Tripod

We take a look at three things that move markets: macro, politics, and mood.

We have an inexplicable market rally to explain. On bonds we remain wary and we also take a look at the Keynesian attitude to inflation.

The obvious explanation for the market rally is Santa Claus, or perhaps in more mundane terms mood. The markets (in both bonds and equities) have had a beating, the shorts were satiated, the cash piles vast, and markets had simply had enough.

So, back up like a bungee it went, the heaviest fallers often bouncing back the highest.

Inflation (still)

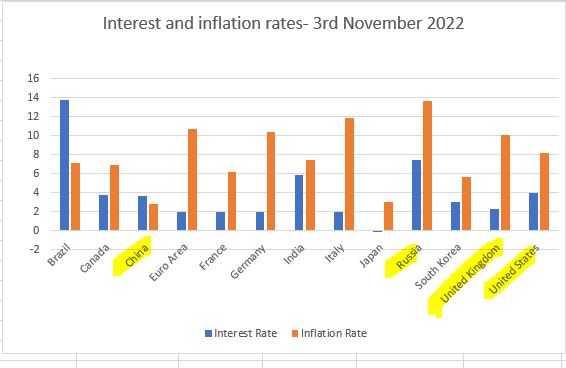

We can talk endlessly about peaks and plateaus for interest rates, but we still don’t see any measures likely to get inflation back to 2%, for several years. But it seems that doesn’t matter now. The so-called base effects, the softness in commodity prices, the excess inventory (rather than prior shortages) all mean inflation will fall, and for most, for now, that’s enough. Regardless of how far or how long it takes.

Indeed, there is some realisation that if prices are really rising at 10%, it is best to buy now, not wait for higher prices.

And for a lot of service-based firms, capacity is indeed short, and they feel free to ram through price rises, to open up their gross margins, assuming (rightly) that if everyone else is doing it, and no one really knows their true cost bases, they are winners. As they are.

And as we long predicted, the elimination of competitors, and monetary tightening, leaves big firms free to expand into a void. After all they have faced flat prices for a long time, so the chance to move prices up is most welcome.

Seeing it like Keynes

So, it is perhaps useful to remind ourselves of the Keynesian view that inflation is “a method of taxation” which is used by the Government to “secure the command over real resources” in the same way as ordinary taxation. So, he was really not a fan.

How then do we explain the UK Treasury (all notional Keynesians) using abundant deficit financing to sustain already overheated demand?

Well in short, we don’t, it is just politics. By raising pensions and welfare in line with inflation, the UK Government is acting as if they need to secure the economy against high unemployment and a recession. The classic ills Keynes addressed.

Although (so far) neither of those disasters is evident anywhere, except in their own predictions. Older hires are rising which is generally a sign of overheated labour markets, looking for marginal supply.

Which is quite neat, as if those evils don’t arrive, the policy clearly worked and if they do, well our politicians tried their best. Given the shambolic recent failures of Treasury predictions, that they have any ongoing credibility is really quite remarkable.

But that process also embeds the long desired extra taxation, resulting from the inflation they are not quelling. There being no limit to how much Governments want to spend, there is equally no limit to their appetite for tax.

All of which nicely pings the pinball back to the Bank of England, which was so very unhelpful in the early autumn, so let’s see how they do now? Will they truly show the steel of the Americans or the Micawberism of the Europeans?

And interest rates (still)

The interest rate (beyond the short-term market rally) is therefore still the big decision. If inflation is here to stay, it all depends (once more) on the US, and on what reason the Federal Reserve has to stop tightening, even with high inflation. We can’t see one. Albeit we are very reluctant to guess there is none, with such strong markets. And it maybe they just had an arbitrary target, which they have now reached.

From this page on the Vanguard website

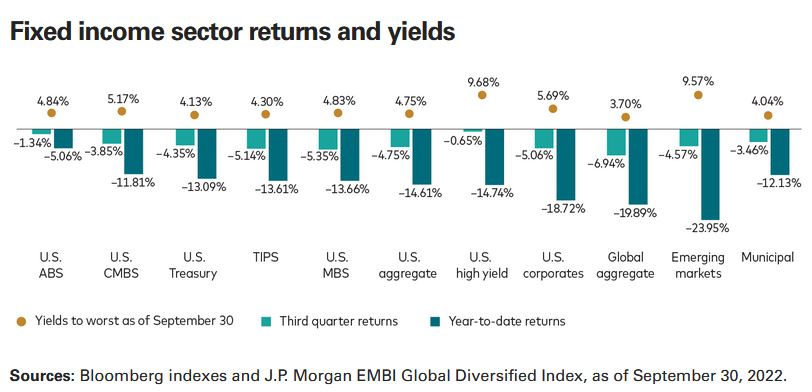

However, that gives us a trio of reasons (apart from the rogues’ gallery above) to still avoid bonds.

