Pain delayed, pleasure denied

We look at the startling emergence of another US based tech bubble, the failure of value investing and offer some reflections on the UK market.

The Bones of World Financial Markets.

This has been a baffling half year in which, with few exceptions, we have ended up going sideways for most of it. The exceptions were in descending order, within equities, the NASDAQ (by a mile), Japan, Germany, the S&P and France. Although all, especially Japan, offset by a weakening local currency for UK investors. A quite unusual, largely unrelated, mix of old and new.

Overall, cyclicals in general, and energy in particular, as well as bonds, and China have been painful and financials at best so-so. It feels like a year to not hold what worked last year and vice versa. Nor is it as simple as growth versus value; neither have worked consistently, except in the case of a small (but rotating) group of tech stocks.

Our view thus far, has been that until global growth starts to move, we stay out of the way. This has been wrong, because the overvalued US mega stocks, were almost the only game in town. Yet jumping in now, of course, also feels very dangerous.

However, a few of our growth markers have, even if flat on the year, started to shift, not the highly speculative micro stuff, which is still falling away, but the solid middle ground. The hot India tech sector, far more connected to Silicon Valley than we realise, has suddenly jumped.

Macro Skeleton

What about the underlying macro story? Well, the pain of the invisible recession, and the pleasure of resulting rate cuts, have been delayed and denied respectively.

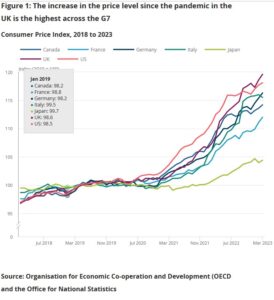

From the UK office of National Statistics – see this chart more clearly on this page.

From the UK office of National Statistics – see this chart more clearly on this page.

Well, there it is, poorly controlled inflation persists, a longer rate squeeze may still be needed. The vanishing China post-lockdown boom means that there was no sudden stimulus to offset that. Our published data (from Andrew Hunt) was saying Chinese ports were remarkably empty three months ago, from soft export demand, a good lead indicator.

All of that was hidden by strong services demand, and in closed economies (as the UK is oddly becoming) there is no relief valve, and hence it suffers embedded high inflation. But clearly consumption is dropping in the US, recent retailer numbers are all over the place, confirming those China export stats.

While on commodities, the failure of sanctions to impact energy is ever more clear, and I doubt OPEC’s ability to stem the energy glut. As a final blow to value stocks, “higher for longer”, on interest rates, which we have been predicting for two years, hurts indebted companies, who increasingly have to refinance at high rates. It also makes their dividend yields less attractive.

When rate cuts do come, growth having survived the storm, may well soar; as we have noted before, the prevailing fashion in investing heavily favours so called “tech moats” and dislikes debt. That markets keep seeking out new moats, real or imagined, is all part of that.

The speed at which digital currency and virtual reality have become old jokes, but generative AI will save us all, is remarkable.

Bond Dilemmas

In bonds we have seen no point in our lending to governments at rates that are below inflation; in most of the world as inflation falls, bonds still remain unattractive, as yields then start to drop too. So, the bond trade has been messy to say the least.

With greater certainty about a consumption recession, the fear of defaults also rises, and the longer rates are high, the more that refinance risk looms. Jumping a spike is possible, vaulting a table, without spilling your drinks, rather less so.

There is also still a ton of money parked up in fixed interest, just waiting for the equity ‘all clear’.

Lost London?

The UK market (yet again) simply flattered to deceive; I struggle to see much hope for it. While we can hope the likely change of government will be an enhancement, it really will just entrench welfare dependency and producer capture of state services, albeit in a rather more disciplined way.

The risk of Brexit always was that we would use our new freedom to rebuild old prisons. Can a new flag on an old workhouse change much? As for where our stunningly high inflation comes from, again, it must be our own creation, the Ukraine energy peak is now a dip, so it is not imported.

While no one wants to say it, tax rises, especially of such magnitude of corporation tax, in particular, are inflationary, but so is the cheap theft of frozen income tax thresholds. Trade unions employ good economists too, they negotiate for higher take home pay. Rate rises also cause extra inflation, especially with our persistent high national and consumer debt levels.

Sterling strength (it is now moving up against the Euro too) is a sign of markets seeing the UK as the best bet for avoiding rate cuts (and for getting more rate rises). That is not a good sign domestically.

