Boris finally quits, and 'Quality Growth'

Boris finally quits: the loss of his Chancellor clearly made this inevitable. We also reflect on the London Quality Growth Conference, held in Westminster last month. It implies a very US bias, driven by two US universities, that seem to dominate much of UK investing and indeed public policy.

First as tragedy, then as farce

So, it is over. The absurd repetition of the same error and the same apology passed from tragedy to farce.

Clearly the belief that you fight inflation and unpopularity, by bankrupting the country with printing money, had also simply become too much for Sunak. That was the fatal blow. Let us hope the next leader is less of a deranged populist. In the real world what is popular seldom overlaps with what is right.

We will skip the look backward, over his flawed career, skip the look forward over the seven dwarves, and fervently hope for a different set of economic policies by his successor. It sounds as if there is plenty of time for a long summer of speculation. The likely candidates are less than attractive, let us say.

How might the UK market respond?

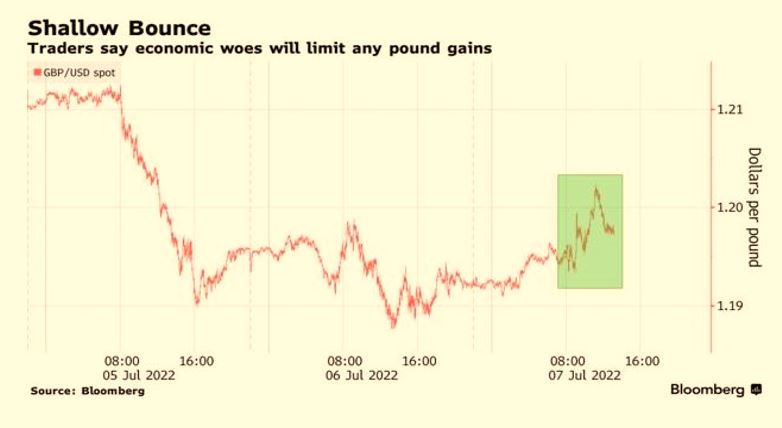

Nor can I fathom a market response to a change of leader in London: bullish that it is over? Or could it be bearish as we don’t know what comes next, or indeed bearish in that it surely strengthens the opposition?

While we felt the Old Lady moved far earlier than others (late in 2021) because of UK fiscal laxity, we see no reason yet for them to back off their August rate hike. Politically it is hard to stop and start interest rate moves, while just repeating a previous measure in mid-summer will look innocuous. I suspect that’s true for September too, but that feels a long way off. And I do note, that as we predicted, the great spike in corn and wheat prices has taken just one growing season to unravel, as farmers react quickly, by adjusting cropping patterns, knocking out another justification for any more price rises.

A weak pound is also importing inflation, and the Bank has to make a stand somewhere, but 1.19 to the dollar feels too early, 1.09? Pressure will start.

Alchemy Unchained?

We turn now to ‘Quality Growth’, an excellent conference and well presented with a dozen first rate managers from the US, UK, Europe presenting.

But it led me to ask about the underlying assumptions of the ‘Quality Growth’ model.

Firstly, there is the Santa Fe school, which speaks of the ultimate failure of nearly all quoted companies. This is the old ‘99% of the S&P 500 stocks contribute nothing to returns’ case. Allied to that is the Columbia (New York) mantra that some companies can beat the pack for ever, so the theory is find those “compounders” with their ‘deep moats’ and your investors will win for ever.

It was surprising how much of current fund management practice is wedded to those two assumptions. They look remarkably shaky to me, but if believed by enough of the industry, are likely to become self-fulfilling.

Which adds to another oddity: we know active managers seldom beat index investing. But this year should be showing the exact opposite. Passive long only funds are destroying wealth at a terrifying speed. So true active managers should do well too, but oddly (and absurdly) perhaps because of this “a few chosen winners” theory, they too seem to willingly forget about valuation.

True Believers

You see these few companies are (after exhaustive analysis) the nailed-on winners, so if the market halves, they will still outperform - just hold on and they will come good, the fundamental long-term analysis says so. You will recognise Cathie Wood, Scottish Mortgage are, in some measure, exponents of this too.

