The Glass Bead Game

We look today at a domestic version of a complex, rulebound meaningless pursuit that too many of our brightest and best waste their lives pursuing, and whose twists and spirals ultimately signify nothing. I mean the UK Office of Budget Responsibility (OBR), of which I took a tour this week. Almost nothing there is as it seems.

Meanwhile markets reprise 2023, with tech or bust once more. Although tech and bust is the market fear, as fiscal stimulus and services inflation hold rates too high for some to survive.

UK OBR

The OBR was an explicitly political creation of the coalition government in 2010, with a remit to somehow restrain the ever-increasing debt governments take on, to bribe electors. They were also keeping half an eye on the much older ‘debt ceiling’ style US legislation. It failed; so now the OBR just thrives on telling the government how much more it can spend or not collect, with spurious accuracy; purportedly managing public money.

It doesn’t forecast anything as a forecast is an expected outturn. All it does is crank the handle on the old, discredited Treasury model, creating projections. A projection is 1) a ‘what if’ assuming all other things are equal and 2) only as good as its underlying model.

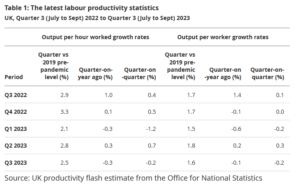

One clear flaw is the requirement to take government spending plans as viable when they are usually not. They also have no idea where public sector productivity is heading. It has no remit to look at how productivity might be helped and no capacity to look back at how wrong its old ‘forecasts’ were. That is the job of the National Audit Office, it seems.

It also won’t talk to the Bank of England, as that organization has executive powers (to raise or lower rates) and the OBR apparently must just be a commentator: more glass bead rules.

So, it fiddles with the model and its six hundred inputs and countless equations to give precise answers to pointless questions, because each answer sits in its own vacuum.

There’s a heavy focus too on tax revenue, but with quite a thin staff, this results in excessive reliance on HMRC, who can be hopelessly wrong (and typically over optimistic on tax yields). But again, if the tax bods claim some complex, job destroying, arcane nonsense will raise income, in it goes. The side effects of such decisions must also be ignored.

It has no remit to assess how taxes impact productivity, which partly explains many of Hunt’s blatantly anti-growth measures. As a result, the economy is locked into low productivity, getting steadily worse.

From the ONS flash report here

For all that the financial press will be full of the OBR cogitations on the forthcoming budget (March 6th). One little bit of power they do have involves a requirement for the Chancellor to give ten days’ notice of the budget contents (hence no doubt the usual leakage levels) and for two months before that, they sift through proposals and indicate how each, in isolation, would work. The economy is an interconnected entity, they know, yet there is no attempt to give us an overall view.

THE LOST RALLY

I have few rational reasons why anyone would lend the UK Government at under 4% for ten years, were it not for some foolish faith in the OBR projections, without reading the small print.

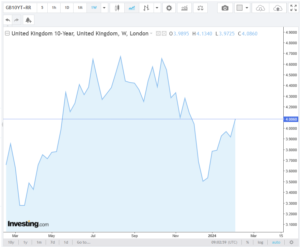

Which brings us to markets: back in November the UK ten-year gilt yielded 4.5%, by about Christmas falling to 3.5%, and now it is back over 4% and headed higher.

Chart from this website

Quite a spin in ten weeks for a ten-year duration instrument. This is why that Christmas rally in value stocks was ignited, and indeed started to push out into Real Estate, various Alternatives and certain smaller stocks.

Although it didn’t move those stocks most sensitive to the credit markets, who will need to rollover/refinance current debt. This affects for example, the renewables, private equity, and office property. The problem there is of both rates and availability. With the scale of asset mark downs, whether interest is 6% or 8% is not the issue; there is no funding appetite even at 20%.

The year-end rally moved a wide group of stocks, from extremely cheap to still very cheap. We then realized that it was not yet safe to go back in, so buyers evaporated, and prices faded. With state debt at 4%, against persistent inflation, fixed income is also oddly unenticing. So, the market default has been to pile back into the biggest, most liquid, US tech stocks and similar easy-in/easy-out momentum trades, like bitcoin.

There is little sign of deflation in services, no evidence of it in housing, where supply issues dominate, and little in financial services; indeed, all the supply side mess of COVID and excess regulation, is simply getting worse. Public sector pay inflation is also high and going higher (don’t tell the OBR).

