THERE IS NO SANITY CLAUSE

Three big topics this week from three central banks, all of whom look to be in a muddle, with their knitting all jumbled up and highly implausible. Entirely predictable inflation meanwhile threatens to sweep them off their path, as they tinker with micro adjustments to interest rates.

Boris is diverting, but we doubt if it all matters; pre-Christmas entertainment. If he were logical or even vaguely numerate, he would change, but he’s not, and he won’t, but nor does he need to.

The Lib Dems win a by-election, that Labour fails to contest, but it makes no difference in Parliament, and it lets Boris look contrite mid-term. He will survive this with ease.

Which is not to say he should, or that he’s not making a hash of COVID, the sequel. In keeping the NHS in its current format, Boris fails to ask, as many have before him, whether it is still fit for purpose. This remains an urgent question. It can’t simply collapse every year.

Bailey - Bank Governor and historian

But perhaps Andrew Bailey, Governor of the Bank of England, understands the extraordinary risks Boris poses to the economy, and has hiked rates to show that. A Cambridge (Queens) historian, with a doctorate on the impact of the Napoleonic Wars on the cotton industry of Lancashire, he will know full well the impact of a French orchestrated trade war backed up by a dodgy pan European monetary system.

A consummate insider, via the LSE, he moved on to the ascending ladder of the Bank, which did include a slightly unfortunate move into the FCA. This turned out to have rather more real villains than he was used to. Married to the head of the Department of Government at the LSE, he will be very well aware of the political game and the current mood in Whitehall.

He’s seen enough inflation and has decided the Bank must pretend to act. Not only is the rate rise trivial, but it also coincides with a continuation of Government bond buying (QE), an odd call. That the last thing the economy needed was still more liquidity, has surely been obvious for eighteen months now.

Christine Lagarde and Jerome Powell

In Europe the same mishmash exists. We have been hearing Christine Lagarde explain why the ECB is now accelerating one asset buy back (APP) while ending another one (PEPP). She was winging it with the phrase “utterly clear” in answer to a pertinent question, when it was clearly anything but. Still, she did seem to have her ear rather closer to the ground on wage inflation, at least compared to Jerome Powell.

He by contrast has been caught with his pants on fire, trying to weasel his way out of the Fed failing to spot inflation, by saying that most market commentators agreed. Remind me, which is the canine, and which the wagging appendage?

Basic economics - why inflation arises

We called it on inflation as soon as that stock market rally took off, and for the simplest of economic reasons: the pandemic had reduced global productive capacity, so absent a change in price levels, the economy was less productive, profits were therefore lower, competition would therefore be less (unless prices rose), and total production must fall. Less output, same demand will always mean inflation.

Forget the energy issue, forget supply chains, less capacity, more demand always means trouble. True based on that one schoolboy error, the dopey measures to reduce capacity further by more regulation, hiking the minimum wage, paying people not to work and so on, plus embarking on accelerated decarbonization and a few new trade wars, was not going to help much either. But please no more “surprise” inflation, it was baked in. (See extract from my book, Smoke on the Water, blog dated July 2020, title re-appearing shortly on Amazon)

After the interest rate rise

However, we have also long felt that interest rates can’t rise enough to stop inflation, but that as governments have to back off fiscal stimulus, as they are already overborrowed, the lower productive capacity will itself shrink demand, and in the end cause inflation to fall. But we see that as taking years, not months.

Why are interest rates not rising to combat inflation? No political will for a start, and any one country that gets too far out of line will find currency appreciation itself addresses the problem. So, do we believe the US “dot plot” suggesting three rate rises in 2022, while the Euro zone does nothing? We struggle to.

