WE ARE NOT NOW THAT STRENGTH

Markets are confused, as are Central Banks, and while generally indifferent to small wars, we know that’s how large wars start. And we have another month till November 5th and the US election. In the UK the Chancellor says it is all terrible, but is splashing cash around with abandon, but then cancelling dozens of projects, and claiming she is pro-growth, while taxing investment ever harder and encouraging so much capital flight even the OBR has noticed.

The colossal COVID debt burden still hovers over everything, a burden that can only be shed by growth or inflation, one an investor’s friend, the other their mortal foe.

Market confusion is more about politics than economics, no US rate cut in July, then a double cut in September, now a November (post-election) cut looks uncertain. The stated reason for a double cut was weak employment, but the real reason was political. Powell even said in his press conference that the Governors voted for the jumbo cut “in the best interests of the American people” so not economics, and I suspect those archetypal insiders will believe keeping Trump out is exactly that.

So, we get a “value” rally, as collapsing labour markets would lead to multiple rate cuts, and market interest rates, surprised at the severity, then overshoot on the downside.

Except there is little evidence of anything wrong in US labour markets, as Friday showed, they are fine, and wages, along with rigid labour markets are driving inflation. Weird. But then good labour markets, plus buoyant earnings, plus falling rates sounds pretty good for equities?

Plus, something most odd in China, which from nowhere became one of the top markets in the last year, outperforming the major UK averages. Yet no one is clear why, on fundamentals. Yes, there was a stimulus package, possibly one focused on equities, possibly bigger than expected, but no one thinks it solves anything.

So, it (and ripples into luxury and metals) seems an almighty short squeeze. China had become so unloved, even its proudest fans had bailed out. The rush back in left other emerging markets, like India, struggling.

[Culled from two pages on Yahoo finance – read more here and here]

MANNERS, CLIMATES, COUNCILS, GOVERNMENTS.

Meanwhile, the Tory Conference was oddly upbeat, with some real choices, and a fair bit of optimism. The Tory party is in theoretical retreat, but greatly energised by a real debate, with members involved, about the new leader and a new direction. The disastrous election result had focused minds nicely, and yet was still discounted. Starmer had won fewer votes than Corbyn, and his popularity was already below Sunak’s. The loss was about “three tens”; voters switching to Reform, to the Lib Dems and the Sofa, sitting it out.

None of that was the love of another party, all of it was hatred of those Tories, divided and incompetent and now gone. In so far as the rump of the party now had stars, they were all standing for leader, no big guns were left after the disaster.

It was generally agreed that it must be the fault of Central Office and candidate selection, not the Party. The conference was also largely devoid of the usual big brother manipulation, fake applause, dire autocue speeches approved by a SPAD and ministers just too busy to care.

Tugendhat was bouncy, had the youth vote and the best video, but not convincing. Cleverly had worked hard, was fun and avuncular, relaxing and the obvious unity candidate. Jenrick gave some very strong speeches, plenty of thought, but seemed off-form and weary at the closing main event. Badenoch is an enigma, slightly thrown by adding “2030” to her pitch, when everyone was suddenly thinking “2029” again. Yet she is the one who wants to reform, draw a line below the stale “what did we do last time” and start afresh. She had the best merch too.

It is still a split party, for all that. A good chunk of the younger party is very keen on Net Zero, and they were extremely visible, indeed Net Zero before all else. However the MPs know that was a Cameron fantasy, so I am not sure how that plays out.

But also, a clear understanding that talking right, governing left is finally over, and that border security is high priority, and defence is too, but not with quite the gung-ho optimism of before.

In many ways Starmer’s inability to know what sleaze and greed looks like, even if it is all innocent (a big even) bodes ill for his time; “they are all the same” is a deep-seated rallying cry of pain.

THE SCEPTRE AND THE ISLE

I am enjoying “The Sale of the Late King’s Goods”, a slightly wonkish account of Charles I’s lost trophies, but an excellent canter through the lead up to the English Civil War. It is striking how state policy was all so plausible and desirable, except for a massive inconsistency on faith, finance and Europe.

