Not what it seems?

Housing, China and Big Tech – all are regarded as ‘un-investable’ - ending last year the above three sectors were all under a cloud, but one broke free, why?

Plus, Powell scares the market by thinking too loudly.

HOUSE PRICES

Well let’s start with housing. UK residential property prices are holding up fairly well given the magnitude of rate rises, while UK housebuilder share prices look fairly awful. There is a confusing mix of income and capital issues to examine.

Housing itself holds up well – many reasons: demand of course, high levels of employment, heavy net migration and the normal new household formation provide a base demand level well above new build levels. At a time when it is unattractive to fund speculative new build (so units not pre-sold before commencement) because of finance charges, and with a planning system that is both over prescriptive and under resourced, supply will stay slow.

So, the logic of fairly steady prices for existing housing stock holds, buyers will need more cash, but with (in real terms) falling house prices, that can be done. It moves funds from (largely UK) borrowers to (largely UK) savers, but leaves total disposal income in the country (after HMRC takes a cut) largely unaltered.

While rising rentals, reflecting pent up demand and the pressure on debt funded landlords, adds to new build demand and provokes more supply at the institutional level, at least. So, we don’t see a price crash (however desirable in some areas) at these levels.

So why then are housebuilders so disliked? Sales of houses will indeed slow, so reducing dividend cover, but the core business itself is fine and the capital value holds steady, albeit discounted by more.

CHINA TRAPS

China? Here we have almost the same issue, fundamentally sound, but politically hard to justify investment. That taint spreads to companies that sell into China too. It is very hard to ignore this vast market, and the undoubted speed of innovation and high productivity of a command economy. When so many other places fall back, China is tempting.

China has the size, finance skills and levers to deliberately act counter-cyclically, stepping out of sync with the global economy. So (on that narrative) it has ducked the blight of post COVID reopening inflation, by a deliberately slow exit, stockpiling commodities, and then stepping out of the market to defuse price spikes.

Arguably even with foreign capital, it was happy to load up when it was cheap with few restrictions, on both equity and debt, but equally happy to step back when prices and restrictions start to apply. Choice or circumstance? In an opaque system who really knows. . . But a China slowdown is not the same in type or duration as a free market one.

Like housebuilders it remains uninvestable, but for all that, there is value.

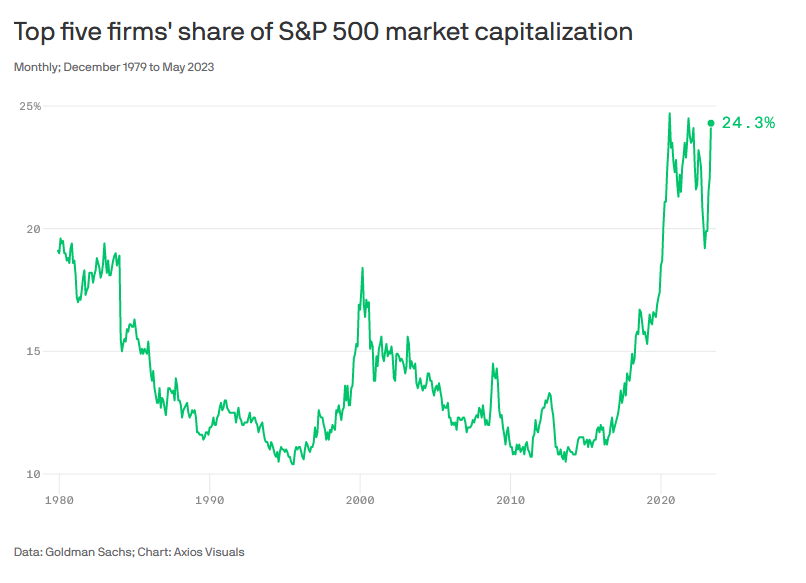

MEGA CAP VALUATIONS

So, to the third of the trinity, large cap tech. These are all US based, highly profitable, with not a lot of debt, but typically appear overvalued. In the old free money days, fast growing tech was enough, so the layer just below, also profitable, simply fed off the reflected glory of the mega caps, and so on all the way down to the start-ups and chronic loss makers. That link has broken, values are now about both size and sector. This is odd. Normally if you broke (say) Microsoft into ten equal parts the total value would go up. This year suggests it would now fall.

So, what are investors doing, if they are ignoring fundamentals? It seems the cash generating highly liquid stocks do enjoy excess market demand in tough times. Some of it is momentum following, some is a falling share count, but mainly it seems investors just really like the name recognition and deep liquidity, to trade the market.

From this website.

If so, it may be dangerous to write this group off. In a market going sideways they provide the price action, and it seems they are so big, so well entrenched and global, that the typical stock specific risk can almost be ignored. You need to be nimble; they fell hard in 2022, but their dominant recovery this year, providing nearly all of global equity performance might be the true reversion to the mean, rather than their sudden collapse when everything was being sold off last year. But that process does guarantee future volatility for them too, and history suggests it will not last.