- If inflation stays elevated, bonds are a rip off, as they have a negative real return.

- If the Fed stays strong, bonds are a rip off, because base rates are still rising.

- And if the Fed wins, but others fail, then bonds are a rip off, because the dollar keeps rising (and hence other currencies fall).

In summary the only bonds that look attractive to us are still short-dated US ones. Which is not really new, nor does it make long term sense, with strongly negative real rates still. Bonds by definition can only have a real return when rates exceed inflation, either due to falling inflation or rising rates. And we don’t see that crossover for a while.

A THREE-LEGGED STOOL

So, we return to that trio: macro, politics, mood. Political uncertainty is much lower (for the next two years) in both the UK and US, and perhaps is not that unstable in Europe either, although the Ukraine war could still change that significantly.

Even China seems a little less keen on confrontation.

Macroeconomic factors really do not yet feel encouraging. It is way too early to declare victory over inflation.

Paradoxically when inflation is clearly beaten, earnings declines will then set in, as pricing power recedes. The failure to see that decline, will indicate inflation remains a threat.

And finally, mood - yes, the mood feels good, for now, although how long that remains is as much psychology as anything else. But if bonds do start to slip, don’t expect the party to keep going for long. Nor will recent dollar weakness persist.

The overall view seems to be that the handbrake turn has been completed, we may slide a bit more, but we won’t spin again.

But that assumes we know a lot about the track and conditions - do we?

PICTURES OF MATCHSTICK MEN

I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

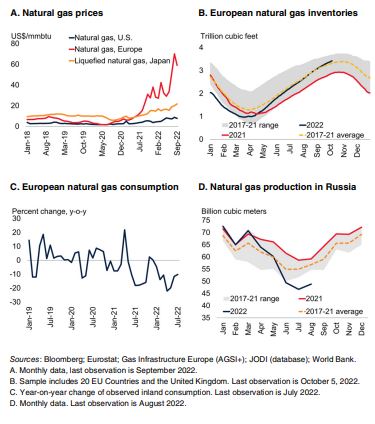

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

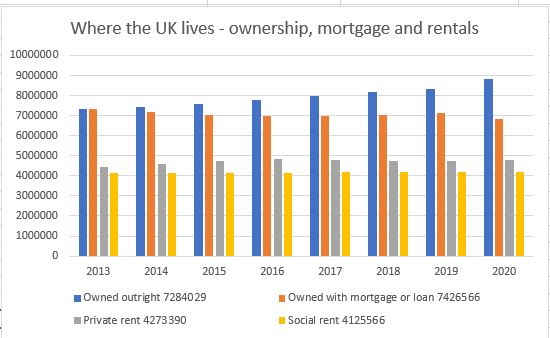

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?

Lend me your fears

I come not to praise Kwasi, but to bury him. This is an explainable, predictable but probably futile coup in the UK Tory Party, along with more King Canute from Bailey of the Bank.

But in markets there is abundant good value, but with few clues on how, or at what cost, inflation is to be tamed. Or indeed what may escape this time.

Political Manoeuvres

We have long noticed the Tory party’s splits and factions, broadly between the left and the right wing. This was a chasm Boris was uniquely able to bridge, by talking right, and acting left. The puzzle, as we noted, was why the left would bring him down to replace him with a right talking right acting Prime Minister. The preference was for a Blairite Conservative, low tax, high spending, but a steady reformer, with a lethal penchant for foreign wars and illogical hatred of the Euro. After Kwarteng’s departure, the Tories now have the doomed high tax big state faction back in charge again.

Hence the need for a pretext to overrule the party members and threaten Truss with the ever-gleaming sword of Damocles, held by the 1922 committee - we are back where the plotters wanted to be after Cameron – with the neutral Hunt playing the safe stooge to hold the fort.