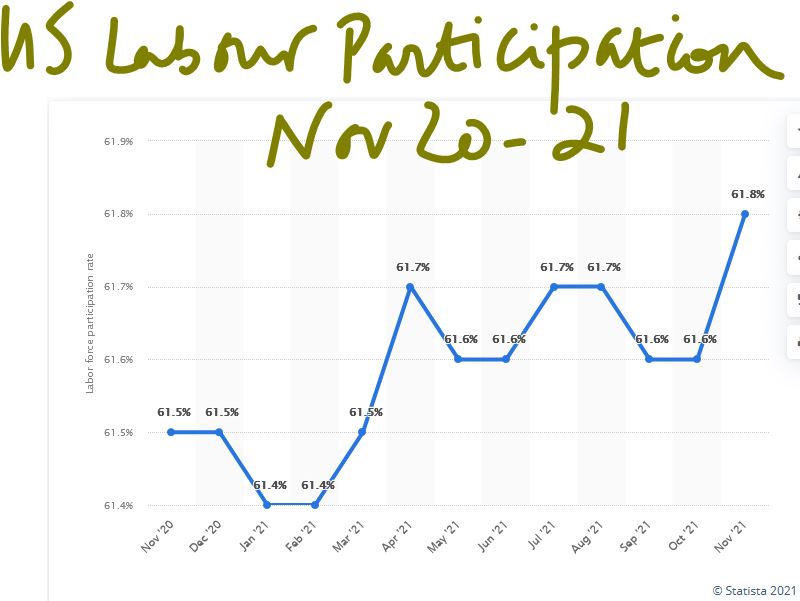

Powell is still clinging to the lower workforce participation rate (which matters) as a signal to defer rate rises and not the unemployment rate (which is more closely related to vacancies) and hence of less fundamental relevance. While employment is great, it will still be unattractive if inflation (and fiscal drag) takes off, thereby holding the participation rate low.

This does still suggest dollar strength, while sterling like other smaller currencies always needs to be wary of getting too far out of line with US rates. But also, a need to fathom out the new look economy. To us, it does not seem service industries that rely on cheap labour are operating in the same world they grew up in. Certainly not if it is onshore.

There is a forced change in government consumption patterns (and hence employment), and this will also be telling. We are heading into quite a different market, when all this shakes down.

Sitting on high cash levels over Christmas, as we are, is pretty cowardly, but if you can’t see the way ahead, slow speeds are usually safer.

We do also rather agree with Chico Marx, this year at least.

Charles Gillams

Monogram Capital Management Ltd

All kinds of everything

We move towards the end of the year with a great deal of challenging uncertainty and big calls to make, on inflation, China, US Politics, whether interest rates are pegged, and a few political issues. The temptation to sit it out and come back after Burns Night, is intense.

A lot of things will be clear then: the severity of the winter, and hence fuel prices, also of the EU COVID spike, the nerve of some Central Banks and who leads the largest one, and how the Beijing Olympics will go. All are potentially significant matters for investors.

Few of these issues are surprises, which is good, indeed we see advanced economies as being in fairly stable shape, but badly damaged by populist politicians, who can’t face telling voters that ‘nothing comes from nothing, nothing ever could’.

Inflation

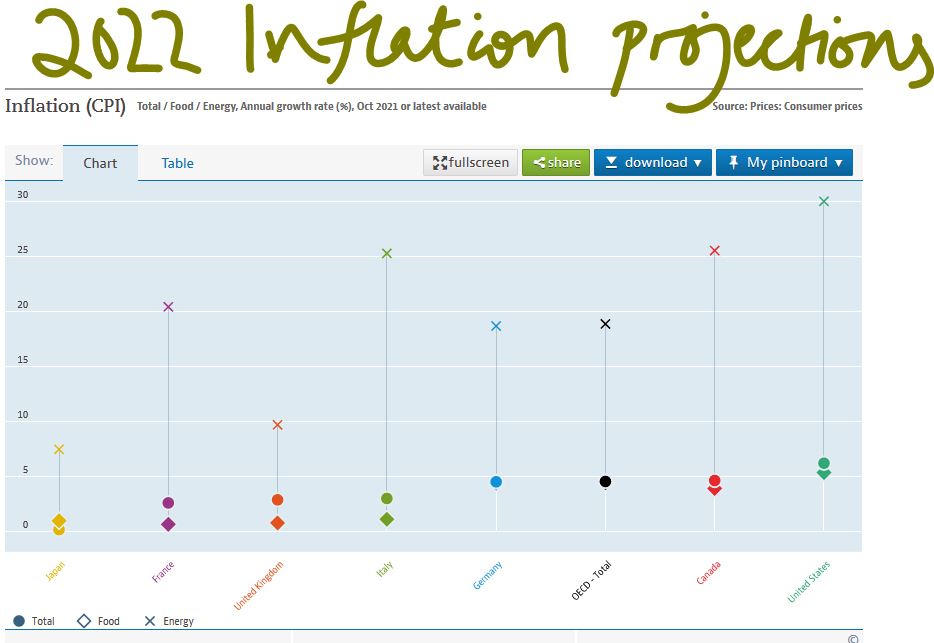

So, on inflation, we took some flak back in the Spring for talking about 5% inflation, but we regard that as pretty conservative now.

