Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

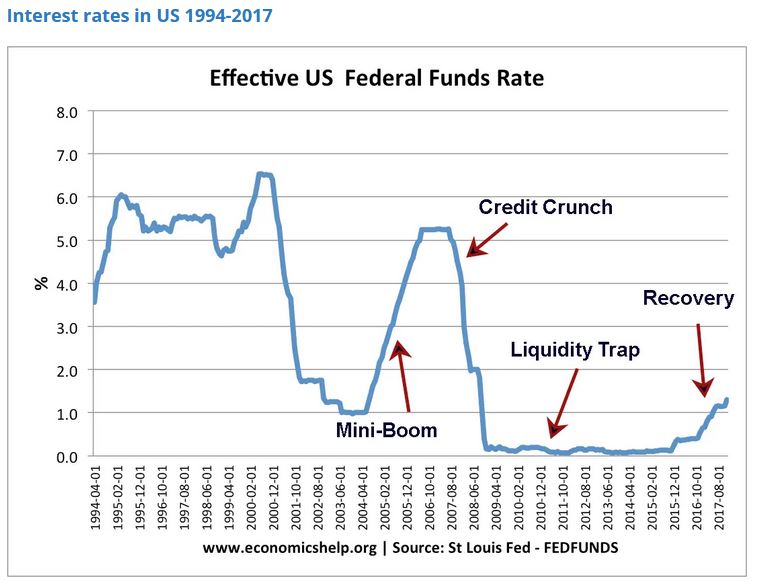

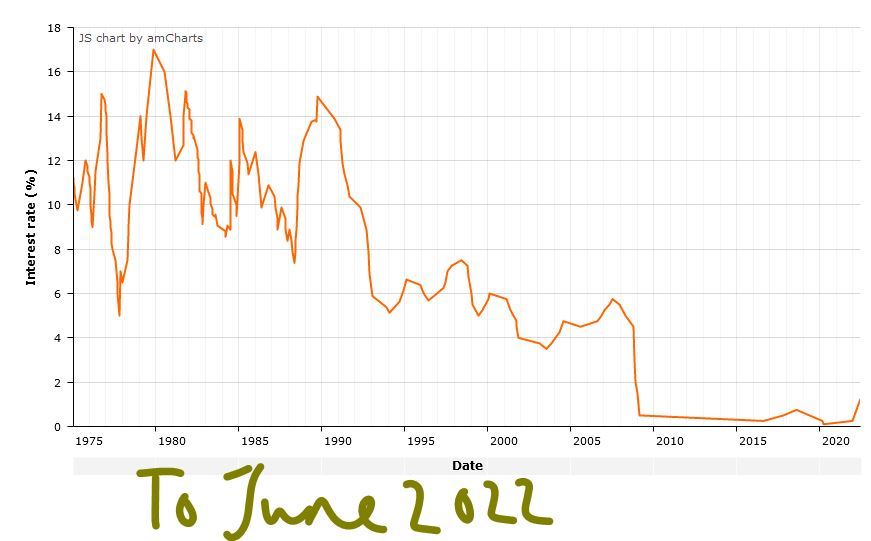

Interest rate cycles

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

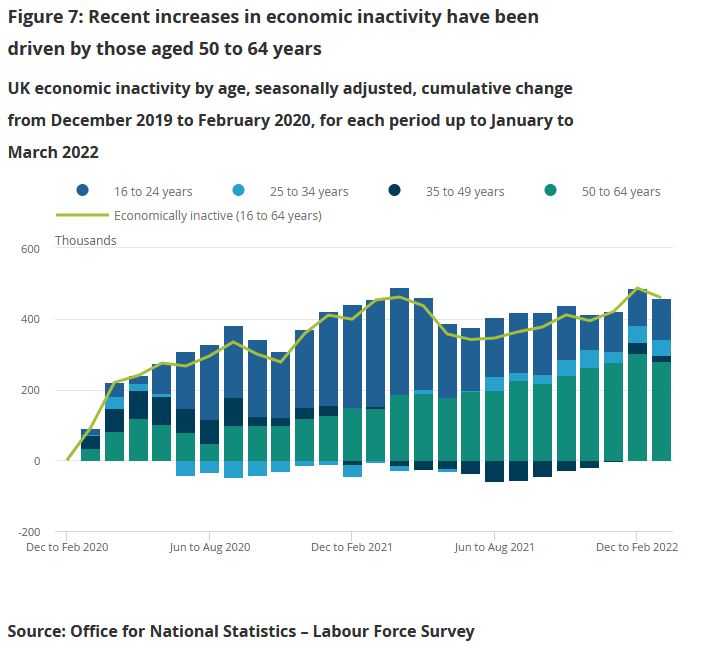

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.

