First Principles

Principles may be lacking in certain quarters, but we will start with the economics of inflation rather than Boris.

How much inflation and for how long?

Inflation is simply too much demand for the available supply, nothing more complex than that. So, you tame it by either less demand or more supply. So, unlike it seems most Central Bank economists, who it turns out are just statisticians, for ever looking back, we must project forward.

That tells us quite clearly that the inflationary imbalance will persist as long as demand stays artificially high and supply is artificially constrained. It is that simple. Forget the rest.

So as long as governments have fiscal laxity, along with negative real interest rates, they are pushing up demand. As long as workers won’t or can’t work, it will reduce supply, as long as economic activity is made less efficient by government action and diktat, it will reduce supply; end of.

So, at the very least Central Bank balance sheets must start reducing, which is not happening, stimulus must be fully withdrawn, which is not happening, and the old workers and their old ways of working must resume, which is not happening. Fresh capital can certainly change some of that, but it takes time.

Putin, Oil, and Geopolitics

What about oil?

This is the one item that alone might distort the picture. Which is positive, as we see oil prices falling in the summer. We also don’t see the West has really grasped what Putin is up to; in all the cold war style hysteria, he is possibly just after what he says. This is for the West to stop fomenting rebellion in Russia’s sphere of influence, and to be clear about NATO expansion plans, where there are indeed none in existence. He might have higher hopes, perhaps of a deal on Crimea in exchange for the Donbas, but we doubt it (or his chances of getting it are low). As might we, less interference in our politics would be nice; but see previous answer.

Nor is it that clear he is actually rationing energy; it is telling that Russia is reported as not able to meet its OPEC + quota, which at these prices is crazy. His oil industry will have been hit by sanctions, and the loss of Western expertise, and the Russian economy will also have suffered under COVID. A loosening of sanctions would really help him, for all his bravado.

If that reading is correct, as the situation winds down and OPEC+ winds up production, oil prices will fall, I would expect quite substantially. Much of the energy spike is self-inflicted, with nuclear plant closing or offline in France and Germany, and reckless price controls, having made using UK gas storage unattractive. All of these things can be sorted out.

Any possible good outcomes on inflation?

So, to inflation, well it won’t care much about the pinpricks inflicted by the likely interest rate rises now under discussion, especially if they creep up so slowly no one notices. It needs a unified 1% OECD jump to cool this lot down, and the ending of stimulus. Neither is likely. Closing the US printing presses, were it to happen, does also have interesting global impacts, as Andrew Hunt notes.

We see it all turning rather glacially, with a bigger slump in inflation, if energy prices fall, but then being generally persistent in the 3% area for the rest of the year. We expect to have both higher rates and inflation for a while.

All of this is mighty tricky for investors, but I don’t sense that just bailing out is right, nor that the actual interest rate rise will cause an enduring slump in all asset prices. Investors have to own something, or they will sit and be mauled by inflation.

And what of Johnson?

It is easy to read the current level of confusion from either side’s viewpoint. Yet to me, I see the normal factional infighting, the usual media exaggeration, some political mischief making, but still no reason to depose a Prime Minister with a very clear mandate and a large majority. Like any large party the Tories have the embittered and passed over, the Remainers and fans of state intervention and a volatile and raw body of new recruits in seats no one ever expected to win. Plus, no doubt a few opportunists who sense that the heavy lifting on COVID and BREXIT is done, and they can now seize all the prizes.

The Tories do need a reset; it would be nice if Downing Street left Ministers to govern and simply acted as a cheerleader. Not that I see that happening, leaders and their hangers on always lust after more and more centralization, more control. But until a compelling, unifying, plausible Tory opponent appears, I foresee no change.

And in a way with reform all but dead, with Gove’s last hurrah on ‘Levelling Up’ a damp squib, it may not matter who leads the Tories, they have very little real power.

It is quite odd how big majorities do so little good, and how poor party discipline is, when they have them.

Charles Gillams

Sea change

A trio of influential knaves to worry about this week, united by a belief that “this time is different”. Well pantomime season is behind us, however we can still all shout “oh no it isn’t”.

