The Art of the Possible

Image from Wikemedia - by Neide José Paixão

Looking at Absolute Return – Can it be Done?

A wise old hand once told me that all investors want is protection from inflation; do that, earn your fees and your job’s done. Read more

Bonds and Bullwhips

What are bonds for? Not always what you think. And the whiplash of the economy, (the bullwhip effect on all markets) makes recession both inevitable and meaningless.

Corporate bonds vs government bonds

So, to compare bonds - a corporate bond is issued to fund a project to produce a return greater than the interest and principal, and then pay the lender back. Much of the value lies in the assessment of how reliable that redemption is. Some of it is also whether the bond is cheaper or more expensive than a similar one, some of it is who is allowed to hold that bond.

But value lies in redemption, especially at the shorter end.

So, on that basis, what are government bonds? Well, they are there to achieve other objectives, seldom involving either redemption or a cash positive lifetime. It is largely accepted that they are a funding device to load debt upon future taxpayers, who luckily can’t vote. And the price of the bond is just what investors will pay for it.

Market rigging

Governments will therefore try to directly rig the market, to avoid paying too much interest, by for instance, mandating all investors and especially pension funds should hold gilts, their debts, on the gloriously fake grounds that they are “safe”. Well, just remember this year’s disastrous collapse, down by a quarter at the long end, with plenty of volatility too, ‘safe’ they are not. But the regulators and professional bodies still peddle versions of the old homily about the percentage of bonds in a portfolio should equal your age.

They can also apparently use the rate of bond interest to control inflation (so they say), so raising it (and devaluing bonds) if inflation rises, albeit the causes of inflation have little to do with the bonds (or bond investors). Then most marvellous of all, they can rig the price by easing and tightening their ‘quantitatives’ at will. Although no one is quite sure what a quantitative is, or indeed where it lives.

So, the government bond market turns out to be pretty much whatever you want it to be. To be contrasted with the weird and feckless equity, whose value can be, pretty much whatever you want it to be. Or indeed bitcoin, whose value….

A difference of degree granted, but less clearly one of substance. Rigged markets in any asset, make us nervous, and all markets are increasingly manipulated, to some degree.

What of bullwhips and earthquakes?

Well, both show a declining sinusoidal wave, that ripples prettily along and disappears. Whether it is the globe scratching its toe itch in Tierra del Fuego, or an irritated ear in Reykjavik, it is very jumpy. Where you stand now can be higher or lower than yesterday; it is erratic, chock full of faults, and crucially, not smooth and cyclical.

So, measuring whether you are higher or lower than last week’s datum matters little, if your fields have vanished into the sea, or indeed your sea has become a field.

So it is with recessions, after the shock we have had, being up or down two quarters in a row is trivial. Indeed, as that slick whipping wave races by, we will certainly be both.

Do changes in the Government bond markets matter?

And trying to decide whether the gyrations in the government bond market have any relevance to the level of the economy when the whole structure is bucking around, is slightly crazy. Nor are yesterday’s maps going to be of any use.

That is even assuming that the price of bonds has any relationship to anything except how little governments want to pay for their exorbitant debts. While I have not even mentioned the wealthy autocracies involved in the same game.

And that’s the market muddle we are in. The US Central Bank is playing old style economics, using the interest rate to control inflation - hang the cost of debt, that’s a problem for Congress.

But the UK and European Central Banks are playing new style, because they fear that the usual medicine will be disastrous for their rather sickly patients.

And US stock markets are using that funny old, discredited, yield curve to predict a recession that is by their definition (two down quarters in a row) inevitable, but ignoring the COVID earthquake which has upended all our old data and assumptions, simply because we have never had one like that before. The curse of econometrics is that we can only predict the future if it resembles the past.

EU stock markets

Meanwhile European stock markets have understood rates are not going up much more, because the EU would prefer to rig the market, so investors think they must have avoided a recession, which is equally a delusion.

And underneath all that is the great big chunk of molten sludge at the core, the vast irredeemable mass of government debt, where real yields are apparently staying submerged everywhere.

So wise men can select from all of that to predict that markets in debt and equity are going to go up a lot or down a lot, really as you wish. And they may all be right, at least somewhere on the globe.

Our own choices

But we still see no point in holding state debt, nor much in holding cash for too long. Corporate debt and equities, especially equities with a real value that you can figure out, maybe. We look at ones without state interference rigging the price, and with an ability to raise prices to hold margins, and which have a dividend yield. Those, we think, may still be attractive.

