Lend me your fears

I come not to praise Kwasi, but to bury him. This is an explainable, predictable but probably futile coup in the UK Tory Party, along with more King Canute from Bailey of the Bank.

But in markets there is abundant good value, but with few clues on how, or at what cost, inflation is to be tamed. Or indeed what may escape this time.

Political Manoeuvres

We have long noticed the Tory party’s splits and factions, broadly between the left and the right wing. This was a chasm Boris was uniquely able to bridge, by talking right, and acting left. The puzzle, as we noted, was why the left would bring him down to replace him with a right talking right acting Prime Minister. The preference was for a Blairite Conservative, low tax, high spending, but a steady reformer, with a lethal penchant for foreign wars and illogical hatred of the Euro. After Kwarteng’s departure, the Tories now have the doomed high tax big state faction back in charge again.

Hence the need for a pretext to overrule the party members and threaten Truss with the ever-gleaming sword of Damocles, held by the 1922 committee - we are back where the plotters wanted to be after Cameron – with the neutral Hunt playing the safe stooge to hold the fort.

Unlikely to win the next election

It foretells the inevitable party split – but we had never seen another Tory term as possible, regardless of the leader. Nor have we ever seen Keir Starmer as needing to do anything but sit tight and keep a grip on his party. If he is also spared the crippling cost of a really tight General Election, he can now face down the Trade Union money men as well.

As for Kwasi, if he stays the course, his troops will yet triumph at Philippi, he is by far the best the Tories have just now and looks to be the future. He has understood that if you fail to free the supply side, in a new productivity revolution, the current national decay will just go on, as it has for twenty years or more. But he has also not torched his future, Miliband style, in the wrong leadership move.