DECLINE AND FAIL

We have nothing to add on what seems a be a new set of forever wars, beyond sadness and dismay. While whoever wins the 2024 elections on either side of the Atlantic, will be forced to do an “Erdogan turn”, or 360 spin. This could happen fairly soon after the polls close.

WHAT POWELL SAID

The markets seem not to like Jerome Powell’s musings on the vast range of things he does not know, at The Economic Club in New York this week. Does his calendar suddenly show his exit date, albeit over two years away? You could almost hear the soft polish of his resume to concede errors and some failed guesses. He even, twice, called US fiscal policy “unsustainable” although he was careful to say that was not now, but only in the future (after he’s left office that is.)

But the long run neutral rate? No idea. The Philipps Curve? No idea. Interest rate transmission rates? No idea. That’s not new, though - it is pretty much what “Data Dependent” always has meant, and markets were previously fine with that.

We will know soon enough, if rates are still rising globally. It certainly makes markets jittery, especially on Friday afternoons.

Reflections & Predictions

This year won’t be last year, that much we know. Nor indeed will it be the inverse, which is inconvenient. So, starting this year as last year, but simply turned face down on the desk, is a trap.Read more

WHAT DO THEY KNOW OF ENGLAND?

Let us look at tech, private equity and this seeming market bounce, driven by those sectors. The NASDAQ is up almost 10% at 11,320 after a trio of twelve-month lows in the mid 10,300’s, the latest of those lows just this week. Meanwhile it looks like the US Elections have delivered both gridlock and a rebuff for Trump, which some see as a perfect mix.

Today’s post title is derived from Rudyard Kipling at his most sanguine and reflective.

I HAVE FLUNG YOUR STOUTEST STEAMERS TO ROOST

The true horror of the tech wreck has also been concealed for UK investors, by the climb in the dollar, a move that seems to be going into reverse. In terms of closing prices sterling has rallied hard from 1.08 to 1.18 in a little over a month. This has left the NASDAQ collapse, from touching 16,000 - brutally exposed, now without much of the concealing currency appreciation.

Where is the Nasdaq headed?

We suspect that the NASDAQ is heading lower still, but accept that is a big call.

From this page on Tradingeconomics

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making.

However, market sentiment has perhaps turned, the tech rubbish generally got chucked out early. The subsequent switching out of the tech majors probably had to be into Treasuries, where their recent price rises suggest some demand, or into cash.

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making. Bumping up against that is the second phase of the market collapse, as the multiples on profitable tech giants returned to earth.

And cash (and oddly apparently the S&P) has also been seeing inflows from China and crypto, as those areas have sold down hard. There is also the unpleasant negative impact of holding cash, on returns. Put this together with sentiment, and this may well help the NASDAQ bounce into the year end. However, many fund managers cite the dotcom bust as meaning this is now starting a multi-year sideways recovery phase, not a quick bounce at all.

LONG BACKED BREAKERS CROON

A concurrent look at Private Equity is important. NASDAQ multiples drive much of their values and are falling, and with such a recent twelve-month low, Q3 valuations (private equity valuations are always lagged) have further losses built in. And a sprinkling of those will now also be based on a significantly higher dollar too. That won’t be pretty either.

Plus, as we know there are some spectacular blow ups lurking in there, the insolvent FTX was a big investor in, and investee company for, some well-known PE names. Overall, despite solid reports, I am still expecting some fair-sized holes in quoted private equity, as either the NASDAQ rises and the dollar falls, causing currency losses, or the NASDAQ falls and the dollar rises and the one again masks the other.

Access to distress financing, has it seems largely vanished, as it does at times like this, making the chance of highly damaging wipe outs, not just down rounds, much greater.

A possible dollar sterling parity?

But those talking of dollar sterling parity are surely way off now. So, regardless of future disasters, I want more information before seeing UK Quoted Private Equity Investment Trusts as a buy. About six months after the NASDAQ bottom, will be a good valuation point, and that likely means Q3 2023. At that point we will know what the current large discounts really refer to; I don’t expect them to look anything like as generous.

THE UK - UNDER A SHRIEKING SKY

There is a lot of market optimism about the next UK budget, based on Hunt being really nasty. That may overstate his hand, as the Government has long abandoned reform, it can only support out of control spending by harsh tax rises, which will certainly kill jobs, but probably the wrong ones.

Nor can it do much to enhance investment and has foresworn labour market reforms, so both of those, with existing policies and more rate rises, must encourage the persistence of poor productivity.

Although of course the real budget numbers will be barely mentioned; energy, rate rises, and inflation are largely out of Hunt’s hands. He is lucky all three do look a lot better than when he was installed. So, the need for harsh medicine is rather reduced, and may even disappoint.

But just as the rally helped US risk assets, so it helped others, like property, come off a deeply oversold floor. TR Property Investment Trust has jumped 30% in a month, for example, and still yields over 4%.

Post Mid-term elections for the US

And coming full circle, although slowing inflation took a lot of the credit, at least some of the post Mid Term bounce came from realising that the Federal Reserve now has an ally in the legislature. It can be less vigorous in steering the economy, just relying on the brake pedal, as Biden and Congress are no longer able to simultaneously hammer the accelerator.

