DETONATION OR ROTATION

Two big market forces are at work just now, one is rotation out of the low interest rate winners, to wherever we go next, the other might be something more spectacular.

Enough of the market still sits in the “don’t know” category, to make everyone uneasy. The VIX is high.

So, what would cause the more explosive outcome? Traditionally higher rates divert more of the profits of indebted companies to banks and bondholders, so the theory goes, reducing dividends. Or at the more extreme level, this also makes refinancing debt harder.

This comes with a ‘second order’ impact, in that consumers or buyers also shovel more towards the banks, less towards the producers.

But none of this seems remotely likely yet, the world is awash with cash, and savings levels and interest rates have barely stirred from their COVID slumber.

Markets seem to be just talking about normalising, not slamming the brakes on.

Will we grow regardless of inflation?

The other big risk would be a failure of non-inflationary growth, which also seems unlikely. There are few practical signs of governments enacting the type of supply side restraint needed, we know. We still look for some self-restraint on how much governments seize in taxation; with high inflation taxes should be being cut, or thresholds systematically raised, but that’s also not happening.

The ‘idiot populace’ as curated by the media, constantly wants more supply side restrictions, greater consumption and lower prices, as if this was all somehow available; it is not. The worry here is that governments having messed up the big issues, give way to yet more populist demands for the impossible. At the same time, markets are also getting a little less keen to finance such nonsense or, being markets, raising the price at which they do so.

Well, all that is possibly true and has been happening for a while, but the old theory was that innovation was too fleet footed for any of that stuff to matter much. This is getting a bit tired, but broadly still seems to hold.

What if Ukraine does erupt?

So, the third detonator is in Vlad’s hands. Is a reverse Barbarossa coming down an autobahn near you? Well let’s assume yes, because he’s finally lost it. It is still fairly clear that if he steps onto NATO territory his army is in trouble, US and NATO airpower will rapidly outgun him. So, I discount that. But perhaps Ukraine does indeed end up like Belarus. China will support Putin, so the UN is irrelevant.

Then what? Well, a nation the size of Spain gets locked out of European commerce. Not important. Defence spend goes up? Well, some would say ‘about time’. Germany can decide to burn coal or nuclear or freeze, see previous answer. Come to that, so can we.

Given Russian gas must go somewhere, a bit like Iranian oil, it probably goes to China, which then trades it or cuts back its own Far East imports. Gas as we all know, can’t be stored for any useful length of time. Russia needs the earnings from it, so it will emerge on the market somewhere, at pretty much the current price.

It will be messy, it will create hard choices, but Russia is well on its way to autarky already, it can certainly live without dollars. Is this really a detonator? On its own, I doubt it.

Where is the rotation?

So, we still conclude all this market reaction is rotation, and it is out of overpriced US equities, where Biden created the biggest inflation bubble by far, and where interest rates are rising faster than elsewhere in the OECD. Hence, we see the hazard as mainly still on Wall Street, and to a lesser degree to the US economy. We’re looking at rising rates, a strong dollar, increased detachment from the global economy, and none of it helps earnings, but nothing is catastrophic either. The US (unlike the UK) wisely seized the chance to be energy independent.

But even so, we are not yet that concerned, valuations in the US are still extreme, as many sets of earnings seem to show, once the market looks at forward guidance, it shudders, and prices fall. A lot of built-in growth is needed to get price earnings ratios back down to earth, and that’s what’s being hit just now. To use a forty or fifty times earnings multiple, needs a lot of confidence about the future. That stretched temporal certainty is now lacking.

This is not that unusual for a rotation, but in that case, markets will bounce, and that will suddenly move a lot of funds off the side lines and back in. Where is that process now? Well going back to the Jan 27th low is causing some excitement. But we are not sure even that’s a disaster. Overall, the taking out of that and the October 2021 S&P low, won’t be fun, but the market still had a heck of a run up last year.