The King was desperate to be trendy, to think common decency only applied to others, had no real conviction, in restlessly appeasing various European Courts, seeking favours that never came. While funding was all about just getting to the next OBR review with enough cash to pay off friends. (Well OK, not the OBR back then, but a truly sovereign Parliament).

After finding so many conflicting aims inevitably failed to work, he then tried to drag Scotland into a standard set of beliefs and rules, and hoped blindly that the Irish would do us a favour. The desire to be liked, to look good, to look to Europe for answers, to throw money at white elephants and foreign wars, and the absurd doctrinal battles, all felt far too familiar.

If we don’t know where we are going, just buying expensive tickets won’t complete our journey. To strive, to seek.

The title of this piece comes from Ulysses, a poem by Alfred, Lord Tennyson

https://poets.org/poem/ulysses

Andrew Hunt’s piece this month, which looks at the solidity of underlying data and China may be of interest to serious investors.

Tiptoeing Through the Tulips

Is real estate safe yet? How about renewables? And an innocuous Tulip.

All three of this week’s topics are notable for what they are not, Real Estate valuations do not reflect property markets or indeed replacement cost, Renewable Energy valuations do not reflect anything much, but include plenty of hope, and the new City Minister seems to have no obvious purpose beyond being a safe and reasonably loyal supporter of all things welfare related.

Unreal Estate

As we have remarked before, somehow the RICS valuations of property assets, used to value quoted property companies, became heavily reliant on interest rates and comparable bond yields and rather less interested in the real property market. They also seem to have become a tool for bank lending, disregarding other more real-world factors. Which explains the paradox of falling valuations alongside robust occupancy levels and a level of visible new office construction, certainly in London, which remains unabated and indeed the wider market is seemingly indifferent to the slump.

There is a lot behind those paradoxes, long lead times through planning, the desire to replace older stock if (as so often) it is to be leased out, the dominance of bank funding, not equity. Even so both collapsing valuations and the discounts then applied, have been damaging. This has been exacerbated by underlying fears about vanishing bank financing, in many ways a self-fulfilling prophecy.

We had something of a buyer’s strike where vendors can’t get bank finance to stay, and their potential buyers can’t finance to buy. The impact of working from home and the inevitable changes in business models adds to this.

Some areas, notably much of Docklands and many regional and secondary offices, have become untouchable. Closed end property vehicles have been forced to sell to meet bank covenants, and several open-ended ones have simply been forced to liquidate. Something of a perfect storm.

Yet, prime real estate has in the end, come through over time, and as we have noted before the residential market has been pretty immune from falls in at least nominal value.

In both UK and Europe valuations are now becoming more stable, and I would expect for the same reason they fell so fast, they will start to recover as rates fall.

For all that, in the equity market this year we have seen reasonable returns, as discounts to stated NAVs narrow, on both sides of the Atlantic. A number of activists are also pushing through mergers or reconstructions, which helps.

And yet nerves persist, the underlying discounts maybe less, but for Investment Trusts that own REITs, there are two tiers of discount (one underlying and one at the vehicle itself) and that top level has widened in cases.

Having endured that lot, and avoided earlier temptation, I am looking to re-stablish positions in half a dozen of these stocks in the UK and Europe, to work out the two that look like long term holds into the next cycle.

Not Renewed

Renewables have somewhat of the same issue, they are valued in part, again on the discount rate, so were driven down by rate rises, but also an odd view that energy prices are destined to fall over time. However, just as I have seldom seen prime city centre values fall for long, the hope of long run falling energy prices, runs counter to my experience.

There is also a great deal of uncertainty, both about what they produce, after numerous equipment and supplier failures, when they produce, and most of all, how to get product to the consumer with a credible margin.

But overall, the two sectors, property and renewables are quite similar, you have to get land, get planning, install infrastructure, hire builders, pay banks, realise your timescales were always far too optimistic, be nice to buyers, accept a discount, move on.

Having been wary of Renewables on the way down, I do now wonder if they are a separate asset class, or just a subset of several, including utilities, construction and distribution. If so, is it not better to leave that to the big multinationals with deep pockets?

Planting Tulips

So, to the new City Minister : Reading the current incumbent’s speech to the Stock Exchange, (not high on my list) it was of course indistinguishable from the last lot. The Treasury keeps these speeches, and the newest minister trots them out – often this is just an exercise in how well the next one mimics sincerity.