Boris seems to be the least of our problems, if the greatest of villains, for the scurrilous crime of enjoying himself, what a rat. While Powell is providing an increasing threat to the poor and exploited across the globe by generating financial instability, and the lamest of the lot, Lagarde is just repeating a political line. The Euro zone debt figures look like this. A sharp rise from an already overstretched position, but still benefiting from falling rates, so when that rate line turns, the problem will really bite.

Will markets ever trust the Fed (if they did this time, outside the gilded denizens of Wall Street) again? Hopefully not, the trouble with putting administrators in charge of Central Banks is they rely only on historic facts, it is in the job description, that’s what they polish, hone and serve up.

But the economy is dynamic

The mismatch is that the economy is dynamic, and has no printed rule book, beyond that of the rocket; what goes up, must come down, immutable like gravity. And you simply can’t wish gravity away.

So, this Fed is programmed to repeat what it can see looking backwards, and all the obedient commentators on Wall Street who simply echo its nonsense, are of little use, except to fleece the gullible and to signal false comfort to one another.

Having said for most of last year “there is no inflation” they have turned on a sixpence, to say inflation is now out of control. Talking of six or seven rate hikes; they wish, just banker’s fantasies. Although markets, not surprisingly, are now suddenly jittery.

Investment implications

This week we went from feeling over 20% cash was too cautious, to feeling we had missed the boat on value stocks, back to feeling 20% cash was really just fine, all in the space of four short days.

So, because that sea change in inflation expectations was so abrupt, this is a genuine dislocation, we do see the NASDAQ and both the concept stocks on infinite multiples and the mega tech stocks on thirty- or forty-times earnings, as in some trouble, in a process that does not feel over yet.

There is a ton of selling, and the spoofing assets, including crypto, will be heading down, in a dip that feels likely to be around for a little while. But two things stand out, firstly until rates start to top out, this excess money simply can’t go into bonds, so what happens to it? Secondly if the market assumptions about Powell and Lagarde are both right, you are going to be paid handsomely to hold dollars, while simultaneously being charged to hold Euros. We don’t see that as sustainable either. One must be wrong.

Looking ahead

This is why Lagarde’s confidence in no rate hikes, feels like a lawyer’s bluff, as if currencies move, it won’t be her choice for long. While uninvested money, on which fund management fees are still charged, always makes asset gatherers nervous; it will all go somewhere.

That also leaves the question of how much growth we will actually see, as if it is below expectations, then inflation will be choked off, labour force participation will fall, US rate rises will run out of steam. There are already signs of that. While given the scale of market movements, the ending of bond buying by the Fed (long overdue) and even a modest run off of the balance sheet, will be pretty irrelevant, both are really drops in the financial ocean.

The froth blown off

So, the good news is we will see normal investment conditions, the froth blown off, bonds producing a yield, along with slower growth and moderating inflation, which we do feel will be backing off by mid-year. All of course will rather depend on the progress of COVID, because we still see (and have done for nigh on two years) this inflation is directly caused by COVID responses.

Reducing the output capacity of the economy, with no cut in demand, has to cause price rises. These price rises will exist everywhere COVID does, so trying to pin them to a single cause or location is not easy. They will persist until the demand/capacity equations correct, which with COVID is a multi-year task.

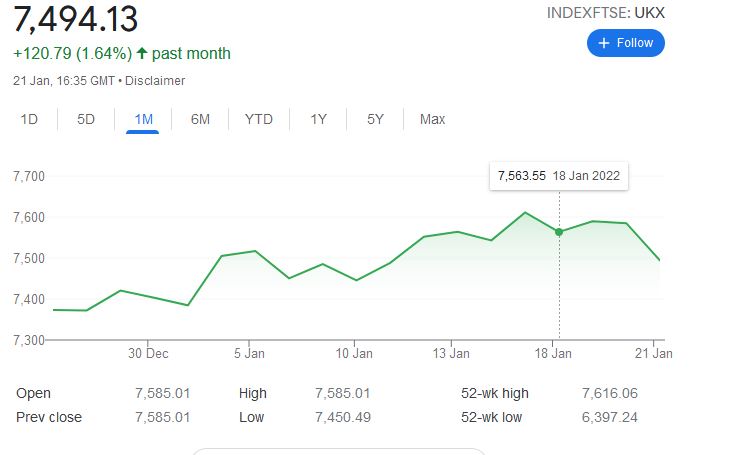

The FTSE finally gets a look in

So, a sea change yes, a market dislocation yes, but if it is as bad as is currently feared, with some big winners resulting in the financials, real assets and energy. All of which, on those fundamentals, still look to us good value, hence the visible support for the FTSE 100.