Unlikely to win the next election

It foretells the inevitable party split – but we had never seen another Tory term as possible, regardless of the leader. Nor have we ever seen Keir Starmer as needing to do anything but sit tight and keep a grip on his party. If he is also spared the crippling cost of a really tight General Election, he can now face down the Trade Union money men as well.

As for Kwasi, if he stays the course, his troops will yet triumph at Philippi, he is by far the best the Tories have just now and looks to be the future. He has understood that if you fail to free the supply side, in a new productivity revolution, the current national decay will just go on, as it has for twenty years or more. But he has also not torched his future, Miliband style, in the wrong leadership move.

Will any of this stem the attacks by market traders? I doubt it. Will any of this forestall the inevitable sharp rise in interest rates, I doubt it. Or indeed stop ongoing sterling losses. To quell inflation requires interest rates above inflation, you can’t bear down from below. It remains daft to think UK interest rates can be effective whilst remaining underneath US ones either, as we said in our previous post.

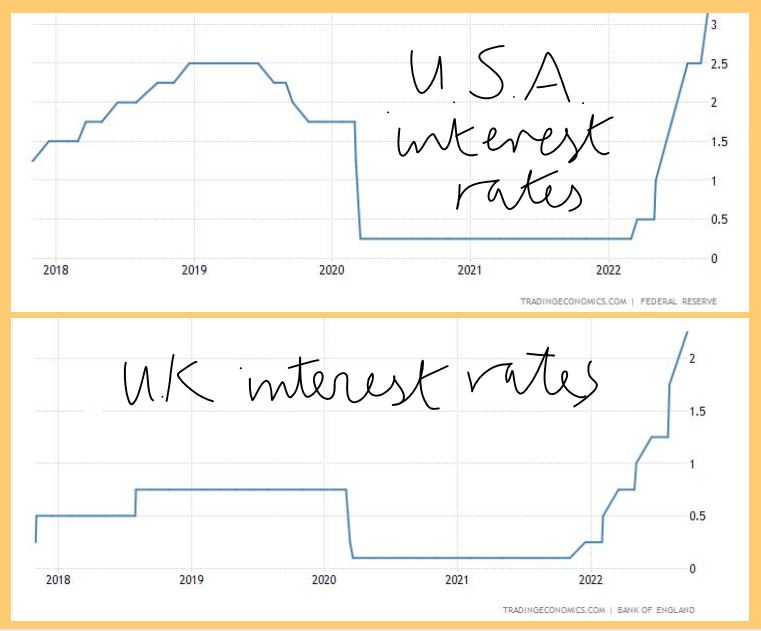

Both clipped from this site, and set out side by side. The core data as is cited below are from the Federal Reserve and the Bank of England respectively.

So, what is the shape of this next recession?

I think we are now starting to see it. Not that much unemployment, the current tight labour market, without addressing increased workforce participation, is going nowhere. Nor is a secondary residential property crash certain. That is so last century, both areas are now far more heavily fortified sectors than they were last time. And both are now designed (and legislated) to be fiercely inflexible downwards. That is what the current labour market (and our dire productivity performance) is telling us.

House prices are propped up by a very generous market backdrop, ongoing vice like planning, high land taxation, tons of liquidity and a deep political fear of the consequences of a collapse. For all the moaning, borrowers are still able to load up at negative real rates, with a highly competitive mortgage market and generous fixed term offers.

But do expect a general slaughter of small businesses (or rather the current collapse will go on despite the various support packages). Expect weak margins for UK based firms, ever more exposed to competition, from far more generous and protectionist states.

WTO rules really are in tatters now and routinely ignored by powerful countries like the US and Germany. Expect a resulting fall in quality both in goods and services, again a continuation of current trends, as globalisation retreats.

But remember too, that so far, we do have inflation, but not a recession. The current dislocation is caused by a resource switch towards savers, who at all levels have had slim returns for a while, and we will now instead punish borrowers, who have had an absurdly easy, subsidised, inflationary decade.

The big picture, overall

Meanwhile in the energy world, a resource transfer is taking place from energy users to energy producers, who have likewise had a thin time of it. That those energy producers are places like the US, Russia, Saudi Arabia, Iran, Nigeria, Brazil, is a remarkable own goal for Europe.

