Cheer Up, They Said

After a pleasant summer, the dampness returns, exposing a quite enormous and unbalanced level of growth among the verdant thickets of both Middle England and the NASDAQ.

Markets must climb a wall of worry, and the next two months are not short of that. Forget interest rates and non-existent recessions, that’s just the stuttering voice of old economic models, fed fouled data from the last century.

IT IS ALL POLITICS

No, the risks now all look political; the prevailing orthodoxy is the West can keep borrowing levels high, to fund bloated and protected wages and welfare weirdness, impervious to international competition, or indeed to inflation. It has worked so far, and with excess and free flowing capital, there may always be a funder, mainly of state debt or residential mortgages, as well as a buyer of a few anointed equities.

And so far, that has remained the trend and indeed, somehow, the centre has held, once exceptional debt has now become permanent. This is aided in part by centre and centre left parties collaborating to silence the right, often behind the somewhat specious argument of protecting democracy from the wrong kind of votes.

But markets are jittery, they know the sums don’t add up, as do voters.

Debt as % of GDP, US in red, Japan in purple, UK light blue, France dark blue

IMF data mapper – from this page.

The same defence of democracy continues to require the now usual never-ending wars, and divisive and punitive trade barriers and sanctions.

Both businesses and investors are quite happy to sit on the sidelines, until a few questions get answered. The UK budget is expected to finally nail the myth of growth, by heavy new taxation, although it has almost been oversold, the reality might be a relief. It is not just the severity (it won’t be that bad) that matters, but also the direction of travel. Will it hammer savers, investors wealth creators and employment or attack consumption and waste?

Labour denials of an extra £2,000 a year tax on average incomes remains to us implausible and indeed we suggested many would be relieved at only that. Well before the election we said it will need about £20bn (economics is pretty simple really) and suggested the biggest chunk of that will come from fuel duties; we will see. Indeed, we’ve always known that various fudges would be used to skirt round the creaking OBR defences too.

The main UK stock market indices are once more in slow retreat, and while sterling is strong, we attribute that to short term interest rate differentials. High government borrowing is after all good for lenders. While in the US, it remains impossible to tell where the legislature ends up. Although like Starmer, many voters are so convinced the alternative is useless, they will overlook the socialist taint.

EMBRACING THE SIDELINES

Just now, the sidelines feel a good place: hedge funds, shortish term, high quality debt. There is scant evidence that the normal run upwards for emerging markets and smaller companies, from rate cuts, with attendant dollar weakness, has started, although many areas have moved in anticipation. But why buy in September when November is so much more certain?

That switch to smaller companies and emerging markets also may not happen this time, emerging markets have a lot of china dogs that look quite fragile, and smaller company liquidity is dire, so if yields stay high and defaults low, why add risk? While the inevitable fiscal squeeze will not help the hoped for returns and dynamism of a monetary easing cycle; you need both to work.

India meanwhile still stands out long term, but both the centre and more starkly the states are showing a notable loss of fiscal discipline, unrest in Bengal does not help and the IPO market is frothier than a Bollywood musical.

ROULETTE AT THE TORY PARTY

Given the apparent penchant for gambling, how many of the six (now five) chambers hold live rounds? We should glance at these ever-fascinating trials. The party faces strategic questions. Notably when does it expect to recover the 200 odd seats it needs, and how?

Well, I suspect the group saying next time (2029) will still dominate, although it looks rather unlikely. As to how, the assumption, I assume, is by halving the Lib Dems, but that’s only 36 seats, which leaves over 150 to get from Labour.

Interestingly every leadership candidate agrees that it was all Central Office’s fault, not for instance the wrong policies or a foolish rush to the polls. Most also at least pay lip service to rebuilding from the bottom up through local councils. Indeed, they even accept associations might matter.

Although there is also quite a bit, still, of finger crossing and waiting for Labour to implode. Not such an obvious solution this time.

As for Reform, if they also fail to implode, but settle in to be a real alternative, like their French and German counterparts, they will at least deny the Tory party their votes. Who knows, David Cameron might even emerge, in twenty years’ time, like Barnier as the compromise leader, from a party of no current electoral relevance.

It is hard to get involved in the contest, which will be down to four from the original six by next week. With so few MP’s, the choice is not brilliant.

It is a very narrow electorate, just 120 survivors of the wreck, so calling it and the shifting allegiances it reveals is hard. However once decided, it will be clear if the party is going long or short and which seats it is targeting, which in time will matter a great deal. Is it still unaware that a missed target could be fatal?