Wood for the trees

We have all been obsessed with rates and inflation, but we seem to be in danger of missing what looks like a widespread bull market running broadly from last October. This is widely applicable outside the main US markets, including in gold. There is a similar and at times masking trend of dollar weakness.

What are the implications of this?

We also look at the unending tragedy of the various remnants of the Tory party.

Still Rising?

With markets still fixated on the next crash, we can sometimes overlook the long momentum swings. Although the US banking crisis matters, it is of little relevance to the far more concentrated and tightly controlled Basel III banks in Europe. Many would say to excess, but they are clearly tighter rules. The few assets not marked to market are a footnote in Europe; in the Wild West of US regionals, they can be the whole story.

On a one-year basis, the France CAC 40 is up 14%, the German DAX by 12%, with both the UK large cap and Japan’s Nikkei also positive, so equity markets have been strong, almost regardless of rate rises. The US is the main home of negative twelve month returns, but the gap between the S&P and the NASDAQ declines over that period, is now quite small, after the spring bounce back in the latter.

What does that mean?

For all the media love of the disaffected trashing their own communes, doing the right thing on pensions (they were very out of step) apparently helps France.

While the splitting of power in the US Congress and the meanderings of a senile President, has perhaps hurt the US, with everything from banking regulation to the debt ceiling made into a political game.

Brazil is down too, but India and Russia are up.

Well perhaps I go too far, but maybe there is a pattern? Markets like stability.

Relative values

While comparisons are complex where accounting systems diverge, the UK still looks like the lowest rated with the highest yield, and conversely the NASDAQ still has (by some way) the highest rating and lowest yield. US earnings are it seems still much more valuable.

The savagely anti-business stance of the UK, including a brutal rise in corporation tax maybe part of it, it will create a fall in earnings (and likely dividends) next year.

While the less visible, but still onerous onslaught in the US, including a minimum tax take, won’t be good.

So, does inflation matter?

The UK perhaps is also seen as the one major European market that looks to have dithered too long on controlling inflation (which could explain sterling strength). However, I see no real appetite for more austerity in the UK, so I find that assumption slightly puzzling. Having the FX market convinced UK rates are going a lot higher (because of policy failures) is hardly comfortable, but feels a little like re-living last year now.

Oddly too, controlling inflation the US way, has hurt equity markets more, it seems, than letting it burn out in the European style. Heresy to many of us, but that’s what the numbers imply.

All the theory, all the historic data says we now must get a sharp recession, but then grandpa, pray where is your beloved recession? Still looking, since mid February. It seems we must appease the inverted yield curve and believe base rates matter, but a bit more evidence would certainly help.

And rate cuts will be a powerful tonic, when they come. The bears are now reliant on widespread recessions, and soon.

Perhaps the best of this little bull market has gone, but there is a lot of liquidity still about and being out of the market with high inflation, is not great.

A multitude of sins – local elections coming up

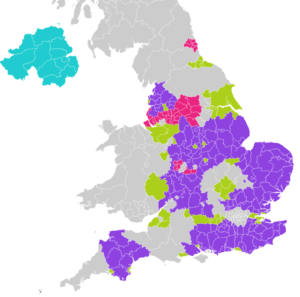

And what of the UK Tory “Party”, if such a mess can be called that. The assumption for a while has been that the imminent local elections will be bad for them. However, they are a curious mix of voting locations this time, not London, not all of the Home Counties, none of the Celtic fringe, but a good chunk (but again not all) of the Red Wall seats. See map below.

Map from Wikipedia page on 2023 local elections

But really it is heavily biased to the Tory heartland, vast swathes of Labour free wards, where they are not even bothering with candidates, so it will not tell us that much. The Lib Dems will do well, but significant conquests in many areas will now require quite substantial swings.

The assumption is also that Dominic Raab was cut down by Sunak, who has yet to learn that throwing competent colleagues under the bus may feel good, but it thins the ranks of effective ministers, and builds up the malcontents. He has handled these badly, and forgets the real target is not his ministers, but his own position.

Tory strategy

Seemingly the Tory party has run just one electoral strategy for years, based on old victories; just trash the opponent. In a two-party state, voters must then decide who they dislike least. And both Labour (and the SNP) have reliably offered something so vile, that a simple victory follows.

But no longer, Labour (despite their recent rather crude posters) still seem innocuous.

The Lib Dems are sticking to their amateur politics, which can also look strangely alluring, if the other two parties look mysterious or inept. The Tories (like the SNP) are now in danger of being judged by results, not by fear or hatred of the alternative.

The score card on that basis looks pretty bad, and Sunak’s pledges are so far, going the wrong way.

