A RIGHT OLD TONKIN

About Influence – American and Russian, mediated by the Chinese

So, to start with what does worry us: That is the slide to a hot war with the powerful Eastern autocracies, fueled by the EU with Napoleonic tendencies, an old man in the White House and a curious sense of ‘crusades’ with no consequences.

For those with long memories of American imperialism, the latest drama even fits neatly as a modern Gulf of Tonkin, a key moment in the slide to war. In that case (south of Hanoi) the clash was naval not aerial but was still notable as one directly between the warring parties and not just their local proxies.

While elsewhere the pieces move, China can not let Russia fail, nor descend into chaos, their long-shared border must stay intact and secure. They no more want the US there than the Russians do. The first step after his confirmation as ruler for life, by Xi, was indeed to go to Moscow.

And the bitter battles in the Middle East of Persian against Arab, Sunni against Shia have cooled abruptly, under Chinese influence. The world once more understands that the US is the threat to peace and stability, not just their fractious neighbours.

For Biden it is an easy fight, the Pentagon so far has played a blinder, what can go wrong? While, for now, France is Europe, no other large state has anything like their stability, Italy is led by the unspeakable, Germany has free market liberals in a bizarre ruling alliance with Greens, Spain is wrapped in its own forthcoming general election, the UK both distinctly detached and under a caretaker government.

The UK budget said nothing, incidentally.

Main influences in France.

While the left in France, as the above photograph shows, are very alive to Macron’s ambitions, to add more territory to the EU, arrange more protectionism for French goods and to suck the labour force out of adjacent states to serve the Inner Empire. Just like Bonaparte tried (and failed) to do, with dire consequences for the French nation.

For all that, the domestic fracas in France (which makes our own strikes look rather tame) was inevitable. Raising (by not a lot) the pension age from 62 to 64, against our own 67 looks small, but it was a clear campaign pledge.

The absence of any minor party wishing to self-destruct, by supporting it in the French legislature, is no great surprise either. So, he has implemented it by decree and Macron has dared the opposition to now either remove his prime ministerial nominee, or shut up.

Banking On Nothing

So, what of markets? Well, the end of SVB is no great loss, it had several policies that had to implode if rates rose, especially on the lending side. It was painfully ‘woke’; I can tell you more about the Board Members sexual orientation, gender and ethnicity than their banking experience, the former just creeps into the end of their latest Annual Report, the latter was invisible to me.

SVB’s long list of ESG triumphs and poses (and it is long) at no point included not going bust. It did commit an extra $5billion to climate change lending, which I guess has all gone up in smoke now. Still apart from all being fired, the bank insolvent, the remnants rescued by the hated Washington mob, under investigation by the DoJ, all the rest of their “G” was superb, and so, so, cool.

I don’t see Credit Suisse as a danger, although it may be in danger. It has had an appalling run of misfortunes, with musical chairs at the top, but it remains a cornerstone of Swiss identity. To let it fold would be highly damaging and cause shockwaves in derivatives markets.

Influence on the markets

So, I do understand the Friday sell off (who wants to be weekend long with regulators on the loose). And we do understand markets needed to go down, after the big October bounce, indeed it was a key reason for our building up over 33% cash or near cash at the previous month end. We knew the winter rally was fake.

But I don’t see this as much more. Retest of the S&P 500 October low? It should not be. I take a lot of heart from bitcoin soaring (63% YTD); if liquidity was short, that would not have happened.

But for all that, I don’t like March in financial markets, too much is uncertain. So, this is more a time for cautious adding, rather than hard buying, but if we get to Easter (and hoping to be wrong on the Tonkin analogy) it does seem a better prospect.

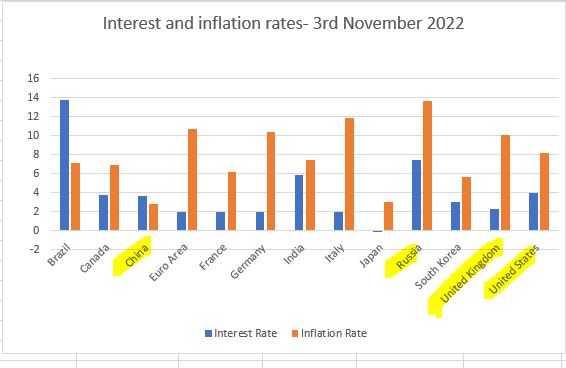

Nor do I see how the various central banks can justify a pause in rate rises, at this point, but nor will they go in hard, that would be folly.

This Fed has made enough mistakes already.

First as Tragedy, then as Farce

This is turning into another unloved bull market, we look at why, and wonder if Chou En Lai was right about the French revolution. Lets start with inflation.

I chanced upon Paul Krugman’s The Return of Depression Economics, written in 2008. Krugman is very much an establishment man, Keynesian to his socks and seeing the great failure of late 20th Century economics being the sudden lack of demand. He has other work and more recent books, but I will focus on this one.