He who pays the piper

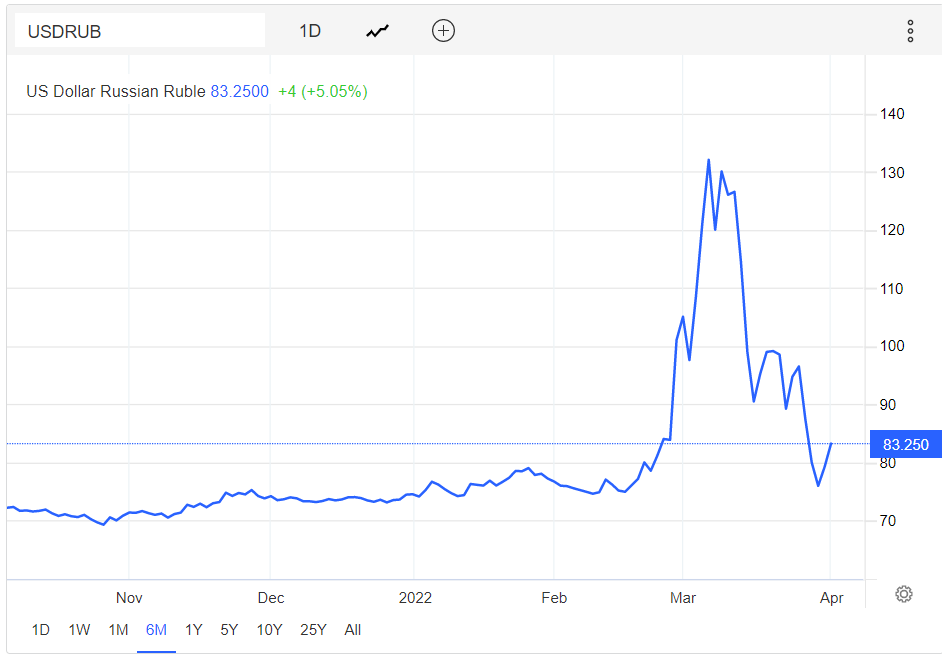

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

DETONATION OR ROTATION

Two big market forces are at work just now, one is rotation out of the low interest rate winners, to wherever we go next, the other might be something more spectacular.

Enough of the market still sits in the “don’t know” category, to make everyone uneasy. The VIX is high.

So, what would cause the more explosive outcome? Traditionally higher rates divert more of the profits of indebted companies to banks and bondholders, so the theory goes, reducing dividends. Or at the more extreme level, this also makes refinancing debt harder.

This comes with a ‘second order’ impact, in that consumers or buyers also shovel more towards the banks, less towards the producers.

But none of this seems remotely likely yet, the world is awash with cash, and savings levels and interest rates have barely stirred from their COVID slumber.

Markets seem to be just talking about normalising, not slamming the brakes on.

Will we grow regardless of inflation?

The other big risk would be a failure of non-inflationary growth, which also seems unlikely. There are few practical signs of governments enacting the type of supply side restraint needed, we know. We still look for some self-restraint on how much governments seize in taxation; with high inflation taxes should be being cut, or thresholds systematically raised, but that’s also not happening.

The ‘idiot populace’ as curated by the media, constantly wants more supply side restrictions, greater consumption and lower prices, as if this was all somehow available; it is not. The worry here is that governments having messed up the big issues, give way to yet more populist demands for the impossible. At the same time, markets are also getting a little less keen to finance such nonsense or, being markets, raising the price at which they do so.

Well, all that is possibly true and has been happening for a while, but the old theory was that innovation was too fleet footed for any of that stuff to matter much. This is getting a bit tired, but broadly still seems to hold.

What if Ukraine does erupt?

So, the third detonator is in Vlad’s hands. Is a reverse Barbarossa coming down an autobahn near you? Well let’s assume yes, because he’s finally lost it. It is still fairly clear that if he steps onto NATO territory his army is in trouble, US and NATO airpower will rapidly outgun him. So, I discount that. But perhaps Ukraine does indeed end up like Belarus. China will support Putin, so the UN is irrelevant.

Then what? Well, a nation the size of Spain gets locked out of European commerce. Not important. Defence spend goes up? Well, some would say ‘about time’. Germany can decide to burn coal or nuclear or freeze, see previous answer. Come to that, so can we.

Given Russian gas must go somewhere, a bit like Iranian oil, it probably goes to China, which then trades it or cuts back its own Far East imports. Gas as we all know, can’t be stored for any useful length of time. Russia needs the earnings from it, so it will emerge on the market somewhere, at pretty much the current price.

