NO NEWS?

Staying on the sidelines till Burns Night still remains rather attractive. Christmas as ever brings thin trading, a lot of speculation and some brutal repression or natural disaster, in a far-off land. Although these days ‘far off’ could include Lille or Llandudno, both pleasantly calm and now even sounding a bit exotic.

But for all the noise, has the investing world really shifted? We did kind of have a Santa Claus rally, but with COVID about, he got shoved back up the chimney pretty fast. Meanwhile Powell was transformed into Scrooge with the terrifying thought that in a massive boom, with high inflation, perhaps he didn’t need to be reinvesting maturing state-owned bonds?

What we see is confusing data, a fair bit of economic damage from Omicron, some people not wanting to be ill, but mostly from a Pavlovian reaction to the very idea of COVID the Sequel. Fortunately like most sequels it was a pale imitation, we knew the cast, guessed the plot, will leave the show early.

Inflation - where have we got to?

Peter Sellers in The Pink Panther films asks an innkeeper if his dog bites; having been assured it did not, the dog snarled and bit him. On remonstrating he was kindly informed “that is not my dog”.

Well clearly Powell, Biden and a few other innumerate players wish to tell us the same about inflation.

Sadly, and transparently, it is their dog, and equally clearly it will bite.

There is an econometrics game of saying there is no inflation (except in; used cars, housing, fuel, take your pick really). That is like selecting the first brick to burst in a failing dam, and saying that the structure was fine, except for this one defective brick.

Therefore, the first sign that (finally) the ‘just a blip’ inflation nonsense has been retired must be good news. This comes along with some evidence that sensible Democrats (well at least one) have spotted that more money for less work in order to buy fewer goods, is probably not actually helping poor American families.

The energy question

We will sort out energy prices, if governments are sensible. So, if, like President Xi, we do bring back a bit of stand by coal capacity, for next winter’s peak. There is plenty of coal around. We have not been too short of wind around here either, of late, the UK also has a good number of salt caverns, which we can (as we used to) stuff with gas, rather than believe the idiots in the Government who felt it was too expensive to have cheap summer gas on stand buy. While at 80 USD even the Saudis will pump more, the Permian certainly will.

So that just needs a bit more planning, a bit less spurious forecasting to within three decimal places, a bit more building in a margin for error, whilst hopefully all the Whitehall types who claimed they were fostering ‘competition’ and could ‘cap’ prices of a global commodity, get moved on (or better out).

It is still next winter’s answer, none of this will help this year much. Most capacity for the next two months is sold.

So, what will Powell do next?

All of this leaves us with massive liquidity, poor labour market participation, excess demand and the normal reaction to all that: inflation picking up and negative real yields slowly being eradicated. What is not to like? Demand plus capacity usually equals growth.

While Powell may have failed to grasp the intricacies of inflation, I am not expecting him to suddenly declare his job done on minority employment rates, with such a poor participation level. So, I expect he will keep trying on that. Which suggests he’s not going to over-indulge in rate rises. Hence the idea the Fed will look at other ways to soak up liquidity, is quite logical.

At this stage of tightening, we don’t find most bonds attractive, but recent history suggests that if the US 10-year bond gets closer to 2%, it attracts foreign money, unless Euro base rates also rise, which still seems unlikely. More buyers will of course push the yield back down.

While China is both cutting rates and provoking some hefty defaults, which is not a great background for foreign investment, especially as they seem to be targeting offshore investors. Without knowing whether the US interest rate tops out at 2% or 4%, emerging market debt (like their equities) could be either cheap or expensive; just now it is very hard to gauge.

So cautiously we plough on - funds must be invested, the (as of now) attractive alternatives, all look pretty expensive or rather risky, while if rates really do start to rise, the dollar will itself become desirable. So, we expect something, some asset, will suddenly catch a bid and soar away. Outside the US mega cap tech stocks, value already abounds.

Overall, a return to normality. With rather fewer gifts from Lapland to be had just for asking; all of this should be quite encouraging.

While it looks like sterling has strengthened for now, the various tin pot media storms have led to the Prime Minister’s critics looking into the abyss and not liking the view very much.

It may look bad to bend some rules, but dropping a Prime Minister for disliking Theresa May’s taste in wallpaper, or treating staff like human beings, or because Liz Truss is ambitious? Not really.

MCM had a good 2021, in our global lower volatility space. The CityWire link to our subsector is here.

Charles Gillams

Monogram Capital Management Ltd

9th January 2022

(article illustration by Martin Speed, creator of the Woofle bears)

Which is the Leviathan?