This does not dent the 2024 story of cutting rates and hence higher stock markets, but it may require some patience, and that delay may itself create more pain.

The Glass Bead Game and the ‘lost marbles’ qualification for office

Our games of self deception are not to be confused with lost marbles of course; it turns out that the onset of senility is now a bar to being prosecuted for storing secret state papers and also, somehow, a recommendation for re-election for four more years, to the most powerful post in the world.

If that ends up giving us Trump again, by default, presumably he will at least have a defense in future years, against those same crimes? He does not have the “Biden defense” available at present, perhaps thankfully.

As the OBR shows, very clever institutions can come up with very silly solutions.

Good intentions

Two quite technical topics this week, hinged on the persistence of old viewpoints on current markets: pricing in UK stock markets, and China, and how we might look into emerging market funds. Plenty of good regulatory intentions, but rather less than welcome outcomes.

FIXED ODDS

Little in the debate on UK markets has looked at the major role played by an increasingly poorly performing small UK bank, Close Bros. Even when it was doing well, it felt odd to have a vital market role being undertaken in a backwater, but as its capitalisation dwindles, the core task of equity market maker, which it provides, seems oddly misplaced.

In smaller UK stocks, we therefore still have a ring holder who, it is said aligns buyers and sellers’ interests. Not mine.

Given the fortunes at the disposal of state banks or indeed the London Stock Exchange, why is Winterflood (a part of Close Brothers) still trying to provide this vital service in the style of an old-fashioned bookie?

It matters greatly, because in many UK stocks and investment trusts, the wide bid offer spreads make dealing almost impossible. If you are eking out a high single figure return, and in these markets not doing badly to do so, Close Brothers scooping 10% off a single trade, in the bid offer spread, is pretty lethal.

With them restricting trade, liquidity disappears, without liquidity so does price discovery, and it is not a stock market any more.

Close has itself also suffered a number of hits lately. It is a hotch potch of old merchant banking activities, along with an expensively acquired asset management business, plus a shocking venture into litigation funding that might ultimately (it is itself a matter for litigation) cost almost as much as they paid for it.

While just lately the FCA has been asking (dear CEO…) about insurance premium finance, oh, and Close has a lot of motor finance too, an area of recent expansion, but also another hot spot for the FCA, after issues on commission. The latter Close has known about for a while, it was a disclosed risk in their last accounts.

All places where margins are quite high, perhaps in the view of the FCA too high.

From: Close brothers website – section on ‘who we are’ - their business model.

Given the lack of any announcements, the 40% share price decline in Close (CBG) over six months, to levels seen just after the GFC, is remarkable. Perhaps this benign graphic is not quite the whole picture?

Premium financing is ironically a good business, because the FCA’s wide and unpredictable view of its own remit makes financial services insurance premiums rather high, but that’s another story.

And market making is run as a bookie, not as a market utility. Winterflood itself can be taking a long or short position. So, investors must fathom both the share price, and which way their market maker is facing. In big stocks with lots of choices that’s all fine and pretty transparent. But in small ones, they can look (and behave) like the only game in town.

And it looks as if last year, they possibly went too short in the autumn. So, when the market turned on a dime in November, a fair bit of short covering took place, prices leapt, in places by over 20% and spreads opened out. And market size dwindled to penny packets.

It matters how? Well, you can get ripped off to deal in smaller UK stocks, where smaller is up to about £300m, and the price can be “wrong”, volatility increases, and liquidity goes. Do companies or investors like any of that? Nope.

It is notable that their trading profits in this area seem to far exceed both their gross (long and short) and net (long less short) positions.

Every big company was small once, and if you choke off the supply you get an ossified market, like the current moribund main FTSE index.

Perhaps the FCA could start to look more at best execution and market depth, and less at arcane ways to double count costs, or ‘protect’ those trying to enter the primary market from strict rules. This interview with Witan makes a reasonable case for looking after the secondary market first, not just the big IPO’s, with their juicy listing fees.

Investor protection is about investors making money, not about them losing it as cheaply as possible.

CHINESE BURNS

After our piece last time, we have been looking at Emerging Market funds ex China, because far from being the great hope of EM investors, China (and not just the PRC, but also Hong Kong) has become the rock that shatters fragile performance.