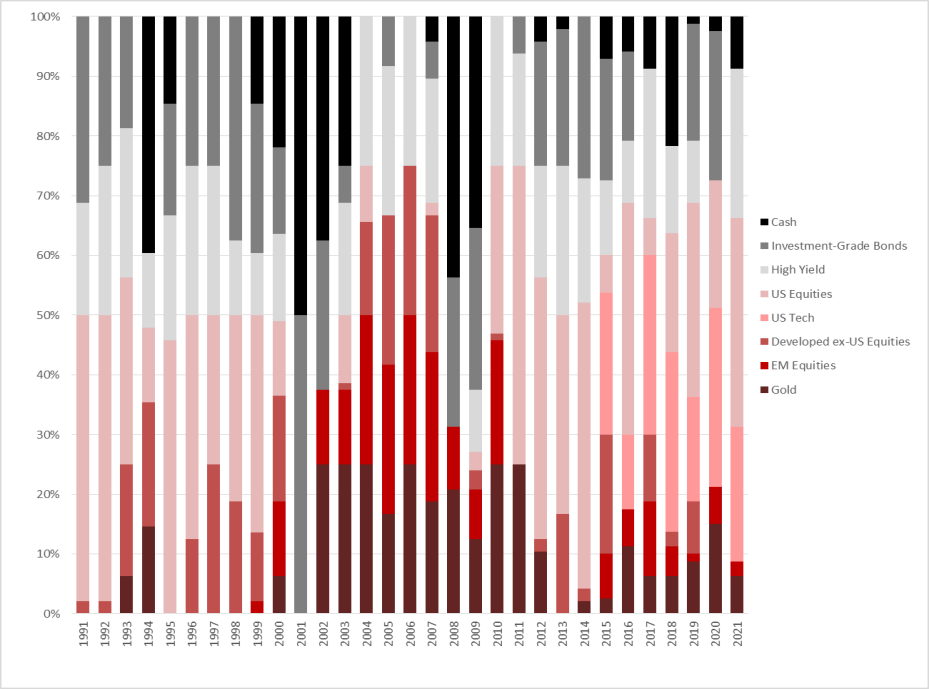

Have a look at where our MonograM investment model allocates funds based on momentum, over the last three decades, the US is absent for significant stretches. We rebalance monthly, the next one will be most interesting.

And inevitably, we do feel cautious too, but it is about levels, not wipe outs. Rotation not detonation.

Charles A R Gillams

Monogram Capital Management Ltd

First Principles

Principles may be lacking in certain quarters, but we will start with the economics of inflation rather than Boris.

How much inflation and for how long?

Inflation is simply too much demand for the available supply, nothing more complex than that. So, you tame it by either less demand or more supply. So, unlike it seems most Central Bank economists, who it turns out are just statisticians, for ever looking back, we must project forward.

That tells us quite clearly that the inflationary imbalance will persist as long as demand stays artificially high and supply is artificially constrained. It is that simple. Forget the rest.

So as long as governments have fiscal laxity, along with negative real interest rates, they are pushing up demand. As long as workers won’t or can’t work, it will reduce supply, as long as economic activity is made less efficient by government action and diktat, it will reduce supply; end of.

So, at the very least Central Bank balance sheets must start reducing, which is not happening, stimulus must be fully withdrawn, which is not happening, and the old workers and their old ways of working must resume, which is not happening. Fresh capital can certainly change some of that, but it takes time.

Putin, Oil, and Geopolitics

What about oil?

This is the one item that alone might distort the picture. Which is positive, as we see oil prices falling in the summer. We also don’t see the West has really grasped what Putin is up to; in all the cold war style hysteria, he is possibly just after what he says. This is for the West to stop fomenting rebellion in Russia’s sphere of influence, and to be clear about NATO expansion plans, where there are indeed none in existence. He might have higher hopes, perhaps of a deal on Crimea in exchange for the Donbas, but we doubt it (or his chances of getting it are low). As might we, less interference in our politics would be nice; but see previous answer.

Nor is it that clear he is actually rationing energy; it is telling that Russia is reported as not able to meet its OPEC + quota, which at these prices is crazy. His oil industry will have been hit by sanctions, and the loss of Western expertise, and the Russian economy will also have suffered under COVID. A loosening of sanctions would really help him, for all his bravado.

