The Glass Bead Game

We look today at a domestic version of a complex, rulebound meaningless pursuit that too many of our brightest and best waste their lives pursuing, and whose twists and spirals ultimately signify nothing. I mean the UK Office of Budget Responsibility (OBR), of which I took a tour this week. Almost nothing there is as it seems.

Meanwhile markets reprise 2023, with tech or bust once more. Although tech and bust is the market fear, as fiscal stimulus and services inflation hold rates too high for some to survive.

UK OBR

The OBR was an explicitly political creation of the coalition government in 2010, with a remit to somehow restrain the ever-increasing debt governments take on, to bribe electors. They were also keeping half an eye on the much older ‘debt ceiling’ style US legislation. It failed; so now the OBR just thrives on telling the government how much more it can spend or not collect, with spurious accuracy; purportedly managing public money.

It doesn’t forecast anything as a forecast is an expected outturn. All it does is crank the handle on the old, discredited Treasury model, creating projections. A projection is 1) a ‘what if’ assuming all other things are equal and 2) only as good as its underlying model.

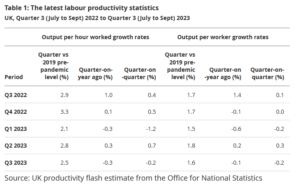

One clear flaw is the requirement to take government spending plans as viable when they are usually not. They also have no idea where public sector productivity is heading. It has no remit to look at how productivity might be helped and no capacity to look back at how wrong its old ‘forecasts’ were. That is the job of the National Audit Office, it seems.

It also won’t talk to the Bank of England, as that organization has executive powers (to raise or lower rates) and the OBR apparently must just be a commentator: more glass bead rules.

So, it fiddles with the model and its six hundred inputs and countless equations to give precise answers to pointless questions, because each answer sits in its own vacuum.

There’s a heavy focus too on tax revenue, but with quite a thin staff, this results in excessive reliance on HMRC, who can be hopelessly wrong (and typically over optimistic on tax yields). But again, if the tax bods claim some complex, job destroying, arcane nonsense will raise income, in it goes. The side effects of such decisions must also be ignored.

It has no remit to assess how taxes impact productivity, which partly explains many of Hunt’s blatantly anti-growth measures. As a result, the economy is locked into low productivity, getting steadily worse.

From the ONS flash report here

For all that the financial press will be full of the OBR cogitations on the forthcoming budget (March 6th). One little bit of power they do have involves a requirement for the Chancellor to give ten days’ notice of the budget contents (hence no doubt the usual leakage levels) and for two months before that, they sift through proposals and indicate how each, in isolation, would work. The economy is an interconnected entity, they know, yet there is no attempt to give us an overall view.

THE LOST RALLY

I have few rational reasons why anyone would lend the UK Government at under 4% for ten years, were it not for some foolish faith in the OBR projections, without reading the small print.

Which brings us to markets: back in November the UK ten-year gilt yielded 4.5%, by about Christmas falling to 3.5%, and now it is back over 4% and headed higher.

Chart from this website

Quite a spin in ten weeks for a ten-year duration instrument. This is why that Christmas rally in value stocks was ignited, and indeed started to push out into Real Estate, various Alternatives and certain smaller stocks.

Although it didn’t move those stocks most sensitive to the credit markets, who will need to rollover/refinance current debt. This affects for example, the renewables, private equity, and office property. The problem there is of both rates and availability. With the scale of asset mark downs, whether interest is 6% or 8% is not the issue; there is no funding appetite even at 20%.

The year-end rally moved a wide group of stocks, from extremely cheap to still very cheap. We then realized that it was not yet safe to go back in, so buyers evaporated, and prices faded. With state debt at 4%, against persistent inflation, fixed income is also oddly unenticing. So, the market default has been to pile back into the biggest, most liquid, US tech stocks and similar easy-in/easy-out momentum trades, like bitcoin.