It will be messy, it will create hard choices, but Russia is well on its way to autarky already, it can certainly live without dollars. Is this really a detonator? On its own, I doubt it.

Where is the rotation?

So, we still conclude all this market reaction is rotation, and it is out of overpriced US equities, where Biden created the biggest inflation bubble by far, and where interest rates are rising faster than elsewhere in the OECD. Hence, we see the hazard as mainly still on Wall Street, and to a lesser degree to the US economy. We’re looking at rising rates, a strong dollar, increased detachment from the global economy, and none of it helps earnings, but nothing is catastrophic either. The US (unlike the UK) wisely seized the chance to be energy independent.

But even so, we are not yet that concerned, valuations in the US are still extreme, as many sets of earnings seem to show, once the market looks at forward guidance, it shudders, and prices fall. A lot of built-in growth is needed to get price earnings ratios back down to earth, and that’s what’s being hit just now. To use a forty or fifty times earnings multiple, needs a lot of confidence about the future. That stretched temporal certainty is now lacking.

This is not that unusual for a rotation, but in that case, markets will bounce, and that will suddenly move a lot of funds off the side lines and back in. Where is that process now? Well going back to the Jan 27th low is causing some excitement. But we are not sure even that’s a disaster. Overall, the taking out of that and the October 2021 S&P low, won’t be fun, but the market still had a heck of a run up last year.

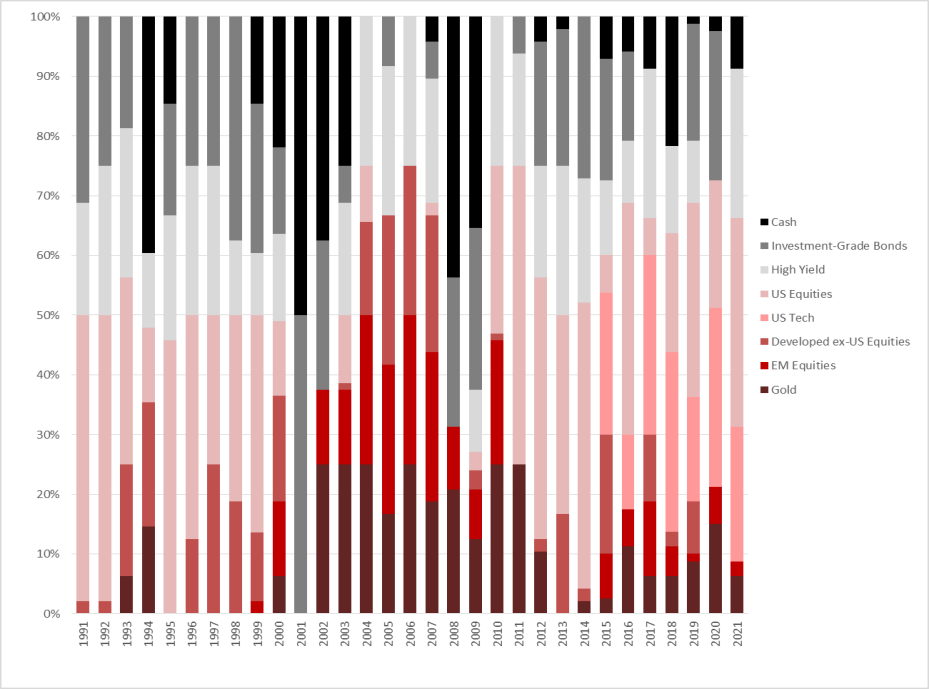

Have a look at where our MonograM investment model allocates funds based on momentum, over the last three decades, the US is absent for significant stretches. We rebalance monthly, the next one will be most interesting.

And inevitably, we do feel cautious too, but it is about levels, not wipe outs. Rotation not detonation.

Charles A R Gillams

Monogram Capital Management Ltd

First Principles

Principles may be lacking in certain quarters, but we will start with the economics of inflation rather than Boris.

