Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

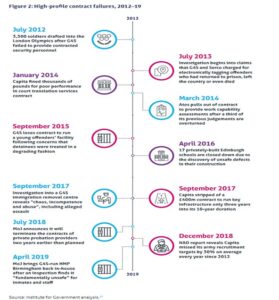

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

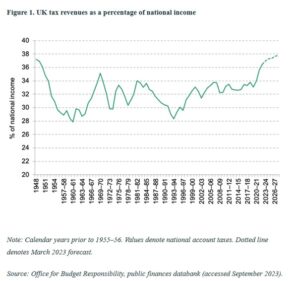

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

Reserve in Reverse

Fallen Emperor?

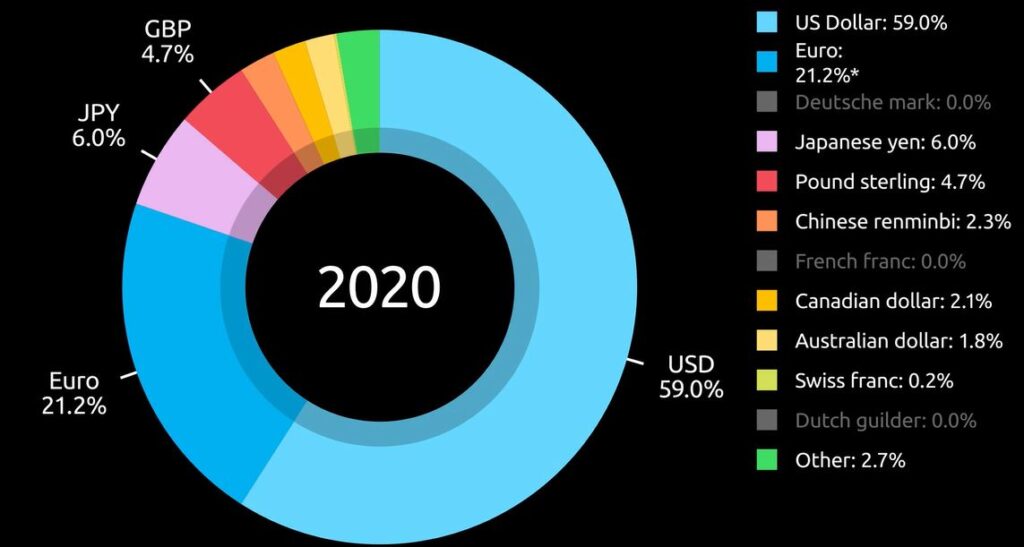

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

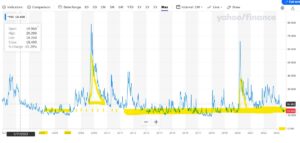

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).

FEEDING FIDO

International interest rates - what a dog’s dinner! But perhaps also a wake-up call: this is real life - governing for your social media feed does not work. We take a glance, too at the property market.

MARKET EVENT OR MACRO?

Our view has long been that we need rates at 5% to make a dent in labour inflation, both in the UK and US. It looks like the Fed (to our surprise) finally agreed. But with that comes a risk of overshoot, driven by the timing of the US mid-term elections. Powell, perhaps rather more attuned to politics than his banker colleagues, was keen to drop the bombshell early, rather than on 2nd November, right on top of the mid-term elections. So, I think the Fed’s now done with giant rises. Future rises may be less and spaced out, and quite possibly not that many.

One of the most chilling sections in Powell’s press conference was when asked about the global implications: yes, he assured us, he quite often takes tea with international colleagues. That was it. This time round the US is happy to crash through the global economy without a care in the world.

Encouraging short sellers

It seems Bailey of the Bank failed to get the memo, because oblivious to the soaring dollar, he stuck to plodding domestic rate rises, as if Leviathan was not bursting forth from the deep. Lifting rates by 0.5% when the dollar lifted 0.75% the day before felt like a joke. And if Bailey could not see that, the markets could: UK two-year gilts abruptly repriced to US rates.