This is a week to ponder the role of private equity in portfolios, in what may be an early phase of a great investment and technological explosion. There seems to be no sign of higher interest rates and a stubborn refusal by Central Banks to care much about inflation. The talk of a UK raise always looked to us like a head fake which we ignored.

Spotting good and bad private equity

So first to private equity, a beast that comes in many guises, not all benign from an investor viewpoint. All liquidity fueled equity explosions come with a heavy loading of chancers; Bonnie and Clyde’s rationale for bank robbery remains valid.

Good private equity relies on management being superior to that of their targets. This can be in their analysis, their execution, their swiftness of foot or their innovation. All of this generally flourishes away from the hidebound inertia of many listed companies and their professional Boards of tame box tickers.

Bad private equity uses accounting tricks, the malleable fiction that the last price is the right price in particular, and the terrible phrase “discounted revenue multiple” which is a nice conceit for “never made a profit”. All of these share the same vice of management marking their own work.

So, we struggle with the likes of Scottish Mortgage and its little array of unquoted Chinese firms, the alphabet soup of non-voting share classes and love affair with management. Maybe they are that skilled, but nothing that looks like a real two-way market is evident to us, in many of these valuations. We have by contrast long admired Melrose Industries for their quite ruthless devotion to turning over their investments, good or bad and stapling executive pay to actual cash realizations paid to investors.

Where we stand – given our strategy

For an Absolute Return specialist there are added constraints: we want to hold under twenty positions altogether and all in ones we can sell tomorrow afternoon. And we like holdings where valuations are transparent, there is no gearing (there is usually quite enough in the private equity deals already), and you can pick them up for a fat double digit discount: oh, and we do like a yield too.

So, we are looking for big, listed options with hundreds of high-quality funds bundled together and for any yield, a bias towards management buy outs. We are certainly not at the venture capital end, with silly pricing, high fail rates, unrealistic managers, and not a decent accountant in sight and aspirations to change the world. Met those, invested in too many, and donated more shirts off my back than I care to enumerate to their serial failures and inexhaustible funding rounds.

But there are good things about Private Equity, one is that in a rising market, it can be like clipping a coupon. The accounting rules require them to be backward looking, so coming out of a trough they are typically reporting on valuations that are three or four months old, which in turn reflects business activity up to six months old. As they trade at a discount of typically 25% or so, you can buy today at a 25% discount to the value of the business they were doing in the spring. There are no guarantees, but for most, that was a lot worse than current conditions, so today’s price is simply wrong. This is a time machine that lets you buy now but pay at old prices.

Watch for built in volatility in private equity

These lags are complex, the reference points are often public market valuations, and so there is volatility built into them. While in an Absolute Return fund, not only are choices limited but the overall exposure must be too. However, in those rare purple patches of fast recovery and expansion they are excellent for performance.

What kills these bonanzas off is tight credit. In part they need debt for trade, but also their realizations rely heavily on it. A closed IPO market does them no good (just as they enjoy an exuberant one). That is a risk, as liquidity starts to tighten, that this will hurt, but as Powell and the Bank of England both showed, there is no political appetite for that just yet.

The UK and US on taming the leviathan

Indeed, Sunak’s UK budget yet again feels reckless, devoid of any discipline and with every department cashing in. Government spending is predicted to rise to 42% of GDP by 2026, a fifty year high. Healthcare alone is predicted to have grown by 40% in real terms since 2009 (both estimates from the oddly named Office for Budget Responsibility). At that level of loading, it is inching closer to hollowing out the entire budget and causing it to implode. (Leviathan was just such a creature “because by his bigness he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together” feels an apt description of this new giant state apparatus.)

But that gamble means there is no room to pay higher interest rates, or the economy will be reduced to a double-sided monster. The one face devoted to raising debt and levying taxes and paying interest, the other to feeding out of control public spending, with nothing left in between.