The role of benchmarking

There are several structural problems in EM funds, one is the role of benchmarking. A good idea at one time, it allows investors to compare performance to something specific. But it has become quite expensive (guess who pays?), as benchmarks don’t come cheap, if you now have to have them.

It also rather neatly points out to investors, when an index fund might do a better job than active managers, and worst of all, especially with the oddly amateur directors of most UK investment companies, leaves them ‘hugging’ or enslaved, to the benchmark. For good reasons in one sense (you don’t get fired for just about beating the benchmark) but for bad in others (all the funds are boringly similar). They just make the same mistakes together. And a beaten benchmark, that is itself falling, means the investor still suffers losses. I have yet to meet an investor that liked those.

The impact is both direct, so you can’t find India funds without Reliance Industries (the biggest stock), for example, and indirectly so as to “generate alpha” funds take bigger risks within a market, rather than have a below benchmark position in that market, even if all their analysis says they should just quit that particular town. Which is why funds find reasons to linger in bad neighbourhoods.

Another bias that hits the EM sector (which for a decade now has flattered to deceive) is that their stock analysis is focused on stocks they have held, while the investor wants to hear about stocks they should hold.

So, a fund manager typically gives a detailed list of analysts and companies followed by their firm, and it is full of what looked sensible when all those analysts were hired. So, in EM, there are stacks of China analysts, of organisations based in Singapore (the preferred offshore China centre, after Hong Kong got too hot), hundreds (if not thousands) of Chinese stocks covered, but all the buying is now into India. With quite nominal stock coverage; and hardly anyone based in the country.

Just as to a hammer, every problem is a nail, so to those EM analysts every opportunity is in China. Until outfits like Janus Henderson and Templeton stop having toolkits full of hammers, they won’t be able to stop breaking investors’ hearts with China. Nor will investors realise quite how much this infects their performance.

This will slowly correct, but small funds that can exit China totally in a week, and have a global remit, with no equity benchmark, dare I say it, have quite an edge.

It is a vast and nuanced space, Lazards provides a good overview.

And it is not just EM specialists, we looked at Ruffer of late, it has got broken China littered amongst its portfolios.

So, we worry that the Christmas rally looked broad based, because of a bear squeeze over a range of stocks, that then reversed with early January selling, based rather more on fundamentals. In which case 2024, so far, is in danger of looking more like 2023, less like the cyclical turning point many hope for. We do see earnings falling, of course and then ultimately rate cuts rescuing valuations. But ultimately may be quite a while.

WENN DU LANGE IN EINEN ABGRUND BLICKST

We look briefly at China, not as an investment, but more an existential threat. And we finish the lessons of the Greek coup in 2015. While little else surprises? Except perhaps the pessimism apparently shown by the long bond.

But even that might have a good reason.

DIRE STRAITS

I looked idly at a certain pink paper’s New Year quiz and asked my companion for views, and on most topics, we had one, or could find one. But on one, ‘will Xi invade Taiwan?’ I had no idea.

Not because after Ukraine there is any doubt it would be mindlessly stupid to do so, and plunge China back into the dark ages. That much is obvious. There is no way China can “go it alone” - without Western markets, capital, and innovation, it heads back to where Iran, Pakistan, Congo, and Argentina have been.

But a distant echo tells me that I don’t know for certain. Perhaps my confidence that Putin would not be so stupid as to invade Ukraine, tints my view; I was wrong there.

I am also largely assuming any military contest is unpredictable, so I tend to focus on the long-term economic impacts alone. But I still don’t know that Xi won’t try, which will clearly crash world markets.

I will deliberately not gaze into that abyss, but I can’t ignore it. The best response I have is where two stocks are equally attractive, and on like valuations, I would buy the one with the lower Chinese exposure. Maybe my limited action says that I think it is possible, but really not that likely. The other option of course is adding to gold and safe haven currencies.

Looked at a Swiss Franc graph of late?

From : Google Finance currency page

Most investable firms can shed China, just as many have shed Russia, but at a much higher price. The reciprocal asset seizures will be vast.

And although it won’t cripple Starbucks, Tesla or Apple, it will be a big slice of asset destruction for them.