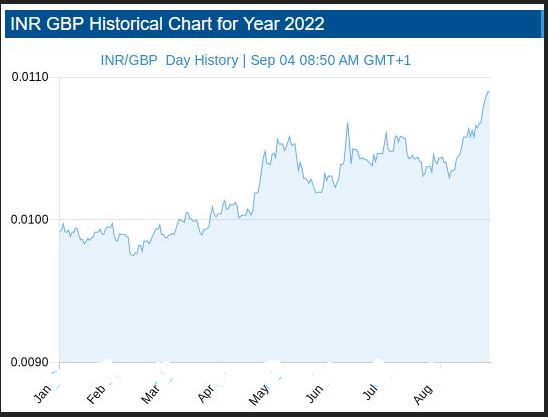

But sterling is still hobbled by UK rates at 2.25% - too low. By trying to be clever on the rate rise, Bailey has simply let the short sellers in. As the chart below shows, having already hit the renminbi and the yen, it was obvious who was next. Sterling is a small but liquid currency block, with no allies – so it typically pays more to borrow. The markets just needed the signal.

From : this site’s fine moving graphs

I doubt all that volatility really makes much difference to the real economy. Indeed, the Bank has now braced sterling nicely. As for the pension schemes, the FCA (Bailey’s last top job) created the foible of pensions being forced to hold loads of so called “risk free” assets to prop up UK government borrowing. A most amusing idea, always going to blow up one day.

Not that sure even 4.5% rates will slow wage inflation up. But we will know soon enough, after all the destination was to us never in doubt, just the arrival time. I still see the strain of rates rising to (say) 8% as too much for the electorate in either the US (the leader) or the UK (who follow).

Recession fears?

Nor do I consider either the US or UK end rates to be high enough to cause a severe recession, although clearly, they will have an impact on asset prices, and in the end, labour markets.

So, I conclude this is more a market event than an economic one. And surprisingly it is all in bonds (and therefore currencies).

Investors will hang back until they see those settle down and that could take the rest of the year. So, although everything is perhaps cheap, the VIX will keep many on the side-lines.

The UK at least feels at bargain levels, but buying dollar stocks still feels somewhat pricey.

BRICKS AND MORTAR

So, to property. Well, we got this one wrong. Partly we failed to see Ukraine becoming a big war, but one with no quick winner. This triggered European (in particular) energy inflation. Partly we therefore saw interest rate rises staying in single figures, which is not what some REIT prices imply.

Not that we have changed our longer term “4&4” view on interest rates and inflation, (so higher for longer) but other investors and markets clearly have. You can’t fight the tape.

In general, outside the warehouse sector, real estate companies (unlike say Private Equity) had already taken the hit to values, their balance sheets showed the new world, backed by real deals. So, adding a second discount does seem odd.

Gearing levels are not high, and debt maturities well extended, and interest (still) well covered. Maybe private markets are worse, but it is not clear why that contagion spreads into quoted ones. If there is a blow up, it is not obviously in public markets or mainstream lending.

But if quoted markets are right, what of residential markets?

Well logically as they are still going up, do residential prices now have a big drop built in, which is yet to happen? The price of mortgage banks, home builders and builders’ merchants all say ‘yes’. But how will it happen? It is not a big sector in UK public markets, but the odd couple that do exist (Mountview, Grainger) have also taken a hammering. They have some debt and are rental specialists (of various types).

So, markets say yes, house prices will also collapse.

Do I believe that? Anymore than talk of imminent dollar sterling parity and 8% base rates? Frankly no. Stagnate, chop around, go sideways, blow the froth off. Sure. Collapse; is wishful thinking.

After Armageddon I fully expect to see a plucky estate agent emerge from the ruins, justifying an offer above the asking price for the debris, with potential (but may need planning consents).

So, if true, that means despite a hair-raising ride, those mortgage banks and residential owners will in time emerge resilient.