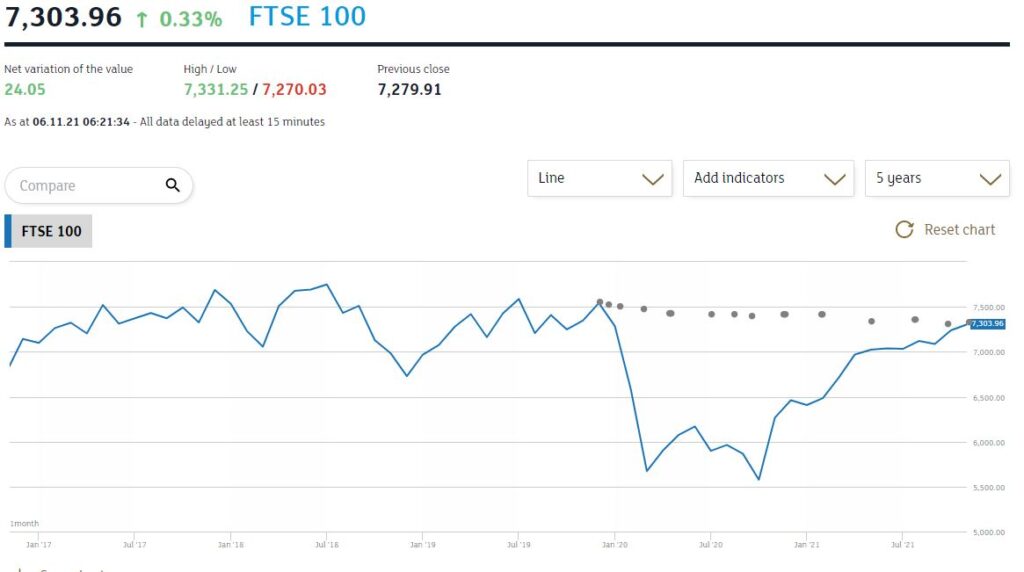

Thanks in a slightly odd way to a Democrat Senator, America has avoided throwing itself under that same bus, but with no effective political opposition the UK is now powerless to resist. Sterling’s relentless decline from the summer high and a FTSE 100 index still below its pre-COVID peak signify what markets feel about all this.

From the London Stock Exchange graph

So, while we were more bearish than we have been all year, in terms of asset allocation, at the end of October, we have yet to call time on the Private Equity cycle, that has provided such a powerful boost this year. It still feels good value to us.

Of course, we recognize too, that the populist fear is of the wealth creators and an opposing adoration for wealth consumption. Unlike politicians, however, we are tasked with producing real results not vapid dreams.

I guess we can each choose which to regard as the leviathan – the burgeoning state, or private equity.

Charles Gillams

Monogram Capital Management Ltd

Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

Withdrawal of older workers from the labour market

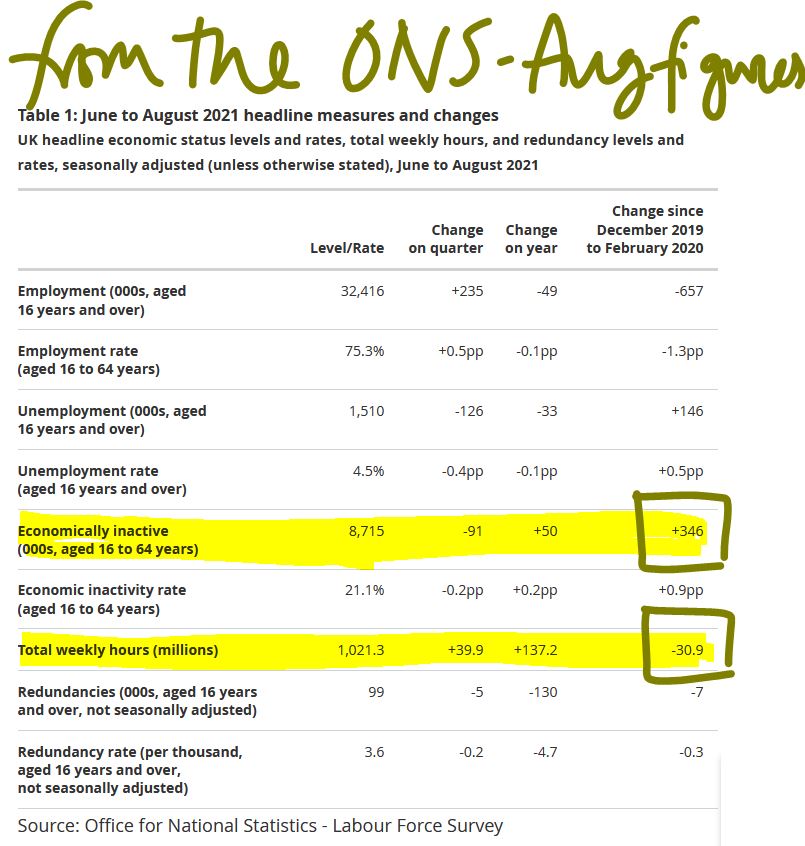

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd

EVERY DOG

Boris seems slowly to be turning into the opposition to his own party, which I suppose is not new for him. Meanwhile China also seems to be hitting an identity crisis. Neither bodes well for investors.