NO DEMOCRACY

Back to Greece - when we last wrote it was to note the ravages imposed by the EU and IMF on the Greek economy, and how the scars still remain. But completing Yanis Varoufakis and his seminal tome, other contexts are clear.

As an academic his note taking and indeed voice and video recordings were quite an exceptional contemporaneous record. Not just of Greece, but of how Europe really worked, in a crisis.

We forget now, that Ukraine also needed a big bailout in 2015, and a choice was made as to which mattered more to, in effect, Germany. The answer in 2015 was Ukraine, with the late Wolfgang Schauble wanting Greece out of the Euro, and Angela Merkel seeing that as a lesser evil, for Germany, than the collapse of the Ukrainian economy.

There is very little ‘EU’ in this incidentally, Germany was the dominant and controlling creditor. The IMF largely sat safely behind its super creditor status. As Yanis notes the IMF funds itself on interest, and that mainly comes from having plenty of distressed debt. Not an attractive feedback loop, however logical. And of course, it largely stood back from Greece – inactivity is often an action taken.

Moving on, the Greek crisis was closely followed by Brexit, at the time we thought that was chance. It is clear it was not, and both sides had learnt a lot from the prior event, to take into the next battle. The EU and Merkel in particular had no interest in rational arguments, having waded through all that guff in Greece; you can see Cameron may have been useless, but he really had no hand to play in his “re-negotiation”. Simply ‘nein’ had worked well in Greece, so Merkel pressed repeat.

The old apparatchik’s argument about “reform from the inside” was clearly flannel; popular mandates are for the birds. As a result, the Brexit faction knew it had to be a clean exit, with one shot to the head. Sadly, Theresa May failed to realise that, and when the EU subsequently realised she had thrown her majority away, they had no reason to agree any deal, or not to expect another craven capitulation.

What of Greece now?

Well, it simply lost a big chunk of its economy (circa 20%) to creditors and demolished welfare payments and entitlements, for a generation. Was that fatal? Not really, life expectancy rose through that decade, as elsewhere in Europe.

The left largely destroyed its high-water mark, one-off advantage, but remains a mid-teens political faction.

The October 2023 regional elections saw even more regional governorships fall to the centre right New Democracy. This was along with a rip-roaring stock market in 2023 as the long rebound continued.

EU

And in Europe? Well, those June Parliament elections are getting interesting, Syriza will suffer more losses, and the gains by the centre right in Italy, Holland etc. are likewise yet to show up in Strasbourg. This provides context for this week’s defenestration of the French prime minister, for a near novice (at ministerial level). It seems this was a poisoned chalice for the big guns of En Marche, as the party are well behind Le Pen in the polls.

The European Parliament is such a mash-up of parties, and with limited real power, no change can be dramatic, but for once it could be at least interesting. The super-spending high regulating internationalist left, may get a setback.

Financial markets

Markets? I don’t think they ever get going till after Martin Luther King’s birthday is celebrated on Monday. Despite the need for news, the decline in global rates is baked in, and remains positive for equities, especially rate sensitive stocks.

You can stare into the Chinese abyss, but be careful that is does not stare back at you, you will see what you most fear or least know, as Nietzsche knew.

Happy New Year.

Skipped - what will 2024 look like?

May I say we told you so? In "Skipping Along" before the summer break we called the end to rate rises, and by the November Fed meeting, we were well on board for a "rip your face off" rally. Feeling ripped? Anyone coming to the equity party in December, has just not been paying attention.

And our powerful MomentuM model had investors buying Japan and European Indices LAST December, so they have milked that entire rally. It also signaled buying back into the NASDAQ from May, arguably a bit late, but still very effective.

Jerome Powell said nothing new this week, and the New Year still looks bright for the beaten-up stocks, regions and sectors, as rates decline. I suspect prospects for the perennial winners to keep on winning are not too bad. Although economic growth will suffer (and so will earnings), but valuations still have some space to catch up amongst a lot of this year's losers, as discount rates keep swinging lower and bond yields dwindle.

A RED CHRISTMAS – Looking forward a year.

A year ahead, politics looks more interesting: so, what will the newly elected British House of Commons do next Christmas? What are the choices and likely outcomes?

The new Labour prime minister will care relatively little about political opponents, and quite a lot about holding party discipline.