There is little sign of deflation in services, no evidence of it in housing, where supply issues dominate, and little in financial services; indeed, all the supply side mess of COVID and excess regulation, is simply getting worse. Public sector pay inflation is also high and going higher (don’t tell the OBR).

This does not dent the 2024 story of cutting rates and hence higher stock markets, but it may require some patience, and that delay may itself create more pain.

The Glass Bead Game and the ‘lost marbles’ qualification for office

Our games of self deception are not to be confused with lost marbles of course; it turns out that the onset of senility is now a bar to being prosecuted for storing secret state papers and also, somehow, a recommendation for re-election for four more years, to the most powerful post in the world.

If that ends up giving us Trump again, by default, presumably he will at least have a defense in future years, against those same crimes? He does not have the “Biden defense” available at present, perhaps thankfully.

As the OBR shows, very clever institutions can come up with very silly solutions.

Skipped - what will 2024 look like?

May I say we told you so? In "Skipping Along" before the summer break we called the end to rate rises, and by the November Fed meeting, we were well on board for a "rip your face off" rally. Feeling ripped? Anyone coming to the equity party in December, has just not been paying attention.

And our powerful MomentuM model had investors buying Japan and European Indices LAST December, so they have milked that entire rally. It also signaled buying back into the NASDAQ from May, arguably a bit late, but still very effective.

Jerome Powell said nothing new this week, and the New Year still looks bright for the beaten-up stocks, regions and sectors, as rates decline. I suspect prospects for the perennial winners to keep on winning are not too bad. Although economic growth will suffer (and so will earnings), but valuations still have some space to catch up amongst a lot of this year's losers, as discount rates keep swinging lower and bond yields dwindle.

A RED CHRISTMAS – Looking forward a year.

A year ahead, politics looks more interesting: so, what will the newly elected British House of Commons do next Christmas? What are the choices and likely outcomes?

The new Labour prime minister will care relatively little about political opponents, and quite a lot about holding party discipline.

Nor, we are told, will he seek early solutions to some of the more intractable constitutional problems (Second Chamber, Proportional Representation, Party Funding etc.), as based on his predecessor's experience, that just wastes precious time.

For all that, when it comes, his manifesto will (at last you may say) be festooned in clear deliverables, a plan to govern, at least for the next year. While Rachel Reeves is influential, the drive will be legislative, not economic. But as ever The Chancellor will have to then deliver the possible.

A DOLLOP OF BORROWING

So, more debt, extra tax, spending cuts are the options facing her, to fund that manifesto along with a cursory fig leaf for growth. The latter is needed (like the absurd Tory public spending targets) to get the Office for Budget Responsibility on side. Albeit responsibility is what you take, whereas the OBR offer simply a comptometer's sign off on specious forecasts.

For all that the Treasury thinks Gilt markets pay attention to the OBR, although I doubt it. So very early on, the rather too stringent self-imposed spending and funding restraints the Tories have adopted, will be quietly reconfigured. The rise again of a few PFI like schemes to keep stuff off the books is likely; Labour does not do fiscal hawks.

Falling interest rates and lower indexation provide small windfalls, and binning the 'irresponsible' Tory promises of tax cuts, won't hurt the numbers either. So yes, more debt, low tens of billions at least will be used.

A SPLASH OF TAX

What of tax? Can the pips be made to squeak. Yes, again, I am sure they will be, although not really on income tax, and I think for employed staff not on NI either. Labour has no love of the entrepreneur, who is too poor to hire lobbyists or to make donations. So, a bit more squeezed there off the self-employed and small business owners.

I expect a big hike in fuel tax, especially petrol and aviation fuel, under a green cloak, generating another £10 billion. Consumption taxes remain rewarding: VAT rates, thresholds, and exemptions are all likely targets. And if they are inflationary, just adjust them away in your numbers. Nothing new – claiming them to be a 'one off' (of course).