What is not to like? Well, self-reinforcing buying propelling valuation is dangerous; ask the Woodward investors about that one. But we also get odd clusters (identified as the winners, or the winning group, or amongst which will be winners; choose your terminology, like Tesla or Palantir or Netflix), which cut loose from sane valuations, becoming for a while mere intellectual Ponzi schemes, moving only upward, fed by endless new money.

Until they don’t.

And every time ‘buying the dip’ gets burnt, there is less fuel for the next attempt, and less appetite to try.

Too narrow a view?

I am not wholly convinced by the ‘only a few stocks matter’ theory; for a start, you have to be very lucky with your baseline, even if you can spot the gems.

But even less do I believe that you can really thread the needle to identify the great companies, and secretly buy them, without shifting their prices and then hold them, in public portfolios. If you are right (and success requires you to be right) then everyone else piles in, and valuations simply become a function of overall liquidity.

The belief that having found them, you can leave them in your portfolio for decades, feels somewhat quaint. There are some giants that do perform year on year, but we all know of plenty of giants that rise and stumble (see above), and many that have multi-year slumbers (most oil and bank stocks).

Fashion or Momentum?

So, at the conference, we had a hall of great fund managers, but also the odd IFA pleading to be told about current performance, which was simply shrugged off. Our clients are always keen to be told about our recent performance, I am sure in truth so are theirs.

Given the structure of the market, now may be the perfect time to buy Quality Growth, but that bigger question about rates and inflation trumps all. And investing, we know, is about fashion, that’s why momentum (usually) works.

I do like some of these funds, and respect their hard-working managers, but feel investing needs a hybrid approach, quality, yes, growth yes, but critically valuation and momentum too.

It seems like public policy has also increasingly drifted in the direction of this “picking winners” theory and backing what are believed to be high yield, clean, desirable industries, rather irrespective of their viability.

Public Policy implications

Once you accept fund managers can spot these, you perhaps accept governments can also nurture them and scatter tax breaks around them. This will, at the same time, destroy the rest of the commercial ecosystem, in part, oddly to fund the hoped for predictable and desirable elite. Look at what Tesla (again) has done, extensively subsidised by exchequers round the world.

Does real life work like that? I doubt it - but investing theory has clearly now tainted public policy too.