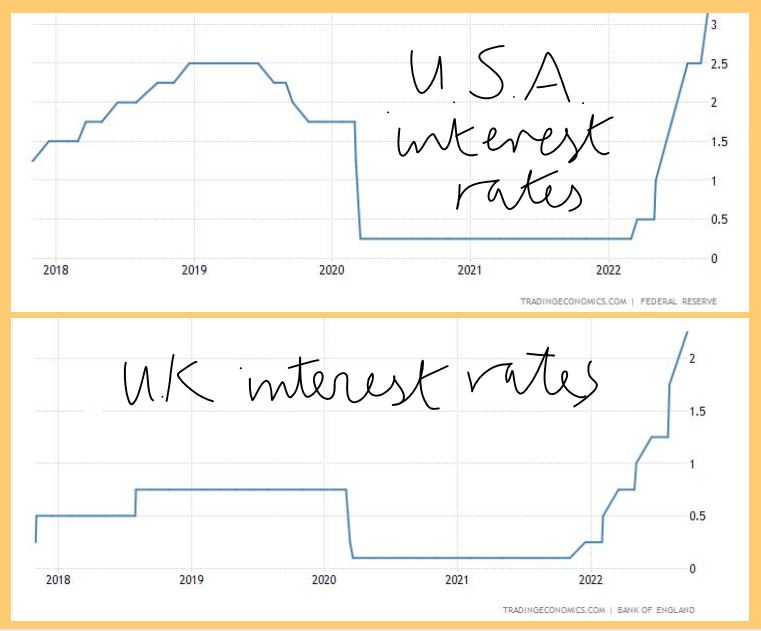

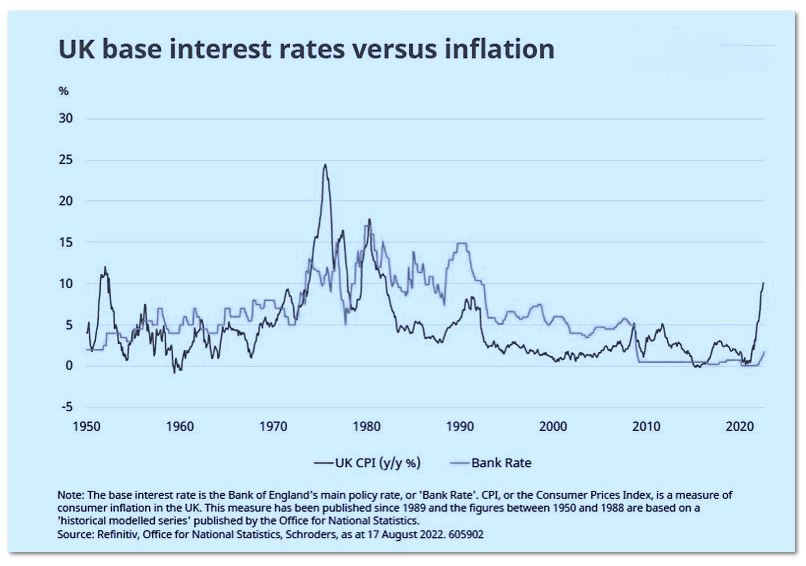

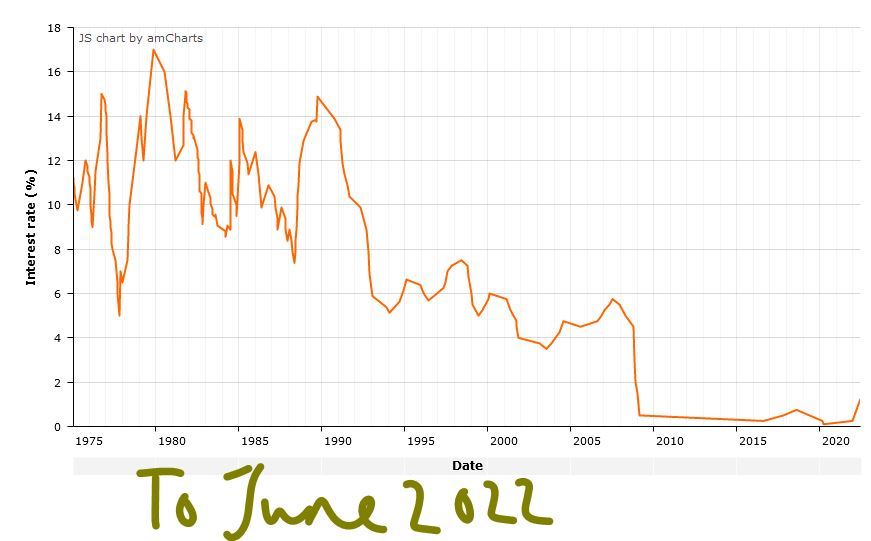

Will any of this stem the attacks by market traders? I doubt it. Will any of this forestall the inevitable sharp rise in interest rates, I doubt it. Or indeed stop ongoing sterling losses. To quell inflation requires interest rates above inflation, you can’t bear down from below. It remains daft to think UK interest rates can be effective whilst remaining underneath US ones either, as we said in our previous post.

Both clipped from this site, and set out side by side. The core data as is cited below are from the Federal Reserve and the Bank of England respectively.

So, what is the shape of this next recession?

I think we are now starting to see it. Not that much unemployment, the current tight labour market, without addressing increased workforce participation, is going nowhere. Nor is a secondary residential property crash certain. That is so last century, both areas are now far more heavily fortified sectors than they were last time. And both are now designed (and legislated) to be fiercely inflexible downwards. That is what the current labour market (and our dire productivity performance) is telling us.

House prices are propped up by a very generous market backdrop, ongoing vice like planning, high land taxation, tons of liquidity and a deep political fear of the consequences of a collapse. For all the moaning, borrowers are still able to load up at negative real rates, with a highly competitive mortgage market and generous fixed term offers.

But do expect a general slaughter of small businesses (or rather the current collapse will go on despite the various support packages). Expect weak margins for UK based firms, ever more exposed to competition, from far more generous and protectionist states.

WTO rules really are in tatters now and routinely ignored by powerful countries like the US and Germany. Expect a resulting fall in quality both in goods and services, again a continuation of current trends, as globalisation retreats.

But remember too, that so far, we do have inflation, but not a recession. The current dislocation is caused by a resource switch towards savers, who at all levels have had slim returns for a while, and we will now instead punish borrowers, who have had an absurdly easy, subsidised, inflationary decade.

The big picture, overall

Meanwhile in the energy world, a resource transfer is taking place from energy users to energy producers, who have likewise had a thin time of it. That those energy producers are places like the US, Russia, Saudi Arabia, Iran, Nigeria, Brazil, is a remarkable own goal for Europe.

But it is neutral for the world.

Indeed, much of those surplus funds will now be collected as various direct and indirect tax revenues, or to pay down debt, or as new investable funds, or distributed as dividend payments, but very little of that vast energy price transfer leaves the known universe.