From the OECD data here.

We see it as structural too, not related solely to excess demand, supply chains or energy prices. All of these matter, but the last two are indeed transient, and excess demand is within the power of the fiscal and monetary authorities to affect. The real trouble is both the lingering and severe harm COVID is causing to productivity, especially in the service sector and in a public sector still too reliant on overmanning and allied with that, the curse of politicians trying to exploit the pandemic to pay off their chums.

Our conclusion is that we will have higher prices at least for the next two quarters and possibly all of next year. Critically Central Banks will most likely be powerless to prevent or reduce that, without bringing the house down.

Broken China?

One cannot but be envious of the performance turned in, yet again, by Scottish Mortgage. The half year gains are massively from one stock, Moderna, and then a broad raft of e-commerce and big data plays. So, really, they just continue to surf the NASDAQ run. By contrast their big cap China positions generally damaged performance but have not yet been visibly trimmed. Although China does drop from 24% to 17% of their NAV, which is significant, with North America rising from 50% to 57%. (I should also mention we don’t hold a position in this stock and have not had one this year.)

So, NASDAQ strength allows them to survive what for most fund managers has been the poison of owning anything in China this year. A decision we took, guided by our momentum models, very early.

We also note the manager’s viewpoint, which broadly aligns with a view that what Beijing is doing, is what the West should do as well, in attacking and controlling big tech platforms and their associated excesses. Telling the biggest companies to also do more to reduce inequality and cure social problems hurts profits; but they still see both as not unreasonable requests and they claim big Chinese companies are already willingly complying.

Yet for all the apparently cold rationality of the Scottish Mortgage viewpoint, we do understand it, and do see China trashing their participation in areas of global commerce and capital markets as an odd piece of self-harm, if it is really their aim, not just an ill-thought-out consequence of domestic actions.

So, we see the set back so far in China stock prices, as based on the possibility of the area being uninvestable, like Russia, but not yet on that certainty - see the how strong the trade figures are even with India, a so-called political antagonist. But tipping over to uninvestable would be a market shock and again we inch closer to that, with each diplomatic spat.

United States - and the Fed Chairman

The big US call, and again we signaled this as critical a while back, and actually well before the US Presidential Election, is about Powell. My sense is removing a competent Fed Chair for purely partisan reasons would be damaging to markets and the dollar. But the pressure on the ailing Biden to do just that feels intense, and I am struggling to see who in the White House will have the maturity to stop it, if Biden caves in.

Would a new Chair do things differently? Might markets push harder still for a rate rise and the dollar, short term at least, suffer? For now, re-appointment is still expected, but the odds on a shock are shortening.

Interest rates

The Bank of England is also, quietly in the midst of a storm, it is not actually independent however hard it claims otherwise, it relies too much on Whitehall just to survive, and, in a way, can’t do anything meaningful on inflation anyway. Still a rate rise, even a notional one, would show it is still awake. It makes little sense just now, but as a symbol might yet happen. To us it simply adds emphasis to the political chaos overtaking Johnson and the ongoing shift towards an institutional alignment with a Starmer government.

Material interest rate rises (so returning us to positive real rates) during 2022 therefore still feel impossible. Indeed, German rates have once more flirted with changing the nominal sign, only to collapse back into negative territory.

To sum up - where does that leave us?

Well curiously, mildly bullish. We may not much like the position, but who cares about that, our task is to make money for investors. We also have had a think about what rescued investors from the COVID slump, on the basis that a future sharp inflexion in interest rates could look much the same.

What we see is the power of real growth, not the flotsam of cash hungry concept companies that can never pay a dividend, but fast-growing, broad-based technology – following that has been the winner for a decade. We do want to call time on that, partly for the nonsense and scams it tugs along behind it, but we still struggle to see the turn.

Charles Gillams

Monogram Capital Management Ltd

POWELL / GOVE : DROPPING THE PILOTS?

Jerome Powell looked ill at ease twice at his Wednesday press conference, with neither occasion related to monetary policy. While in the UK, Gove’s sidelining is the end of any chance of reform from this UK government.

Oddly when asked about his ‘hand in the till’, for bailing out his own family position in US Municipal bonds, Powell barely flinched. So why then is he worried?

The Powell press conference - what riled him?