We apparently have a real budget due soon, but this vain Prime Minister seems bent on upstaging his own team, so we had a pile of tax rises and changes to tax law bundled out in a haphazard fashion in response to the endless (and insatiable) demands of one ministry.

A likely collision course with natural Tories

That pretty well defines bad governance, and these ad hoc excursions into major spending plans are a hallmark of waste and short termism. So, to me the investor headline should be about planning ahead for the Tory government to either fail in front of an exhausted electorate, or less plausibly given the large majority, to implode. But have no doubt that No 10 and the mass of the Tory party are now set on a collision course.

The extraordinary extravagance of the blunt furlough scheme has always been the fiscal problem, and it is hard to believe, as many bosses are clamouring for new migration to solve multiple labour problems, largely in some measure of their own making, that the government has still parked up a fair chunk of two million workers, on pretty close to full pay.

I struggle to comprehend that number in a hot summer labour market, nor do I see why employers would cling onto staff until October at which point, presumably they take a decision? Are these ghost workers? Already happily in new jobs, but having done a deal with their bosses to split the loot, their fake pay for not being? Are these people HR have forgotten or are too scared to fire? Will they really try to pick up work they put down eighteen months back, in a largely different world and probably for a now quite alien organisation?

Who knows, but the whole thing cost £67 billion (so far) and that’s what Boris needs back. I challenge anyone to give a lucid explanation of how his latest proposal “fixes” social care for the elderly. Nor to explain how in parts of the country like this, with no state care home provision anyway, it can ever be called “fair”. So, to me, it is just bunce for the ever-gaping maw of the state, and the idea, with Boris in charge, that it will ever be temporary or even accounted for, is somewhat risible.

What would “fix” social care is transparent, autonomous, local provision, not bullied by a dozen state agencies, not run by money grubbing doctors, not harried by property developers and absurd land costs, nor daft HMRC grabs on stand-by staff pay, and it needs to be highly invested in simple technology, all IT integrated with the NHS; not this crippled, secretive, subscale mess.

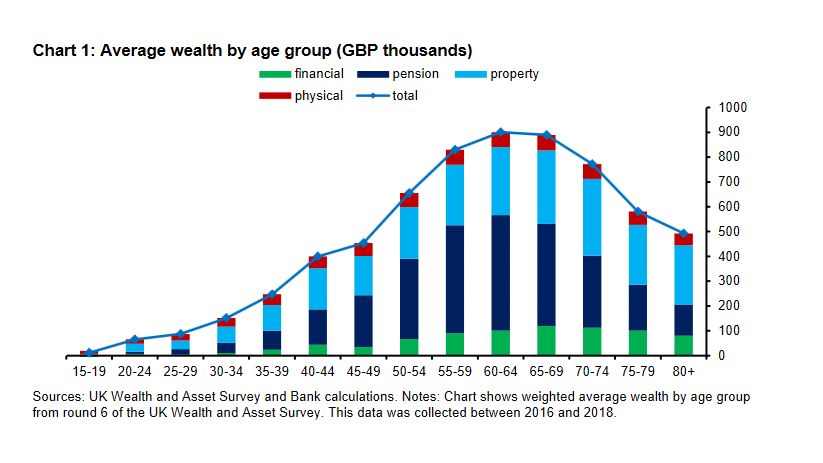

It is not that there is no problem, but it is as much operational as financial. A recent Bank of England paper looking at wealth distribution highlights how in retirement property comes to both dominate assets and also shrinks far more slowly with age.

(Sourced from this speech given at the London School of Economics, by Gertjan Vlieghe, member of the Bank of England’s Monetary Policy Committee.)

Of course, the crux here is seeing a family home as both an asset and an essential for life. That is the distortion, and this fiddling with care rules attacks the symptom, not the cause.

Can you trust a word he says?

So, now tax on income rises, a broken promise, employer tax rises, broken promise, the ‘triple lock’ on pensions is ditched, broken promise, and to top it off those working beyond normal retirement age (now 66) get a 25% tax penalty, via another broken promise. Oh, and if you are mug enough to save, then dividends will get hit too.

Again, there is a real problem but this is by no means a logical answer either: I guess the Treasury were applying heat on excess debt, and this is sand kicked back in their face, but it shows no sign of anyone solving anything. The UK has both high debt levels and no supportive currency block around it, sure France and Italy look bad, but they have Germany to help. The UK does not. Hence the anxiety.