For Europe, however the decline happens with the slow loss of productivity, plus the demographic torque. Meanwhile borrowing our way out, is suddenly becoming far more painful.

The political turmoil is ultimately from this change, and the longer states borrow more and pretend nothing has changed, the less effective will be their remedies. And indeed, the more the big efficient producers, like China, the US and Saudi Arabia will thrive. Neither more debt, nor protectionism will solve this, nor indeed will more global military adventurism.

Confidence is understandably damaged

Given that backdrop the mood music is damaged just now. Markets are trying to spark rallies, but with no real confidence yet.

Investors sense there is value, but with too little data to know where.

But whisper it quietly, Santa Claus is due, and the market mood is not quite as bleak as events suggest it should be.

FEEDING FIDO

International interest rates - what a dog’s dinner! But perhaps also a wake-up call: this is real life - governing for your social media feed does not work. We take a glance, too at the property market.

MARKET EVENT OR MACRO?

Our view has long been that we need rates at 5% to make a dent in labour inflation, both in the UK and US. It looks like the Fed (to our surprise) finally agreed. But with that comes a risk of overshoot, driven by the timing of the US mid-term elections. Powell, perhaps rather more attuned to politics than his banker colleagues, was keen to drop the bombshell early, rather than on 2nd November, right on top of the mid-term elections. So, I think the Fed’s now done with giant rises. Future rises may be less and spaced out, and quite possibly not that many.

One of the most chilling sections in Powell’s press conference was when asked about the global implications: yes, he assured us, he quite often takes tea with international colleagues. That was it. This time round the US is happy to crash through the global economy without a care in the world.

Encouraging short sellers

It seems Bailey of the Bank failed to get the memo, because oblivious to the soaring dollar, he stuck to plodding domestic rate rises, as if Leviathan was not bursting forth from the deep. Lifting rates by 0.5% when the dollar lifted 0.75% the day before felt like a joke. And if Bailey could not see that, the markets could: UK two-year gilts abruptly repriced to US rates.

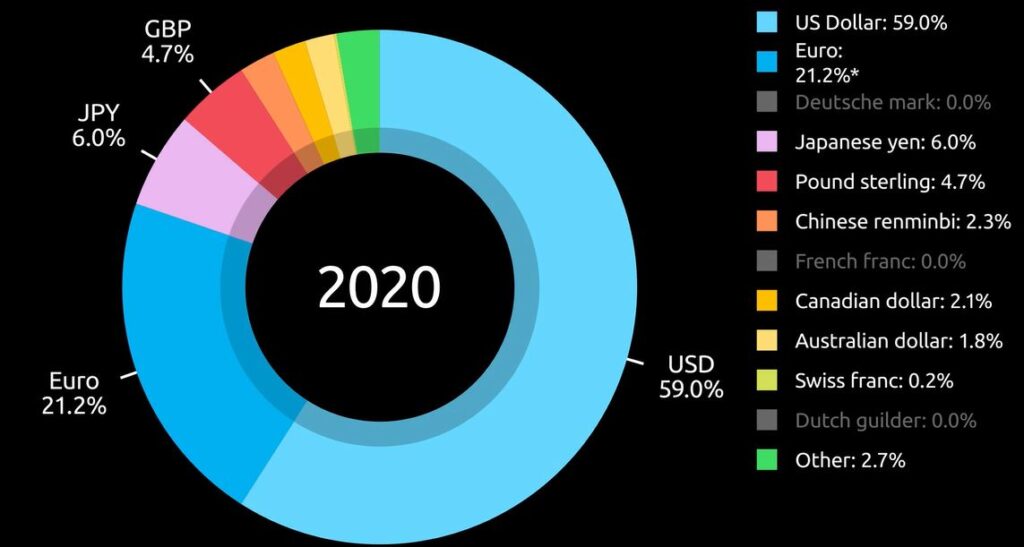

But sterling is still hobbled by UK rates at 2.25% - too low. By trying to be clever on the rate rise, Bailey has simply let the short sellers in. As the chart below shows, having already hit the renminbi and the yen, it was obvious who was next. Sterling is a small but liquid currency block, with no allies – so it typically pays more to borrow. The markets just needed the signal.