Has the Treasury orthodoxy changed? No. The allocation of capital remains the point of pain at the end of staggering amounts of hopelessly outdated regulation, some of them completely failing in their objectives. That much is unchanged.

Tulip herself is deeply worthy, UCL degree in Eng Lit, King’s London Masters in Politics, Policy, Government, so she should know how it all works and be able to write a good memo. But if we think the Government’s talk of “growth” is anything more than the illusory plug to stop the welfare budget draining us dry, a most implausible appointment. The milch cow must be kept placidly tethered, while it is milked.

The City will naturally be content, as ever, as long as no one rocks the boat.

But for all the ill-mannered sneering at the nice Mr. Draghi, and the EU’s failure to grow, we are in pretty much the same place. Now if Tulip wanted to be useful, and justify her principled disloyalty over leaving the EU, she should be mapping out how to join the Euro in 2030.

No road back to Rome exists, save through that thicket of joining the Euro first, the EU got that wrong before, it will not do so this time.

While of course half of Draghi’s capital market complaints are shorthand for saying that after all, Europe needs the City of London, not vice versa.

Cheer Up, They Said

After a pleasant summer, the dampness returns, exposing a quite enormous and unbalanced level of growth among the verdant thickets of both Middle England and the NASDAQ.

Markets must climb a wall of worry, and the next two months are not short of that. Forget interest rates and non-existent recessions, that’s just the stuttering voice of old economic models, fed fouled data from the last century.

IT IS ALL POLITICS

No, the risks now all look political; the prevailing orthodoxy is the West can keep borrowing levels high, to fund bloated and protected wages and welfare weirdness, impervious to international competition, or indeed to inflation. It has worked so far, and with excess and free flowing capital, there may always be a funder, mainly of state debt or residential mortgages, as well as a buyer of a few anointed equities.

And so far, that has remained the trend and indeed, somehow, the centre has held, once exceptional debt has now become permanent. This is aided in part by centre and centre left parties collaborating to silence the right, often behind the somewhat specious argument of protecting democracy from the wrong kind of votes.

But markets are jittery, they know the sums don’t add up, as do voters.

Debt as % of GDP, US in red, Japan in purple, UK light blue, France dark blue

IMF data mapper – from this page.

The same defence of democracy continues to require the now usual never-ending wars, and divisive and punitive trade barriers and sanctions.

Both businesses and investors are quite happy to sit on the sidelines, until a few questions get answered. The UK budget is expected to finally nail the myth of growth, by heavy new taxation, although it has almost been oversold, the reality might be a relief. It is not just the severity (it won’t be that bad) that matters, but also the direction of travel. Will it hammer savers, investors wealth creators and employment or attack consumption and waste?

Labour denials of an extra £2,000 a year tax on average incomes remains to us implausible and indeed we suggested many would be relieved at only that. Well before the election we said it will need about £20bn (economics is pretty simple really) and suggested the biggest chunk of that will come from fuel duties; we will see. Indeed, we’ve always known that various fudges would be used to skirt round the creaking OBR defences too.

The main UK stock market indices are once more in slow retreat, and while sterling is strong, we attribute that to short term interest rate differentials. High government borrowing is after all good for lenders. While in the US, it remains impossible to tell where the legislature ends up. Although like Starmer, many voters are so convinced the alternative is useless, they will overlook the socialist taint.

EMBRACING THE SIDELINES

Just now, the sidelines feel a good place: hedge funds, shortish term, high quality debt. There is scant evidence that the normal run upwards for emerging markets and smaller companies, from rate cuts, with attendant dollar weakness, has started, although many areas have moved in anticipation. But why buy in September when November is so much more certain?

That switch to smaller companies and emerging markets also may not happen this time, emerging markets have a lot of china dogs that look quite fragile, and smaller company liquidity is dire, so if yields stay high and defaults low, why add risk? While the inevitable fiscal squeeze will not help the hoped for returns and dynamism of a monetary easing cycle; you need both to work.

India meanwhile still stands out long term, but both the centre and more starkly the states are showing a notable loss of fiscal discipline, unrest in Bengal does not help and the IPO market is frothier than a Bollywood musical.

