The Turn of the Screw

So, we have Truss now. The continuity candidate, not the dull man who would take away our sweeties. But also, the same old Fed, keen to do just that. And its time we took a look at Starmer, the other continuity candidate and an excellent book on him; required reading for serious investors.

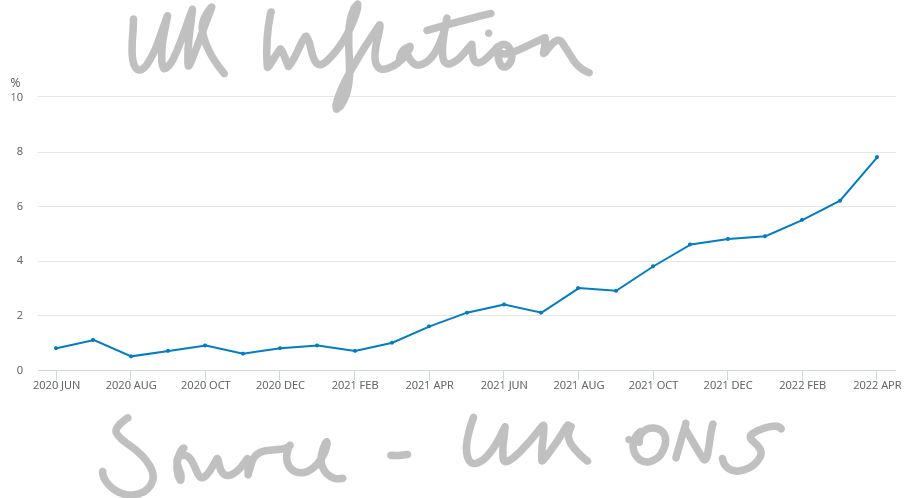

Otherwise, it is always a good summer when nothing changes. Markets swoop and soar vainly trying to catch our attention, but the reality remains that rates have to rise enough to destroy the excess demand that causes inflation. And they have to rise to equal or surpass that level, eye-watering as that prospect is. It will not be over until the US jobs report goes negative, and stays negative; anything less is prolonging the pain.

Presentation over substance

But this is a time of intensely political Central Banks, headed up by people without a grounding in economics, but a lot of “presentation skills”. They will be dragged kicking and screaming and smiling to do what they should have done last year, hoping vainly for some supply side reform or windfall to help out. But largely still facing the exact opposite, populists who think subsidies “cure” or ameliorate inflation.

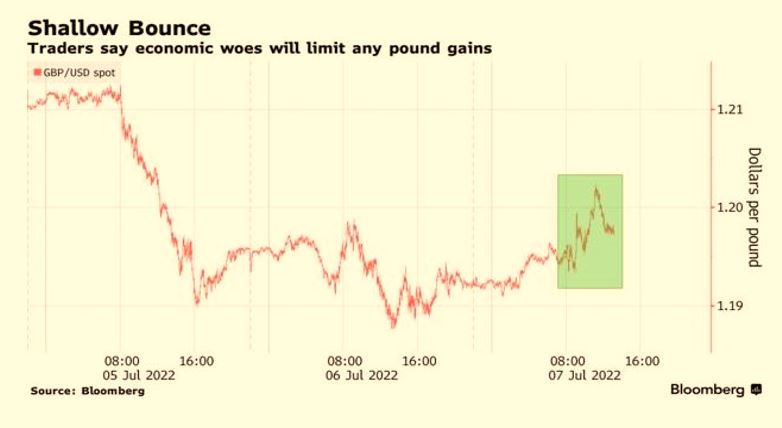

Markets are oddly buoyant; they get like this at times, but we see that as a mix of delusion, the self-reinforcing strength of the dollar (be very careful of that one, it is a new bubble) and the spluttering remnants of buying on the dip.

But be under no illusion, Central Banks trying to guess where the economy is going is like fly fishing with a jar of marmite. Entertaining, but highly unlikely to catch anything.