But it is neutral for the world.

Indeed, much of those surplus funds will now be collected as various direct and indirect tax revenues, or to pay down debt, or as new investable funds, or distributed as dividend payments, but very little of that vast energy price transfer leaves the known universe.

For Europe, however the decline happens with the slow loss of productivity, plus the demographic torque. Meanwhile borrowing our way out, is suddenly becoming far more painful.

The political turmoil is ultimately from this change, and the longer states borrow more and pretend nothing has changed, the less effective will be their remedies. And indeed, the more the big efficient producers, like China, the US and Saudi Arabia will thrive. Neither more debt, nor protectionism will solve this, nor indeed will more global military adventurism.

Confidence is understandably damaged

Given that backdrop the mood music is damaged just now. Markets are trying to spark rallies, but with no real confidence yet.

Investors sense there is value, but with too little data to know where.

But whisper it quietly, Santa Claus is due, and the market mood is not quite as bleak as events suggest it should be.

Into Broad, Sunlit Uplands?

This week has included a major but baffling fixed interest event in London. And we include some thoughts on the novelty of a conservative prime minister for the Conservative party - but first, the shape of the coming recession.

Who Survives in the Coming Recession?

It may help to see this recession, as just the reversal of the COVID boom, paid for with debt and deeply inflationary; in which case what should it look like? The ultimate aim will be to unlock labour markets, where we said (in our newsletter of 20-3-21) that COVID would do most harm.

Unlike traded goods or commodities or liquid assets, there is no simple snap back available without pain, because labour pricing is inflexible downwards. Indeed organised labour has worked hard to embed that inflexibility, notably in minimum wage laws, and the crippling of the hated gig economy.

Certain capital assets too are stranded and inflexible, but probably not most commercial (or residential) rents. Large single purpose buildings may be vulnerable and we feel, so is quite a lot of owner occupied residential property, whereby recent unearned gains will now need reversing.

Labour costs have two available paths. Either the 40% of working age adults who have now withdrawn from the labour market must (in some measure) return. It is their ongoing withdrawal post COVID that has hurt most. While COVID has also created (mainly in the public sector) a lot of extra staffing that is hard to step back from, especially in healthcare, which further depletes the available labour pool, and must also be reversed. Reducing labour taxes also helps.

Possible business failures

If not, there may instead need to be widespread private sector business failures. The third option, a speeding up of capital investment to substitute for labour, has somehow failed to be either fast enough or effective enough. It seems just too hard for businesses to predict demand paths, to commit to such expenditure. Cap ex is all about confidence, which is absent.

How then to measure if this labour reset finally happens? Well it looks as if job creation will need to go into reverse, with a net two quarters (at least) of contraction. There are plenty of businesses to fail, speculative and derivative loss making tech for a start, retailers of goods who over extended in the supply chain inspired boom, service sector spaces, where the current surge has drawn in capacity well in excess of long run demand, will all get hit.

As will everyday businesses, that have net margins that can’t withstand the double figure interest rates demanded of sub prime (i.e. now most SME) borrowers.

Paint that template over where the most savage equity falls have already happened, it fits quite well. But it is by no means universal, if IP, not labour matters, or labour can be off-shored, it is in a better place.

Although as jobs disappear, so the strain reaches further into total consumption and demand.

Fixed or Floating.

What of fixed income? Well we took the view early this year that you can’t stand in the way of an avalanche, unless you hope to surf it. So we kept clear, and still are.