From : this site’s fine moving graphs

I doubt all that volatility really makes much difference to the real economy. Indeed, the Bank has now braced sterling nicely. As for the pension schemes, the FCA (Bailey’s last top job) created the foible of pensions being forced to hold loads of so called “risk free” assets to prop up UK government borrowing. A most amusing idea, always going to blow up one day.

Not that sure even 4.5% rates will slow wage inflation up. But we will know soon enough, after all the destination was to us never in doubt, just the arrival time. I still see the strain of rates rising to (say) 8% as too much for the electorate in either the US (the leader) or the UK (who follow).

Recession fears?

Nor do I consider either the US or UK end rates to be high enough to cause a severe recession, although clearly, they will have an impact on asset prices, and in the end, labour markets.

So, I conclude this is more a market event than an economic one. And surprisingly it is all in bonds (and therefore currencies).

Investors will hang back until they see those settle down and that could take the rest of the year. So, although everything is perhaps cheap, the VIX will keep many on the side-lines.

The UK at least feels at bargain levels, but buying dollar stocks still feels somewhat pricey.

BRICKS AND MORTAR

So, to property. Well, we got this one wrong. Partly we failed to see Ukraine becoming a big war, but one with no quick winner. This triggered European (in particular) energy inflation. Partly we therefore saw interest rate rises staying in single figures, which is not what some REIT prices imply.

Not that we have changed our longer term “4&4” view on interest rates and inflation, (so higher for longer) but other investors and markets clearly have. You can’t fight the tape.

In general, outside the warehouse sector, real estate companies (unlike say Private Equity) had already taken the hit to values, their balance sheets showed the new world, backed by real deals. So, adding a second discount does seem odd.

Gearing levels are not high, and debt maturities well extended, and interest (still) well covered. Maybe private markets are worse, but it is not clear why that contagion spreads into quoted ones. If there is a blow up, it is not obviously in public markets or mainstream lending.

But if quoted markets are right, what of residential markets?

Well logically as they are still going up, do residential prices now have a big drop built in, which is yet to happen? The price of mortgage banks, home builders and builders’ merchants all say ‘yes’. But how will it happen? It is not a big sector in UK public markets, but the odd couple that do exist (Mountview, Grainger) have also taken a hammering. They have some debt and are rental specialists (of various types).

So, markets say yes, house prices will also collapse.

Do I believe that? Anymore than talk of imminent dollar sterling parity and 8% base rates? Frankly no. Stagnate, chop around, go sideways, blow the froth off. Sure. Collapse; is wishful thinking.

After Armageddon I fully expect to see a plucky estate agent emerge from the ruins, justifying an offer above the asking price for the debris, with potential (but may need planning consents).

So, if true, that means despite a hair-raising ride, those mortgage banks and residential owners will in time emerge resilient.

Sadly, for many, that also suggests, without forced sellers from the buy to let market (where there will be a few), the stock of housing units won’t change and therefore nor will rents. Housing stock is very lagged and current moves will only close the pipeline two years out. Only mass unemployment hits rents, and if this is a market event, not an economic one, it won’t change, because structural unemployment is not the issue. Indeed, we are at record low unemployment levels.

In summary

A market tremor created in Washington, was transmitted to the UK, and is now rippling round the world; either currencies hold their interest rate differential with the dollar, or get crushed.

Old news; it is odd isn’t it, how so many clever people failed to read the memo?

Into Broad, Sunlit Uplands?

This week has included a major but baffling fixed interest event in London. And we include some thoughts on the novelty of a conservative prime minister for the Conservative party - but first, the shape of the coming recession.

Who Survives in the Coming Recession?