Truss: Issues and options

Truss meanwhile looks like a re-run of Boris; it won’t be quite that simple, but it looks like more style over substance, a different set of lobbyists, but nothing really changing. The idea either she or the EU can afford a bust up with the UK, just shows how silly markets can get.

Some of her programme may make sense, both the NI (tax) rises, and the corporation tax increases were badly timed and should be reversed, given inflation is doing the hard work already through fiscal drag (or frozen tax thresholds).

The rises were proposed when we were exiting the COVID crisis, but before we understood the energy one. We said so the last time we wrote to you.

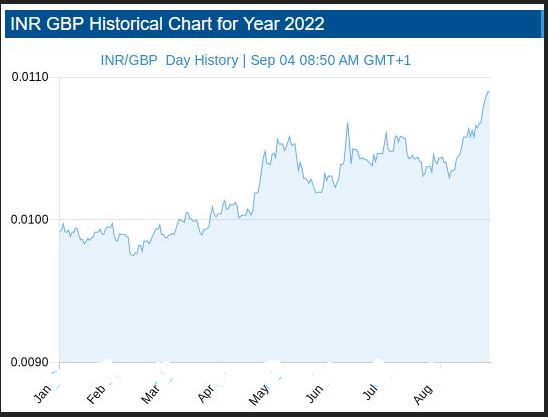

Ditching a few Treasury backed white elephants (HS2, Freeports, the crazy fiddling fetish on capital allowances) would do no harm either, but overall, the market’s verdict is clear: fiscal responsibility is still a long way out. We can all see how sterling has collapsed against the dollar; it is less clear why it has fallen against the Indian Rupee or the Chinese Yuan.

Source: See this website for all the daily data.

A book to read for all investors

So to Starmer, the likely next UK prime minister, where we need to pay more attention. Both on his mindset and on why the Labour Party hates him so much. Which in turn explains why (and with the Tories fatal ideological split heading them into Opposition), he is so fixated on party control.

Oliver Eagleton writes very well. His recent book The Starmer Project looks at four episodes, his left wing legal start, his transformation into a Tory enforcer with a penchant for exporting judicial expertise to the colonies (don’t laugh), his alleged machinations to back the People’s Vote nonsense to bring Corbyn down (pretty dense stuff, even now) and his use as the Blairite stalking horse to put a stop to Corbyn’s chiliastic tendencies, (which also gives you a trigger warning about a light dusting of Marxist ideological claptrap).

So Starmer is all about what works, which would make a nice change.

We’re looking at a very global mindset, apparently quite a strong Atlanticist outlook, keen to work with European authorities, but aware that the Brexit boat has sailed. An interest in devolving power down, but keenly alert to the risk of anarchy that entails. Indecisive, a Labour Party outsider (on his first election in 2015, apparently his nomination had to be held back to ensure he had the minimum length of prior party membership). Starmer is not exactly collegiate, but he has run a Whitehall department (as Director of Public Prosecutions) so not a loose cannon.

Very London too, Southwark, Reigate, Guildhall School of Music (sic), Oxford for post grad law, Leeds as an undergraduate. So should at least know where the Red Wall was. But lest you relax too much, a total ignorance of economics or business, let alone how to create growth. It won’t be easy.

And what about Markets?

Well for a UK (or non US) investor you only had one question this year. If you ditched the local currency you made money, and if you held onto sterling you got hit. Our GBP MonograM model is doing fine, it got that one big call right: kind of all you need. If you are a dollar investor, outside of energy your best place was cash. And our USD model took longer to spot that shift. As for active investing, sadly pretty much the same, the dollar is the story, or dollar assets. All of which perhaps makes dollar earners in the UK look cheap still.

But for now we see the story as a currency one, and at heart that is just about the timing of tightening interest rate spreads. The widening of those spreads has caused the recent havoc.

So when (finally) the European and UK Central Banks abandon futile incrementalism and get the big stick out, that will call the turning point.

