FEEDING FIDO

International interest rates - what a dog’s dinner! But perhaps also a wake-up call: this is real life - governing for your social media feed does not work. We take a glance, too at the property market.

MARKET EVENT OR MACRO?

Our view has long been that we need rates at 5% to make a dent in labour inflation, both in the UK and US. It looks like the Fed (to our surprise) finally agreed. But with that comes a risk of overshoot, driven by the timing of the US mid-term elections. Powell, perhaps rather more attuned to politics than his banker colleagues, was keen to drop the bombshell early, rather than on 2nd November, right on top of the mid-term elections. So, I think the Fed’s now done with giant rises. Future rises may be less and spaced out, and quite possibly not that many.

One of the most chilling sections in Powell’s press conference was when asked about the global implications: yes, he assured us, he quite often takes tea with international colleagues. That was it. This time round the US is happy to crash through the global economy without a care in the world.

Encouraging short sellers

It seems Bailey of the Bank failed to get the memo, because oblivious to the soaring dollar, he stuck to plodding domestic rate rises, as if Leviathan was not bursting forth from the deep. Lifting rates by 0.5% when the dollar lifted 0.75% the day before felt like a joke. And if Bailey could not see that, the markets could: UK two-year gilts abruptly repriced to US rates.

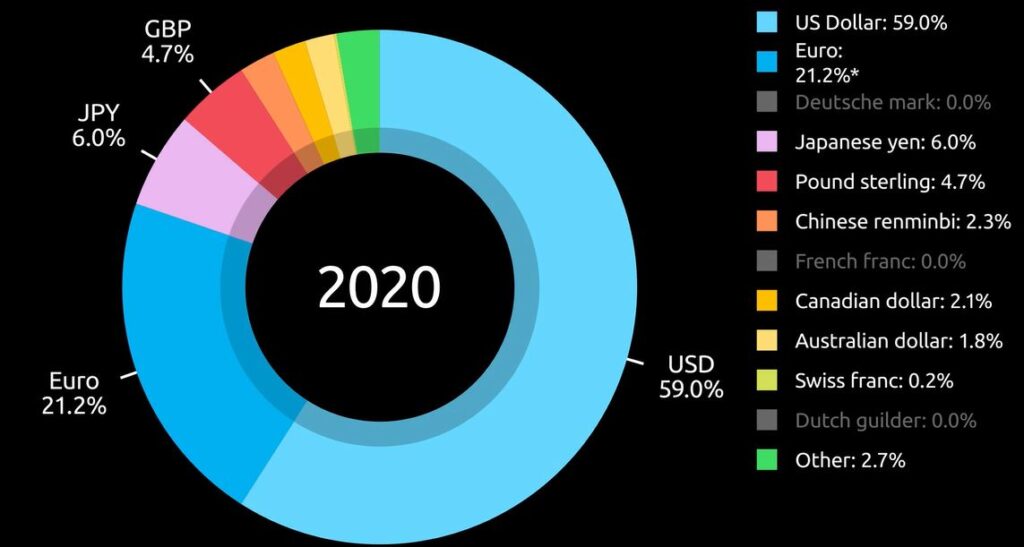

But sterling is still hobbled by UK rates at 2.25% - too low. By trying to be clever on the rate rise, Bailey has simply let the short sellers in. As the chart below shows, having already hit the renminbi and the yen, it was obvious who was next. Sterling is a small but liquid currency block, with no allies – so it typically pays more to borrow. The markets just needed the signal.

From : this site’s fine moving graphs

I doubt all that volatility really makes much difference to the real economy. Indeed, the Bank has now braced sterling nicely. As for the pension schemes, the FCA (Bailey’s last top job) created the foible of pensions being forced to hold loads of so called “risk free” assets to prop up UK government borrowing. A most amusing idea, always going to blow up one day.

Not that sure even 4.5% rates will slow wage inflation up. But we will know soon enough, after all the destination was to us never in doubt, just the arrival time. I still see the strain of rates rising to (say) 8% as too much for the electorate in either the US (the leader) or the UK (who follow).

Recession fears?