Nor, we are told, will he seek early solutions to some of the more intractable constitutional problems (Second Chamber, Proportional Representation, Party Funding etc.), as based on his predecessor's experience, that just wastes precious time.

For all that, when it comes, his manifesto will (at last you may say) be festooned in clear deliverables, a plan to govern, at least for the next year. While Rachel Reeves is influential, the drive will be legislative, not economic. But as ever The Chancellor will have to then deliver the possible.

A DOLLOP OF BORROWING

So, more debt, extra tax, spending cuts are the options facing her, to fund that manifesto along with a cursory fig leaf for growth. The latter is needed (like the absurd Tory public spending targets) to get the Office for Budget Responsibility on side. Albeit responsibility is what you take, whereas the OBR offer simply a comptometer's sign off on specious forecasts.

For all that the Treasury thinks Gilt markets pay attention to the OBR, although I doubt it. So very early on, the rather too stringent self-imposed spending and funding restraints the Tories have adopted, will be quietly reconfigured. The rise again of a few PFI like schemes to keep stuff off the books is likely; Labour does not do fiscal hawks.

Falling interest rates and lower indexation provide small windfalls, and binning the 'irresponsible' Tory promises of tax cuts, won't hurt the numbers either. So yes, more debt, low tens of billions at least will be used.

A SPLASH OF TAX

What of tax? Can the pips be made to squeak. Yes, again, I am sure they will be, although not really on income tax, and I think for employed staff not on NI either. Labour has no love of the entrepreneur, who is too poor to hire lobbyists or to make donations. So, a bit more squeezed there off the self-employed and small business owners.

I expect a big hike in fuel tax, especially petrol and aviation fuel, under a green cloak, generating another £10 billion. Consumption taxes remain rewarding: VAT rates, thresholds, and exemptions are all likely targets. And if they are inflationary, just adjust them away in your numbers. Nothing new – claiming them to be a 'one off' (of course).

UK property taxes are low in the South East, due to a long-standing failure to re-rate, so there is some scope there. With more housing coming, this will likely be punitive. But there are other enduring loopholes, that make little sense: REITs, Limited Liability Partnerships, a lot of EIS, VCT, Freeport stuff, albeit none of that is big ticket. I guess some simple populist tariffs may arrive as well. Labour is at heart protectionist.

All in all, I expect Labour to get enough from extra debt and taxation to provide a budget to tackle (rather than just top up deficits in the funding of) some long-standing reforms. I'd also expect seizures of assets. The Treasury seems to have a taste for balancing the books illegally, and there is little judicial protection.

PRESENTS FOR SOME

I don't expect infrastructure or defense budgets to be much loved – that's some of the cuts. The undoubted green spend will likely benefit (or keep on benefiting) China's manufacturers, more than the UK, but do still expect energy prices to go on up. They are the modern sin tax.

But higher tax, debt and spending can be pretty good for the economy, as Biden has shown, it all depends on how long you can get others to fund you for, and at what price.

Much as I am sure Labour don't want to crash the pound, they normally eventually find a way to do so, and for all my glib assumptions, they will be starting far closer to the edge than most new governments, for some while.

THE HANGOVER

How useful is that analysis? Well don't expect the FTSE to collapse, this will be a spending regime, but do expect stock specific damage, although arguably a lot of that is in the price of impacted sectors, or indeed the long standing (and ongoing) flight from UK equities overall.

The FTSE is mired in a twenty-year stagnation, from 7,000 in 2000 to well, 7,000 now, although not to altogether discount the medium-term Tory inspired rally. Note what Labour, even Blairite Labour, gives you.

On the other hand, sitting, duck-like, waiting to be hit, or worse buying into vulnerable areas, feels quite high risk.

The election outcome is (and has been for a while) clear. Nor is this a safe European coalition of the sane and less sane. It will be red through and through.

Given so many other options, and that some of the pain will be direct on pensions and property, it seems a good time to start planning on the investment side.

The MP's pension fund invests only 1.7% in UK listed equity. Do they know something?

Have a magnificent Christmas and thank you for reading.

We will be back on January 14th.

Charles Gillams

17-12-2023

By their works . . .

The November bounce in markets was a bit of an illusion, as interest rates may no longer matter, but foreign exchange still does. Inflation in commodities is probably sorted.

Meanwhile, Jeremy Hunt tinkers.