Charles Gillams

The Times They are A Changin’

Rishi or Truss, can either be worse than Boris?

Also, we do seem to be decisively leaving the decade of low rates and by implication the experiment of quantitative easing. On a twelve-month basis, bar the FTSE 100, all major markets are down, although that is only just true for Europe and Japan. The Nasdaq and Aim are the big losers, and their recent recovery looks like a head fake to us.

We look at the global economy, and investment options.

So, what does the race for the next UK prime minister now look like?

It is not that important anyway, if as I assume, the next election is lost already.

These are stand in candidates, with no real grip on the party and likely to be loathed by the surviving group of Tory MP after that 2025 contest. Like a relegated football manager, they will have shaky job prospects.

Is there much to choose between them? Again, I am not sure, they have established that the party to its core hates higher taxation, whatever fantasies Boris had, and some at least understand that a smaller government or higher debt, is what the hard choices of governing are about.

I rather expect much of the ‘difficult’ stuff attempted by the last Cabinet will get ditched by new ministers. It still would be wrong to say the new team can’t achieve much, the governing majority is solid, and further bloodletting inconceivable. I would anticipate that they will still have two and a half years to run.

The two candidates compared

Sunak is admired for his high-profile experience as Chancellor, disliked for his willingness to raise taxes, loathed for wielding the knife on Boris. Truss is thought to be opportunistic, and rather unfairly for being dim and not substantial.

But I don’t expect much of a change, more fiscal conservatism, less besotted greenery, perhaps less socially liberal, but only to the extent of holding the line, not really rowing back. Short term stability, long term decline.

Preparing for another European killing field?

But you do feel Sunak would be less of a cold war warrior.

The report that the Chief of the British General Staff had called this “our 1937 moment” and launched “Operation MOBILISE” suggests the bloodlust is well and truly up, all adding to the hefty training programme. We are already deep into a proxy war ourselves.

I hear it is just as insane in the Pentagon. There is even high level gossip about this being the final great “killing field” in our centuries’ old hostility to Russia.

Economy : two questions affecting interest rates and inflation

As for the global economy, we had two great questions for the year, how long could the Fed “extend and pretend” over inflation, and how quickly everyone else would then play catch up.

Well pretty well the day Powell was re-confirmed earlier this year, he binned the Jackson Hole pretence that high employment did not have to mean high inflation.

I suspect (and so do markets) that he won’t really go after inflation, if he did so, we would have interest rates in double figures by Christmas.

Bread, job, and a roof, these three a politician must provide, and just one without the others, is a vote destroyer.

The current modest level of rate rises will let inflation creep lower, but will not control it, and we don’t see interest rates topping out for quite a while, not helped by the very low starting point. Although overall, it looks like the currency markets are forcing the rest of the world to follow in raising rates quite fast and in the end, to the same levels. Nevertheless, in Europe the response to double digit inflation, has so far only extended to ending negative rates.

As if that will matter, as the Euro collapses; they will have to move faster. Lagarde confidently delivering total guff and mysterious lawyerly threats won’t save Italy.