He should be upset that the unemployment rate among black Americans is twice the level it was pre-COVID, at over 6% still. Given his pledge to hold the money taps open till that is fully recovered, which has for a while been clearly impossible without traumatic inflation, harming those same citizens, that should concern him.

This has long been Powell’s talisman to ward off the hard left, who are bent on two great goals, firstly taking over the reins of power by ejecting him and secondly finishing off Wall Street, as they so nearly did under Obama. Kamala Harris has not been in that triumphant position, at least not yet, so do the left really want to accept another deputy?

I doubt it.

So, the two questions Powell was riled by, were one about the new deputy governor, who has in this case the power to drive the regulatory agenda, mandated under Dodd Franks. Now, if one of Senator Warren’s acolytes can be inserted there, Powell will find life immeasurably harder. But for markets worse still,(the second question) was if Powell himself is chopped (Trump looked into it) before the recovery is complete. A weakened Biden has few other goodies to offer, if his portmanteau bill to throw $3 trillion of cash to his voters fails, scrapping a top Trump nominee at the Fed, might be the political trade-off.

While for Powell, as this all starts to get rather dirty, I could see him for the first time, asking if he was really that bothered.

The US recovery - stimulus, markets, and minorities unemployment

The rest was all telegraphed passivity, still pumping enormous stimulus into the US economy, long after the recovery is running hot.

The US 10-year bond resumed its gentle lapping sound against the low-rate rocks, the storm of inflation roared on overhead, and the shadow of crossed fingers, fell on every vault.

The market has turned, in the US at least, from worrying about ‘when’, to guessing ‘how high’, with, given the global malaise, some confidence that “not very” is the answer.

Chop the Chair of the Fed, and that delicate illusion shatters. While whatever his politics, shipping Jerome off the transom, will hurt those same beleaguered minorities most. We should never underestimate the zeal of a convert, and he is that.

Sidelining Gove

We have not seen that kind of zeal on these shores for over a decade. True, various short-lived moneymen have breezed through ministries, failing to unpick their form and function, scattered management speak and chums’ contracts around equally liberally, and left.

But lifting the drains, sorting the plumbing, fixing the boiler type reform, no, Gove is oddly (because he was useless at it) the last of those to fall. But he had the great merit of scaring people and driving legislation, which with the stodgy morass of public sector spend, is part of the battle. But the idea that he can either help on “levelling up” (which is just a catch phrase, and always will be) or pacify the Celtic fringe, hungry for real power (and unaware it does not exist) is risible.

Meanwhile, the Cabinet Office is quietly stripped of ministers, to be put back in the box marked “too difficult” once more.

A parallel with Chinese policies

This is like selling the inhabitants of East Turkmenistan down the road for some of Chairman Xi’s foggy promises on future coal fired power stations. It would be sad if it weren’t true.

Although China is now helping us return to a land beloved by investors, where money is scarce and hence actually earns a return. While risk still clearly comes in many forms; including Marxist morality, that is, if such a thing exists.

Big corporate failures do at least achieve that heightened risk awareness.

Charles Gillams

Monogram Capital Management Ltd

:) You might already know that 'dropping the pilot' is a famous cartoon by Tenniel from 1890 when the Kaiser dropped Bismarck.

ESG : Being All Things to All Men

I have been attempting to not write about ESG all year, as passions run high, and it feels to be more about faith and politics than Environmental Social and Governance (whatever that is) itself, as they encompass an incredibly wide set of issues, now being squeezed remorselessly into a few tick boxes.

However, I have been greatly enjoying Simon Schama’s magisterial tome on the Batavian Republic, as the Netherlands were known during what we loosely call the French Revolutionary wars. The analogies to the situation today are startling.

Can you Take a Position on ESG Issues?

In the environmental universe, I personally tend to be far more a “dark green”, than a “light green”, which in very crude terms holds that sustainability is not a matter of work-rounds with the “same as before” levels of consumption, but of a reshaping to avoid the extraordinary growth in raw consumption seen over my lifetime. More Monbiot than Musk, you might say.

Yet on trade, by contrast, I would ally strongly with the ‘Social’ part of it: nothing frees a nation like free trade, and nothing builds prosperity so fast. Just ask the Chinese.

A new Form of Colonialism?

Free trade also includes the free movement of capital, so that the relentless red lining of the most impoverished third of the planet on the grounds of failing to meet our Western standards of governance, feels very much like old colonial exploitation.

