First as Tragedy, then as Farce

This is turning into another unloved bull market, we look at why, and wonder if Chou En Lai was right about the French revolution. Lets start with inflation.

I chanced upon Paul Krugman’s The Return of Depression Economics, written in 2008. Krugman is very much an establishment man, Keynesian to his socks and seeing the great failure of late 20th Century economics being the sudden lack of demand. He has other work and more recent books, but I will focus on this one.

IMF Remedies

He has particular vitriol for the way the IMF repeatedly used austerity in its many forms, as the antidote to all and any of the chaos created by a deflating bubble. So, taxes up, spending down and crush demand to stabilise a currency, to avoid the extremes of bank collapses.

In Krugman’s world, it was more important to regulate banks, and it seems hedge funds, thereby stopping the sources of instability in the credit markets, and to then prop up demand.

Well, the echoes are there, current policy remains both IMF applauded austerity to save the currency, which is just what Hunt inflicted on the UK last year, and a desperate search for ways to pump up demand, to stop stagflation. Much as Biden is doing with the US and the amusingly called Inflation Reduction Act, and indeed the MAGA type, neo-Trumpian, protectionism now evident in the CHIPS Act. The rush to global rearmament should be just as effective.

All in the end versions of Keynesian demand creation – digging holes in highways to refill.

Echoes of Old Bubbles

Krugman is not indifferent to the bubbles this creates in the US stock market and US housing prices but would seem, like Senator Warren, to suggest whatever the question, more bank (and shadow bank) regulation is the answer.

It is odd as you piece together many establishment views, how this policy of ‘create bubbles, and then carefully regulate their deflation’, but never cut demand too hard, is now the undeclared reality of mainstream economic policy at Western Central Banks.

Krugman is blistering on some old tropes, the Schumpeterian theory of creative destruction gets short shrift, which still lingers in the financial press in complaints about ‘zombie’ companies (which I have always found weird). Likewise, that global development is all about rigging resource prices, which haunts the walls of a million coffee shops and a fair few churches and is also (sadly) tosh.

So, he is not all bad.

The New Bernanke Put

Nor when you understand how deep his influence is, does this financial market seem so strange, because the Central Banks hope inflation is external (weather, politics, madmen fighting etc) so this will “mean revert” in time. Alongside this sits a very wary take on destabilising currencies by interest rate differentials. The old guard real world elements break through occasionally (and have supporters, like the splendidly lucid El-Erian) especially with double figure inflation on the rampage, but they are not heeded for long.

Seen like that, while the stock market hates bubbles and inflation, it can’t shake the belief that in some form the “Bernanke Put” is still in play.

In which case ‘higher for longer’ on interest rates is a paper tiger, as rates don’t cause recessions, regulatory failure and hot money flows do. In that world buying an overpriced but liquid US market and buying the dollar looks, to many, like low risk. Not to us.

Inflation control?

And yes, as we have long argued, this won’t control inflation, but it seems who cares? We don’t need to fear the stock and housing bubbles deflating abruptly, as the Central Banks won’t allow that. Nor should we worry about rates, as Central Banks can’t let them rise much more, without jeopardising their over-indebted host governments.

So yes, old hands may hate a rising market into an economic slow-down, but they are it seems, just part of history.

What then to buy? Arms companies are not significant post ESG, the China trade is (we feel falsely) boosting already elevated resource prices, and travel companies are getting plenty of attention. Meanwhile areas of bountiful state subsidy (an ever-increasing list) are happy too. However, that is a fairly unattractive list. And are valuations in those areas still reasonable?

I can see why some investors just think playing around with Tesla options is the best bet (we don’t).

Then as Farce, Modern Imperial Europe

Chou En Lai when asked about the French Revolution was of the view (it is said) that it was “too early to tell”. I have been reading Michael Broers’ brilliant Europe Under Napoleon, an extended love letter to the EU, in favour of rational technocratic administration, with a deep-seated fear of the sans-culottes.

This seems to highlight so much of the French desire to see the EU as the Napoleonic Empire, without the bad bits. The terror of the rabble, the urban bias, the fetishism of one law, the desire to paint any opposition to EU autocracy as unspeakable - it all rather gels.