SAVERS TO BORROWERS

As for markets, I tend to ignore summer and short week trading, and the switch from bonds to equities, from savers to borrowers is a powerful economic force, as rates fall, but while the direction is clear, the angle of descent is not.

I assume it could be worse, that is even more uncertain but wondering how. Roll on Guy Fawkes Day.

OUR OWN EVOLUTION

This blog is evolving - when we started Monogram was a fund manager in widely accessible products, but that’s no longer the path - we are increasingly moving towards family offices and offshore clients.

With a less domestic focus, it seems time to move this to a stand-alone blog. Which brings with it a touch more freedom. It will continue to remain fascinated by the world of economics and politics, and indeed fund management. But may be happier to poke about in the mud for sustenance, or sound a startled alarm, as we become the Campden Snipe.

It is Not a Pipe

A long view this time : Has the price of capital changed for good? How bad is the UK position? Oh, and the unusual universality of colonialism.

A Far Off Galaxy

Let’s start with colonialism. I have been reading about the benighted past of Bulgaria (R.J. Crampton, 2nd Ed, CUP). A Bulgarian I know said that the country ‘has a knack for picking the wrong side’ - a little harsh, I thought. However, it has always existed as a colony, aside from a brief imperial phase around the last millennium but one, and before that when it equated to Thrace, almost as far back again.

Given the option, Bulgaria recently opted to join the Western European empires’ current formulation as the EU and NATO - the latter being the armed wing of Western thought. Bulgaria had suffered horribly under the Soviets, with a steady and ruthless coercion of an existing multiparty democracy, at a speed just enough to keep outsiders ignorant, or if not, passive.

That history gives me a whole new viewpoint, on the string of broadly similar states. The Balkans and The Middle East all appear in a new light, and indeed I start to comprehend the bitter sideshows (as they seem now) in both World Wars, over that same terrain.

The collapsing empires (Russian, Ottoman, Roman,) seem more influential than the current rulers in so many former colonial states. They are really not, as we think now, a series of nations fighting for ‘independence’. In most cases that independence is fragile to the point of being mythical, while the internal fissures are enduring. The cracks of nations within empires, not of states within a world.

Now You See It

One passage in Crampton’s work stood out “by mid-summer social and industrial unrest were widespread with strikes by civil servants. On transport networks, and despite the provisions of the law, in the ports and medical services. The government was forced to grant a 26% wage increase to all state employees, an action which weakened its attempts to control the budget deficit and inflation and which did little to impress the international financial organisations.”

Written about conditions just before another wrenching Balkan realignment last century, this rather made me stop and reflect.

A parallel with the UK?

Just how close are we in the UK to that edge? Lost in a warm feeling for individual strikers and their causes, and a very British willingness just to plough on, there still seems to be a real danger.

I am well aware of our great national strengths, in the arts, our language, higher education, science, heritage, even logistics and retailing - they are enduring causes for optimism. But long-term investors need to weigh up the recent damage, especially the loss of political capital by the “responsible” right, the high levels of debt and taxation, which coupled with low productivity, could also spell trouble, the certainty of ongoing nationalism and the unhealed rift of Brexit.

There is danger too in the probability of a Labour government, which however centrist the leader is, will have left wing factions to assuage. It is equally dangerous to continue our recent experience of minimal ministerial experience. I hope the change won’t be as bad as I fear, but it will probably be worse than I hope.

This remains a reason for the FTSE to be anchored to late 20th Century levels, despite almost every stock I research looking cheap. The fear of being still cheaper tomorrow rules.

Do Markets Care?

On the other hand, re-pricing capitalism after the decade of populist nonsense by central bankers does feel pretty good. If you have no cost of money and no reward for savers, financial gambling prevails.

All of this raises a key issue: is the apparent resurgence of speculation (the greater fool theory of investing) permanent? In which case investors should probably just watch momentum. Or is this most recent re-run of the last decade’s speculative phase, really transient?