And we are not alone, many markets and stock prices bottomed out in October and are steadily inching up. Our own MonograM momentum models (both in the USD and GBP versions, a rarity this year) have triggered a re-entry into equites, and for once in a while, not US ones.

Something is shifting under our feet. So next year at least, is very unlikely to be like this year.

When we next write the calendar will have changed and no doubt many rate rises will have happened. But we doubt if the big themes will change much.

In the meantime, Seasons Greetings and a prosperous New Year, to all our readers.

WHAT DO THEY KNOW OF ENGLAND?

Let us look at tech, private equity and this seeming market bounce, driven by those sectors. The NASDAQ is up almost 10% at 11,320 after a trio of twelve-month lows in the mid 10,300’s, the latest of those lows just this week. Meanwhile it looks like the US Elections have delivered both gridlock and a rebuff for Trump, which some see as a perfect mix.

Today’s post title is derived from Rudyard Kipling at his most sanguine and reflective.

I HAVE FLUNG YOUR STOUTEST STEAMERS TO ROOST

The true horror of the tech wreck has also been concealed for UK investors, by the climb in the dollar, a move that seems to be going into reverse. In terms of closing prices sterling has rallied hard from 1.08 to 1.18 in a little over a month. This has left the NASDAQ collapse, from touching 16,000 - brutally exposed, now without much of the concealing currency appreciation.

Where is the Nasdaq headed?

We suspect that the NASDAQ is heading lower still, but accept that is a big call.

From this page on Tradingeconomics

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making.

However, market sentiment has perhaps turned, the tech rubbish generally got chucked out early. The subsequent switching out of the tech majors probably had to be into Treasuries, where their recent price rises suggest some demand, or into cash.

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making. Bumping up against that is the second phase of the market collapse, as the multiples on profitable tech giants returned to earth.

And cash (and oddly apparently the S&P) has also been seeing inflows from China and crypto, as those areas have sold down hard. There is also the unpleasant negative impact of holding cash, on returns. Put this together with sentiment, and this may well help the NASDAQ bounce into the year end. However, many fund managers cite the dotcom bust as meaning this is now starting a multi-year sideways recovery phase, not a quick bounce at all.

LONG BACKED BREAKERS CROON

A concurrent look at Private Equity is important. NASDAQ multiples drive much of their values and are falling, and with such a recent twelve-month low, Q3 valuations (private equity valuations are always lagged) have further losses built in. And a sprinkling of those will now also be based on a significantly higher dollar too. That won’t be pretty either.

Plus, as we know there are some spectacular blow ups lurking in there, the insolvent FTX was a big investor in, and investee company for, some well-known PE names. Overall, despite solid reports, I am still expecting some fair-sized holes in quoted private equity, as either the NASDAQ rises and the dollar falls, causing currency losses, or the NASDAQ falls and the dollar rises and the one again masks the other.

Access to distress financing, has it seems largely vanished, as it does at times like this, making the chance of highly damaging wipe outs, not just down rounds, much greater.

A possible dollar sterling parity?

But those talking of dollar sterling parity are surely way off now. So, regardless of future disasters, I want more information before seeing UK Quoted Private Equity Investment Trusts as a buy. About six months after the NASDAQ bottom, will be a good valuation point, and that likely means Q3 2023. At that point we will know what the current large discounts really refer to; I don’t expect them to look anything like as generous.

THE UK - UNDER A SHRIEKING SKY

There is a lot of market optimism about the next UK budget, based on Hunt being really nasty. That may overstate his hand, as the Government has long abandoned reform, it can only support out of control spending by harsh tax rises, which will certainly kill jobs, but probably the wrong ones.

Nor can it do much to enhance investment and has foresworn labour market reforms, so both of those, with existing policies and more rate rises, must encourage the persistence of poor productivity.

Although of course the real budget numbers will be barely mentioned; energy, rate rises, and inflation are largely out of Hunt’s hands. He is lucky all three do look a lot better than when he was installed. So, the need for harsh medicine is rather reduced, and may even disappoint.

But just as the rally helped US risk assets, so it helped others, like property, come off a deeply oversold floor. TR Property Investment Trust has jumped 30% in a month, for example, and still yields over 4%.

Post Mid-term elections for the US

And coming full circle, although slowing inflation took a lot of the credit, at least some of the post Mid Term bounce came from realising that the Federal Reserve now has an ally in the legislature. It can be less vigorous in steering the economy, just relying on the brake pedal, as Biden and Congress are no longer able to simultaneously hammer the accelerator.