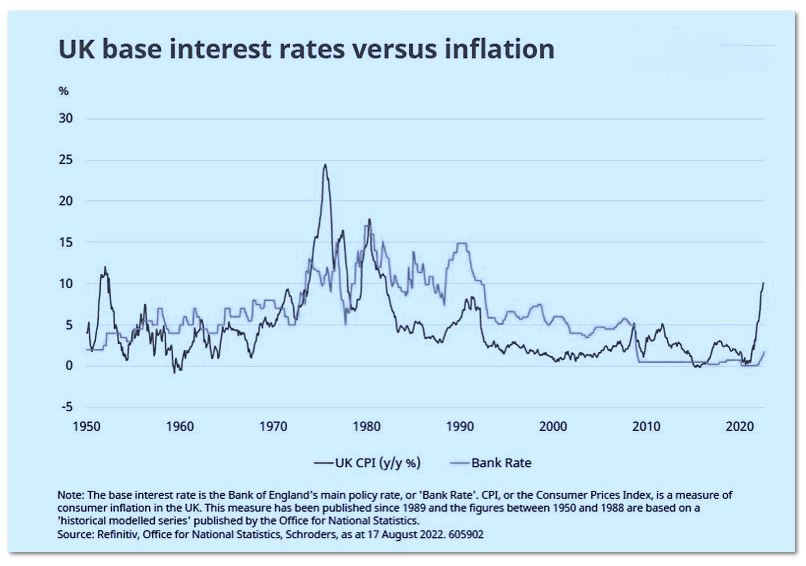

Source : this page

It was a very well attended fixed income conference in London this week, so credit is clearly back into portfolios, big time. My worry was the Table Mountain (or Brecon Beacons or Grand Canyon) graphs. All of which were steep sided, but flat topped, and on all of which, just now, is the exact point when lungs bursting, you climb the last butte, to see a vast sunlight upland.

Really? Why? No idea, but somehow the collective belief is rates top out circa 4% and then fall.

Certainly not if they mirror the inflation path (see above), that gap is now vast twixt interest rates and inflation; it will close - it has to. However we see more rises, not a near term peak and also far slower falls, than the market does. Reason? It is labour inflation that now drives it, and it won’t roll over soon.

Unless that is, the rate rises so far have done real damage and rates are then cut to mitigate a severe recession. If that’s the expectation (and it may be) you really don’t want equities at all, not even energy, the year’s bright spot.

So the question is, are high yield bonds now cheap?

Well yes, and quite attractive; defaults at the rate now implied, are unheard of. But if that odd plateau graph of rates is wrong, everything has yet to get even cheaper. That’s the rub. And that is why, for now, bar floating rate, secured, we are still not going into credit. And also because global interest rates must eventually align, so the dollar’s ongoing strength is a bad sign, as that will have to reverse too. This makes dollar assets themselves now dangerous.

The same dilemma is true for equities, yes, high quality, mid-size companies look cheap, the FTSE 250 is down some 20% in a year, almost as bad as the NASDAQ, whereas the FTSE 100 is modestly up (a distinction shared only with the Nifty 50). But again, we thought that value was emerging in the summer, but sadly not so; the market still sees a viscous earnings contraction ahead.

Which brings us back to employment, either it must fall, or participation must rise, and I fear we expect a fall, which seems more likely. This cycle, in the all important labour markets, still feels a long way from done.

New Broom

As for Truss, well talk of growth at the inept and hidebound Treasury is a nice change. As is that of getting the country working (spot on). This is core free market stuff. Has she the votes? Pretty sure she has, it was odd for the left wing of the party to eject Boris, who his actions showed was one of theirs. To unseat another leader would guarantee oblivion, so they must back her.

Worrying about fiscal rectitude, for a two year government, seems oddly implausible too. Yet she still fell prey to the old belief that governments (and higher tax) solve everything with her energy package, least of all can that solve demand based inflation. That is for Central Banks to do, and as ever, they are getting no help from the rest of government.

Does this suggest a big US rate hike this week? Not sure, we are much more seeing the end point as rather higher, than faster near term rises. We kind of think the Fed has made their point already.

The Turn of the Screw

So, we have Truss now. The continuity candidate, not the dull man who would take away our sweeties. But also, the same old Fed, keen to do just that. And its time we took a look at Starmer, the other continuity candidate and an excellent book on him; required reading for serious investors.

Otherwise, it is always a good summer when nothing changes. Markets swoop and soar vainly trying to catch our attention, but the reality remains that rates have to rise enough to destroy the excess demand that causes inflation. And they have to rise to equal or surpass that level, eye-watering as that prospect is. It will not be over until the US jobs report goes negative, and stays negative; anything less is prolonging the pain.

Presentation over substance

But this is a time of intensely political Central Banks, headed up by people without a grounding in economics, but a lot of “presentation skills”. They will be dragged kicking and screaming and smiling to do what they should have done last year, hoping vainly for some supply side reform or windfall to help out. But largely still facing the exact opposite, populists who think subsidies “cure” or ameliorate inflation.