Nor do I consider either the US or UK end rates to be high enough to cause a severe recession, although clearly, they will have an impact on asset prices, and in the end, labour markets.

So, I conclude this is more a market event than an economic one. And surprisingly it is all in bonds (and therefore currencies).

Investors will hang back until they see those settle down and that could take the rest of the year. So, although everything is perhaps cheap, the VIX will keep many on the side-lines.

The UK at least feels at bargain levels, but buying dollar stocks still feels somewhat pricey.

BRICKS AND MORTAR

So, to property. Well, we got this one wrong. Partly we failed to see Ukraine becoming a big war, but one with no quick winner. This triggered European (in particular) energy inflation. Partly we therefore saw interest rate rises staying in single figures, which is not what some REIT prices imply.

Not that we have changed our longer term “4&4” view on interest rates and inflation, (so higher for longer) but other investors and markets clearly have. You can’t fight the tape.

In general, outside the warehouse sector, real estate companies (unlike say Private Equity) had already taken the hit to values, their balance sheets showed the new world, backed by real deals. So, adding a second discount does seem odd.

Gearing levels are not high, and debt maturities well extended, and interest (still) well covered. Maybe private markets are worse, but it is not clear why that contagion spreads into quoted ones. If there is a blow up, it is not obviously in public markets or mainstream lending.

But if quoted markets are right, what of residential markets?

Well logically as they are still going up, do residential prices now have a big drop built in, which is yet to happen? The price of mortgage banks, home builders and builders’ merchants all say ‘yes’. But how will it happen? It is not a big sector in UK public markets, but the odd couple that do exist (Mountview, Grainger) have also taken a hammering. They have some debt and are rental specialists (of various types).

So, markets say yes, house prices will also collapse.

Do I believe that? Anymore than talk of imminent dollar sterling parity and 8% base rates? Frankly no. Stagnate, chop around, go sideways, blow the froth off. Sure. Collapse; is wishful thinking.

After Armageddon I fully expect to see a plucky estate agent emerge from the ruins, justifying an offer above the asking price for the debris, with potential (but may need planning consents).

So, if true, that means despite a hair-raising ride, those mortgage banks and residential owners will in time emerge resilient.

Sadly, for many, that also suggests, without forced sellers from the buy to let market (where there will be a few), the stock of housing units won’t change and therefore nor will rents. Housing stock is very lagged and current moves will only close the pipeline two years out. Only mass unemployment hits rents, and if this is a market event, not an economic one, it won’t change, because structural unemployment is not the issue. Indeed, we are at record low unemployment levels.

In summary

A market tremor created in Washington, was transmitted to the UK, and is now rippling round the world; either currencies hold their interest rate differential with the dollar, or get crushed.

Old news; it is odd isn’t it, how so many clever people failed to read the memo?