Charles Gillams

Monogram Capital Management Ltd

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

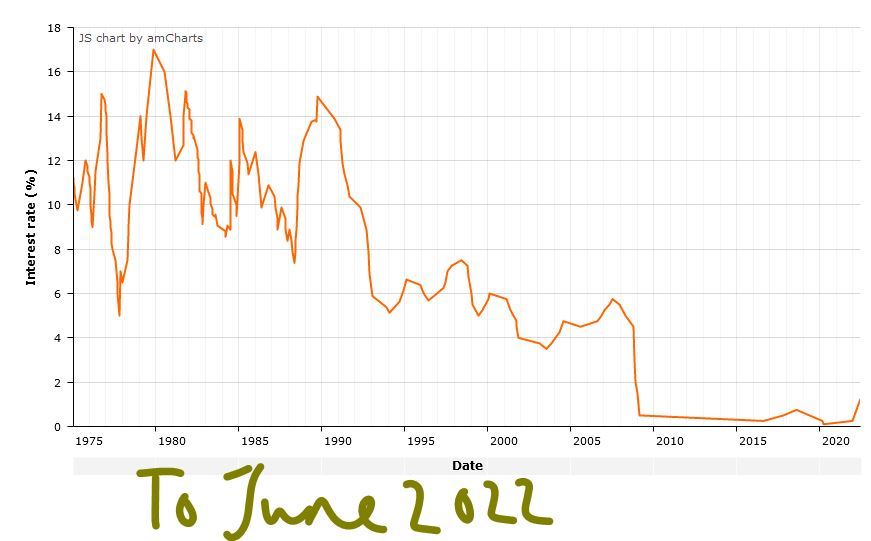

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

Interest rate cycles

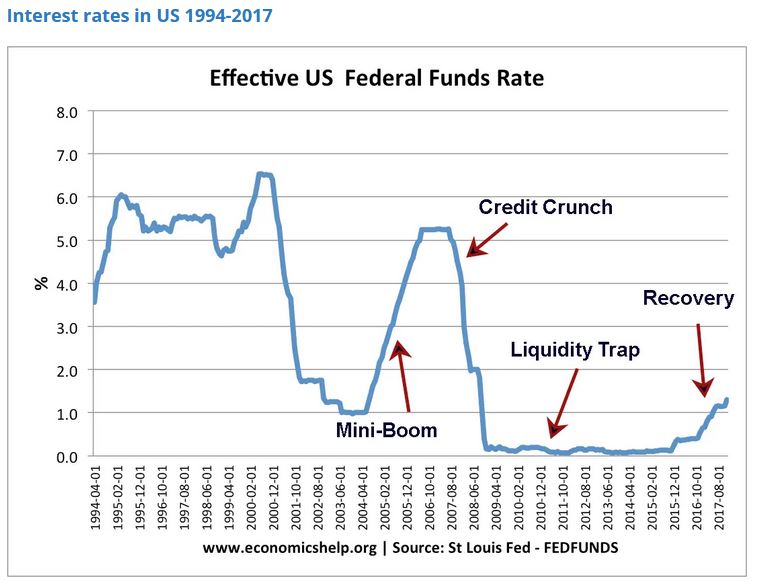

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

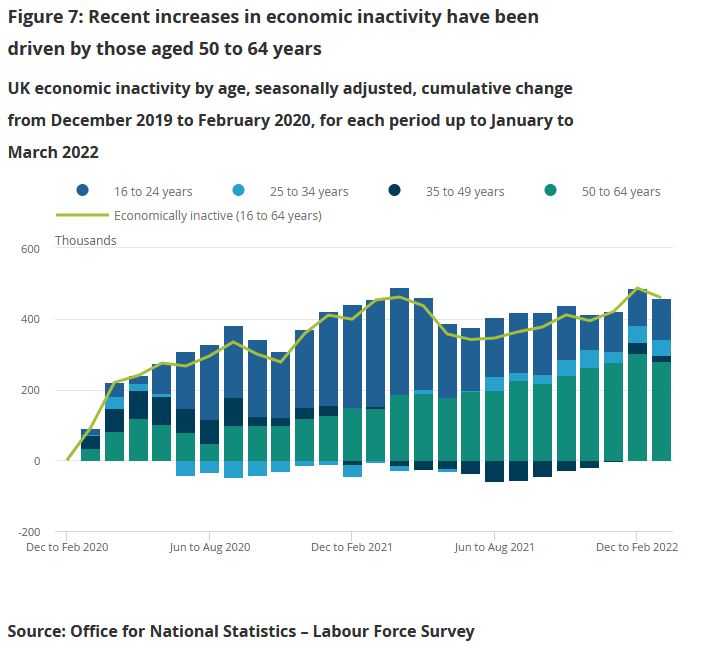

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.

INDIA : ‘OUTER CHINA ‘CROST THE BAY’?

Is India really rising?

For much of last year India was the top major stock market, and remains the best on a twelve-month basis, the main index up +9%: not bad, we look at why. While less exotically the lags in global markets, when the macro picture is changing rapidly, are getting tough to navigate. Too many fund managers and Wall Street analysts simply don’t change, when the facts do.

Indian Stock Market rises to 4th largest, globally

First to India, in Premier Modi’s time in office it has gone from the tenth largest global economy to knocking on fifth, which is now predicted for 2027.

If true it will have overtaken a lot of Europe on the way. It is also already the fourth largest global stock market.

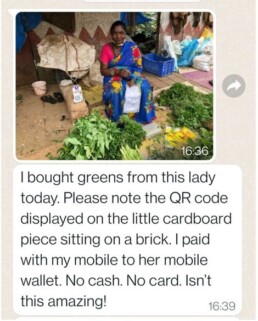

Welfare - and Highways in India

It has done it in part by two great leaps, firstly to take the millions of poor onto a national database for the direct distribution of welfare, creating the fastest monetisation of a society in history: the type of simple, big scale computerisation that works. It allows vast, complex, nimble schemes, both for welfare and tax, to be executed without a morass of red tape and civil servants milking them. The cash, meanwhile, gets right to the app of the men (or importantly as often) women who need it. Secondly it has taken a once Federal system, at least in commerce terms and unified it, creating a true single market. Neither seem that big, but both were critical steps. Remember how fond we were of the European Single Market? This one is twice the size.