UK property taxes are low in the South East, due to a long-standing failure to re-rate, so there is some scope there. With more housing coming, this will likely be punitive. But there are other enduring loopholes, that make little sense: REITs, Limited Liability Partnerships, a lot of EIS, VCT, Freeport stuff, albeit none of that is big ticket. I guess some simple populist tariffs may arrive as well. Labour is at heart protectionist.

All in all, I expect Labour to get enough from extra debt and taxation to provide a budget to tackle (rather than just top up deficits in the funding of) some long-standing reforms. I'd also expect seizures of assets. The Treasury seems to have a taste for balancing the books illegally, and there is little judicial protection.

PRESENTS FOR SOME

I don't expect infrastructure or defense budgets to be much loved – that's some of the cuts. The undoubted green spend will likely benefit (or keep on benefiting) China's manufacturers, more than the UK, but do still expect energy prices to go on up. They are the modern sin tax.

But higher tax, debt and spending can be pretty good for the economy, as Biden has shown, it all depends on how long you can get others to fund you for, and at what price.

Much as I am sure Labour don't want to crash the pound, they normally eventually find a way to do so, and for all my glib assumptions, they will be starting far closer to the edge than most new governments, for some while.

THE HANGOVER

How useful is that analysis? Well don't expect the FTSE to collapse, this will be a spending regime, but do expect stock specific damage, although arguably a lot of that is in the price of impacted sectors, or indeed the long standing (and ongoing) flight from UK equities overall.

The FTSE is mired in a twenty-year stagnation, from 7,000 in 2000 to well, 7,000 now, although not to altogether discount the medium-term Tory inspired rally. Note what Labour, even Blairite Labour, gives you.

On the other hand, sitting, duck-like, waiting to be hit, or worse buying into vulnerable areas, feels quite high risk.

The election outcome is (and has been for a while) clear. Nor is this a safe European coalition of the sane and less sane. It will be red through and through.

Given so many other options, and that some of the pain will be direct on pensions and property, it seems a good time to start planning on the investment side.

The MP's pension fund invests only 1.7% in UK listed equity. Do they know something?

Have a magnificent Christmas and thank you for reading.

We will be back on January 14th.

Charles Gillams

17-12-2023

By their works . . .

The November bounce in markets was a bit of an illusion, as interest rates may no longer matter, but foreign exchange still does. Inflation in commodities is probably sorted.

Meanwhile, Jeremy Hunt tinkers.

EQUITY MARKETS and the FABLED FIRST RATE CUT

The dramatic November rally, only looks that way if you are a dollar investor and for some weird reason the archaic Gregorian calendar matters to you. Sticking with the even older Julian one would have made October's performance much better and leave us ten days more of November to enjoy. Plus, lots more shopping days to Christmas.

While it was great for the big US indices, almost (but not quite) hitting the year's highs, in the UK, it was rather less so; the FTSE hit 8,000 in March and has slid down since, back to pre-COVID levels around 7,500.

The November US rally was also dented for sterling investors by a dramatic 4% slide in the dollar.

So, while it feels attractive, the fascination with the first rate cut date is pretty spurious. That is not the market driver. Markets have so far given us nothing this year for avoiding a global recession and seeing the last rate hike of the current cycle.

Surely that is worth something?

AND LONG BONDS

In a like fashion long dated bonds are giving us very little for having nailed inflation, and having (at least in the US) a credible inflation fighting stance again. So those, if you trust the US Government's credit, are not looking bad. This patch of inflation may have stretched the meaning of transitory, but it clearly remains just that, not a 30-year phenomenon.

Instead we see the recent fall in yields as being more driven by relief that rates have topped, and a desire to lock in nice returns in the global reserve currency, attributes which seem likely to overwhelm domestic US worries about high levels of issuance.