If that reading is correct, as the situation winds down and OPEC+ winds up production, oil prices will fall, I would expect quite substantially. Much of the energy spike is self-inflicted, with nuclear plant closing or offline in France and Germany, and reckless price controls, having made using UK gas storage unattractive. All of these things can be sorted out.

Any possible good outcomes on inflation?

So, to inflation, well it won’t care much about the pinpricks inflicted by the likely interest rate rises now under discussion, especially if they creep up so slowly no one notices. It needs a unified 1% OECD jump to cool this lot down, and the ending of stimulus. Neither is likely. Closing the US printing presses, were it to happen, does also have interesting global impacts, as Andrew Hunt notes.

We see it all turning rather glacially, with a bigger slump in inflation, if energy prices fall, but then being generally persistent in the 3% area for the rest of the year. We expect to have both higher rates and inflation for a while.

All of this is mighty tricky for investors, but I don’t sense that just bailing out is right, nor that the actual interest rate rise will cause an enduring slump in all asset prices. Investors have to own something, or they will sit and be mauled by inflation.

And what of Johnson?

It is easy to read the current level of confusion from either side’s viewpoint. Yet to me, I see the normal factional infighting, the usual media exaggeration, some political mischief making, but still no reason to depose a Prime Minister with a very clear mandate and a large majority. Like any large party the Tories have the embittered and passed over, the Remainers and fans of state intervention and a volatile and raw body of new recruits in seats no one ever expected to win. Plus, no doubt a few opportunists who sense that the heavy lifting on COVID and BREXIT is done, and they can now seize all the prizes.

The Tories do need a reset; it would be nice if Downing Street left Ministers to govern and simply acted as a cheerleader. Not that I see that happening, leaders and their hangers on always lust after more and more centralization, more control. But until a compelling, unifying, plausible Tory opponent appears, I foresee no change.

And in a way with reform all but dead, with Gove’s last hurrah on ‘Levelling Up’ a damp squib, it may not matter who leads the Tories, they have very little real power.

It is quite odd how big majorities do so little good, and how poor party discipline is, when they have them.

Charles Gillams

NO NEWS?

Staying on the sidelines till Burns Night still remains rather attractive. Christmas as ever brings thin trading, a lot of speculation and some brutal repression or natural disaster, in a far-off land. Although these days ‘far off’ could include Lille or Llandudno, both pleasantly calm and now even sounding a bit exotic.

But for all the noise, has the investing world really shifted? We did kind of have a Santa Claus rally, but with COVID about, he got shoved back up the chimney pretty fast. Meanwhile Powell was transformed into Scrooge with the terrifying thought that in a massive boom, with high inflation, perhaps he didn’t need to be reinvesting maturing state-owned bonds?

What we see is confusing data, a fair bit of economic damage from Omicron, some people not wanting to be ill, but mostly from a Pavlovian reaction to the very idea of COVID the Sequel. Fortunately like most sequels it was a pale imitation, we knew the cast, guessed the plot, will leave the show early.

Inflation - where have we got to?

Peter Sellers in The Pink Panther films asks an innkeeper if his dog bites; having been assured it did not, the dog snarled and bit him. On remonstrating he was kindly informed “that is not my dog”.

Well clearly Powell, Biden and a few other innumerate players wish to tell us the same about inflation.

Sadly, and transparently, it is their dog, and equally clearly it will bite.

There is an econometrics game of saying there is no inflation (except in; used cars, housing, fuel, take your pick really). That is like selecting the first brick to burst in a failing dam, and saying that the structure was fine, except for this one defective brick.

Therefore, the first sign that (finally) the ‘just a blip’ inflation nonsense has been retired must be good news. This comes along with some evidence that sensible Democrats (well at least one) have spotted that more money for less work in order to buy fewer goods, is probably not actually helping poor American families.