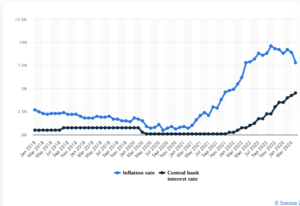

For a better view, see this page on Statista

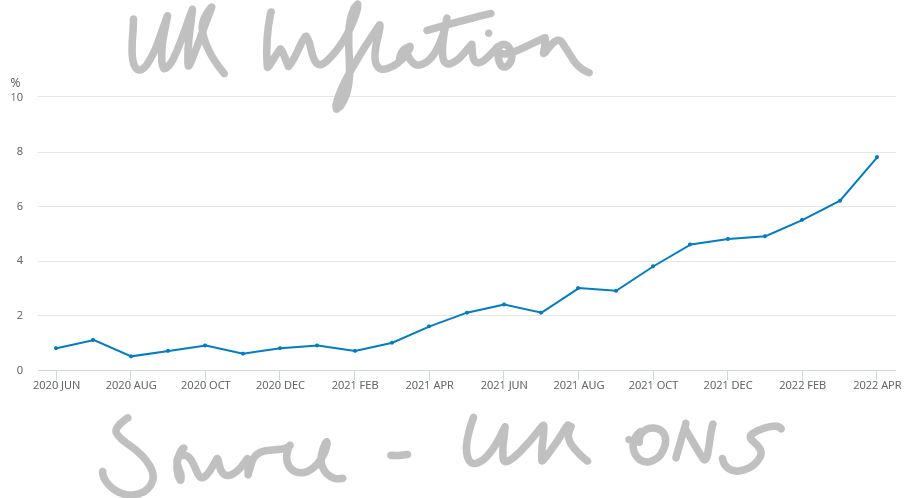

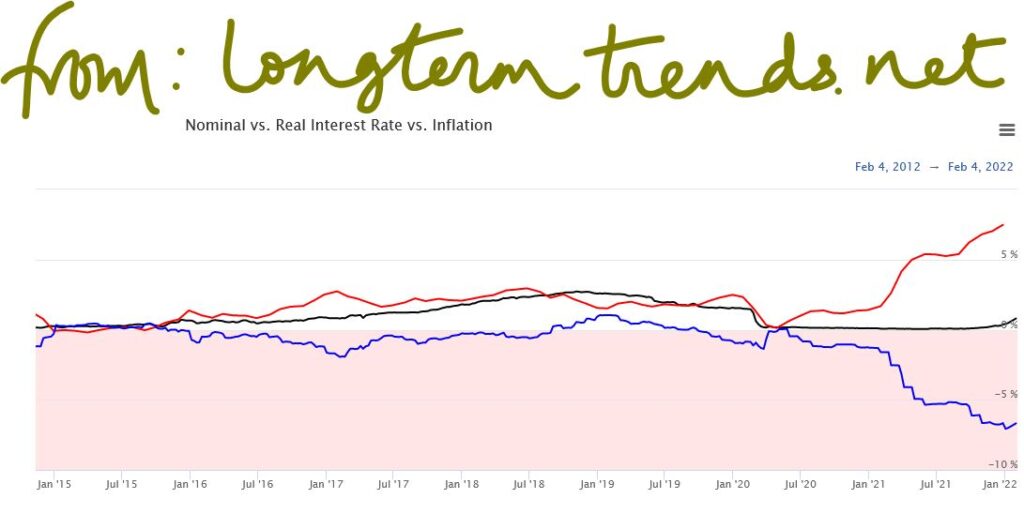

As long as inflation exceeds the cost of money, assets will likely rise; the widespread return of real interest rates (a point we are almost at) should slow that down.

After that point what matters is cash flow, and whereas gambling will favour growth stocks, real returns come about when interest rates are high, but inflation is also falling. The gap matters and we are not there yet.

This is probably the crux of the next two years, and we doubt that having had a serene and slow drift towards recession, there is any reason either to expect a suddenly faster descent now, or really to expect the corollary, a sudden fall in interest rates, to offset a deep recession.

If rates stay high, but have indeed peaked and inflation declines, value investors should be in a better place. If they get it wrong, they are at least paid to wait.

As we have seen in the last twelve months, growth investors fuelled by borrowed money really do need a rising market, they get hit twice if it falls: both through a loss of capital and then the need to fund loss-making assets at real rates.

The Monogram View

Overall, our position has been that fundamentals should win, but we suspect momentum will win. Spotting the next momentum shift early, therefore remains a powerful driver of returns.

One narrative of 2023 (so far) is that the SVB crisis and stronger growth combined led to far more liquidity than markets expected. This fed into the gambling stocks, giving them momentum.

So, although the first half was not what we expected, the second half might still be. But it is just one narrative, and it may still be the wrong one.