COMMODITIES

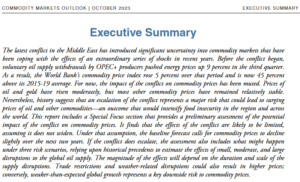

Commodities are where economics in the raw is most visible, especially soft commodities. High prices will always bring in marginal land, and there is no shortage of land on the planet. It may take a planting cycle or two, but food inflation always was transitory. Corn is now below pre COVID prices, let alone pre-Ukraine.

We believe the same is true for energy, for two long standing reasons: the first is that sanctions don't work, certainly not against enormous blocks like China and Russia. The second is that high prices create supply and in a highly tradeable commodity, they do so quite fast.

So, the idea of shutting in energy to manipulate the market price, is in the end self-defeating. It has to be. So however much the anti-carbon lobby and OPEC desire high prices, they are not sustainable. Indeed, it feels as likely that we get one of those crushing late spring drops in prices designed to flush out over-geared operators. That weapon works best, when interest rates are high and storage tanks are full. So why not use it? I remain far more nervous about the oil patch than most, it has yet to see the post COVID, overstocking crisis, that has rippled through so many sectors. Held off by the Ukraine war, oversupply is still around.

The World Bank October commodities forecast base case is for continuing declines.

Look at Healthcare stocks, still suffering from the COVID bubble deflating, despite new wonder drugs.

A stock like Worldwide Healthcare Trust, peaked in summer 2021 and has then slid remorselessly lower.

A LOOK AT HUNT'S TAX FANTASIES

Well, why bother, his tax give back is rightly mocked as trivial. His vague attempts to get welfare under control are painted as draconian, when they are anything but. While his games around a set of unrealistic self-defeating assumptions that he gives the OBR to produce nonsense projections in return are just absurd.

Full expensing for corporation tax is clever in only one sense, it is certainly not a tax cut, whatever he says, it is just bringing forward deductibility from after the next election, so off his watch. It is not changing what is deductible at all, and there will be loads of complex rules against deductions still, as ever.

While to most sensible cap ex modelling, the tax treatment remains damaged by last year's massive corporation tax hike. The long-term tax profile simply does not change, so it does not encourage investment, whatever he claims.

Oddly the real tidying up, as ever, is handled by Gove, quietly putting in place critical and very welcome new political funding measures, which reverse some of the long slide into democratic absurdity inflicted by inflation.

And he pops up in odd places as the fixer still, like Dublin trying to get the Ulster Assembly back in action - a vital if unpleasant piece of plumbing too.

Those are late but worthy actions, as a career ends.

The efforts on investments, while welcome and overdue are still tinkering, and the games with ISAs are as boring as ones with capital allowances. We see no real effort to simplify matters for domestic investors. The joke slashing of capital gains allowances (far from indexing or freezing they are still going down) shows a profound dislike of investors and investment.

Instead, a we get a work round to help UK investors buy fractions of Nvidia, - really?

Charles Gillams

3-12-23

Blowing through the Jasmine

What is happening in the offshore wind market? Come to that what is happening in the onshore hurricane blowing round Westminster? And even after this market rally, arriving much as we expected last time, what should we still worry about? Valuations, recessions and inflation, all matter even if rate rises don't now.

A Feeling of Unreality in Westminster

One year in, Rishi looks incompetent and chaotically inconsistent. I simply can't explain Cameron's grinning re-emergence, it feels like a bad dream or worse joke. I hope he could never be selected again as an MP, after his murky financial dealings. The House of Lords is clearly less constrained. The arrogant indifference and heavy taint of sleaze can't be in the interest of voters.

There is a feel of an echo chamber inside Downing Street, of a puppet leader being strung along by unseen forces. Just last month the whole theme of the Party Conference was a fresh start, the last thirty years were apparently rubbish. Then we have this.

To the country and investors, it does not matter, although a half-awake opposition, or slew of oppositions, will be desirable in future; even if opposition politics is now easiest if you just wait for the other side to foul up and social media to rip them apart.

