge of support for the Greens, apparently the very voters the weird Tory infatuation with hard left environmental policies were meant to entice.

Indeed, a whole set of Tory policies designed to raise energy prices, have gone down like a lead balloon.

What voters want and politicians need to deliver

You do wonder if they will ever get round to realising voters really want just three things, a roof over their heads, bread on the table and a job. Deliver those and do so competently, and politics is easy.

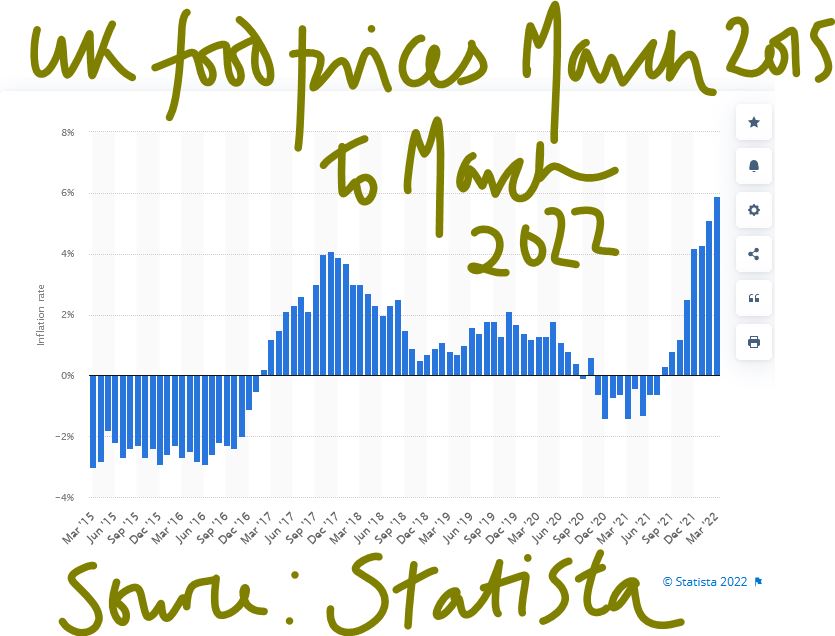

The roof bit is a shambles; it turns out policies designed to enrich cabinet members and senior civil servants with buy to let portfolios, are not so good for anyone else. I suspect the job bit will soon turn turtle, and the bread bit is going off the rails too. See graph below:

Here is a link to the relevant page on Statista

We notice that the big Western democracies still seem hell bent on raising energy prices, which is universally unpopular.

UK local elections - a brief look at opposition policies

So, the other thing markets in the UK (and sterling) will be doing is wonder about Starmer policies, more critically does he have the “bottom” to either appoint radical reformers, or have them lined up in key seats? Let’s say he does. He will still continue the headlong wealth destruction of punitive taxation and the assault on business investment. He will over-regulate (that’s his background). The sole variable therefore feels like any plausible capacity to reform.

He is not afraid of hard choices, or of thinking long, both good points and incidentally he is not Blairite enough to be America’s poodle and get involved in picking pointless foreign wars. Although he will likely dismember the United Kingdom, either of political necessity or by accident. We really can’t see much support for sterling in that package.

Central Banks - are they signalling a hard landing?

Inflation is spiking into double figures, and Central Banks are explaining

1) it is really not their fault

2) they are only responsible for “core inflation” (so without the important stuff)

3) but anyway they must still raise rates to offset the malign effects of other state policies.

It is looking truly absurd.

Not that interest rates are off the floor yet, although the US bond market seems convinced rates over 3% are now nailed on, while oddly the UK Gilt-edged market seems unconvinced of exactly the same thing. This of course is helping an on-going collapse in Sterling.

Meanwhile the possibility of ending negative rates in Europe has caused great excitement and the Euro to strengthen, at least against sterling. The divergence is related to a belief that the Fed which raised three months after the Bank of England is now more hawkish, a belief which seems more about wishful thinking than anything the Fed has actually done so far.