Markets are oddly buoyant; they get like this at times, but we see that as a mix of delusion, the self-reinforcing strength of the dollar (be very careful of that one, it is a new bubble) and the spluttering remnants of buying on the dip.

But be under no illusion, Central Banks trying to guess where the economy is going is like fly fishing with a jar of marmite. Entertaining, but highly unlikely to catch anything.

Truss: Issues and options

Truss meanwhile looks like a re-run of Boris; it won’t be quite that simple, but it looks like more style over substance, a different set of lobbyists, but nothing really changing. The idea either she or the EU can afford a bust up with the UK, just shows how silly markets can get.

Some of her programme may make sense, both the NI (tax) rises, and the corporation tax increases were badly timed and should be reversed, given inflation is doing the hard work already through fiscal drag (or frozen tax thresholds).

The rises were proposed when we were exiting the COVID crisis, but before we understood the energy one. We said so the last time we wrote to you.

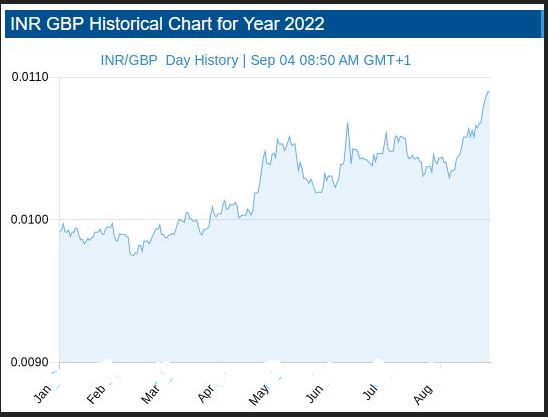

Ditching a few Treasury backed white elephants (HS2, Freeports, the crazy fiddling fetish on capital allowances) would do no harm either, but overall, the market’s verdict is clear: fiscal responsibility is still a long way out. We can all see how sterling has collapsed against the dollar; it is less clear why it has fallen against the Indian Rupee or the Chinese Yuan.

Source: See this website for all the daily data.

A book to read for all investors

So to Starmer, the likely next UK prime minister, where we need to pay more attention. Both on his mindset and on why the Labour Party hates him so much. Which in turn explains why (and with the Tories fatal ideological split heading them into Opposition), he is so fixated on party control.

Oliver Eagleton writes very well. His recent book The Starmer Project looks at four episodes, his left wing legal start, his transformation into a Tory enforcer with a penchant for exporting judicial expertise to the colonies (don’t laugh), his alleged machinations to back the People’s Vote nonsense to bring Corbyn down (pretty dense stuff, even now) and his use as the Blairite stalking horse to put a stop to Corbyn’s chiliastic tendencies, (which also gives you a trigger warning about a light dusting of Marxist ideological claptrap).

So Starmer is all about what works, which would make a nice change.

We’re looking at a very global mindset, apparently quite a strong Atlanticist outlook, keen to work with European authorities, but aware that the Brexit boat has sailed. An interest in devolving power down, but keenly alert to the risk of anarchy that entails. Indecisive, a Labour Party outsider (on his first election in 2015, apparently his nomination had to be held back to ensure he had the minimum length of prior party membership). Starmer is not exactly collegiate, but he has run a Whitehall department (as Director of Public Prosecutions) so not a loose cannon.

Very London too, Southwark, Reigate, Guildhall School of Music (sic), Oxford for post grad law, Leeds as an undergraduate. So should at least know where the Red Wall was. But lest you relax too much, a total ignorance of economics or business, let alone how to create growth. It won’t be easy.

And what about Markets?

Well for a UK (or non US) investor you only had one question this year. If you ditched the local currency you made money, and if you held onto sterling you got hit. Our GBP MonograM model is doing fine, it got that one big call right: kind of all you need. If you are a dollar investor, outside of energy your best place was cash. And our USD model took longer to spot that shift. As for active investing, sadly pretty much the same, the dollar is the story, or dollar assets. All of which perhaps makes dollar earners in the UK look cheap still.

But for now we see the story as a currency one, and at heart that is just about the timing of tightening interest rate spreads. The widening of those spreads has caused the recent havoc.

So when (finally) the European and UK Central Banks abandon futile incrementalism and get the big stick out, that will call the turning point.

Charles Gillams