So, Boris has had a fine Cameron-like bonfire of dozens of electoral promises; the worm turned on Cameron (and Clegg) when he couldn’t keep his word, and so it will turn on Boris. This time he won’t have Corbyn as the pantomime bete noir to bail him out. Indeed, Kier Starmer’s response linking this problem to inflated property prices is remarkably prescient, even if his typically confiscational solution is not.

These tax levels (as a % of GDP) have not been seen in fifty years, for an economy with a noticeably less effective grasp on government expenditure and a rather less globally competitive commercial base.

While tax rises are emerging everywhere (see below), and public service reform has become a simple money equation, need more service, spend more money, a dangerous one-way road.

Source: from this primary report

While notably, ‘buy to let’ is again left untouched. London house prices have doubled in this century, the FTSE 100 has moved from circa 6800 at its late 1999 peak to 7030 now and remains below pre-pandemic levels. So clearly this is not the time to hit the investors in jobs and business, who have had a 5% nominal gain (that is a 60% real loss) in twenty years and yet to leave the buy to let rentiers trading in second-hand hopes, with their 60% real gain in that time, untouched.

And don’t give us the dividends argument; the buy to let plutocrats get plenty of rent and all their sticky little service charges. This measure simply hits the workers and investors in business and pampers the bureaucrats and the rentiers. It makes very little sense, unless you are a senior civil servant or a retired prime minister, like Blair, of course.

Chinese insularity - the new version

Meanwhile China I feel is now detaching itself from both the rule of international law (in so far as it ever bothered) and more interestingly the world financial system. It may indeed end up better off, but for now (and this is also a change from much of the last 50 years) it does not feel it needs to attract external capital.

So much of its trade and capital markets engagement has been predicated on securing capital; this is an odd and novel twist. Although perhaps a logical response to the West, who rather than conserving capital as a scare resource, are immersing the world in torrents of surplus cash and inflation.

Much of China’s policy about their own global investment (so outside China) also used to have the same theme, driven by the desire for returns, influence and to hold their own export-based currency down.

But no more, it seems, and their inherent desire for autarchy, the hermit kingdom trope, has only been emphasized by Trump, WHO and the madness of the internet. It apparently wants to be the new Germany, (no longer the new USA), so it will be insular and conservative: cautious, not driven mad by debt and the baubles it procures.

Well, if true it will be different, whether it can really be done, without a wave of disruptive defaults is unclear, but don’t doubt the length of vision, so unlike our own government. While a theme of this century has also been where China leads, the rest must reluctantly follow.

Even a dog has its day, but for investors both the UK and China now feel significantly more canine than at the start of the summer.

Inflation: The elephant in the room?

Inflation and how persistent it is, now fascinates us although we will skip how that relates to US bond yields, as that currently makes no sense. We’re also pondering the recent high performance from non-US markets.

We signaled inflation as a forthcoming problem well over a year ago, and slightly oddly not for either of the two reasons now cited so often. The received wisdom, that it is all about freight rates and used car prices, identifies specific issues we had not spotted.

Freight and used cars – really?

The freight issue seems to be a jumble of factors, dominated by having the ‘wrong’ demand structure, so in any movement of goods (or people), one way traffic is also the worst, if you can get the return route paid for by someone else, you will always halve the cost. Hence the obsession on most mass transport with return tickets. Sudden demand shifts destroy that balanced economy. But clearly there is more to it, so poor port capacity, extra flows created (or existing flows destroyed) by COVID all matter, all that PPE displaced other goods, while grounding airlines eliminated vast amounts of high value hold space.

But all of that, the natural creation of new capacity (that is making more containers), or simply activating more shipping from lay ups, will create new supply, and we therefore recognize that whole process as a fairly short-term spike.

As for used cars, well, I can see from the congested roads that no one is using public transport, but with global over capacity, how long will that surge in demand for cars last? In general shutting car plants due to excess capacity still remains the trend. While flaws in the too tight “just in time” schedules have been apparent for a while, not helped by almost bespoke production, but that too is all probably transient.

After all, a hire car can be any colour, as long as it is black.

So, what did worry us about inflation? Capacity and competition remain the two drivers.

It was capacity, as either the number of viable business units has to decrease, if the costs per unit increase, or the price per unit sale must rise, hence inflation. This is obvious to most, although it seems not to many Central Banks. For a while any business will, it is true, keep going, even if only generating a marginal contribution, but soon it must either cease trading or lift prices. Companies just don’t sit about making losses, in the real economy.