Overall, however we still remain cautious, we expect this pre-Christmas rally to fade, rate rises to persist into at least Q2 2023 and rate cuts to be a 2024 feature. And peak gloom lies ahead as those rate rises conclude and then start to actually bite.

Looking ahead

In general markets have had a solid look at the worst case this year, from famine to invasion and nuclear war, to out-of-control Central Banks and deluded politicians, and nothing terribly dramatic has transpired. So even with bad things still happening, we don’t see a repeat of this year’s dramatic falls either.

Charles Gillams

- The Kipling Society meets on November 16th, at the Royal Overseas League.

PICTURES OF MATCHSTICK MEN

I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

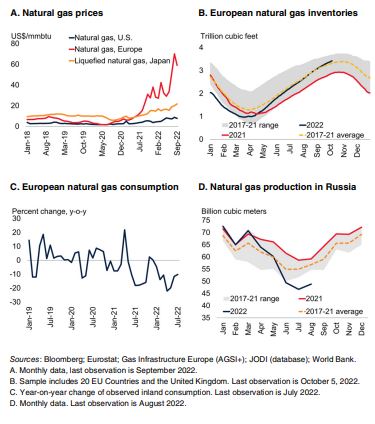

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

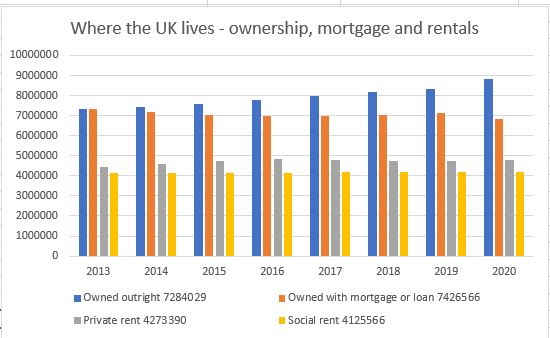

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?

FEEDING FIDO

International interest rates - what a dog’s dinner! But perhaps also a wake-up call: this is real life - governing for your social media feed does not work. We take a glance, too at the property market.

MARKET EVENT OR MACRO?

Our view has long been that we need rates at 5% to make a dent in labour inflation, both in the UK and US. It looks like the Fed (to our surprise) finally agreed. But with that comes a risk of overshoot, driven by the timing of the US mid-term elections. Powell, perhaps rather more attuned to politics than his banker colleagues, was keen to drop the bombshell early, rather than on 2nd November, right on top of the mid-term elections. So, I think the Fed’s now done with giant rises. Future rises may be less and spaced out, and quite possibly not that many.

One of the most chilling sections in Powell’s press conference was when asked about the global implications: yes, he assured us, he quite often takes tea with international colleagues. That was it. This time round the US is happy to crash through the global economy without a care in the world.

Encouraging short sellers

It seems Bailey of the Bank failed to get the memo, because oblivious to the soaring dollar, he stuck to plodding domestic rate rises, as if Leviathan was not bursting forth from the deep. Lifting rates by 0.5% when the dollar lifted 0.75% the day before felt like a joke. And if Bailey could not see that, the markets could: UK two-year gilts abruptly repriced to US rates.