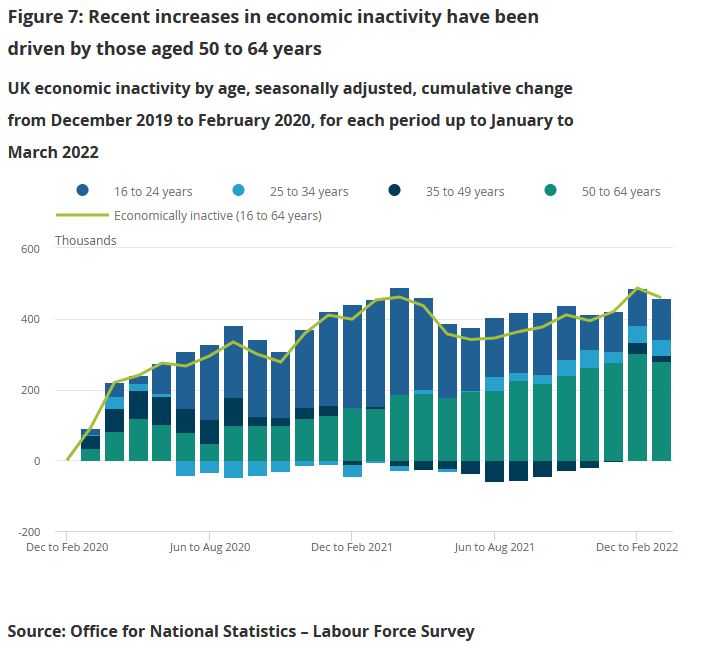

The economic models everyone is relying on to forecast otherwise, seem to assume no incremental rise in energy prices next year, and indeed a sizable fall. That maybe so, but there will still be a lag as this year’s rises have not been fully absorbed and will echo and bounce around the economy for a while to come. Not least through a still very tight labour market, which has several years of lost capacity due to COVID and indeed the familiar demographic time bomb.

A slackening in wage inflation needs US and Northern European unemployment to at least double; no sign of that yet. It is a muddled employment market with spatial and skill deficits, so increasing capacity where it matters, will take time. Not least because of persistent high surplus labour levels to the South and West in Europe.

So, if the Fed (and Wall Street) insists (as it does) on calling this transitory inflation, or now the new phrase, ‘peak inflation’, they are simply using dud econometric models (again).

What next?

Cash flow will again be king, capital will be well rewarded in the bond markets, dividends will have competition, non-dividend payers face a long winter. Experience of the dot com bust, and then the banking crisis, suggests it takes three or four years to retool models based on prior poor capital allocation (and boy have we had that). Not the three or four months which is being assumed.

Granted we were oversold at 3666 on the S&P 500, perhaps an auspicious low. Yields meanwhile had shot out beyond reason, but reluctantly we consider this pleasant bounce can’t survive. We accept too that earnings are OK, but they are in most cases a poor indicator of economic forces that take years to establish themselves. The extinction of even capitalist dinosaurs takes time.

And then there is the great concertina of rates: ignore what each Central Bank says, in the end they must march to one beat, that of the dollar.

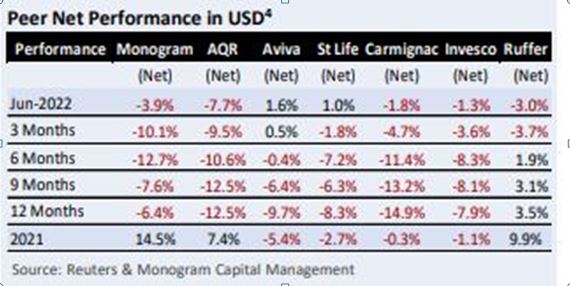

Monogram performance, compared to others in the Absolute Return sector

It is striking that our USD MonograM model now holds no equities or bonds, our GBP MonograM model is fully invested in both. While the list of storied Absolute Return managers who fail to beat our model remains embarrassing.

Download the newsletter of which this table is a section, for the full data.

There is no availability of this model, except through ourselves; perhaps it is time to talk to us about using it?

Do get in touch, an exploratory discussion is never wasted.

We wish you a pleasant summer: as good Europeans, we will fall silent for August.

I hope it all looks clearer when we return.

Charles A R Gillams

Boris finally quits, and 'Quality Growth'

Boris finally quits: the loss of his Chancellor clearly made this inevitable. We also reflect on the London Quality Growth Conference, held in Westminster last month. It implies a very US bias, driven by two US universities, that seem to dominate much of UK investing and indeed public policy.

First as tragedy, then as farce

So, it is over. The absurd repetition of the same error and the same apology passed from tragedy to farce.

Clearly the belief that you fight inflation and unpopularity, by bankrupting the country with printing money, had also simply become too much for Sunak. That was the fatal blow. Let us hope the next leader is less of a deranged populist. In the real world what is popular seldom overlaps with what is right.