The Sleep of Reason

Big picture risk assessments today, and worries about the prevailing style of regulation - we look at where the next bank blow up maybe. We’re assuming this will again be caused by regulators and their herding behaviour. On the upside, an improving medium-term market outlook. Also, dollar danger.

But before I begin…

First of all, many thanks to those who replied to our sentiment survey, you are a cautious crowd! Over half (53%) sitting on the fence, alongside us. The largest directional group is bullish on equities (18%), but it is a pretty even bull/bear split with bonds, and quite a few equity bears too.

Regulatory Myopia and Declining Banks

Bank boards (and auditors) are still clearly confusing regulatory approval with sound banking, in the odd belief that excuse will wash, when they implode. In particular we worry about the vast amount of debt that is sitting on bank balance sheets, at below current market levels, and not in this case issued by governments.

We have notable anxiety about two areas, fixed rate mortgages and investment grade debt where, especially for the former, the numbers are vast. Perhaps the tightening steps to date appear so ineffective, just because so much of this old low-cost issuance, is only very slowly rolling off .

Big picture – the effect of long dated low-cost loans, with rising interest rates

This leaves cheap money in the system, funded by banks, that have to pay way more to keep funding these long-term deals. They’re doing this typically with short-term sources, like deposits. In sub-prime, asset finance, trade finance, consumer finance, none of it matters much, as they are pretty short duration. Which is where most people worry, because of default rates, we don’t.

But in mortgages especially the regulator typically issues the future economic scenarios to banks, who then price (originate) and provide for losses against that projection.

If that projection is absurdly few rate rises, for a decade (as it was till fairly recently), it seems banks just follow obediently along. As a result, they have issued vast amounts of long dated, low cost loans based on false or unrealistic assumptions.

Those regulator driven economic assumptions/scenarios are key, and yet are lost in the detail. Each bank has to publish them if you dig deep enough. (Some are on p155-157 of the HSBC accounts, for example, if you have the stamina.)

Re-mortgages – what they contribute to our big picture

The other part is refresh rates, in a falling interest rate world, borrowers re-mortgage every few years, but in a rising one early redemptions virtually stop. So, the whole system gums up, without fresh liquidity. Regulators have not seen, and have no data, on such a ‘higher rates for longer’ world. So, it is assumed that world cannot exist. While the key thing (still) on these scenarios is that interest rates are still assumed to be like rockets, straight up straight down.

Now if you assume that, there is some short term pain, but normal service resumes soon enough with no long-term issue. But is it realistic? It is a vast slow moving market as in this publication of the FCA’s mortgage lending statistics .

Inevitably the scenario dispersion used is small, indicating a regulatory finger remains on the scales. So, most banks take the Central Bank forecast as the middle way, with say 10% either side. All as at the historic balance sheet date. Last year they were nonsense even before publication, two months on.

That is aside from Hong Kong, where real economic models, with real outcome ranges are visible. For most markets you see a skein of twisted rope drifting laconically into the future, but on HK they produce an exploding ammunition graph, smoke trails looping everywhere.

To a lesser extent BP debt (a classic investment grade, big, global borrower) is a similar problem. It has half fixed, half floating issuance, but the fixed is at 3% with a fourteen-year average term and the floating at twice that, at 6%. Now someone holds that fixed debt, and if regulated it will have to now be held below par. Are BP going to prepay it? Despite the roar of cash coming in, why would they? It is stuck, unusable for 14 years, unless inflation (and rates) collapse as fast as predicted.

What else is driving markets?

The big upside drivers to us are, the end of COVID, the end of the energy spike and falling rates. The first two will help through 2023 and 2024. Rising rates are still hurting, but again 2024 and beyond looks good.

While the biggest current downside driver is the recession, which will impact 2023, but again rebound in 2024. So, the issue is: will the rather timorous monetary tightening and anaemic reductions in the absurd fiscal overdrive, be enough to defuse all that good news coming in the next year?

Markets apparently think not.

We are particularly struck by the NASDAQ up 18% year to date, yet our tech bell weather share, Herald Investment Trust (HIT) is still (marginally) down YTD. So is this a bitcoin-type story (all about liquidity) or is it based on tech fundamentals? If the latter, then why is it seemingly glued to the US, and not translatable? Even failing to reach non-US holders of US companies.

For now, until the price of global tech shifts, I treat the US as a special case; growth is not back yet.

While the currency charts are unclear, it does also feel like the beginning of the end of the great dollar story, with sterling persistently ticking higher of late.