Zero-carbon? Can't Do it Yesterday?

A lot of notable recent shifts in the offshore wind sector, not surprisingly, as with so many zero carbon panaceas and the rush to do it all yesterday, the wheels are starting to come off. It is nothing like as cheap, or job creating, as the green zealots claimed or hoped. Protectionism is not helping either.

As Platts shows, for September, the more you make, the lower the price, just like real farming. UK offshore wind power is the least desirable in the entire European market.

Nothing wrong with the idea of offshore wind, and experts like SSE in the UK do well on big arrays in shallow waters, planned slowly, at least so far. Although even those are pricey and tend to need massive connecting grid structures.

Both Siemens and Orsted, to a degree newer entrants (at least compared to SSE), have taken a battering. Siemens had acquired a Spanish maker, but during the COVID fall out something came adrift, and it has hit big capacity and quality problems, resulting in billions in write offs – now it is restructuring – with a € 7BN subsidy from a group of banks. Heavy rotating machinery is always engineering hell; sticking it up a windy pole in salt water, is never that wise.

Orsted, the Danish developer, lopped 50% off its share price after ditching projects off Rhode Island and New Jersey - further billions written off. The idea you can put these things up off rocky coasts in areas of strong ocean currents and loads of shipping is quite interesting (and very New York, form over substance).

What torpedoed those projects was funding. The political desire for easy answers to high energy consumption made for poor outcomes (as ever), if everyone rushes to do it all at once, you simply create a cost bubble.

The single unit cost is never the same as for a thousand units; scaling up is always the tough part of any new technology.

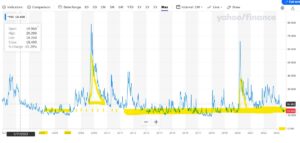

Orsted share price - sourced from Yahoo finance - sharp focus on data

So, while Xi and Biden proclaim they will still save the planet, Biden rhetoric meets cost inflation once again, and cost inflation (and higher energy prices, a speciality of his) wins. Toss in protectionism, so that a Danish company is disqualified from his WTO busting subsidies, and the numbers no longer worked.

The Germans meanwhile find their own green funding trick ruled out by their own Constitutional Court, it involved taking a pre COVID funds surplus, and applying COVID emergency rules (on excessive deficit funding) and then spending it all post COVID. Isn't it odd that didn't really work? All three parts seem wrong.

Finally, the UK got no takers for this year's wind farm licences, as the guaranteed power price was too low. Next year the price has shot up, again guaranteeing higher energy prices for UK consumers (and industry) in the process.

Recession, Inflation and Valuations

Of the trio of recession, inflation and valuation, each investor has a particular fear. To me the nasty one remains inflation, and its friend rationing and stagnation. A lot simply can no longer be done. So that the modern solution (see above) of just throwing more money at it, from higher taxation and debt is largely pointless. Indeed, any farmer knows if you quadruple the inputs, it is still quite easy to halve the outputs.

We are deep into public service rationing now; we don't call it that, but persistent planned under delivery is rationing.

So, service sector inflation with declining 'outputs', is the issue. And that's the funny number 'outputs' we still record in GDP, so turning up, and being paid is an output, even if nothing (increasingly the case, both on turning up and doing anything) is actually done.

Recession? Well, I guess so, basic logic still says it must arrive some time; yet I still don't see big credit defaults or strain and a cooling labour market is clearly beneficial anyway.

And finally, valuations, well nearly everything looks cheap, outside big cap tech in the US, which somehow always feels pricey.

As rates fall through 2024, and funds flow out of cash and fixed interest, and M&A picks up, valuations still appear attractive. Albeit 2024 will (once more) be politically rather interesting.

Still, we could end up with some big questions answered and indeed big characters finally, finally, leaving the stage.

Maybe a summer breeze does lie ahead.

Charles Gillams

19-11-23

Reserve in Reverse

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).