We are less sure on how high interest rates go. All three Central Banks seem to be hoping something will turn up, and inflation will ease. This is a view we share, but we really doubt the trivial rate rises so far, are the “something”.

Market turmoil - how far will they fall?

This leads on to the current market turmoil: With the US feeling very exposed, partly because it went up so high (relative to other markets), it has further to fall. Nor do we see the valuations on quoted US growth stocks as offering good value at these levels. They had become so detached from reality the gap is just too big, and the repeated attempts to buy the dips, just disguises a long-term trend down. The FTSE100 over five years is down, and the NASDAQ climbed over 100% in the same time. A 25% further US fall is at the least plausible.

Other markets will then get sucked down, and in Europe and Japan they are hard hit by their reliance on imported energy (the US is an energy exporter). While for now, their rates are not moving either, the resulting devaluation makes the value gap to US growth stocks, feel even greater. Buying overvalued stock in an overvalued currency, is not always great.

What do our models say about the markets?

Our MonograM momentum models suggest a turning point for both Europe (including within that bundle the UK) and Japan is close. It is only a model, we remind ourselves, and is quite able to give a false signal. It also sees this as true in dollar terms, not sterling. So, there is plenty of noise and last week had all the elements we dislike, a month end, plus a shortened market week, plus Central Bank meetings, created a baffling miasma of signals.

However, on current policies we anticipate a crash; the only issue now is how hard the landing is.

He who pays the piper

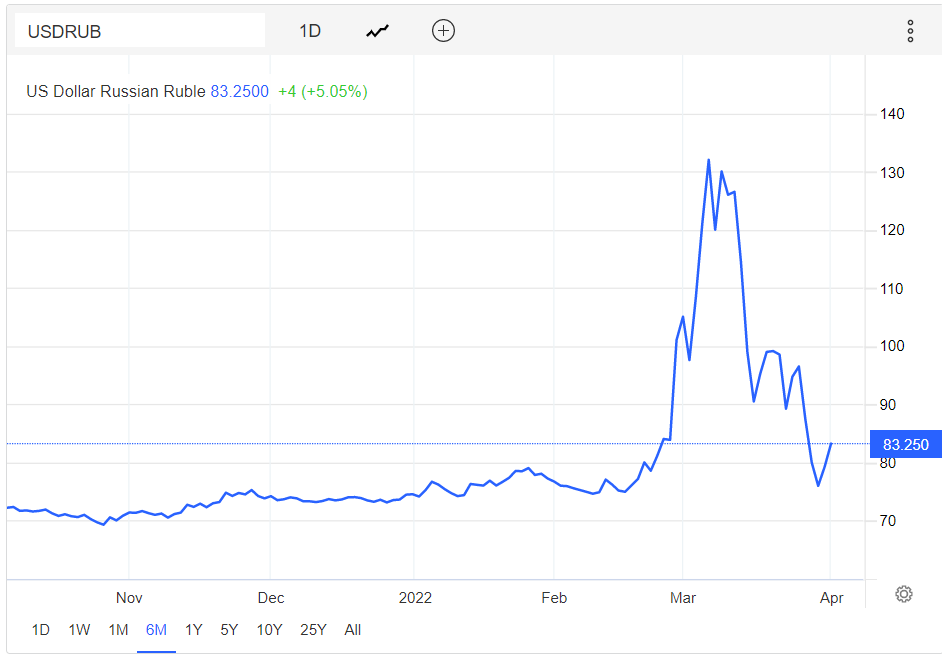

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

Tech Wreck or Much Ado

Talking Tech today - We think that market cycles are longer and far less repetitive than we like to assume.

Asset price ramps - the tech story

But each speculative ramp up and blow off in assets shares much the same features. Our view is the faster they go up, the less likely they are to recover having come back down. And a lot are pretty well back where they started, in price terms at least.

Yet the avarice of founders and sponsors in exploiting, seemingly without consequences, these destabilizing bubbles seems oddly popular, helped by the vast tax hauls they often create, themselves inflaming the process. The media of course delight in hyping them, somehow immune from the sin of market manipulation, which profits them mightily.