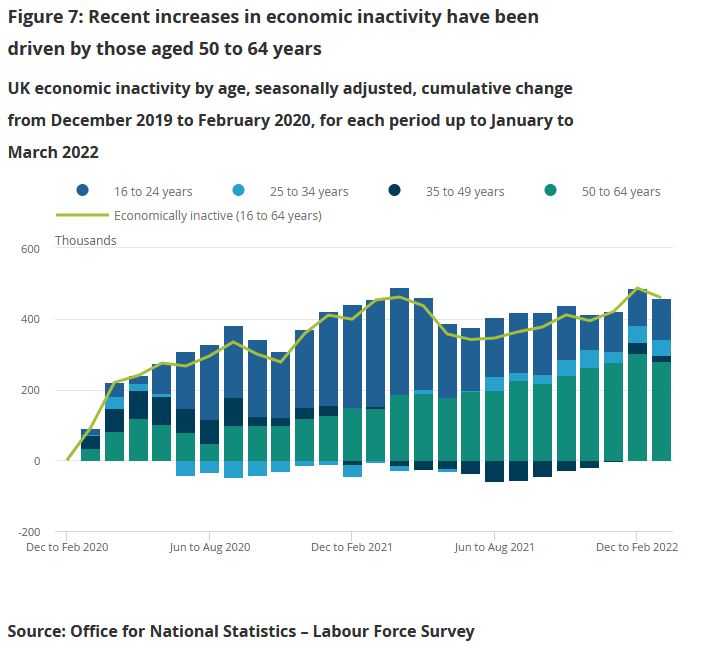

It may help to see this recession, as just the reversal of the COVID boom, paid for with debt and deeply inflationary; in which case what should it look like? The ultimate aim will be to unlock labour markets, where we said (in our newsletter of 20-3-21) that COVID would do most harm.

Unlike traded goods or commodities or liquid assets, there is no simple snap back available without pain, because labour pricing is inflexible downwards. Indeed organised labour has worked hard to embed that inflexibility, notably in minimum wage laws, and the crippling of the hated gig economy.

Certain capital assets too are stranded and inflexible, but probably not most commercial (or residential) rents. Large single purpose buildings may be vulnerable and we feel, so is quite a lot of owner occupied residential property, whereby recent unearned gains will now need reversing.

Labour costs have two available paths. Either the 40% of working age adults who have now withdrawn from the labour market must (in some measure) return. It is their ongoing withdrawal post COVID that has hurt most. While COVID has also created (mainly in the public sector) a lot of extra staffing that is hard to step back from, especially in healthcare, which further depletes the available labour pool, and must also be reversed. Reducing labour taxes also helps.

Possible business failures

If not, there may instead need to be widespread private sector business failures. The third option, a speeding up of capital investment to substitute for labour, has somehow failed to be either fast enough or effective enough. It seems just too hard for businesses to predict demand paths, to commit to such expenditure. Cap ex is all about confidence, which is absent.

How then to measure if this labour reset finally happens? Well it looks as if job creation will need to go into reverse, with a net two quarters (at least) of contraction. There are plenty of businesses to fail, speculative and derivative loss making tech for a start, retailers of goods who over extended in the supply chain inspired boom, service sector spaces, where the current surge has drawn in capacity well in excess of long run demand, will all get hit.

As will everyday businesses, that have net margins that can’t withstand the double figure interest rates demanded of sub prime (i.e. now most SME) borrowers.

Paint that template over where the most savage equity falls have already happened, it fits quite well. But it is by no means universal, if IP, not labour matters, or labour can be off-shored, it is in a better place.

Although as jobs disappear, so the strain reaches further into total consumption and demand.

Fixed or Floating.

What of fixed income? Well we took the view early this year that you can’t stand in the way of an avalanche, unless you hope to surf it. So we kept clear, and still are.

Source : this page

It was a very well attended fixed income conference in London this week, so credit is clearly back into portfolios, big time. My worry was the Table Mountain (or Brecon Beacons or Grand Canyon) graphs. All of which were steep sided, but flat topped, and on all of which, just now, is the exact point when lungs bursting, you climb the last butte, to see a vast sunlight upland.

Really? Why? No idea, but somehow the collective belief is rates top out circa 4% and then fall.