Sadly, for many, that also suggests, without forced sellers from the buy to let market (where there will be a few), the stock of housing units won’t change and therefore nor will rents. Housing stock is very lagged and current moves will only close the pipeline two years out. Only mass unemployment hits rents, and if this is a market event, not an economic one, it won’t change, because structural unemployment is not the issue. Indeed, we are at record low unemployment levels.

In summary

A market tremor created in Washington, was transmitted to the UK, and is now rippling round the world; either currencies hold their interest rate differential with the dollar, or get crushed.

Old news; it is odd isn’t it, how so many clever people failed to read the memo?

The Turn of the Screw

So, we have Truss now. The continuity candidate, not the dull man who would take away our sweeties. But also, the same old Fed, keen to do just that. And its time we took a look at Starmer, the other continuity candidate and an excellent book on him; required reading for serious investors.

Otherwise, it is always a good summer when nothing changes. Markets swoop and soar vainly trying to catch our attention, but the reality remains that rates have to rise enough to destroy the excess demand that causes inflation. And they have to rise to equal or surpass that level, eye-watering as that prospect is. It will not be over until the US jobs report goes negative, and stays negative; anything less is prolonging the pain.

Presentation over substance

But this is a time of intensely political Central Banks, headed up by people without a grounding in economics, but a lot of “presentation skills”. They will be dragged kicking and screaming and smiling to do what they should have done last year, hoping vainly for some supply side reform or windfall to help out. But largely still facing the exact opposite, populists who think subsidies “cure” or ameliorate inflation.

Markets are oddly buoyant; they get like this at times, but we see that as a mix of delusion, the self-reinforcing strength of the dollar (be very careful of that one, it is a new bubble) and the spluttering remnants of buying on the dip.

But be under no illusion, Central Banks trying to guess where the economy is going is like fly fishing with a jar of marmite. Entertaining, but highly unlikely to catch anything.

Truss: Issues and options

Truss meanwhile looks like a re-run of Boris; it won’t be quite that simple, but it looks like more style over substance, a different set of lobbyists, but nothing really changing. The idea either she or the EU can afford a bust up with the UK, just shows how silly markets can get.

Some of her programme may make sense, both the NI (tax) rises, and the corporation tax increases were badly timed and should be reversed, given inflation is doing the hard work already through fiscal drag (or frozen tax thresholds).

The rises were proposed when we were exiting the COVID crisis, but before we understood the energy one. We said so the last time we wrote to you.

Ditching a few Treasury backed white elephants (HS2, Freeports, the crazy fiddling fetish on capital allowances) would do no harm either, but overall, the market’s verdict is clear: fiscal responsibility is still a long way out. We can all see how sterling has collapsed against the dollar; it is less clear why it has fallen against the Indian Rupee or the Chinese Yuan.

Source: See this website for all the daily data.

A book to read for all investors

So to Starmer, the likely next UK prime minister, where we need to pay more attention. Both on his mindset and on why the Labour Party hates him so much. Which in turn explains why (and with the Tories fatal ideological split heading them into Opposition), he is so fixated on party control.

Oliver Eagleton writes very well. His recent book The Starmer Project looks at four episodes, his left wing legal start, his transformation into a Tory enforcer with a penchant for exporting judicial expertise to the colonies (don’t laugh), his alleged machinations to back the People’s Vote nonsense to bring Corbyn down (pretty dense stuff, even now) and his use as the Blairite stalking horse to put a stop to Corbyn’s chiliastic tendencies, (which also gives you a trigger warning about a light dusting of Marxist ideological claptrap).

So Starmer is all about what works, which would make a nice change.

We’re looking at a very global mindset, apparently quite a strong Atlanticist outlook, keen to work with European authorities, but aware that the Brexit boat has sailed. An interest in devolving power down, but keenly alert to the risk of anarchy that entails. Indecisive, a Labour Party outsider (on his first election in 2015, apparently his nomination had to be held back to ensure he had the minimum length of prior party membership). Starmer is not exactly collegiate, but he has run a Whitehall department (as Director of Public Prosecutions) so not a loose cannon.