Note : Further reading, for those interested in Bulgaria :

See also, The Bogomils: A Study in Balkan Neo-Manichaeism, Obolensky, Dmitri.

Bonds and Bullwhips

What are bonds for? Not always what you think. And the whiplash of the economy, (the bullwhip effect on all markets) makes recession both inevitable and meaningless.

Corporate bonds vs government bonds

So, to compare bonds - a corporate bond is issued to fund a project to produce a return greater than the interest and principal, and then pay the lender back. Much of the value lies in the assessment of how reliable that redemption is. Some of it is also whether the bond is cheaper or more expensive than a similar one, some of it is who is allowed to hold that bond.

But value lies in redemption, especially at the shorter end.

So, on that basis, what are government bonds? Well, they are there to achieve other objectives, seldom involving either redemption or a cash positive lifetime. It is largely accepted that they are a funding device to load debt upon future taxpayers, who luckily can’t vote. And the price of the bond is just what investors will pay for it.

Market rigging

Governments will therefore try to directly rig the market, to avoid paying too much interest, by for instance, mandating all investors and especially pension funds should hold gilts, their debts, on the gloriously fake grounds that they are “safe”. Well, just remember this year’s disastrous collapse, down by a quarter at the long end, with plenty of volatility too, ‘safe’ they are not. But the regulators and professional bodies still peddle versions of the old homily about the percentage of bonds in a portfolio should equal your age.

They can also apparently use the rate of bond interest to control inflation (so they say), so raising it (and devaluing bonds) if inflation rises, albeit the causes of inflation have little to do with the bonds (or bond investors). Then most marvellous of all, they can rig the price by easing and tightening their ‘quantitatives’ at will. Although no one is quite sure what a quantitative is, or indeed where it lives.

So, the government bond market turns out to be pretty much whatever you want it to be. To be contrasted with the weird and feckless equity, whose value can be, pretty much whatever you want it to be. Or indeed bitcoin, whose value….

A difference of degree granted, but less clearly one of substance. Rigged markets in any asset, make us nervous, and all markets are increasingly manipulated, to some degree.

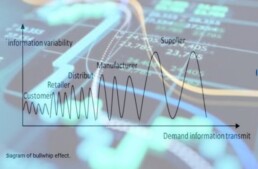

What of bullwhips and earthquakes?

Well, both show a declining sinusoidal wave, that ripples prettily along and disappears. Whether it is the globe scratching its toe itch in Tierra del Fuego, or an irritated ear in Reykjavik, it is very jumpy. Where you stand now can be higher or lower than yesterday; it is erratic, chock full of faults, and crucially, not smooth and cyclical.

So, measuring whether you are higher or lower than last week’s datum matters little, if your fields have vanished into the sea, or indeed your sea has become a field.

So it is with recessions, after the shock we have had, being up or down two quarters in a row is trivial. Indeed, as that slick whipping wave races by, we will certainly be both.

Do changes in the Government bond markets matter?

And trying to decide whether the gyrations in the government bond market have any relevance to the level of the economy when the whole structure is bucking around, is slightly crazy. Nor are yesterday’s maps going to be of any use.

That is even assuming that the price of bonds has any relationship to anything except how little governments want to pay for their exorbitant debts. While I have not even mentioned the wealthy autocracies involved in the same game.

And that’s the market muddle we are in. The US Central Bank is playing old style economics, using the interest rate to control inflation - hang the cost of debt, that’s a problem for Congress.

But the UK and European Central Banks are playing new style, because they fear that the usual medicine will be disastrous for their rather sickly patients.

And US stock markets are using that funny old, discredited, yield curve to predict a recession that is by their definition (two down quarters in a row) inevitable, but ignoring the COVID earthquake which has upended all our old data and assumptions, simply because we have never had one like that before. The curse of econometrics is that we can only predict the future if it resembles the past.

EU stock markets

Meanwhile European stock markets have understood rates are not going up much more, because the EU would prefer to rig the market, so investors think they must have avoided a recession, which is equally a delusion.

And underneath all that is the great big chunk of molten sludge at the core, the vast irredeemable mass of government debt, where real yields are apparently staying submerged everywhere.

So wise men can select from all of that to predict that markets in debt and equity are going to go up a lot or down a lot, really as you wish. And they may all be right, at least somewhere on the globe.

Our own choices

But we still see no point in holding state debt, nor much in holding cash for too long. Corporate debt and equities, especially equities with a real value that you can figure out, maybe. We look at ones without state interference rigging the price, and with an ability to raise prices to hold margins, and which have a dividend yield. Those, we think, may still be attractive.