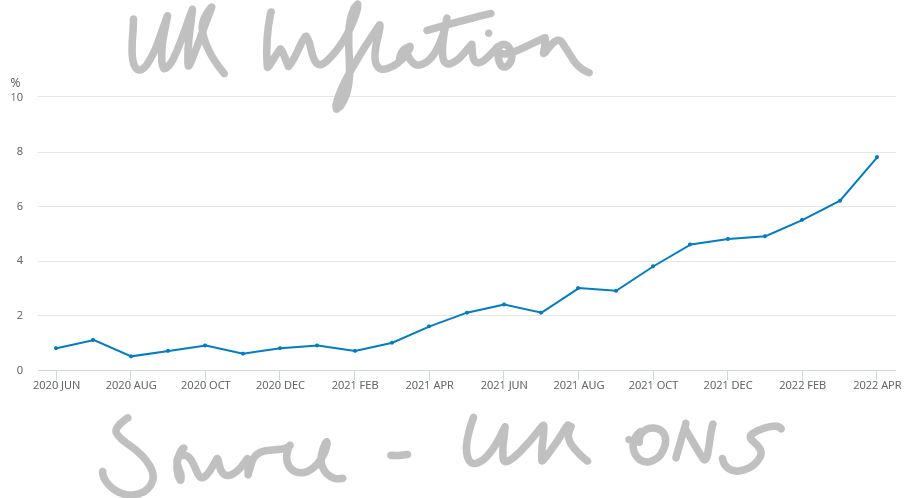

Certainly not if they mirror the inflation path (see above), that gap is now vast twixt interest rates and inflation; it will close - it has to. However we see more rises, not a near term peak and also far slower falls, than the market does. Reason? It is labour inflation that now drives it, and it won’t roll over soon.

Unless that is, the rate rises so far have done real damage and rates are then cut to mitigate a severe recession. If that’s the expectation (and it may be) you really don’t want equities at all, not even energy, the year’s bright spot.

So the question is, are high yield bonds now cheap?

Well yes, and quite attractive; defaults at the rate now implied, are unheard of. But if that odd plateau graph of rates is wrong, everything has yet to get even cheaper. That’s the rub. And that is why, for now, bar floating rate, secured, we are still not going into credit. And also because global interest rates must eventually align, so the dollar’s ongoing strength is a bad sign, as that will have to reverse too. This makes dollar assets themselves now dangerous.

The same dilemma is true for equities, yes, high quality, mid-size companies look cheap, the FTSE 250 is down some 20% in a year, almost as bad as the NASDAQ, whereas the FTSE 100 is modestly up (a distinction shared only with the Nifty 50). But again, we thought that value was emerging in the summer, but sadly not so; the market still sees a viscous earnings contraction ahead.

Which brings us back to employment, either it must fall, or participation must rise, and I fear we expect a fall, which seems more likely. This cycle, in the all important labour markets, still feels a long way from done.

New Broom

As for Truss, well talk of growth at the inept and hidebound Treasury is a nice change. As is that of getting the country working (spot on). This is core free market stuff. Has she the votes? Pretty sure she has, it was odd for the left wing of the party to eject Boris, who his actions showed was one of theirs. To unseat another leader would guarantee oblivion, so they must back her.

Worrying about fiscal rectitude, for a two year government, seems oddly implausible too. Yet she still fell prey to the old belief that governments (and higher tax) solve everything with her energy package, least of all can that solve demand based inflation. That is for Central Banks to do, and as ever, they are getting no help from the rest of government.

Does this suggest a big US rate hike this week? Not sure, we are much more seeing the end point as rather higher, than faster near term rises. We kind of think the Fed has made their point already.

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

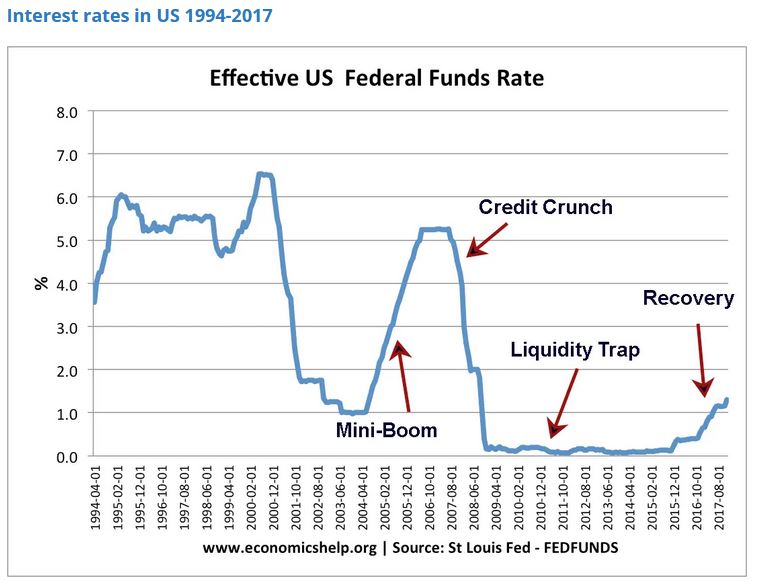

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

Interest rate cycles

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.