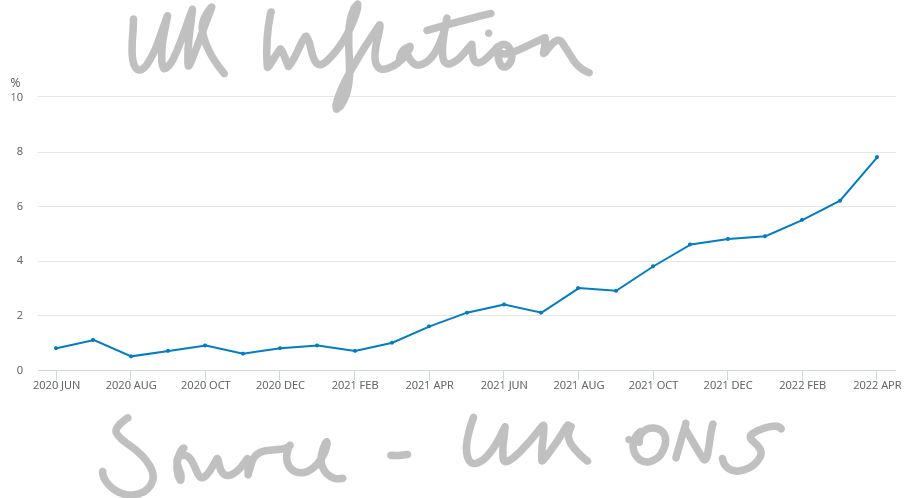

How much inflation and for how long?

Inflation is simply too much demand for the available supply, nothing more complex than that. So, you tame it by either less demand or more supply. So, unlike it seems most Central Bank economists, who it turns out are just statisticians, for ever looking back, we must project forward.

That tells us quite clearly that the inflationary imbalance will persist as long as demand stays artificially high and supply is artificially constrained. It is that simple. Forget the rest.

So as long as governments have fiscal laxity, along with negative real interest rates, they are pushing up demand. As long as workers won’t or can’t work, it will reduce supply, as long as economic activity is made less efficient by government action and diktat, it will reduce supply; end of.

So, at the very least Central Bank balance sheets must start reducing, which is not happening, stimulus must be fully withdrawn, which is not happening, and the old workers and their old ways of working must resume, which is not happening. Fresh capital can certainly change some of that, but it takes time.

Putin, Oil, and Geopolitics

What about oil?

This is the one item that alone might distort the picture. Which is positive, as we see oil prices falling in the summer. We also don’t see the West has really grasped what Putin is up to; in all the cold war style hysteria, he is possibly just after what he says. This is for the West to stop fomenting rebellion in Russia’s sphere of influence, and to be clear about NATO expansion plans, where there are indeed none in existence. He might have higher hopes, perhaps of a deal on Crimea in exchange for the Donbas, but we doubt it (or his chances of getting it are low). As might we, less interference in our politics would be nice; but see previous answer.

Nor is it that clear he is actually rationing energy; it is telling that Russia is reported as not able to meet its OPEC + quota, which at these prices is crazy. His oil industry will have been hit by sanctions, and the loss of Western expertise, and the Russian economy will also have suffered under COVID. A loosening of sanctions would really help him, for all his bravado.

If that reading is correct, as the situation winds down and OPEC+ winds up production, oil prices will fall, I would expect quite substantially. Much of the energy spike is self-inflicted, with nuclear plant closing or offline in France and Germany, and reckless price controls, having made using UK gas storage unattractive. All of these things can be sorted out.

Any possible good outcomes on inflation?

So, to inflation, well it won’t care much about the pinpricks inflicted by the likely interest rate rises now under discussion, especially if they creep up so slowly no one notices. It needs a unified 1% OECD jump to cool this lot down, and the ending of stimulus. Neither is likely. Closing the US printing presses, were it to happen, does also have interesting global impacts, as Andrew Hunt notes.

We see it all turning rather glacially, with a bigger slump in inflation, if energy prices fall, but then being generally persistent in the 3% area for the rest of the year. We expect to have both higher rates and inflation for a while.

All of this is mighty tricky for investors, but I don’t sense that just bailing out is right, nor that the actual interest rate rise will cause an enduring slump in all asset prices. Investors have to own something, or they will sit and be mauled by inflation.

And what of Johnson?

It is easy to read the current level of confusion from either side’s viewpoint. Yet to me, I see the normal factional infighting, the usual media exaggeration, some political mischief making, but still no reason to depose a Prime Minister with a very clear mandate and a large majority. Like any large party the Tories have the embittered and passed over, the Remainers and fans of state intervention and a volatile and raw body of new recruits in seats no one ever expected to win. Plus, no doubt a few opportunists who sense that the heavy lifting on COVID and BREXIT is done, and they can now seize all the prizes.

The Tories do need a reset; it would be nice if Downing Street left Ministers to govern and simply acted as a cheerleader. Not that I see that happening, leaders and their hangers on always lust after more and more centralization, more control. But until a compelling, unifying, plausible Tory opponent appears, I foresee no change.

And in a way with reform all but dead, with Gove’s last hurrah on ‘Levelling Up’ a damp squib, it may not matter who leads the Tories, they have very little real power.

It is quite odd how big majorities do so little good, and how poor party discipline is, when they have them.

Charles Gillams