And we are not alone, many markets and stock prices bottomed out in October and are steadily inching up. Our own MonograM momentum models (both in the USD and GBP versions, a rarity this year) have triggered a re-entry into equites, and for once in a while, not US ones.

Something is shifting under our feet. So next year at least, is very unlikely to be like this year.

When we next write the calendar will have changed and no doubt many rate rises will have happened. But we doubt if the big themes will change much.

In the meantime, Seasons Greetings and a prosperous New Year, to all our readers.

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

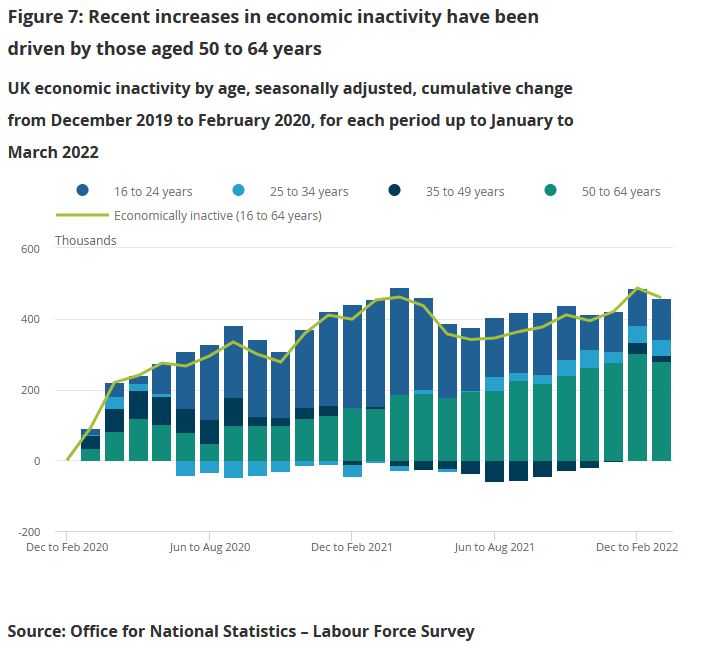

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.

LOCATING THE ELUSIVE BASE

the investment impact of recent events

CRANES

I spent last Sunday in the elusive pursuit of grus grus, in the upper Marne basin, East of Paris. For some reason the Common Crane had already left in a bid to cross Central Europe, heading for the Artic, weeks earlier than in most seasons. Clearly, they knew something about the airspace ahead of them.

While the largely empty Lac du Der, also had lessons on levelling up; here was a vast and disruptive engineering scheme, it seemed executed without too much controversy, operating well and with the surrounding villages wealthy, quietly prosperous and largely content. Or so it looked in the February sunshine. It was all in pretty harmonious concord with nature too.

THE FRENCH MODEL

It seems the French can see the grand scope of government, the need to provide top class infrastructure. Here is their France Relance plan up to 2030. Up to 3-4 billion Euro is likely to be spent in 2022 alone.

The issue is perhaps not just politics, but the unspeakably low quality and lack of vision of the UK governing class. The French cities have retained their great buildings, the administration is a high profile and visible force, not something to park in the burbs, having ejected them from city centres to grab their assets for still more rentier housing. Nor does the state foolishly aim to do everything, the peage (and TGV) enable high class fast communication, but certainly not always for the lowest price. Nor is health care completely and absurdly free, irrespective of demand. But it is effective.

Power is cheap and plentiful, no hysteria about nuclear there, and the military proud and visible, even the transport police are packing heat. So, watch that off peak ticket schedule.

Of course, not all is rosy. COVID hysteria still ruled, masks and vaccine passes were required for everyone, for everything.

Yet if any UK government is serious about leveling up, (as in the recent White Paper) here is both a lesson, and an indication that Gove’s piffling attempts are a mockery; he needs more like £48 billion to start it, not £4.8 billion.

You feel they just picked up the easy option from the choices their tired civil servants had suggested. Perhaps it was the one that said, “No real impact, but sounds OK for now”.