From: this page published by the NY federal reserve.

From: this page published by the NY federal reserve.

That’s a real danger for portfolios that thrived on dollar power last year.

We close wishing you a happy Easter break. We will be back with St George.

A RIGHT OLD TONKIN

About Influence – American and Russian, mediated by the Chinese

So, to start with what does worry us: That is the slide to a hot war with the powerful Eastern autocracies, fueled by the EU with Napoleonic tendencies, an old man in the White House and a curious sense of ‘crusades’ with no consequences.

For those with long memories of American imperialism, the latest drama even fits neatly as a modern Gulf of Tonkin, a key moment in the slide to war. In that case (south of Hanoi) the clash was naval not aerial but was still notable as one directly between the warring parties and not just their local proxies.

While elsewhere the pieces move, China can not let Russia fail, nor descend into chaos, their long-shared border must stay intact and secure. They no more want the US there than the Russians do. The first step after his confirmation as ruler for life, by Xi, was indeed to go to Moscow.

And the bitter battles in the Middle East of Persian against Arab, Sunni against Shia have cooled abruptly, under Chinese influence. The world once more understands that the US is the threat to peace and stability, not just their fractious neighbours.

For Biden it is an easy fight, the Pentagon so far has played a blinder, what can go wrong? While, for now, France is Europe, no other large state has anything like their stability, Italy is led by the unspeakable, Germany has free market liberals in a bizarre ruling alliance with Greens, Spain is wrapped in its own forthcoming general election, the UK both distinctly detached and under a caretaker government.

The UK budget said nothing, incidentally.

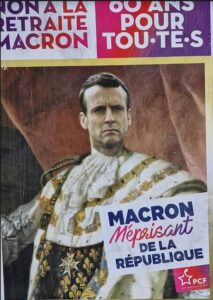

Main influences in France.

While the left in France, as the above photograph shows, are very alive to Macron’s ambitions, to add more territory to the EU, arrange more protectionism for French goods and to suck the labour force out of adjacent states to serve the Inner Empire. Just like Bonaparte tried (and failed) to do, with dire consequences for the French nation.

For all that, the domestic fracas in France (which makes our own strikes look rather tame) was inevitable. Raising (by not a lot) the pension age from 62 to 64, against our own 67 looks small, but it was a clear campaign pledge.

The absence of any minor party wishing to self-destruct, by supporting it in the French legislature, is no great surprise either. So, he has implemented it by decree and Macron has dared the opposition to now either remove his prime ministerial nominee, or shut up.

Banking On Nothing

So, what of markets? Well, the end of SVB is no great loss, it had several policies that had to implode if rates rose, especially on the lending side. It was painfully ‘woke’; I can tell you more about the Board Members sexual orientation, gender and ethnicity than their banking experience, the former just creeps into the end of their latest Annual Report, the latter was invisible to me.

SVB’s long list of ESG triumphs and poses (and it is long) at no point included not going bust. It did commit an extra $5billion to climate change lending, which I guess has all gone up in smoke now. Still apart from all being fired, the bank insolvent, the remnants rescued by the hated Washington mob, under investigation by the DoJ, all the rest of their “G” was superb, and so, so, cool.

I don’t see Credit Suisse as a danger, although it may be in danger. It has had an appalling run of misfortunes, with musical chairs at the top, but it remains a cornerstone of Swiss identity. To let it fold would be highly damaging and cause shockwaves in derivatives markets.

Influence on the markets

So, I do understand the Friday sell off (who wants to be weekend long with regulators on the loose). And we do understand markets needed to go down, after the big October bounce, indeed it was a key reason for our building up over 33% cash or near cash at the previous month end. We knew the winter rally was fake.

But I don’t see this as much more. Retest of the S&P 500 October low? It should not be. I take a lot of heart from bitcoin soaring (63% YTD); if liquidity was short, that would not have happened.

But for all that, I don’t like March in financial markets, too much is uncertain. So, this is more a time for cautious adding, rather than hard buying, but if we get to Easter (and hoping to be wrong on the Tonkin analogy) it does seem a better prospect.

Nor do I see how the various central banks can justify a pause in rate rises, at this point, but nor will they go in hard, that would be folly.

This Fed has made enough mistakes already.

First as Tragedy, then as Farce

This is turning into another unloved bull market, we look at why, and wonder if Chou En Lai was right about the French revolution. Lets start with inflation.