IMF Remedies

He has particular vitriol for the way the IMF repeatedly used austerity in its many forms, as the antidote to all and any of the chaos created by a deflating bubble. So, taxes up, spending down and crush demand to stabilise a currency, to avoid the extremes of bank collapses.

In Krugman’s world, it was more important to regulate banks, and it seems hedge funds, thereby stopping the sources of instability in the credit markets, and to then prop up demand.

Well, the echoes are there, current policy remains both IMF applauded austerity to save the currency, which is just what Hunt inflicted on the UK last year, and a desperate search for ways to pump up demand, to stop stagflation. Much as Biden is doing with the US and the amusingly called Inflation Reduction Act, and indeed the MAGA type, neo-Trumpian, protectionism now evident in the CHIPS Act. The rush to global rearmament should be just as effective.

All in the end versions of Keynesian demand creation – digging holes in highways to refill.

Echoes of Old Bubbles

Krugman is not indifferent to the bubbles this creates in the US stock market and US housing prices but would seem, like Senator Warren, to suggest whatever the question, more bank (and shadow bank) regulation is the answer.

It is odd as you piece together many establishment views, how this policy of ‘create bubbles, and then carefully regulate their deflation’, but never cut demand too hard, is now the undeclared reality of mainstream economic policy at Western Central Banks.

Krugman is blistering on some old tropes, the Schumpeterian theory of creative destruction gets short shrift, which still lingers in the financial press in complaints about ‘zombie’ companies (which I have always found weird). Likewise, that global development is all about rigging resource prices, which haunts the walls of a million coffee shops and a fair few churches and is also (sadly) tosh.

So, he is not all bad.

The New Bernanke Put

Nor when you understand how deep his influence is, does this financial market seem so strange, because the Central Banks hope inflation is external (weather, politics, madmen fighting etc) so this will “mean revert” in time. Alongside this sits a very wary take on destabilising currencies by interest rate differentials. The old guard real world elements break through occasionally (and have supporters, like the splendidly lucid El-Erian) especially with double figure inflation on the rampage, but they are not heeded for long.

Seen like that, while the stock market hates bubbles and inflation, it can’t shake the belief that in some form the “Bernanke Put” is still in play.

In which case ‘higher for longer’ on interest rates is a paper tiger, as rates don’t cause recessions, regulatory failure and hot money flows do. In that world buying an overpriced but liquid US market and buying the dollar looks, to many, like low risk. Not to us.

Inflation control?

And yes, as we have long argued, this won’t control inflation, but it seems who cares? We don’t need to fear the stock and housing bubbles deflating abruptly, as the Central Banks won’t allow that. Nor should we worry about rates, as Central Banks can’t let them rise much more, without jeopardising their over-indebted host governments.

So yes, old hands may hate a rising market into an economic slow-down, but they are it seems, just part of history.

What then to buy? Arms companies are not significant post ESG, the China trade is (we feel falsely) boosting already elevated resource prices, and travel companies are getting plenty of attention. Meanwhile areas of bountiful state subsidy (an ever-increasing list) are happy too. However, that is a fairly unattractive list. And are valuations in those areas still reasonable?

I can see why some investors just think playing around with Tesla options is the best bet (we don’t).

Then as Farce, Modern Imperial Europe

Chou En Lai when asked about the French Revolution was of the view (it is said) that it was “too early to tell”. I have been reading Michael Broers’ brilliant Europe Under Napoleon, an extended love letter to the EU, in favour of rational technocratic administration, with a deep-seated fear of the sans-culottes.

This seems to highlight so much of the French desire to see the EU as the Napoleonic Empire, without the bad bits. The terror of the rabble, the urban bias, the fetishism of one law, the desire to paint any opposition to EU autocracy as unspeakable - it all rather gels.

Well perhaps the parallels go too far, but in looking at the bizarre actions of the EU over Ulster it is tempting to see more than just childish spite. The resources thrown at half a dozen sleepy border crossings (reportedly 20% of all external border EU customs checks last year) made little rational sense. Even if not that bad, it was overkill.

So, I can half see why the DUP feel that getting rid of bureaucratic bullying is just appeasement, but looking at the litany of inconvenience to be scrapped, this does still feel like a win for all sides.

But as with markets, I suspect all the fundamental problems still remain.

The Scottish Play: Luck or judgement?

Three topics this week: has Sunak’s luck changed? Has India’s bull run ended, and where is this much-discussed recession?

Reflections & Predictions

This year won’t be last year, that much we know. Nor indeed will it be the inverse, which is inconvenient. So, starting this year as last year, but simply turned face down on the desk, is a trap.Read more

Tripod

We take a look at three things that move markets: macro, politics, and mood.

We have an inexplicable market rally to explain. On bonds we remain wary and we also take a look at the Keynesian attitude to inflation.

The obvious explanation for the market rally is Santa Claus, or perhaps in more mundane terms mood. The markets (in both bonds and equities) have had a beating, the shorts were satiated, the cash piles vast, and markets had simply had enough.

So, back up like a bungee it went, the heaviest fallers often bouncing back the highest.