Well perhaps the parallels go too far, but in looking at the bizarre actions of the EU over Ulster it is tempting to see more than just childish spite. The resources thrown at half a dozen sleepy border crossings (reportedly 20% of all external border EU customs checks last year) made little rational sense. Even if not that bad, it was overkill.

So, I can half see why the DUP feel that getting rid of bureaucratic bullying is just appeasement, but looking at the litany of inconvenience to be scrapped, this does still feel like a win for all sides.

But as with markets, I suspect all the fundamental problems still remain.

The Art of the Possible

Image from Wikemedia - by Neide José Paixão

Looking at Absolute Return – Can it be Done?

A wise old hand once told me that all investors want is protection from inflation; do that, earn your fees and your job’s done. Read more

Reflections & Predictions

This year won’t be last year, that much we know. Nor indeed will it be the inverse, which is inconvenient. So, starting this year as last year, but simply turned face down on the desk, is a trap.Read more

Tripod

We take a look at three things that move markets: macro, politics, and mood.

We have an inexplicable market rally to explain. On bonds we remain wary and we also take a look at the Keynesian attitude to inflation.

The obvious explanation for the market rally is Santa Claus, or perhaps in more mundane terms mood. The markets (in both bonds and equities) have had a beating, the shorts were satiated, the cash piles vast, and markets had simply had enough.

So, back up like a bungee it went, the heaviest fallers often bouncing back the highest.

Inflation (still)

We can talk endlessly about peaks and plateaus for interest rates, but we still don’t see any measures likely to get inflation back to 2%, for several years. But it seems that doesn’t matter now. The so-called base effects, the softness in commodity prices, the excess inventory (rather than prior shortages) all mean inflation will fall, and for most, for now, that’s enough. Regardless of how far or how long it takes.

Indeed, there is some realisation that if prices are really rising at 10%, it is best to buy now, not wait for higher prices.

And for a lot of service-based firms, capacity is indeed short, and they feel free to ram through price rises, to open up their gross margins, assuming (rightly) that if everyone else is doing it, and no one really knows their true cost bases, they are winners. As they are.

And as we long predicted, the elimination of competitors, and monetary tightening, leaves big firms free to expand into a void. After all they have faced flat prices for a long time, so the chance to move prices up is most welcome.

Seeing it like Keynes

So, it is perhaps useful to remind ourselves of the Keynesian view that inflation is “a method of taxation” which is used by the Government to “secure the command over real resources” in the same way as ordinary taxation. So, he was really not a fan.

How then do we explain the UK Treasury (all notional Keynesians) using abundant deficit financing to sustain already overheated demand?

Well in short, we don’t, it is just politics. By raising pensions and welfare in line with inflation, the UK Government is acting as if they need to secure the economy against high unemployment and a recession. The classic ills Keynes addressed.

Although (so far) neither of those disasters is evident anywhere, except in their own predictions. Older hires are rising which is generally a sign of overheated labour markets, looking for marginal supply.

Which is quite neat, as if those evils don’t arrive, the policy clearly worked and if they do, well our politicians tried their best. Given the shambolic recent failures of Treasury predictions, that they have any ongoing credibility is really quite remarkable.

But that process also embeds the long desired extra taxation, resulting from the inflation they are not quelling. There being no limit to how much Governments want to spend, there is equally no limit to their appetite for tax.

All of which nicely pings the pinball back to the Bank of England, which was so very unhelpful in the early autumn, so let’s see how they do now? Will they truly show the steel of the Americans or the Micawberism of the Europeans?

And interest rates (still)

The interest rate (beyond the short-term market rally) is therefore still the big decision. If inflation is here to stay, it all depends (once more) on the US, and on what reason the Federal Reserve has to stop tightening, even with high inflation. We can’t see one. Albeit we are very reluctant to guess there is none, with such strong markets. And it maybe they just had an arbitrary target, which they have now reached.