While on the ground, the highway network has expanded by 50% since 2014 and in the air the number of domestic air travellers has doubled, air freight is almost as fast growing. A great deal of this is built on the IT sector, which has doubled in the last decade, and was already pretty big.

India seems to have achieved all of that while cutting oil consumption (per unit of GDP), and while racing ahead with the renewables it is so well suited for. It is also as we now know, one of the world’s big grain, especially wheat, exporters.

Some patches of India excel, others not so much

Stock market performance has been good over that time too. I went to kick the irrigation pipes in Modi’s Gujarat, before he got the top job. I liked what I saw; they were colossal and the vision to take them far inland, well away from current irrigation, spoke of a great ambition. The co-ordination and mechanisation spoke of good (and rather un-Indian) execution. It was a shock, when in Bengal at that time, I felt it was mired in politics, with too many huddled and piteous masses, inhabiting another century. But the West and South of the country were different; Bangalore was already aping Silicon Valley, albeit with traffic congestion to match.

That has kept going, tough reforms, enacted on a big scale were needed, and have been provided. But for markets, especially for the ex-colonial power, it has not been easy. Modi is a populist, he tore up the Mauritius tax treaty, introducing CGT to offshore investors, re-wrote the tax law to force Vodafone India into a billion-dollar insolvency, and had to have national assets embarrassingly repossessed, before paying Cairn back an unlawful billion-dollar tax heist.

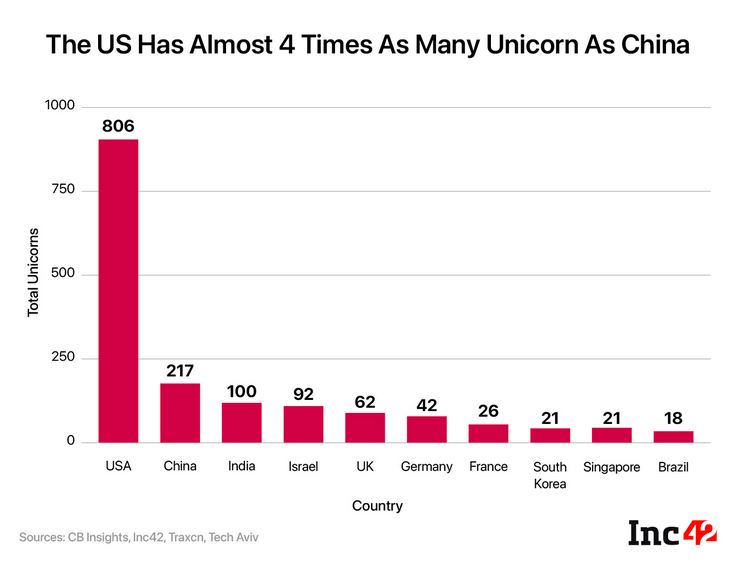

The other big risk was that the park was overrun by unicorns, and it was (and is) hard to know which will flourish, exploiting this vast unified fast-growing market (the OECD say the fastest growing large economy this year) and which will get foot rot in the monsoon floods.

While some of that was also funk money from Silicon Valley, which may now return to base, as the NASDAQ valuations fold, and indeed from China, which still remains in a different universe.

The history of jumping on (or falling under) Indian juggernauts, is not that great either. Racy IPO valuations falling to earth, have been painfully apparent.

But perhaps India will indeed come up like thunder, outer China, ‘crost the bay*.

Now to Stock Markets - in a word, Horrible.

We are having the normal churn, as a lot of vested interests and ‘long term holds’ get destroyed and no one seems to know where the lags are, in either debt or equity markets; a toxic mix. Certainly not company management, and therefore not the big lines of “analysts” often printing corporate client forecasts on fancy notepaper. Odd how so many research teams think the FD they diligently talk to has a clue. They do eventually (one hopes) but day to day, week by week, not really.