Effectively you’re saying – ‘yes, do sell what you like, made by who you like, using what you like, but just not to our markets’.

How can anyone be in one place on all of these often-opposing issues? If you are, the investable universe shrinks to nothing, or indeed paradoxically becomes everything. I have seen ESG bonds where China and Qatar were the top holdings, I am sure on perfect ‘E’ box ticking, but not my idea of either the ‘S’ or the ‘G’ part of it.

Governance, the most Elastic Concept of all?

While in my experience, few things have so powerfully increased inequality as remuneration committees, festooned in ways to line the pockets of directors, and singularly toothless in their stated aim. But all it seems fine on the weird ‘G’ criteria.

There are many other fraternal and earnest slogans now hiding deceit. Several of the current entrepreneurs most carefully cloaked in greenery and its social equivalent, have a decidedly old-fashioned view of governance, a fondness for non-voting shares and other tricks, and boards stuffed with their mates, which then also leaves the substance of the ‘G’ part well short of the mark.

So, to me ESG ends up as so wide, that an investor who really cares must pick and choose where to place the emphasis. Yet even this is seldom possible, in part because so many collective instruments are already being packaged in strict tick box compliance, which massively restricts your options.

The curse of all index investing is you end up taking a set of equities typically based on their market capitalization, so “desirable” stocks by definition end up in wider and wider sets of indices. As so much is now index investing, you are then forced to acquire both sheep and goats, with little chance of avoiding one and adding to the other.

However, as a fund manager you must always play a twin game, of either allocating capital to where it is most productive or allocating capital to where it is most popular. Clients tell you they desire the former, so they want good ESG credentials, but actually want to have the best return too, in other words the latter.

Governments, as China is now clearly showing far prefer (as they must) the productive to the popular. Popularity is proving dangerous in that market, as therefore is for now, index investing. Just as you pile into owning the latest media sensation, the state starts destroying it, almost a re-run of our experience in investing in UK banking.

All of which leads me to conclude that like anything else in markets, ESG can be good value, but can also be poor value; what it can’t be is always wholesome. Investors should realize that if it is not to be all things to all men, it must also ultimately cause them losses as well as gains.

I could add a line on Jackson Hole and Jerome Powell, but that is all that it deserves, nothing new was said.

I notice that he too has become, skillfully, all things to all men.

Charles Gillams

Monogram Capital Management Ltd

Holiday reading – Simon Schama – Patriots and Liberators.

Simon Schama unpicks the eternal power and politics questions, seen through the simpler although less familiar lens of the Dutch.

I now finally understand what Camperdown was all about, so apparently it is not a racecourse, after all.

Although the Anglo Russian invasion of Holland remains mysterious, it does remind us how fleeting our alliances are.

The British showed considerable skill in repeatedly landing in Holland, looting the place, seizing much of the Dutch fleet, and then executing a negotiated evacuation, when they had clearly failed in their main mission of “liberation”, without too much embarrassment: an under rated skill it seems.

The sheer impossibility of nation building by force and myriad other democratic puzzles were exhaustively thrashed out by the Batavians, under the baffled eyes of the French invaders. Nothing changes, it seems.

While the sections on taxation and local government are rather strangely relegated to near the end, but feel to me, something of a connoisseur of both, perpetually modern. This was the period when the old inherited ways were first discarded, and our new ‘modern’ systems sketched in.

Their arguments over decades are now ours too. The clash of a European superpower and democratic freedom rings true still, the crippling burden of an overmighty, half blind and deeply corrupted centre remorselessly subverting the myth of its own creation by greed, the utter folly of war and the deep atavistic permanence of old boundaries are all visible.

Fiasco

First Posted on 7th March 2021

WHY SYSTEMS FAIL, AND IT IS REALLY NOT ABOUT MONEY

A winter lockdown forces us all to examine our domestic interiors, with in my case perhaps a superfluity of paper, which led me to “Fiasco”, by Thomas E. Ricks. It is a seminal description of how complex systems create monsters and then fail, not for lack of effort, nor goodwill, nor money, but from thrashing about with no coherent strategy.

Indeed, arguably all those three inputs make matters worse. The tale simply told, in a largely deadpan tone, is of the greatest failure of American foreign policy since Pearl Harbour, and the greatest crime perpetuated by a British Prime Minister, since the Bengal Famine. It is how Bush, looking for revenge after 9/11, has spawned the disasters of the modern Middle East and locked us all into an unending cycle of terrorism and for the millions of people in the Middle East and beyond, brought poverty and despair.