I suspect most investors have a ‘marker stock’, to indicate where we are in the cycle, to me it has been the Amati AIM VCT. It has a fair range of stocks, competent fund managers, a reasonable yield. It topped out first in about April last year, had another go at the top in late August or so, and has been downhill all the way since. About £200m of assets, a discount control in place, generally real companies, not concept stocks.

So not an obvious spoof.

This was unlike the SPACS, which we first highlighted in late 2020, and where they have been far more destructive, in most cases, even when containing a real business (and many did not).

Sometimes governments get pulled in too. All those profits make for flush lobbyists, generous donations. The London Stock Exchange, a quasi-regulator, bends easily to any wind that blows an irregular but ripe bounty to its coffers.

So, of all the myriad useful potential reforms and regulations, making SPACS easier was depressingly to the fore in ministerial recommendations. Likewise funny voting rights, which stop the founders getting hoofed out when it all goes south.

And what about crypto currencies?

We can debate whether crypto was the same, a lot of the crypto universe clearly was, and itself it was inflated by that same goldrush mentality. Indeed, plenty of market professionals tired of the chore of marketing real companies with real data are entranced by the lure of money for nothing.

Bitcoin is almost the perfect vehicle in this hyper speculative world, and yet we are ambivalent on it. It is very clean (once the dirty mining is done) and it produces carbon rather than arsenic (unlike gold) as a by-product. It can’t be tainted or doctored or indeed intercepted, so it is quite a pure asset. Of course, you can mislay it, and once lost it is rather elusive, it slips back into the great money sea and is lost quickly in the waves.

Some say it is too hard to turn into real money, dollars in the main, but nearly every investment is tough to realise, certainly most ‘alternatives’ are and far too often the fees investors are charged are based on inflated values.

Tech valuations

So, back in the tech wreck. We don’t believe the high valuations were ever anything but the flush through of extreme greed, created by an industry still able to sell duff product, to its heart’s content, for colossal fees, along with skilled media manipulation. Or as a recent Henderson’s fund manager report said “investment bankers, greedy management teams and ruthless private equity vendors” are to blame.

Judging the product in tech is always really hard. But judging what a reasonable value for the optionality of many of these shares is, should usually be far easier. A good rule of thumb is see how in “normal times” they are valued, both because that is when you will almost inevitably need to sell, but also it reflects the funder’s ability to keep propping up losses. That is typically not measured in decades, but at most a few years.

COVID did not help, it closed the new issue pipeline, devasted large areas of the existing market and of course washed torrents of hot cash over everything. Less to buy, more to buy it with, a bit of a feeding frenzy and away we went. But that’s now over.

Nor do I really think this vast pump and dump enterprise was undone, as the market wisdom is, just by the threat of rising rates. The idea you can precisely discount some pie in the sky projection also feels slightly odd. The precision of diamond to cut the substance of weak custard, seldom produces a sharp, solid, edge.

How might we regard “concept” tech stocks now?

Seen as driven by supply and demand, bulked up by liquidity and the “greater fool” argument should you unload the stock, means you should beware of the belief that many of these stocks are anywhere near a bottom, until either they produce real cash flow, or a period of years allows them to de-risk their valuations.

Seen in that light, and given the overhang of listing, taxation and scrutiny they now face, it should be more about how much should you discount their cash pile by, not what premium to NAV do they merit. Oh, and I’m talking about real Net Asset Value, not capitalized losses, (however you bottle it), a loss is not an asset, whatever the craven auditor says.

Nor is looking for a trade buyer sensible, buyers have to buy the whole thing, not a little slice where the value can easily be frothed up.

My preference is good active specialist tech managers. There are a few, at a nice discount, but pick your entry point with care, at this stage of the game.

A lot of the late 2020 and 2021 excitement turns out to be Much Ado About Nothing, a startling production (above) of which closed recently at the RSC.