The finance team in companies

The finance team sits at the end of long and confused reporting lines, stuffed with dud AI (especially on inventory), and with no handle on returns, credits or sudden weather spikes. Knowledge? No, not much. While on top of erratic demand, their supply chains are like using a rubber band to pick a lock - all over the place and unpredictable, and remarkably elastic. Trouble is what you ordered, the currency, the freight costs and arrival dates are all plus or minus quite a lot. Fine if you can sell all you land, at any price, not so good when others have too much stock too.

Try picking a reliable single digit margin, out of that morass.

So, when rates and demand shift fast, forecasts simply melt away. Valuations don’t really change of course, but market prices do, and that’s when you need to clearly know fundamental values. The rest is froth, just crypto analysis, not the real thing.

So, markets that rely on earnings forecasts quarter by quarter, could go just about anywhere, because no one knows.

For me, now is the time to buy cheap quality, with a yield, but otherwise just watch the spectacle from the sidelines.

Hard Landings?

Local elections tell us remarkably little about national ones. We reflect on those. Meanwhile US equity markets are in turmoil, and some big numbers are changing very fast - some further musings.

Do English local elections count ?

We start with the UK, or rather English local elections, the devolved governments (oddly) have a rather greater read through from local to national. But overall, nothing in the results changed our view that Boris will probably survive, unless the Tory party unites around an alternative, which is pretty near impossible: it has too many splits.

Nor has our long-standing opinion that all Keir needs to do is keep his head down and he will be the next Prime Minister changed. Although if Labour starts to believe it is a shoo in, and can pick who it likes as leader, it will also self-destruct. Which is just about the only chance the Liberal Democrats have of being relevant.

Just how politically marginal local elections are, is shown by the surge of support for the Greens, apparently the very voters the weird Tory infatuation with hard left environmental policies were meant to entice.

Indeed, a whole set of Tory policies designed to raise energy prices, have gone down like a lead balloon.

What voters want and politicians need to deliver

You do wonder if they will ever get round to realising voters really want just three things, a roof over their heads, bread on the table and a job. Deliver those and do so competently, and politics is easy.