Strategy matters

How? Well as Ricks tells it, they used the wrong tool for the wrong job: the strategy was hazy, mission creep endemic, the reporting system mangled everything to suit those making the reports. In the meantime, the aims kept shifting, and staff rotation and comfort swamped the original purpose of simply executing the mission.

While those they were sent to save, service and otherwise succour, were embittered and made hostile by the sacrifices they were expected to make, in return for specious, obscure propaganda.

So that led to the USA seeing the Iraqi people as the enemy, not just their crazed leader, while the entire Iraqi government was blamed for funding and concealing these non- existent weapons. Read it. Because from that flowed the failure of Phase IV (the post conflict reconstruction), the hostile occupation (not liberation) of Iraq, the idiocy of making that occupation subservient to Pentagon (not civilian) demands, the destruction of the fragile sectarian balance between Shia and Sunni, the rise of ISIS, the Syrian nightmare, Yemen, and the Iran nuclear programme.

Meanwhile, the attendant loss of money, the coming to power of the isolationist and militia based right wing in the US, the triumph of China in the emerging world, the resurgence of Russian thuggery all remorselessly followed on. Simply unbelievable. As Hicks writes it, you can hear the quiet click, as the lid of Pandora’s box was ever so gently released; beats bat breeding labs in Wuhan for the sheer laconic horror of it.

They did start the fire.

I do not know what the Pope going to Baghdad shows, beyond a startling personal courage, but it is no ordinary trip. The story also shows how in the modern world massive complex heavily manned delivery systems just can’t operate. They are dinosaurs. There was nothing inherently wrong with the US Army, but yet it created its own defeat.

WHY THIS SYSTEM WILL FAIL TOO, AND AGAIN, IT IS NOT ABOUT THE MONEY

So, to the UK budget, another set of tactical responses to poorly understood problems, hemmed in by contradictory rules, horribly distorted by politics. Sadly, the government really does believe it is the presentation that matters, not delivery. So, we had Rishi, spooling out unending largesse, and crudely claiming he was going to level with us, and level up North Yorkshire, and hand out freeport concessions to his chums and give Ulster another £5m for their paramilitaries (oh, you missed that one?).

A more extensive piece will shortly be on our website. It questions whether we are building back better. To me this looks more like ‘business as usual’, no growth, no decent jobs, London’s supremacy ploughing on, the regions thrown scraps. Green? When you freeze vehicle fuel prices for the eleventh year? Hardly. So yes, the budget was a relief, but no it should not have been. I doubt if markets will like it much, just because the publicans do.

DEBT AND EQUITY MARKETS AND INTEREST RATES

Markets Well, there is another puzzle, I thought the august President of Queens’ College Cambridge was going to self-combust into his tache, such was his thrill at seeing the bond vigilantes shooting up the US ten-year interest rate, during the week. Biden must pay his electoral base the bribe needed to win those Georgia Senate seats, at the full inflationary excess of $1.9 trillion, pumped onto an economy that is already visibly and dangerously overheating. The one Game Stop we do need, won’t happen.

So, you have $27 trillion and rising of outstanding US government debt, do the maths, if the bond vigilantes push rates up by 1% for the average duration of that debt, 65 months, that will cost you some $1.5 trillion back. So sure, you can cough up on your election pork, but it will cost the American people $3.4 trillion to do that.

Well, we don’t actually think that attempted rate increase can stick, for all the reasons it failed to stick over the last decade. Powell at the Fed then agrees with us, which on past form is perhaps an ominous sign of our approaching error (or possibly his gaining of wisdom).

Equity markets certainly felt unhinged; they started to whipsaw around in a frankly worrying fashion. On prior performance this does need sorting out, before it is safe to go back in. If (of all places) the US will lead on raising rates, it has to then pull up all other global interest rates, which we know will slow growth and take the wind out of the recovery. Indeed, it may threaten it, it has to cut (see above) how much governments can then borrow, has to start foreign exchange rates jockeying for position, has to question the whole free money basis of tech valuations.

I simply don’t think this recovery and these valuations can stand that just yet, and after a decent pause, the Fed (like many other Central Banks do already) will have to act to somehow hold down rates. Whatever Governments say, money does have a time value, and behaving as if it does not, is rather unwise. But I think extend and pretend will still persist for a while yet.

Charles Gillams

Monogram Capital Management Ltd