The energy question

We will sort out energy prices, if governments are sensible. So, if, like President Xi, we do bring back a bit of stand by coal capacity, for next winter’s peak. There is plenty of coal around. We have not been too short of wind around here either, of late, the UK also has a good number of salt caverns, which we can (as we used to) stuff with gas, rather than believe the idiots in the Government who felt it was too expensive to have cheap summer gas on stand buy. While at 80 USD even the Saudis will pump more, the Permian certainly will.

So that just needs a bit more planning, a bit less spurious forecasting to within three decimal places, a bit more building in a margin for error, whilst hopefully all the Whitehall types who claimed they were fostering ‘competition’ and could ‘cap’ prices of a global commodity, get moved on (or better out).

It is still next winter’s answer, none of this will help this year much. Most capacity for the next two months is sold.

So, what will Powell do next?

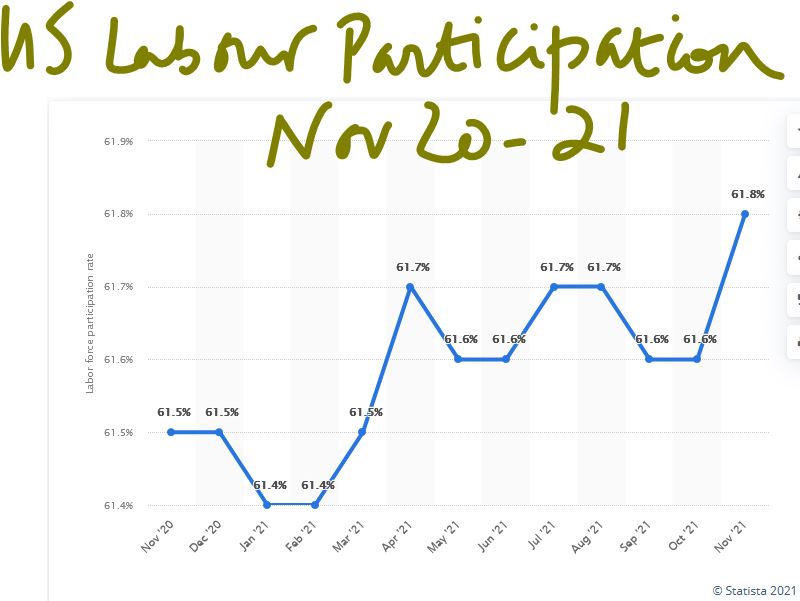

All of this leaves us with massive liquidity, poor labour market participation, excess demand and the normal reaction to all that: inflation picking up and negative real yields slowly being eradicated. What is not to like? Demand plus capacity usually equals growth.

While Powell may have failed to grasp the intricacies of inflation, I am not expecting him to suddenly declare his job done on minority employment rates, with such a poor participation level. So, I expect he will keep trying on that. Which suggests he’s not going to over-indulge in rate rises. Hence the idea the Fed will look at other ways to soak up liquidity, is quite logical.

At this stage of tightening, we don’t find most bonds attractive, but recent history suggests that if the US 10-year bond gets closer to 2%, it attracts foreign money, unless Euro base rates also rise, which still seems unlikely. More buyers will of course push the yield back down.

While China is both cutting rates and provoking some hefty defaults, which is not a great background for foreign investment, especially as they seem to be targeting offshore investors. Without knowing whether the US interest rate tops out at 2% or 4%, emerging market debt (like their equities) could be either cheap or expensive; just now it is very hard to gauge.

So cautiously we plough on - funds must be invested, the (as of now) attractive alternatives, all look pretty expensive or rather risky, while if rates really do start to rise, the dollar will itself become desirable. So, we expect something, some asset, will suddenly catch a bid and soar away. Outside the US mega cap tech stocks, value already abounds.

Overall, a return to normality. With rather fewer gifts from Lapland to be had just for asking; all of this should be quite encouraging.

While it looks like sterling has strengthened for now, the various tin pot media storms have led to the Prime Minister’s critics looking into the abyss and not liking the view very much.

It may look bad to bend some rules, but dropping a Prime Minister for disliking Theresa May’s taste in wallpaper, or treating staff like human beings, or because Liz Truss is ambitious? Not really.