The other part is competition, as the number of operators in a market decrease, the survivors gain greater pricing power to raise prices, while no one builds any new capacity simply to suffer losses. You can easily see these two dynamics play out in the coffee shop sector (or indeed with wine bars and public houses). COVID eliminates 50% of the capacity, by enforced social distancing. Takings must then also fall by 50%. You can prop that business up by furlough, or tax cuts, or eviction bans, but sooner or later the owner will conclude that in a fixed physical space, a 50% revenue cut just can’t work.

With operators in both those sectors and indeed many others deciding they have had enough and don’t want to face mounting debts, the capacity is then lost and the incentive to replace it is weak, so competition inevitably drops.

Looking back at the hire car sector for a moment

We are told it is price inflation caused by a temporary shortage of cars, but that sector famously is full of border line survivors, the margins are wafer thin and often come down to the residual fleet value. Several big firms have also dropped out through insolvency; of the rest many only ever survived on the twin props of residual fleet value and extended manufacturer credit.

Do you think high secondhand values are making them expand their fleets? Not that plausible. More likely they are cashing in. Nor do auto makers need to restock them on vastly extended credit terms, just to keep their own production lines running. New car sales to the sector are always at low margin to bulk buyers. So that’s not likely either.

We think it is quite possibly inflation from capacity cuts and weak competition, and that is nothing like as transitory. That is far more durable, not a brief supply side spike. Turnover is vanity, profit is sanity, as industrialists say.

In short Powell et al want to see no inflation, want to tell their political masters it is all fine, that they can keep running the engine hot, but having skimped on the engine oil, it seems rather more likely that running hot will simply seize the engine. At which point they must either coast to the hard shoulder or apply the handbrake of interest rate rises, before the economy blows a gasket.

Currency and the momentum model.

The other note of interest to us is that non-US markets are starting to flash up on momentum boards as exceeding US returns over some time periods, in particular in GBP comparatives.

In dollar terms the momentum is in the S&P 500 and NASDAQ. However, in sterling terms it is moving. We have noticed Europe shifting ahead for a while, but we were surprised to see our GBP momentum model now drawing our attention to Latin America.

Now a lot of these models (ours included) are very sensitive to the recent past (that is the momentum we care about, after all) and that means there are big moves to fall in or out of the sequence, so care is needed. But despite the headline turbulence and distress in the Latin American continent, it has forces in its favour; the index is dominated by big mining operations, closely followed by oil companies, then banks, which are seeing rates rise sooner than in the rest of the world, and then (often Mexican) consumer goods.

They will find the weaker US dollar helpful in some sectors too, but will especially enjoy the vast demand surge (and short supply line to) the US. So, all in an index with some good reasons for outperformance, despite the political noise.

Is Sajid now a factor to note? Rapid reopening will probably also continue.

Talking of politics, I don’t see the renewed ban on French holidays (or rather the absurd elongated quarantine on return, regardless of vaccine status), as anything to do with COVID. Rather it is a shock coming from the always unstable Tory politics, where the return of Sajid has created the first node of a genuine “not Boris” grouping, as a minister now too valuable to be left out in the cold.

Boris can’t bully him twice, without a major loss of face, so some of the other pretenders to the leadership want to take him down, by sabotage to his policy of an overdue full and proper re-opening.

Shapps, who dreamt up the absurd new ban, it seems wants to usurp the health portfolio, and apparently feels put out at being left in a dull and dangerous ministry, hence his attempt to claim territory and undermine a cabinet foe. However, I think his manoeuvre makes little difference to the overall thrust of government policy on rapid reopening.

We also note, that at long last the destructive and stupid attack on UK banks, by enforcing a dividend ban, when they were awash with cash, simply out of political spite, has been ditched. I suspect it is too late to reverse long term damage to the sector, but even if a year late, common sense is welcome, as is evidence that the colossal 2020 state seizure of power, is at last being pushed back, at a few points.

Last April/May I was writing about these kinds of issues, now sitting in this book, if the more regular amongst my readers would like to take a look – one of the measures has to be consistency of approach, after all. The second volume is under preparation.

Finally, we too will take a summer break, returning to this just before the August Bank Holiday, as summer draws to a close.

We wish you an enjoyable break and a well-earned rest from what has been a crazy year.

Charles Gillams

Monogram Capital Management Ltd

18.07.21