While if it is not that bad, sufficient money will flow into US Treasury stock, from low interest areas, forcing the dollar to rise, and rates down, until other areas are simply pulled along. So no, we won’t then be getting seven rises on this data and equity markets can start to relax.

And what of Boris?

Finally, Boris, now degenerating into farce, but much as we hate what he has become, we recognize one wing of the Tory party feels he is too right wing, while another feels he is too left wing. Both dream of replacing him with their own, but in so far as he splits the difference, the risk that the other faction wins, should keep him in office.

Either faction will demand more of his replacement than they can ever deliver, given that core fundamental split, so such a divide simply hands Downing Street to Keir Starmer. For now, I still feel he survives, and given his nature he will remain impervious to change, but remarkably adept at promising it.

Sterling seems notably unfazed by it all.

Charles Gillams

Monogram Capital Management Limited

NO NEWS?

Staying on the sidelines till Burns Night still remains rather attractive. Christmas as ever brings thin trading, a lot of speculation and some brutal repression or natural disaster, in a far-off land. Although these days ‘far off’ could include Lille or Llandudno, both pleasantly calm and now even sounding a bit exotic.

But for all the noise, has the investing world really shifted? We did kind of have a Santa Claus rally, but with COVID about, he got shoved back up the chimney pretty fast. Meanwhile Powell was transformed into Scrooge with the terrifying thought that in a massive boom, with high inflation, perhaps he didn’t need to be reinvesting maturing state-owned bonds?

What we see is confusing data, a fair bit of economic damage from Omicron, some people not wanting to be ill, but mostly from a Pavlovian reaction to the very idea of COVID the Sequel. Fortunately like most sequels it was a pale imitation, we knew the cast, guessed the plot, will leave the show early.

Inflation - where have we got to?

Peter Sellers in The Pink Panther films asks an innkeeper if his dog bites; having been assured it did not, the dog snarled and bit him. On remonstrating he was kindly informed “that is not my dog”.

Well clearly Powell, Biden and a few other innumerate players wish to tell us the same about inflation.

Sadly, and transparently, it is their dog, and equally clearly it will bite.