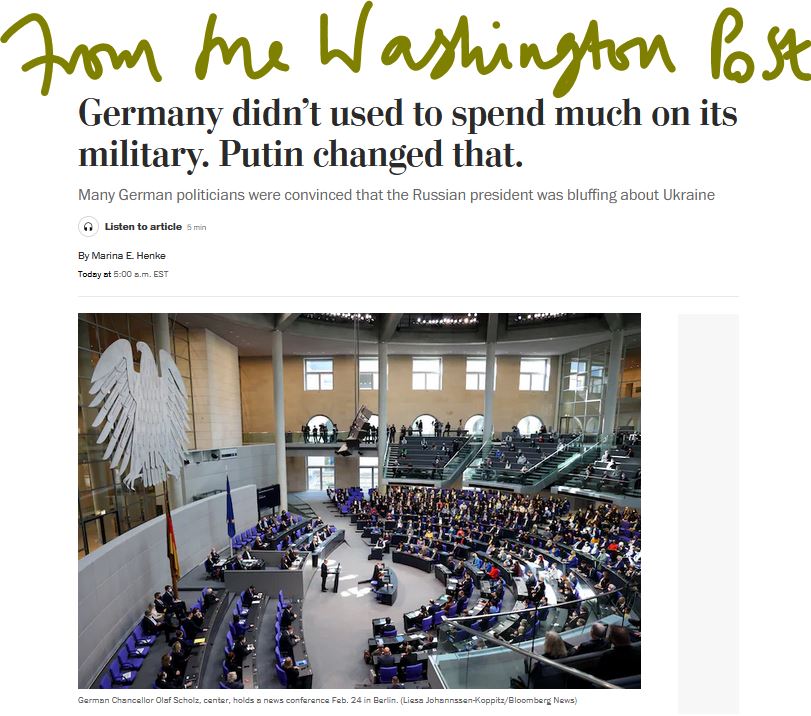

UKRAINE - Did Putin miscalculate the West’s indifference?

Ukraine? Not a lot to add to that. We were wrong that Putin was not stupid enough to do it. Wrong too that it would be over in hours. So, treat our topical ignorance with care. Also, wrong that the West would shilly-shally over piecemeal sanctions. Whether we are wrong yet again in assuming that without a quick win, the sanctions will now damage the global economy quite badly, remains to be seen. I also suspect seizing Central Bank assets can only be done once and once done, global finance and investment will become far more fractured, forever.

But in truth, it was going that way already.

However, this blind market panic seems absurd. I really doubt if Putin, at this point, wants to line his battalions up on a border to provoke NATO, who are I suspect closer to an aerial counter strike than he thinks, and would indeed now love the excuse of any incursion on NATO soil.

He has made it into a popular potential war for the West, the most dangerous sort.

War Tactics

It looks to me as if Russia wants a pincer movement, to isolate Ukraine’s forces in the Donbass, plus a threat to Kiev to topple the government, but has he the muscle to take and hold all of the vast country? Even if he does, that does not suggest he will go further than Ukraine, just now.

While his aims are so blatantly false, success can be easily claimed for almost any outcome. So, a collapse in currencies, and stock markets across Eastern Europe, looks an exaggerated response. True, this is Germany’s worst nightmare come true, no competent military and a gun-shy US, so they must now realign fast, and where Germany goes, so goes the EU. It is not going to fold or fissure in the face of this explicit threat. Although Germany at heart is much more like the UK than France; rapid execution will not be quite as easy as simple announcements. Remember the farce over moving Tempelhof airport?

As yet, the final step of directly locking in Russian energy supplies, large parts of which go to German consumers, has not been taken, but that would, in the short term, be very costly.

Although high taxes on energy give governments a great incentive to let prices rip, (and demand destruction is great for the climate lobby too), but they are rather less popular at the ballot box.

Interest Rates

Meanwhile Powell remains determined to stay behind the curve on rate rises, it is as if the received wisdom on rates, indeed on Central Bank power, has been quietly ditched, and instead he is hoping inflation burns itself out through demand destruction/supply creation. Well, an interesting experiment, but if that’s the game, as we have predicted for a while, inflation will remain gently smouldering, but rate rises will still be very gradual.

The Fed should have turned off the monetary stimulus and reset to ‘normal’ six months ago, by the time they finally move, it will be a full twelve months late. Real rates are deeply negative, levels not seen in decades, and moving fast, this is really not quarter point stuff.

All of the above implies on-going nominal economic growth, ongoing share price appreciation (at least in nominal terms) and an ongoing reward for borrowing to excess.

But despite the rush to safety currently supporting the US dollar (and US assets) the danger to markets is not just from the noisy, tragic, East but also from experimental monetary policy in the US.