From this page on the Vanguard website

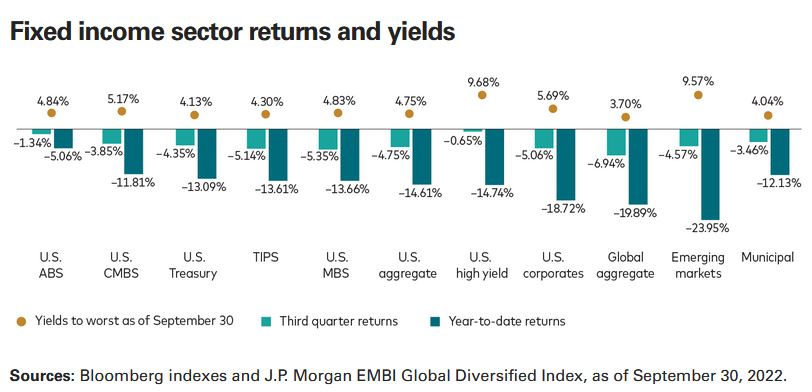

However, that gives us a trio of reasons (apart from the rogues’ gallery above) to still avoid bonds.

- If inflation stays elevated, bonds are a rip off, as they have a negative real return.

- If the Fed stays strong, bonds are a rip off, because base rates are still rising.

- And if the Fed wins, but others fail, then bonds are a rip off, because the dollar keeps rising (and hence other currencies fall).

In summary the only bonds that look attractive to us are still short-dated US ones. Which is not really new, nor does it make long term sense, with strongly negative real rates still. Bonds by definition can only have a real return when rates exceed inflation, either due to falling inflation or rising rates. And we don’t see that crossover for a while.

A THREE-LEGGED STOOL

So, we return to that trio: macro, politics, mood. Political uncertainty is much lower (for the next two years) in both the UK and US, and perhaps is not that unstable in Europe either, although the Ukraine war could still change that significantly.

Even China seems a little less keen on confrontation.

Macroeconomic factors really do not yet feel encouraging. It is way too early to declare victory over inflation.

Paradoxically when inflation is clearly beaten, earnings declines will then set in, as pricing power recedes. The failure to see that decline, will indicate inflation remains a threat.

And finally, mood - yes, the mood feels good, for now, although how long that remains is as much psychology as anything else. But if bonds do start to slip, don’t expect the party to keep going for long. Nor will recent dollar weakness persist.

The overall view seems to be that the handbrake turn has been completed, we may slide a bit more, but we won’t spin again.

But that assumes we know a lot about the track and conditions - do we?

PICTURES OF MATCHSTICK MEN

I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

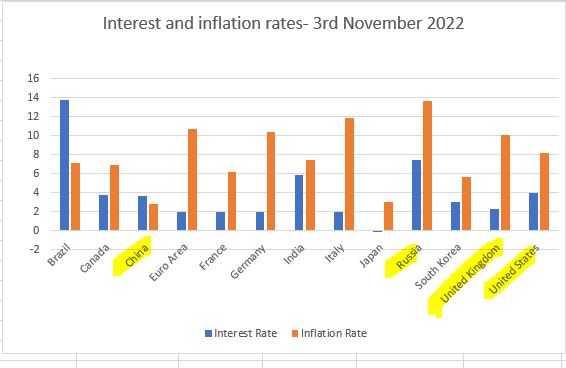

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

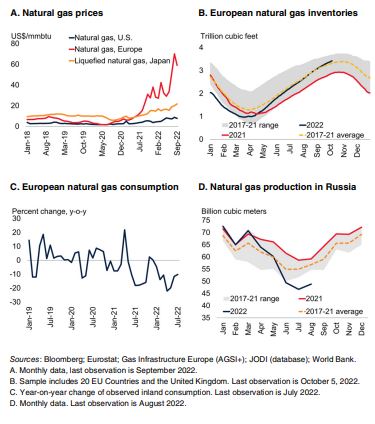

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

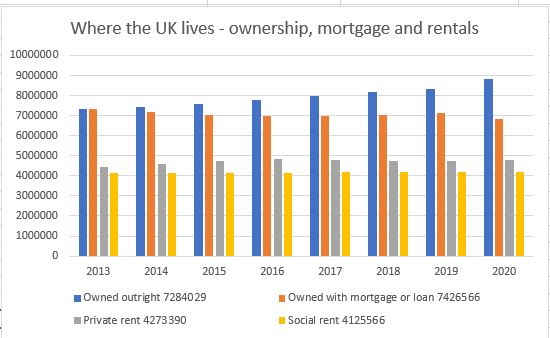

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?