Overall, however we still remain cautious, we expect this pre-Christmas rally to fade, rate rises to persist into at least Q2 2023 and rate cuts to be a 2024 feature. And peak gloom lies ahead as those rate rises conclude and then start to actually bite.

Looking ahead

In general markets have had a solid look at the worst case this year, from famine to invasion and nuclear war, to out-of-control Central Banks and deluded politicians, and nothing terribly dramatic has transpired. So even with bad things still happening, we don’t see a repeat of this year’s dramatic falls either.

Charles Gillams

- The Kipling Society meets on November 16th, at the Royal Overseas League.

Tech Wreck or Much Ado

Talking Tech today - We think that market cycles are longer and far less repetitive than we like to assume.

Asset price ramps - the tech story

But each speculative ramp up and blow off in assets shares much the same features. Our view is the faster they go up, the less likely they are to recover having come back down. And a lot are pretty well back where they started, in price terms at least.

Yet the avarice of founders and sponsors in exploiting, seemingly without consequences, these destabilizing bubbles seems oddly popular, helped by the vast tax hauls they often create, themselves inflaming the process. The media of course delight in hyping them, somehow immune from the sin of market manipulation, which profits them mightily.

I suspect most investors have a ‘marker stock’, to indicate where we are in the cycle, to me it has been the Amati AIM VCT. It has a fair range of stocks, competent fund managers, a reasonable yield. It topped out first in about April last year, had another go at the top in late August or so, and has been downhill all the way since. About £200m of assets, a discount control in place, generally real companies, not concept stocks.

So not an obvious spoof.

This was unlike the SPACS, which we first highlighted in late 2020, and where they have been far more destructive, in most cases, even when containing a real business (and many did not).

Sometimes governments get pulled in too. All those profits make for flush lobbyists, generous donations. The London Stock Exchange, a quasi-regulator, bends easily to any wind that blows an irregular but ripe bounty to its coffers.

So, of all the myriad useful potential reforms and regulations, making SPACS easier was depressingly to the fore in ministerial recommendations. Likewise funny voting rights, which stop the founders getting hoofed out when it all goes south.

And what about crypto currencies?

We can debate whether crypto was the same, a lot of the crypto universe clearly was, and itself it was inflated by that same goldrush mentality. Indeed, plenty of market professionals tired of the chore of marketing real companies with real data are entranced by the lure of money for nothing.

Bitcoin is almost the perfect vehicle in this hyper speculative world, and yet we are ambivalent on it. It is very clean (once the dirty mining is done) and it produces carbon rather than arsenic (unlike gold) as a by-product. It can’t be tainted or doctored or indeed intercepted, so it is quite a pure asset. Of course, you can mislay it, and once lost it is rather elusive, it slips back into the great money sea and is lost quickly in the waves.

Some say it is too hard to turn into real money, dollars in the main, but nearly every investment is tough to realise, certainly most ‘alternatives’ are and far too often the fees investors are charged are based on inflated values.

Tech valuations

So, back in the tech wreck. We don’t believe the high valuations were ever anything but the flush through of extreme greed, created by an industry still able to sell duff product, to its heart’s content, for colossal fees, along with skilled media manipulation. Or as a recent Henderson’s fund manager report said “investment bankers, greedy management teams and ruthless private equity vendors” are to blame.

Judging the product in tech is always really hard. But judging what a reasonable value for the optionality of many of these shares is, should usually be far easier. A good rule of thumb is see how in “normal times” they are valued, both because that is when you will almost inevitably need to sell, but also it reflects the funder’s ability to keep propping up losses. That is typically not measured in decades, but at most a few years.

COVID did not help, it closed the new issue pipeline, devasted large areas of the existing market and of course washed torrents of hot cash over everything. Less to buy, more to buy it with, a bit of a feeding frenzy and away we went. But that’s now over.

Nor do I really think this vast pump and dump enterprise was undone, as the market wisdom is, just by the threat of rising rates. The idea you can precisely discount some pie in the sky projection also feels slightly odd. The precision of diamond to cut the substance of weak custard, seldom produces a sharp, solid, edge.

How might we regard “concept” tech stocks now?

Seen as driven by supply and demand, bulked up by liquidity and the “greater fool” argument should you unload the stock, means you should beware of the belief that many of these stocks are anywhere near a bottom, until either they produce real cash flow, or a period of years allows them to de-risk their valuations.

Seen in that light, and given the overhang of listing, taxation and scrutiny they now face, it should be more about how much should you discount their cash pile by, not what premium to NAV do they merit. Oh, and I’m talking about real Net Asset Value, not capitalized losses, (however you bottle it), a loss is not an asset, whatever the craven auditor says.

Nor is looking for a trade buyer sensible, buyers have to buy the whole thing, not a little slice where the value can easily be frothed up.

My preference is good active specialist tech managers. There are a few, at a nice discount, but pick your entry point with care, at this stage of the game.

A lot of the late 2020 and 2021 excitement turns out to be Much Ado About Nothing, a startling production (above) of which closed recently at the RSC.