We will skip the look backward, over his flawed career, skip the look forward over the seven dwarves, and fervently hope for a different set of economic policies by his successor. It sounds as if there is plenty of time for a long summer of speculation. The likely candidates are less than attractive, let us say.

How might the UK market respond?

Nor can I fathom a market response to a change of leader in London: bullish that it is over? Or could it be bearish as we don’t know what comes next, or indeed bearish in that it surely strengthens the opposition?

While we felt the Old Lady moved far earlier than others (late in 2021) because of UK fiscal laxity, we see no reason yet for them to back off their August rate hike. Politically it is hard to stop and start interest rate moves, while just repeating a previous measure in mid-summer will look innocuous. I suspect that’s true for September too, but that feels a long way off. And I do note, that as we predicted, the great spike in corn and wheat prices has taken just one growing season to unravel, as farmers react quickly, by adjusting cropping patterns, knocking out another justification for any more price rises.

A weak pound is also importing inflation, and the Bank has to make a stand somewhere, but 1.19 to the dollar feels too early, 1.09? Pressure will start.

Alchemy Unchained?

We turn now to ‘Quality Growth’, an excellent conference and well presented with a dozen first rate managers from the US, UK, Europe presenting.

But it led me to ask about the underlying assumptions of the ‘Quality Growth’ model.

Firstly, there is the Santa Fe school, which speaks of the ultimate failure of nearly all quoted companies. This is the old ‘99% of the S&P 500 stocks contribute nothing to returns’ case. Allied to that is the Columbia (New York) mantra that some companies can beat the pack for ever, so the theory is find those “compounders” with their ‘deep moats’ and your investors will win for ever.

It was surprising how much of current fund management practice is wedded to those two assumptions. They look remarkably shaky to me, but if believed by enough of the industry, are likely to become self-fulfilling.

Which adds to another oddity: we know active managers seldom beat index investing. But this year should be showing the exact opposite. Passive long only funds are destroying wealth at a terrifying speed. So true active managers should do well too, but oddly (and absurdly) perhaps because of this “a few chosen winners” theory, they too seem to willingly forget about valuation.

True Believers

You see these few companies are (after exhaustive analysis) the nailed-on winners, so if the market halves, they will still outperform - just hold on and they will come good, the fundamental long-term analysis says so. You will recognise Cathie Wood, Scottish Mortgage are, in some measure, exponents of this too.

What is not to like? Well, self-reinforcing buying propelling valuation is dangerous; ask the Woodward investors about that one. But we also get odd clusters (identified as the winners, or the winning group, or amongst which will be winners; choose your terminology, like Tesla or Palantir or Netflix), which cut loose from sane valuations, becoming for a while mere intellectual Ponzi schemes, moving only upward, fed by endless new money.

Until they don’t.

And every time ‘buying the dip’ gets burnt, there is less fuel for the next attempt, and less appetite to try.

Too narrow a view?

I am not wholly convinced by the ‘only a few stocks matter’ theory; for a start, you have to be very lucky with your baseline, even if you can spot the gems.

But even less do I believe that you can really thread the needle to identify the great companies, and secretly buy them, without shifting their prices and then hold them, in public portfolios. If you are right (and success requires you to be right) then everyone else piles in, and valuations simply become a function of overall liquidity.

The belief that having found them, you can leave them in your portfolio for decades, feels somewhat quaint. There are some giants that do perform year on year, but we all know of plenty of giants that rise and stumble (see above), and many that have multi-year slumbers (most oil and bank stocks).

Fashion or Momentum?

So, at the conference, we had a hall of great fund managers, but also the odd IFA pleading to be told about current performance, which was simply shrugged off. Our clients are always keen to be told about our recent performance, I am sure in truth so are theirs.

Given the structure of the market, now may be the perfect time to buy Quality Growth, but that bigger question about rates and inflation trumps all. And investing, we know, is about fashion, that’s why momentum (usually) works.