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

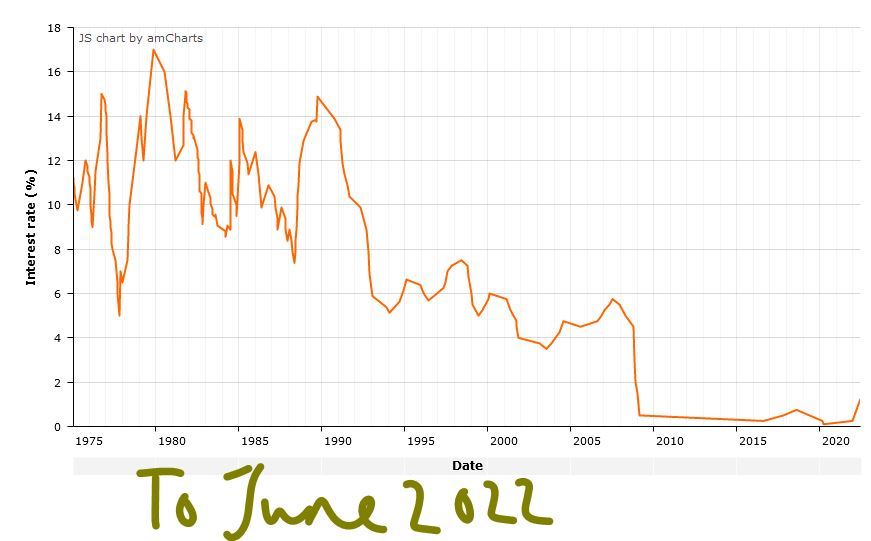

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

Interest rate cycles

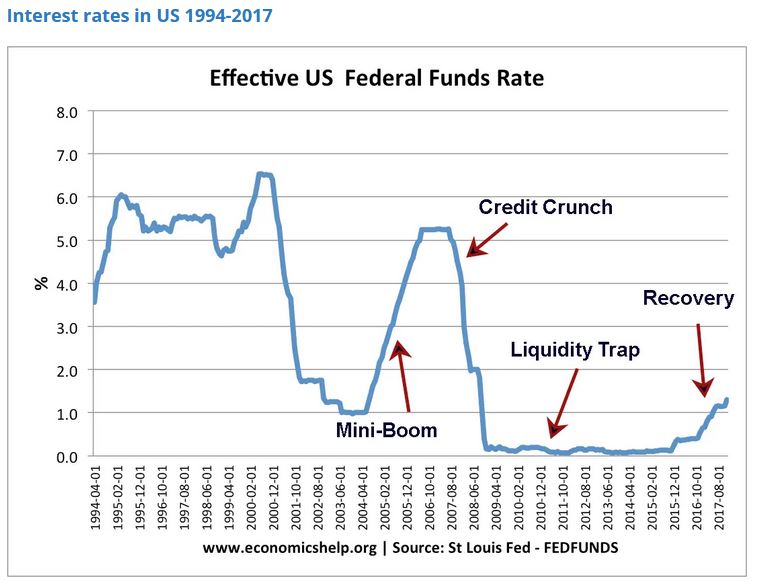

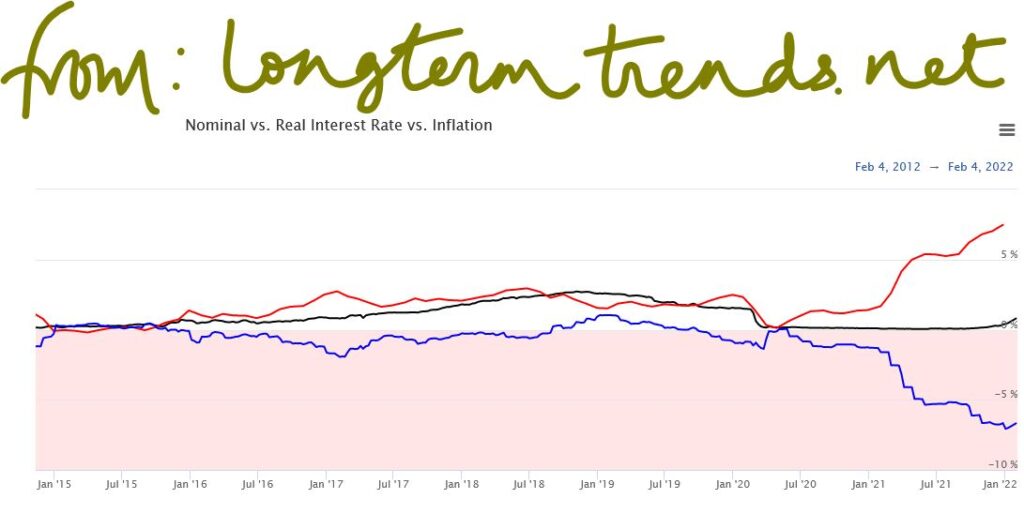

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

LOCATING THE ELUSIVE BASE

the investment impact of recent events

CRANES

I spent last Sunday in the elusive pursuit of grus grus, in the upper Marne basin, East of Paris. For some reason the Common Crane had already left in a bid to cross Central Europe, heading for the Artic, weeks earlier than in most seasons. Clearly, they knew something about the airspace ahead of them.

While the largely empty Lac du Der, also had lessons on levelling up; here was a vast and disruptive engineering scheme, it seemed executed without too much controversy, operating well and with the surrounding villages wealthy, quietly prosperous and largely content. Or so it looked in the February sunshine. It was all in pretty harmonious concord with nature too.