ROULETTE AT THE TORY PARTY

Given the apparent penchant for gambling, how many of the six (now five) chambers hold live rounds? We should glance at these ever-fascinating trials. The party faces strategic questions. Notably when does it expect to recover the 200 odd seats it needs, and how?

Well, I suspect the group saying next time (2029) will still dominate, although it looks rather unlikely. As to how, the assumption, I assume, is by halving the Lib Dems, but that’s only 36 seats, which leaves over 150 to get from Labour.

Interestingly every leadership candidate agrees that it was all Central Office’s fault, not for instance the wrong policies or a foolish rush to the polls. Most also at least pay lip service to rebuilding from the bottom up through local councils. Indeed, they even accept associations might matter.

Although there is also quite a bit, still, of finger crossing and waiting for Labour to implode. Not such an obvious solution this time.

As for Reform, if they also fail to implode, but settle in to be a real alternative, like their French and German counterparts, they will at least deny the Tory party their votes. Who knows, David Cameron might even emerge, in twenty years’ time, like Barnier as the compromise leader, from a party of no current electoral relevance.

It is hard to get involved in the contest, which will be down to four from the original six by next week. With so few MP’s, the choice is not brilliant.

It is a very narrow electorate, just 120 survivors of the wreck, so calling it and the shifting allegiances it reveals is hard. However once decided, it will be clear if the party is going long or short and which seats it is targeting, which in time will matter a great deal. Is it still unaware that a missed target could be fatal?

SAVERS TO BORROWERS

As for markets, I tend to ignore summer and short week trading, and the switch from bonds to equities, from savers to borrowers is a powerful economic force, as rates fall, but while the direction is clear, the angle of descent is not.

I assume it could be worse, that is even more uncertain but wondering how. Roll on Guy Fawkes Day.

OUR OWN EVOLUTION

This blog is evolving - when we started Monogram was a fund manager in widely accessible products, but that’s no longer the path - we are increasingly moving towards family offices and offshore clients.

With a less domestic focus, it seems time to move this to a stand-alone blog. Which brings with it a touch more freedom. It will continue to remain fascinated by the world of economics and politics, and indeed fund management. But may be happier to poke about in the mud for sustenance, or sound a startled alarm, as we become the Campden Snipe.

Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

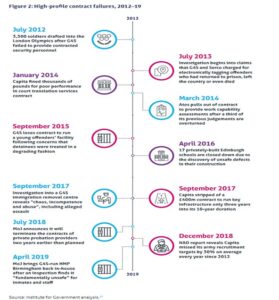

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

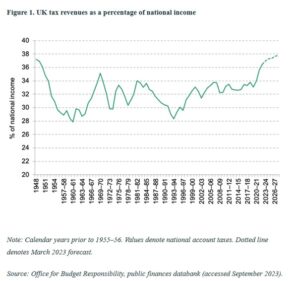

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

The Long Recessional

English local elections, and US regional banks

The English local elections saw the Tories lose 1,058 seats, dropping to 2,299 in the wards contested on Thursday, Labour gained 536 rising to 2,674, while the minor parties saw the Liberal Democrats rise by 405 to 1,626, Independents dropped by 104 to 962, Greens rose by 241 to 481.

What does all that mean for next year? Well, we called the next General Election for Labour the day after the results of the last one, and nothing has changed that view. Nor do we believe talk of falling short of an absolute majority is anything but wishful thinking by bored commentators. Rishi is largely in office, but not in government: a fairly weak cipher for the mandarins behind the throne. When they tell him to abandon core Tory principles, he obeys. This divides his party even further.

So, investors really should focus on the ‘what’; not the ‘if’. The Tories as we noted last time, had most to lose, and will take some heart at the spread of their defeats amongst the opposition parties. Although given the locations contested, both official Labour, and the Corbynite rump voting Green, did well.

This was an anti-Tory vote, rather than pro anything in particular.

We will still see a solid Labour governing majority next year. The Lib Dems will likely be back over fifty seats; as ever un-representative of their larger vote share.

So, what of Starmer?