EQUITY MARKETS and the FABLED FIRST RATE CUT

The dramatic November rally, only looks that way if you are a dollar investor and for some weird reason the archaic Gregorian calendar matters to you. Sticking with the even older Julian one would have made October's performance much better and leave us ten days more of November to enjoy. Plus, lots more shopping days to Christmas.

While it was great for the big US indices, almost (but not quite) hitting the year's highs, in the UK, it was rather less so; the FTSE hit 8,000 in March and has slid down since, back to pre-COVID levels around 7,500.

The November US rally was also dented for sterling investors by a dramatic 4% slide in the dollar.

So, while it feels attractive, the fascination with the first rate cut date is pretty spurious. That is not the market driver. Markets have so far given us nothing this year for avoiding a global recession and seeing the last rate hike of the current cycle.

Surely that is worth something?

AND LONG BONDS

In a like fashion long dated bonds are giving us very little for having nailed inflation, and having (at least in the US) a credible inflation fighting stance again. So those, if you trust the US Government's credit, are not looking bad. This patch of inflation may have stretched the meaning of transitory, but it clearly remains just that, not a 30-year phenomenon.

Instead we see the recent fall in yields as being more driven by relief that rates have topped, and a desire to lock in nice returns in the global reserve currency, attributes which seem likely to overwhelm domestic US worries about high levels of issuance.

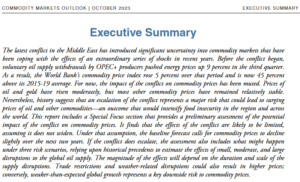

COMMODITIES

Commodities are where economics in the raw is most visible, especially soft commodities. High prices will always bring in marginal land, and there is no shortage of land on the planet. It may take a planting cycle or two, but food inflation always was transitory. Corn is now below pre COVID prices, let alone pre-Ukraine.

We believe the same is true for energy, for two long standing reasons: the first is that sanctions don't work, certainly not against enormous blocks like China and Russia. The second is that high prices create supply and in a highly tradeable commodity, they do so quite fast.

So, the idea of shutting in energy to manipulate the market price, is in the end self-defeating. It has to be. So however much the anti-carbon lobby and OPEC desire high prices, they are not sustainable. Indeed, it feels as likely that we get one of those crushing late spring drops in prices designed to flush out over-geared operators. That weapon works best, when interest rates are high and storage tanks are full. So why not use it? I remain far more nervous about the oil patch than most, it has yet to see the post COVID, overstocking crisis, that has rippled through so many sectors. Held off by the Ukraine war, oversupply is still around.

The World Bank October commodities forecast base case is for continuing declines.

Look at Healthcare stocks, still suffering from the COVID bubble deflating, despite new wonder drugs.

A stock like Worldwide Healthcare Trust, peaked in summer 2021 and has then slid remorselessly lower.

A LOOK AT HUNT'S TAX FANTASIES

Well, why bother, his tax give back is rightly mocked as trivial. His vague attempts to get welfare under control are painted as draconian, when they are anything but. While his games around a set of unrealistic self-defeating assumptions that he gives the OBR to produce nonsense projections in return are just absurd.

Full expensing for corporation tax is clever in only one sense, it is certainly not a tax cut, whatever he says, it is just bringing forward deductibility from after the next election, so off his watch. It is not changing what is deductible at all, and there will be loads of complex rules against deductions still, as ever.

While to most sensible cap ex modelling, the tax treatment remains damaged by last year's massive corporation tax hike. The long-term tax profile simply does not change, so it does not encourage investment, whatever he claims.

Oddly the real tidying up, as ever, is handled by Gove, quietly putting in place critical and very welcome new political funding measures, which reverse some of the long slide into democratic absurdity inflicted by inflation.

And he pops up in odd places as the fixer still, like Dublin trying to get the Ulster Assembly back in action - a vital if unpleasant piece of plumbing too.

Those are late but worthy actions, as a career ends.

The efforts on investments, while welcome and overdue are still tinkering, and the games with ISAs are as boring as ones with capital allowances. We see no real effort to simplify matters for domestic investors. The joke slashing of capital gains allowances (far from indexing or freezing they are still going down) shows a profound dislike of investors and investment.

Instead, a we get a work round to help UK investors buy fractions of Nvidia, - really?

Charles Gillams

3-12-23