Very London too, Southwark, Reigate, Guildhall School of Music (sic), Oxford for post grad law, Leeds as an undergraduate. So should at least know where the Red Wall was. But lest you relax too much, a total ignorance of economics or business, let alone how to create growth. It won’t be easy.

And what about Markets?

Well for a UK (or non US) investor you only had one question this year. If you ditched the local currency you made money, and if you held onto sterling you got hit. Our GBP MonograM model is doing fine, it got that one big call right: kind of all you need. If you are a dollar investor, outside of energy your best place was cash. And our USD model took longer to spot that shift. As for active investing, sadly pretty much the same, the dollar is the story, or dollar assets. All of which perhaps makes dollar earners in the UK look cheap still.

But for now we see the story as a currency one, and at heart that is just about the timing of tightening interest rate spreads. The widening of those spreads has caused the recent havoc.

So when (finally) the European and UK Central Banks abandon futile incrementalism and get the big stick out, that will call the turning point.

Charles Gillams

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

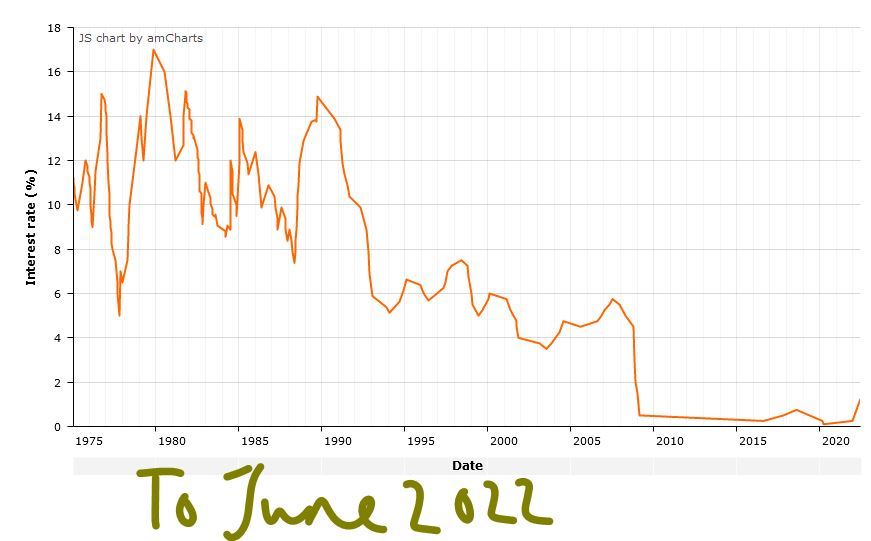

Interest rate cycles

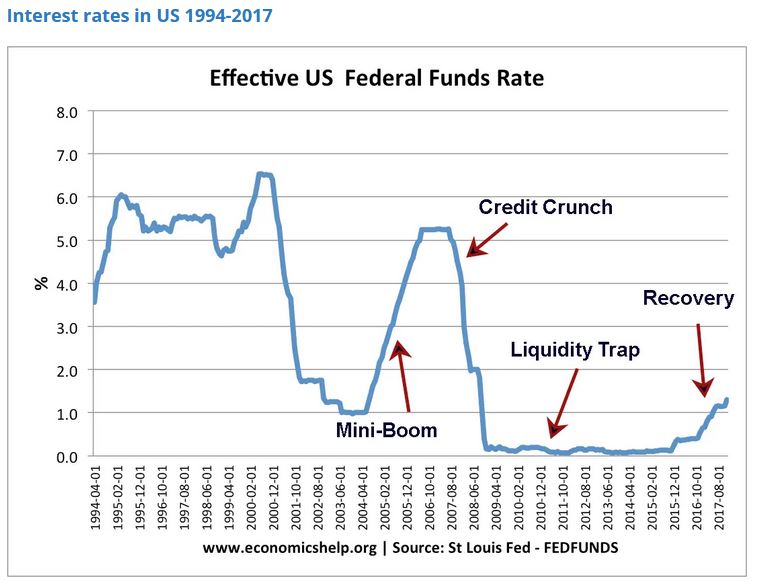

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.