His big offer is that he will stop party infighting and provide stable competent government. It will be Blair redux. The core five aims are currently crime, education, NHS, climate change and growth. Who would have guessed. No doubt apple pie is next.

The method it seems is Blairite targeting, with a bit of management mumbo-jumbo about breaking down silos, overarching aims etc. With the one area of large-scale Soviet style planning in the energy sector, with a state-run organisation, with what sounds like loads of money, but in truth (for the task) is not. Anyway, the big issue is not power generation but transmission.

I guess we do know from Wes Streeting, (the next health minister) that Labour knows the real problem is the public sector unions, part of why Starmer was so keen not to rely on their funding or support. But while ‘silo breaking’ is neat code for curing chronic demarcation fights, again, how does he propose to tackle it? Breaking ossified crusts needs steel. We know soft soap and water won’t do it.

But to tackle that, means splitting up some giant empires and even if Labour wanted to, I doubt if it has the means. At the same time public sector reform requires exiting vast areas where mission creep has expanded a thin film of under-funded interference and sub-par delivery. True Blair did cut loose Scotland and Wales, to wreck their own patches, raise their own taxes, maybe we will see more of that?

So, we should not hope for too much, we will get another well-meaning ambitious left-wing lawyer, but he is not Blair, and Blair despite fond memories, still gave us the GFC and Iraq.

We fear that the hostility to business and enterprise shown by Sunak will persist, it is probably embedded in the Treasury and Whitehall.

The slew of rate rises, and the slow sacrifice of the US Regional Banks

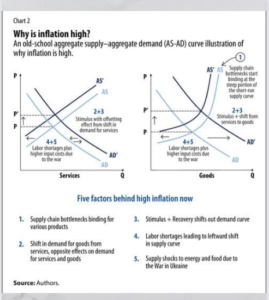

Somehow Wall Street keeps looking for rate cuts, and collapsing inflation, when it is simply not visible in the data. They are so hidebound by their models, that they see inflation as a pile of bricks. You count the bricks; you know what inflation is. But it has never been that, it is like the water table, it is a level, not discrete pieces, and like water it spreads, dampness pervades all. Sure, you can remove bricks, even big pieces of wall, but the water table needs everything to dry up for it to subside.

Taken from this article by IMF staff writers, Agarwal and Kimball in 2022.

You can see the flaws, factors 1, 2 and 5 look like classic bricks, or transitory bricks we should call them now. As for 4 that has been entrenched by regulations, especially on minimum wages, by tax hikes, health fears and support payments, which leaves 3 as the real solvable problem, and it endures. True they rightly noticed it, but by relying too much on the bricks falling, institutional economics just keeps getting it wrong.

You can’t lower the level, while demand remains too strong to be drained away. While the idea you can disperse inflation while piping liquidity in to offset the cost-of-living crisis, is simply daft. Until excess fiscal stimulus stops, inflation will quietly shift, steam away, reform, and then drip back on us; clammy and damp as an English spring.

It helps a bit that vacancies per job seeker are falling in the US, but it is all pretty glacial, the job market is still very tight and wage inflation still embedded. We are awfully short of swallows to be declaring summer’s arrival.

Yet, we do accept Central Banks have largely given up on rate rises, we think too soon, and their main mechanism will now be leaving rates elevated for longer. Along with quantitative tightening, which as few politicians really understand it, they can get away with. Well, it may slowly work.

Looking ahead

We (still) see inflation as higher for longer, rates likewise, and over time the big users of debt, mortgage borrowers and national Treasuries, are going to get used to paying more for it.

Although expect some other fiddle to try to stop this too, which will, naturally, embed inflation and stagnate productivity.

Markets? Well, with plenty of liquidity still and indeed (unjustified) rate cut optimism and many cash flow yields staying attractive, they remain skittish, but with no panic.

So, we are not that gloomy. Although perhaps a sideways summer is ahead.

If your base case is rapid rate cuts and mean reversion, we still have our doubts.

Charles Gillams

Monogram Capital Management Ltd

The Recessional is a great poem by Rudyard Kipling. And the Long Recessional, the title of David Gilmour’s book on RK.

While Shonibare’s trademark mannequins rely on implausible inflation to prevent disaster too.