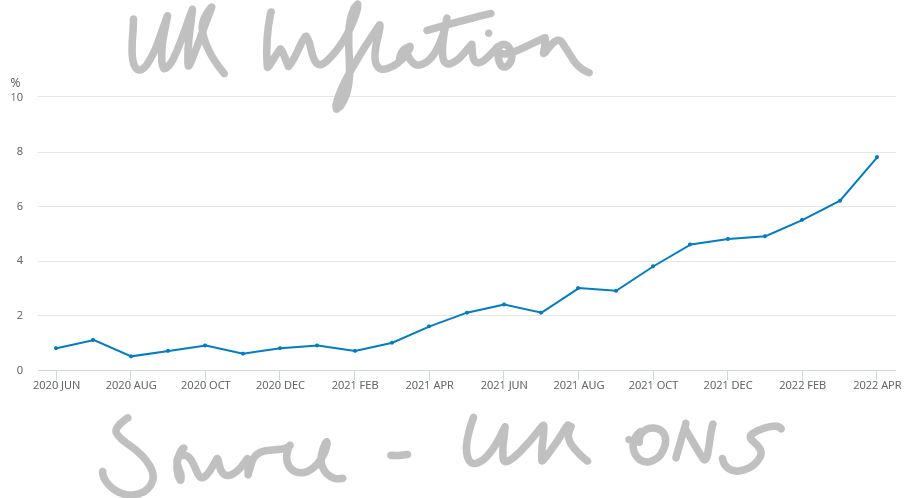

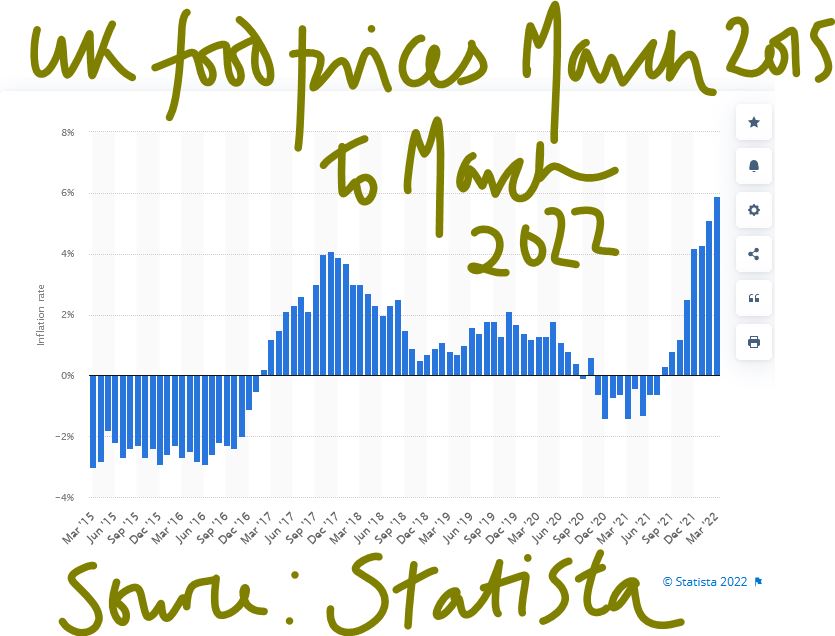

The roof bit is a shambles; it turns out policies designed to enrich cabinet members and senior civil servants with buy to let portfolios, are not so good for anyone else. I suspect the job bit will soon turn turtle, and the bread bit is going off the rails too. See graph below:

Here is a link to the relevant page on Statista

We notice that the big Western democracies still seem hell bent on raising energy prices, which is universally unpopular.

UK local elections - a brief look at opposition policies

So, the other thing markets in the UK (and sterling) will be doing is wonder about Starmer policies, more critically does he have the “bottom” to either appoint radical reformers, or have them lined up in key seats? Let’s say he does. He will still continue the headlong wealth destruction of punitive taxation and the assault on business investment. He will over-regulate (that’s his background). The sole variable therefore feels like any plausible capacity to reform.

He is not afraid of hard choices, or of thinking long, both good points and incidentally he is not Blairite enough to be America’s poodle and get involved in picking pointless foreign wars. Although he will likely dismember the United Kingdom, either of political necessity or by accident. We really can’t see much support for sterling in that package.

Central Banks - are they signalling a hard landing?

Inflation is spiking into double figures, and Central Banks are explaining

1) it is really not their fault

2) they are only responsible for “core inflation” (so without the important stuff)

3) but anyway they must still raise rates to offset the malign effects of other state policies.

It is looking truly absurd.

Not that interest rates are off the floor yet, although the US bond market seems convinced rates over 3% are now nailed on, while oddly the UK Gilt-edged market seems unconvinced of exactly the same thing. This of course is helping an on-going collapse in Sterling.

Meanwhile the possibility of ending negative rates in Europe has caused great excitement and the Euro to strengthen, at least against sterling. The divergence is related to a belief that the Fed which raised three months after the Bank of England is now more hawkish, a belief which seems more about wishful thinking than anything the Fed has actually done so far.

We are less sure on how high interest rates go. All three Central Banks seem to be hoping something will turn up, and inflation will ease. This is a view we share, but we really doubt the trivial rate rises so far, are the “something”.

Market turmoil - how far will they fall?

This leads on to the current market turmoil: With the US feeling very exposed, partly because it went up so high (relative to other markets), it has further to fall. Nor do we see the valuations on quoted US growth stocks as offering good value at these levels. They had become so detached from reality the gap is just too big, and the repeated attempts to buy the dips, just disguises a long-term trend down. The FTSE100 over five years is down, and the NASDAQ climbed over 100% in the same time. A 25% further US fall is at the least plausible.

Other markets will then get sucked down, and in Europe and Japan they are hard hit by their reliance on imported energy (the US is an energy exporter). While for now, their rates are not moving either, the resulting devaluation makes the value gap to US growth stocks, feel even greater. Buying overvalued stock in an overvalued currency, is not always great.

What do our models say about the markets?

Our MonograM momentum models suggest a turning point for both Europe (including within that bundle the UK) and Japan is close. It is only a model, we remind ourselves, and is quite able to give a false signal. It also sees this as true in dollar terms, not sterling. So, there is plenty of noise and last week had all the elements we dislike, a month end, plus a shortened market week, plus Central Bank meetings, created a baffling miasma of signals.

However, on current policies we anticipate a crash; the only issue now is how hard the landing is.