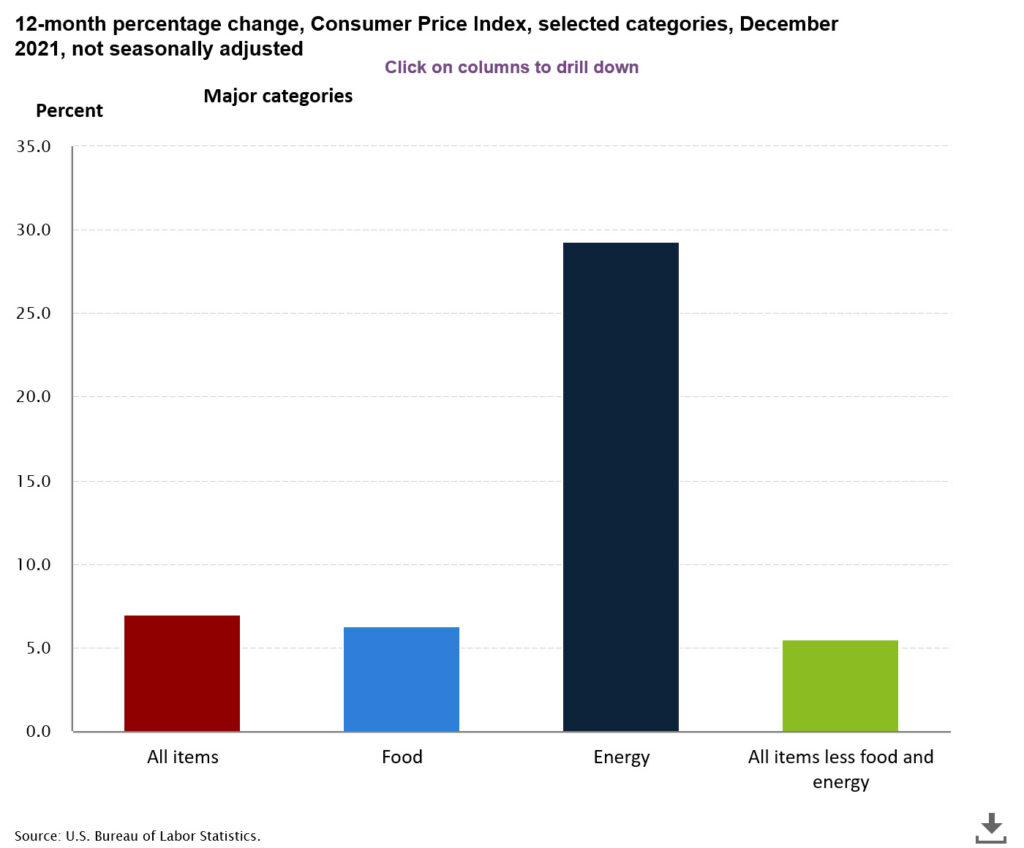

There is an econometrics game of saying there is no inflation (except in; used cars, housing, fuel, take your pick really). That is like selecting the first brick to burst in a failing dam, and saying that the structure was fine, except for this one defective brick.

Therefore, the first sign that (finally) the ‘just a blip’ inflation nonsense has been retired must be good news. This comes along with some evidence that sensible Democrats (well at least one) have spotted that more money for less work in order to buy fewer goods, is probably not actually helping poor American families.

The energy question

We will sort out energy prices, if governments are sensible. So, if, like President Xi, we do bring back a bit of stand by coal capacity, for next winter’s peak. There is plenty of coal around. We have not been too short of wind around here either, of late, the UK also has a good number of salt caverns, which we can (as we used to) stuff with gas, rather than believe the idiots in the Government who felt it was too expensive to have cheap summer gas on stand buy. While at 80 USD even the Saudis will pump more, the Permian certainly will.

So that just needs a bit more planning, a bit less spurious forecasting to within three decimal places, a bit more building in a margin for error, whilst hopefully all the Whitehall types who claimed they were fostering ‘competition’ and could ‘cap’ prices of a global commodity, get moved on (or better out).

It is still next winter’s answer, none of this will help this year much. Most capacity for the next two months is sold.

So, what will Powell do next?

All of this leaves us with massive liquidity, poor labour market participation, excess demand and the normal reaction to all that: inflation picking up and negative real yields slowly being eradicated. What is not to like? Demand plus capacity usually equals growth.

While Powell may have failed to grasp the intricacies of inflation, I am not expecting him to suddenly declare his job done on minority employment rates, with such a poor participation level. So, I expect he will keep trying on that. Which suggests he’s not going to over-indulge in rate rises. Hence the idea the Fed will look at other ways to soak up liquidity, is quite logical.

At this stage of tightening, we don’t find most bonds attractive, but recent history suggests that if the US 10-year bond gets closer to 2%, it attracts foreign money, unless Euro base rates also rise, which still seems unlikely. More buyers will of course push the yield back down.

While China is both cutting rates and provoking some hefty defaults, which is not a great background for foreign investment, especially as they seem to be targeting offshore investors. Without knowing whether the US interest rate tops out at 2% or 4%, emerging market debt (like their equities) could be either cheap or expensive; just now it is very hard to gauge.

So cautiously we plough on - funds must be invested, the (as of now) attractive alternatives, all look pretty expensive or rather risky, while if rates really do start to rise, the dollar will itself become desirable. So, we expect something, some asset, will suddenly catch a bid and soar away. Outside the US mega cap tech stocks, value already abounds.

Overall, a return to normality. With rather fewer gifts from Lapland to be had just for asking; all of this should be quite encouraging.

While it looks like sterling has strengthened for now, the various tin pot media storms have led to the Prime Minister’s critics looking into the abyss and not liking the view very much.

It may look bad to bend some rules, but dropping a Prime Minister for disliking Theresa May’s taste in wallpaper, or treating staff like human beings, or because Liz Truss is ambitious? Not really.

MCM had a good 2021, in our global lower volatility space. The CityWire link to our subsector is here.

Charles Gillams

Monogram Capital Management Ltd

9th January 2022

(article illustration by Martin Speed, creator of the Woofle bears)