THE FRENCH MODEL

It seems the French can see the grand scope of government, the need to provide top class infrastructure. Here is their France Relance plan up to 2030. Up to 3-4 billion Euro is likely to be spent in 2022 alone.

The issue is perhaps not just politics, but the unspeakably low quality and lack of vision of the UK governing class. The French cities have retained their great buildings, the administration is a high profile and visible force, not something to park in the burbs, having ejected them from city centres to grab their assets for still more rentier housing. Nor does the state foolishly aim to do everything, the peage (and TGV) enable high class fast communication, but certainly not always for the lowest price. Nor is health care completely and absurdly free, irrespective of demand. But it is effective.

Power is cheap and plentiful, no hysteria about nuclear there, and the military proud and visible, even the transport police are packing heat. So, watch that off peak ticket schedule.

Of course, not all is rosy. COVID hysteria still ruled, masks and vaccine passes were required for everyone, for everything.

Yet if any UK government is serious about leveling up, (as in the recent White Paper) here is both a lesson, and an indication that Gove’s piffling attempts are a mockery; he needs more like £48 billion to start it, not £4.8 billion.

You feel they just picked up the easy option from the choices their tired civil servants had suggested. Perhaps it was the one that said, “No real impact, but sounds OK for now”.

UKRAINE - Did Putin miscalculate the West’s indifference?

Ukraine? Not a lot to add to that. We were wrong that Putin was not stupid enough to do it. Wrong too that it would be over in hours. So, treat our topical ignorance with care. Also, wrong that the West would shilly-shally over piecemeal sanctions. Whether we are wrong yet again in assuming that without a quick win, the sanctions will now damage the global economy quite badly, remains to be seen. I also suspect seizing Central Bank assets can only be done once and once done, global finance and investment will become far more fractured, forever.

But in truth, it was going that way already.

However, this blind market panic seems absurd. I really doubt if Putin, at this point, wants to line his battalions up on a border to provoke NATO, who are I suspect closer to an aerial counter strike than he thinks, and would indeed now love the excuse of any incursion on NATO soil.

He has made it into a popular potential war for the West, the most dangerous sort.

War Tactics

It looks to me as if Russia wants a pincer movement, to isolate Ukraine’s forces in the Donbass, plus a threat to Kiev to topple the government, but has he the muscle to take and hold all of the vast country? Even if he does, that does not suggest he will go further than Ukraine, just now.

While his aims are so blatantly false, success can be easily claimed for almost any outcome. So, a collapse in currencies, and stock markets across Eastern Europe, looks an exaggerated response. True, this is Germany’s worst nightmare come true, no competent military and a gun-shy US, so they must now realign fast, and where Germany goes, so goes the EU. It is not going to fold or fissure in the face of this explicit threat. Although Germany at heart is much more like the UK than France; rapid execution will not be quite as easy as simple announcements. Remember the farce over moving Tempelhof airport?

As yet, the final step of directly locking in Russian energy supplies, large parts of which go to German consumers, has not been taken, but that would, in the short term, be very costly.

Although high taxes on energy give governments a great incentive to let prices rip, (and demand destruction is great for the climate lobby too), but they are rather less popular at the ballot box.

Interest Rates

Meanwhile Powell remains determined to stay behind the curve on rate rises, it is as if the received wisdom on rates, indeed on Central Bank power, has been quietly ditched, and instead he is hoping inflation burns itself out through demand destruction/supply creation. Well, an interesting experiment, but if that’s the game, as we have predicted for a while, inflation will remain gently smouldering, but rate rises will still be very gradual.

The Fed should have turned off the monetary stimulus and reset to ‘normal’ six months ago, by the time they finally move, it will be a full twelve months late. Real rates are deeply negative, levels not seen in decades, and moving fast, this is really not quarter point stuff.

All of the above implies on-going nominal economic growth, ongoing share price appreciation (at least in nominal terms) and an ongoing reward for borrowing to excess.

But despite the rush to safety currently supporting the US dollar (and US assets) the danger to markets is not just from the noisy, tragic, East but also from experimental monetary policy in the US.