I do like some of these funds, and respect their hard-working managers, but feel investing needs a hybrid approach, quality, yes, growth yes, but critically valuation and momentum too.

It seems like public policy has also increasingly drifted in the direction of this “picking winners” theory and backing what are believed to be high yield, clean, desirable industries, rather irrespective of their viability.

Public Policy implications

Once you accept fund managers can spot these, you perhaps accept governments can also nurture them and scatter tax breaks around them. This will, at the same time, destroy the rest of the commercial ecosystem, in part, oddly to fund the hoped for predictable and desirable elite. Look at what Tesla (again) has done, extensively subsidised by exchequers round the world.

Does real life work like that? I doubt it - but investing theory has clearly now tainted public policy too.

Charles Gillams

Monogram Capital Management Ltd

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

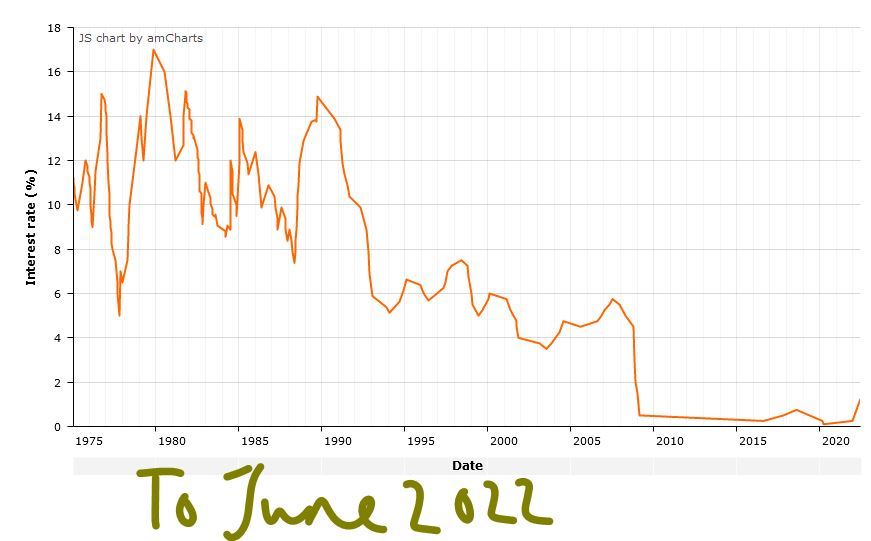

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

Interest rate cycles

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

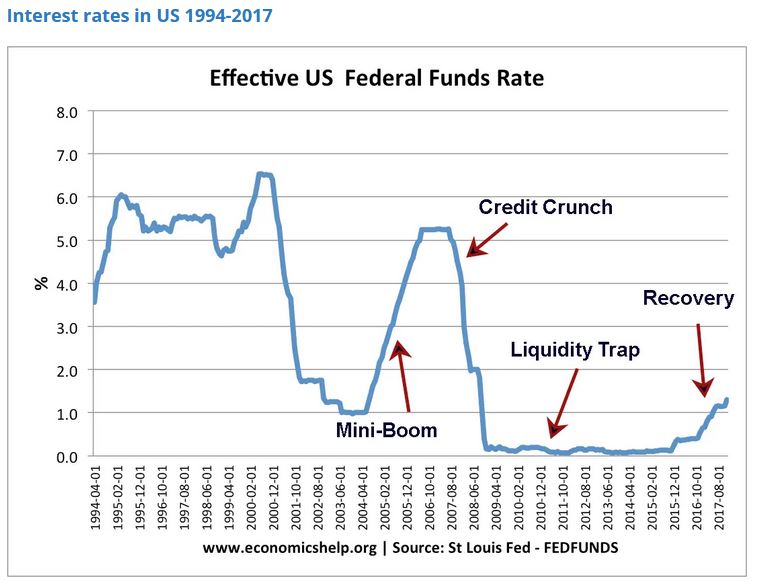

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.