MCM had a good 2021, in our global lower volatility space. The CityWire link to our subsector is here.

Charles Gillams

Monogram Capital Management Ltd

9th January 2022

(article illustration by Martin Speed, creator of the Woofle bears)

THERE IS NO SANITY CLAUSE

Three big topics this week from three central banks, all of whom look to be in a muddle, with their knitting all jumbled up and highly implausible. Entirely predictable inflation meanwhile threatens to sweep them off their path, as they tinker with micro adjustments to interest rates.

Boris is diverting, but we doubt if it all matters; pre-Christmas entertainment. If he were logical or even vaguely numerate, he would change, but he’s not, and he won’t, but nor does he need to.

The Lib Dems win a by-election, that Labour fails to contest, but it makes no difference in Parliament, and it lets Boris look contrite mid-term. He will survive this with ease.

Which is not to say he should, or that he’s not making a hash of COVID, the sequel. In keeping the NHS in its current format, Boris fails to ask, as many have before him, whether it is still fit for purpose. This remains an urgent question. It can’t simply collapse every year.

Bailey - Bank Governor and historian

But perhaps Andrew Bailey, Governor of the Bank of England, understands the extraordinary risks Boris poses to the economy, and has hiked rates to show that. A Cambridge (Queens) historian, with a doctorate on the impact of the Napoleonic Wars on the cotton industry of Lancashire, he will know full well the impact of a French orchestrated trade war backed up by a dodgy pan European monetary system.

A consummate insider, via the LSE, he moved on to the ascending ladder of the Bank, which did include a slightly unfortunate move into the FCA. This turned out to have rather more real villains than he was used to. Married to the head of the Department of Government at the LSE, he will be very well aware of the political game and the current mood in Whitehall.

He’s seen enough inflation and has decided the Bank must pretend to act. Not only is the rate rise trivial, but it also coincides with a continuation of Government bond buying (QE), an odd call. That the last thing the economy needed was still more liquidity, has surely been obvious for eighteen months now.

Christine Lagarde and Jerome Powell

In Europe the same mishmash exists. We have been hearing Christine Lagarde explain why the ECB is now accelerating one asset buy back (APP) while ending another one (PEPP). She was winging it with the phrase “utterly clear” in answer to a pertinent question, when it was clearly anything but. Still, she did seem to have her ear rather closer to the ground on wage inflation, at least compared to Jerome Powell.

He by contrast has been caught with his pants on fire, trying to weasel his way out of the Fed failing to spot inflation, by saying that most market commentators agreed. Remind me, which is the canine, and which the wagging appendage?

Basic economics - why inflation arises

We called it on inflation as soon as that stock market rally took off, and for the simplest of economic reasons: the pandemic had reduced global productive capacity, so absent a change in price levels, the economy was less productive, profits were therefore lower, competition would therefore be less (unless prices rose), and total production must fall. Less output, same demand will always mean inflation.

Forget the energy issue, forget supply chains, less capacity, more demand always means trouble. True based on that one schoolboy error, the dopey measures to reduce capacity further by more regulation, hiking the minimum wage, paying people not to work and so on, plus embarking on accelerated decarbonization and a few new trade wars, was not going to help much either. But please no more “surprise” inflation, it was baked in. (See extract from my book, Smoke on the Water, blog dated July 2020, title re-appearing shortly on Amazon)

After the interest rate rise

However, we have also long felt that interest rates can’t rise enough to stop inflation, but that as governments have to back off fiscal stimulus, as they are already overborrowed, the lower productive capacity will itself shrink demand, and in the end cause inflation to fall. But we see that as taking years, not months.

Why are interest rates not rising to combat inflation? No political will for a start, and any one country that gets too far out of line will find currency appreciation itself addresses the problem. So, do we believe the US “dot plot” suggesting three rate rises in 2022, while the Euro zone does nothing? We struggle to.