I chanced upon Paul Krugman’s The Return of Depression Economics, written in 2008. Krugman is very much an establishment man, Keynesian to his socks and seeing the great failure of late 20th Century economics being the sudden lack of demand. He has other work and more recent books, but I will focus on this one.

IMF Remedies

He has particular vitriol for the way the IMF repeatedly used austerity in its many forms, as the antidote to all and any of the chaos created by a deflating bubble. So, taxes up, spending down and crush demand to stabilise a currency, to avoid the extremes of bank collapses.

In Krugman’s world, it was more important to regulate banks, and it seems hedge funds, thereby stopping the sources of instability in the credit markets, and to then prop up demand.

Well, the echoes are there, current policy remains both IMF applauded austerity to save the currency, which is just what Hunt inflicted on the UK last year, and a desperate search for ways to pump up demand, to stop stagflation. Much as Biden is doing with the US and the amusingly called Inflation Reduction Act, and indeed the MAGA type, neo-Trumpian, protectionism now evident in the CHIPS Act. The rush to global rearmament should be just as effective.

All in the end versions of Keynesian demand creation – digging holes in highways to refill.

Echoes of Old Bubbles

Krugman is not indifferent to the bubbles this creates in the US stock market and US housing prices but would seem, like Senator Warren, to suggest whatever the question, more bank (and shadow bank) regulation is the answer.

It is odd as you piece together many establishment views, how this policy of ‘create bubbles, and then carefully regulate their deflation’, but never cut demand too hard, is now the undeclared reality of mainstream economic policy at Western Central Banks.

Krugman is blistering on some old tropes, the Schumpeterian theory of creative destruction gets short shrift, which still lingers in the financial press in complaints about ‘zombie’ companies (which I have always found weird). Likewise, that global development is all about rigging resource prices, which haunts the walls of a million coffee shops and a fair few churches and is also (sadly) tosh.

So, he is not all bad.

The New Bernanke Put

Nor when you understand how deep his influence is, does this financial market seem so strange, because the Central Banks hope inflation is external (weather, politics, madmen fighting etc) so this will “mean revert” in time. Alongside this sits a very wary take on destabilising currencies by interest rate differentials. The old guard real world elements break through occasionally (and have supporters, like the splendidly lucid El-Erian) especially with double figure inflation on the rampage, but they are not heeded for long.

Seen like that, while the stock market hates bubbles and inflation, it can’t shake the belief that in some form the “Bernanke Put” is still in play.

In which case ‘higher for longer’ on interest rates is a paper tiger, as rates don’t cause recessions, regulatory failure and hot money flows do. In that world buying an overpriced but liquid US market and buying the dollar looks, to many, like low risk. Not to us.

Inflation control?

And yes, as we have long argued, this won’t control inflation, but it seems who cares? We don’t need to fear the stock and housing bubbles deflating abruptly, as the Central Banks won’t allow that. Nor should we worry about rates, as Central Banks can’t let them rise much more, without jeopardising their over-indebted host governments.

So yes, old hands may hate a rising market into an economic slow-down, but they are it seems, just part of history.

What then to buy? Arms companies are not significant post ESG, the China trade is (we feel falsely) boosting already elevated resource prices, and travel companies are getting plenty of attention. Meanwhile areas of bountiful state subsidy (an ever-increasing list) are happy too. However, that is a fairly unattractive list. And are valuations in those areas still reasonable?

I can see why some investors just think playing around with Tesla options is the best bet (we don’t).

Then as Farce, Modern Imperial Europe

Chou En Lai when asked about the French Revolution was of the view (it is said) that it was “too early to tell”. I have been reading Michael Broers’ brilliant Europe Under Napoleon, an extended love letter to the EU, in favour of rational technocratic administration, with a deep-seated fear of the sans-culottes.

This seems to highlight so much of the French desire to see the EU as the Napoleonic Empire, without the bad bits. The terror of the rabble, the urban bias, the fetishism of one law, the desire to paint any opposition to EU autocracy as unspeakable - it all rather gels.

Well perhaps the parallels go too far, but in looking at the bizarre actions of the EU over Ulster it is tempting to see more than just childish spite. The resources thrown at half a dozen sleepy border crossings (reportedly 20% of all external border EU customs checks last year) made little rational sense. Even if not that bad, it was overkill.

So, I can half see why the DUP feel that getting rid of bureaucratic bullying is just appeasement, but looking at the litany of inconvenience to be scrapped, this does still feel like a win for all sides.

But as with markets, I suspect all the fundamental problems still remain.