Inflation (still)

We can talk endlessly about peaks and plateaus for interest rates, but we still don’t see any measures likely to get inflation back to 2%, for several years. But it seems that doesn’t matter now. The so-called base effects, the softness in commodity prices, the excess inventory (rather than prior shortages) all mean inflation will fall, and for most, for now, that’s enough. Regardless of how far or how long it takes.

Indeed, there is some realisation that if prices are really rising at 10%, it is best to buy now, not wait for higher prices.

And for a lot of service-based firms, capacity is indeed short, and they feel free to ram through price rises, to open up their gross margins, assuming (rightly) that if everyone else is doing it, and no one really knows their true cost bases, they are winners. As they are.

And as we long predicted, the elimination of competitors, and monetary tightening, leaves big firms free to expand into a void. After all they have faced flat prices for a long time, so the chance to move prices up is most welcome.

Seeing it like Keynes

So, it is perhaps useful to remind ourselves of the Keynesian view that inflation is “a method of taxation” which is used by the Government to “secure the command over real resources” in the same way as ordinary taxation. So, he was really not a fan.

How then do we explain the UK Treasury (all notional Keynesians) using abundant deficit financing to sustain already overheated demand?

Well in short, we don’t, it is just politics. By raising pensions and welfare in line with inflation, the UK Government is acting as if they need to secure the economy against high unemployment and a recession. The classic ills Keynes addressed.

Although (so far) neither of those disasters is evident anywhere, except in their own predictions. Older hires are rising which is generally a sign of overheated labour markets, looking for marginal supply.

Which is quite neat, as if those evils don’t arrive, the policy clearly worked and if they do, well our politicians tried their best. Given the shambolic recent failures of Treasury predictions, that they have any ongoing credibility is really quite remarkable.

But that process also embeds the long desired extra taxation, resulting from the inflation they are not quelling. There being no limit to how much Governments want to spend, there is equally no limit to their appetite for tax.

All of which nicely pings the pinball back to the Bank of England, which was so very unhelpful in the early autumn, so let’s see how they do now? Will they truly show the steel of the Americans or the Micawberism of the Europeans?

And interest rates (still)

The interest rate (beyond the short-term market rally) is therefore still the big decision. If inflation is here to stay, it all depends (once more) on the US, and on what reason the Federal Reserve has to stop tightening, even with high inflation. We can’t see one. Albeit we are very reluctant to guess there is none, with such strong markets. And it maybe they just had an arbitrary target, which they have now reached.

From this page on the Vanguard website

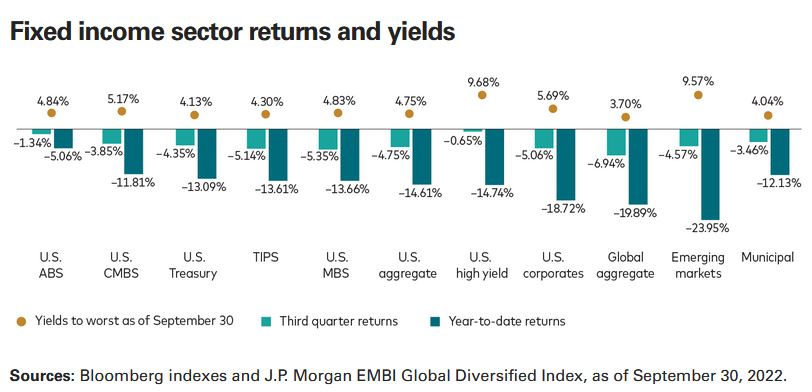

However, that gives us a trio of reasons (apart from the rogues’ gallery above) to still avoid bonds.

- If inflation stays elevated, bonds are a rip off, as they have a negative real return.

- If the Fed stays strong, bonds are a rip off, because base rates are still rising.

- And if the Fed wins, but others fail, then bonds are a rip off, because the dollar keeps rising (and hence other currencies fall).

In summary the only bonds that look attractive to us are still short-dated US ones. Which is not really new, nor does it make long term sense, with strongly negative real rates still. Bonds by definition can only have a real return when rates exceed inflation, either due to falling inflation or rising rates. And we don’t see that crossover for a while.

A THREE-LEGGED STOOL

So, we return to that trio: macro, politics, mood. Political uncertainty is much lower (for the next two years) in both the UK and US, and perhaps is not that unstable in Europe either, although the Ukraine war could still change that significantly.

Even China seems a little less keen on confrontation.

Macroeconomic factors really do not yet feel encouraging. It is way too early to declare victory over inflation.

Paradoxically when inflation is clearly beaten, earnings declines will then set in, as pricing power recedes. The failure to see that decline, will indicate inflation remains a threat.

And finally, mood - yes, the mood feels good, for now, although how long that remains is as much psychology as anything else. But if bonds do start to slip, don’t expect the party to keep going for long. Nor will recent dollar weakness persist.

The overall view seems to be that the handbrake turn has been completed, we may slide a bit more, but we won’t spin again.

But that assumes we know a lot about the track and conditions - do we?