Powell is still clinging to the lower workforce participation rate (which matters) as a signal to defer rate rises and not the unemployment rate (which is more closely related to vacancies) and hence of less fundamental relevance. While employment is great, it will still be unattractive if inflation (and fiscal drag) takes off, thereby holding the participation rate low.

This does still suggest dollar strength, while sterling like other smaller currencies always needs to be wary of getting too far out of line with US rates. But also, a need to fathom out the new look economy. To us, it does not seem service industries that rely on cheap labour are operating in the same world they grew up in. Certainly not if it is onshore.

There is a forced change in government consumption patterns (and hence employment), and this will also be telling. We are heading into quite a different market, when all this shakes down.

Sitting on high cash levels over Christmas, as we are, is pretty cowardly, but if you can’t see the way ahead, slow speeds are usually safer.

We do also rather agree with Chico Marx, this year at least.

Charles Gillams

Monogram Capital Management Ltd

River Deep, Mountain High

Welcome back Mr. Powell - so what is a good response to impending inflation?

After nine months or more the newly reappointed Fed Chair conceded the blindingly obvious: we have an inflation issue, along with the equally transparent need to tighten monetary conditions to quell it. At least he’s fronted up to that, unlike the position in Europe.

What diverts us is what the right response is. Some things are perhaps obvious: gold at least in sterling terms now has positive momentum again. But there is a tremendous volume of liquidity to soak up still, while stimulus will keep being pumped in for a long time. But fixed interest just looks hopeless, credit quality is plummeting, rates are rising, and returns are poor, even in high yield.

Are we clear of COVID effects?

Nor are we really clear of COVID effects. We are yet to pass beyond all the “emergency measures”. So here in the UK, VAT is still reduced, commercial evictions banned, and government departments are still showing that odd mix of budget destroying costs and below normal productivity. So, spending pressure will stay elevated for a good while. Tax rises on corporate profits and on labour through National Insurance hikes, will therefore start to bite, well before the last variant has caused another pfennigabsatze-panik. (spike/trough related panic)

Markets have also been jittery. In general, the buying opportunities just after Thanksgiving have held, which is a good sign. The subsequent gyrations have (so far) indicated a good weight of money ready to buy the dips. But there is little doubt cash is fleeing the overhyped stocks, which are far more prevalent in the US, than in the UK. The shift out of basic commodities is also apparent. So, I would still expect enormous cash balances to build up into the year end in the banking sector, albeit maybe not always in the right places. Any Santa Claus rally will be strictly retail elf driven; the old man is self-isolating this year.

Characteristics of this inflation

Our view remains that the expected high inflation is systemic, simply because of the structural damage and inefficiency inflicted by COVID. So, it maybe transient, but multi-year transient. In this case while the seasonal moves down in energy prices will be a welcome relief, assuming Northern Hemisphere temperatures stay around seasonal norms (and that’s what mid-range forecasts are indicating) - it is not a solution to the inflationary pressures.

Nor do we see the any unwinding of the inventory super cycle caused by the holiday season and the ending of lockdowns, all at once, as having much beneficial impact on price levels.

Businesses all want inventory and will keep rebuilding it across their full ranges for a while. After all, right now holding stock has little financial cost attached.

See this article published by Markit.

Most corporates are at heart squirrels; it won’t be easy to break a new habit.

So how should we play this?

The bigger issue is how to play this - the received wisdom is pile into the US, probably the NASDAQ, while having a side bet on bitcoin or some less disreputable alternatives.

That’s where most investors knowingly or otherwise have their funds.

NASDAQ may churn as dealers try to create some volatility, but the overall (and in our view inflated) levels will most likely remain.

This Omicron variant episode at least has halted the IPO madness, and the whole SPAC nonsense is washed up. Sadly, not a big surprise to see portly old London has just tried to catch a train that left the station last year.

The longer view

But it is a bubble we think - our icf economics monthly looks in more depth at how these played out the last couple of times. Not pleasant, but oddly familiar.

NASDAQ and Bitcoin may yet scale new peaks, but the river below is very deep. Perhaps that old affection for base gold is not just nostalgia?

Time for some year end reflection.

Charles Gillams

Monogram Capital Management