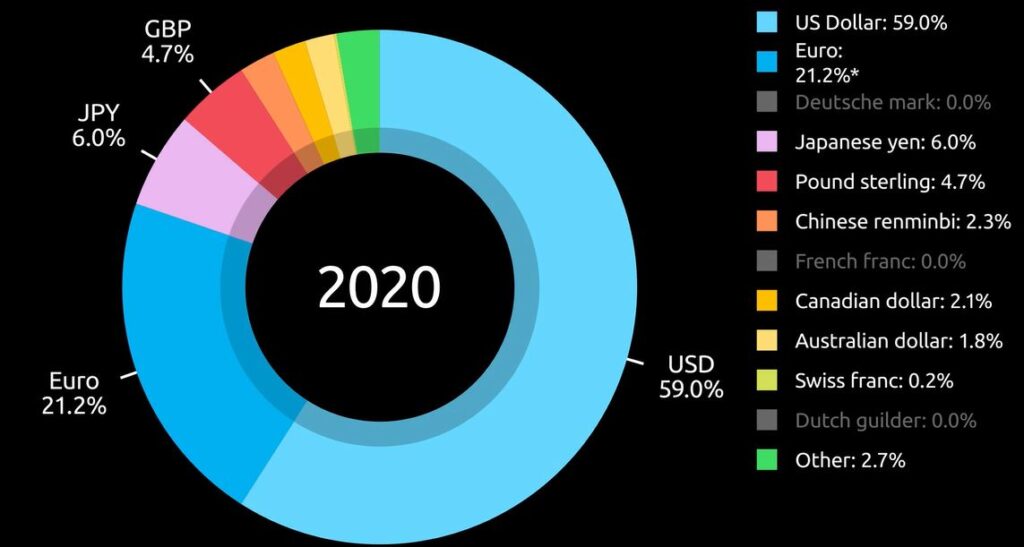

But sterling is still hobbled by UK rates at 2.25% - too low. By trying to be clever on the rate rise, Bailey has simply let the short sellers in. As the chart below shows, having already hit the renminbi and the yen, it was obvious who was next. Sterling is a small but liquid currency block, with no allies – so it typically pays more to borrow. The markets just needed the signal.

From : this site’s fine moving graphs

I doubt all that volatility really makes much difference to the real economy. Indeed, the Bank has now braced sterling nicely. As for the pension schemes, the FCA (Bailey’s last top job) created the foible of pensions being forced to hold loads of so called “risk free” assets to prop up UK government borrowing. A most amusing idea, always going to blow up one day.

Not that sure even 4.5% rates will slow wage inflation up. But we will know soon enough, after all the destination was to us never in doubt, just the arrival time. I still see the strain of rates rising to (say) 8% as too much for the electorate in either the US (the leader) or the UK (who follow).

Recession fears?

Nor do I consider either the US or UK end rates to be high enough to cause a severe recession, although clearly, they will have an impact on asset prices, and in the end, labour markets.

So, I conclude this is more a market event than an economic one. And surprisingly it is all in bonds (and therefore currencies).

Investors will hang back until they see those settle down and that could take the rest of the year. So, although everything is perhaps cheap, the VIX will keep many on the side-lines.

The UK at least feels at bargain levels, but buying dollar stocks still feels somewhat pricey.

BRICKS AND MORTAR

So, to property. Well, we got this one wrong. Partly we failed to see Ukraine becoming a big war, but one with no quick winner. This triggered European (in particular) energy inflation. Partly we therefore saw interest rate rises staying in single figures, which is not what some REIT prices imply.

Not that we have changed our longer term “4&4” view on interest rates and inflation, (so higher for longer) but other investors and markets clearly have. You can’t fight the tape.

In general, outside the warehouse sector, real estate companies (unlike say Private Equity) had already taken the hit to values, their balance sheets showed the new world, backed by real deals. So, adding a second discount does seem odd.

Gearing levels are not high, and debt maturities well extended, and interest (still) well covered. Maybe private markets are worse, but it is not clear why that contagion spreads into quoted ones. If there is a blow up, it is not obviously in public markets or mainstream lending.

But if quoted markets are right, what of residential markets?

Well logically as they are still going up, do residential prices now have a big drop built in, which is yet to happen? The price of mortgage banks, home builders and builders’ merchants all say ‘yes’. But how will it happen? It is not a big sector in UK public markets, but the odd couple that do exist (Mountview, Grainger) have also taken a hammering. They have some debt and are rental specialists (of various types).

So, markets say yes, house prices will also collapse.

Do I believe that? Anymore than talk of imminent dollar sterling parity and 8% base rates? Frankly no. Stagnate, chop around, go sideways, blow the froth off. Sure. Collapse; is wishful thinking.

After Armageddon I fully expect to see a plucky estate agent emerge from the ruins, justifying an offer above the asking price for the debris, with potential (but may need planning consents).

So, if true, that means despite a hair-raising ride, those mortgage banks and residential owners will in time emerge resilient.

Sadly, for many, that also suggests, without forced sellers from the buy to let market (where there will be a few), the stock of housing units won’t change and therefore nor will rents. Housing stock is very lagged and current moves will only close the pipeline two years out. Only mass unemployment hits rents, and if this is a market event, not an economic one, it won’t change, because structural unemployment is not the issue. Indeed, we are at record low unemployment levels.

In summary

A market tremor created in Washington, was transmitted to the UK, and is now rippling round the world; either currencies hold their interest rate differential with the dollar, or get crushed.

Old news; it is odd isn’t it, how so many clever people failed to read the memo?