Hard Landings?

May 8, 2022what-voters-want,stock markets,UK local elections,central banksOpinion,Economy,investment markets,Central Banks,UK Politics,interest rates

Local elections tell us remarkably little about national ones. We reflect on those. Meanwhile US equity markets are in turmoil, and some big numbers are changing very fast - some further musings.

Do English local elections count ?

We start with the UK, or rather English local elections, the devolved governments (oddly) have a rather greater read through from local to national. But overall, nothing in the results changed our view that Boris will probably survive, unless the Tory party unites around an alternative, which is pretty near impossible: it has too many splits.

Nor has our long-standing opinion that all Keir needs to do is keep his head down and he will be the next Prime Minister changed. Although if Labour starts to believe it is a shoo in, and can pick who it likes as leader, it will also self-destruct. Which is just about the only chance the Liberal Democrats have of being relevant.

Just how politically marginal local elections are, is shown by the surge of support for the Greens, apparently the very voters the weird Tory infatuation with hard left environmental policies were meant to entice.

Indeed, a whole set of Tory policies designed to raise energy prices, have gone down like a lead balloon.

What voters want and politicians need to deliver

You do wonder if they will ever get round to realising voters really want just three things, a roof over their heads, bread on the table and a job. Deliver those and do so competently, and politics is easy.

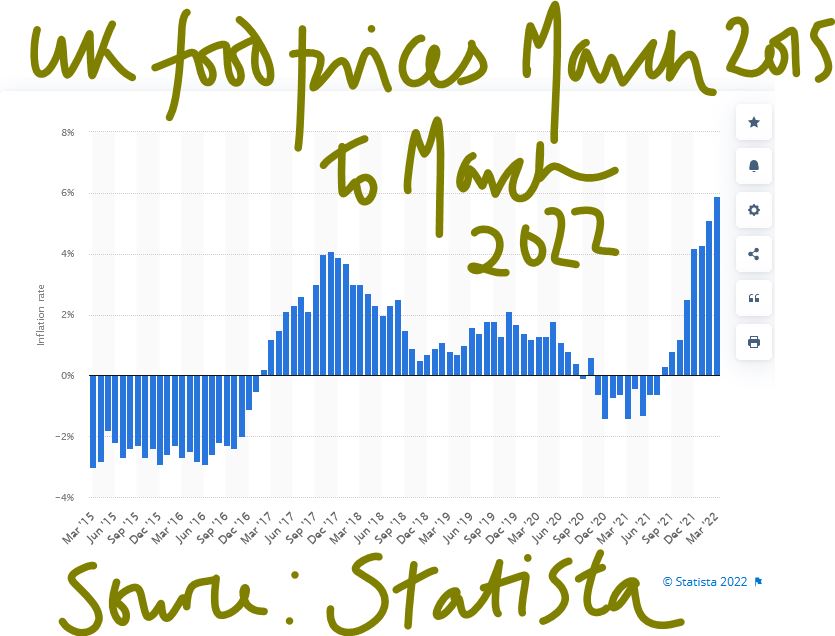

The roof bit is a shambles; it turns out policies designed to enrich cabinet members and senior civil servants with buy to let portfolios, are not so good for anyone else. I suspect the job bit will soon turn turtle, and the bread bit is going off the rails too. See graph below:

Here is a link to the relevant page on Statista

We notice that the big Western democracies still seem hell bent on raising energy prices, which is universally unpopular.

UK local elections - a brief look at opposition policies

So, the other thing markets in the UK (and sterling) will be doing is wonder about Starmer policies, more critically does he have the “bottom” to either appoint radical reformers, or have them lined up in key seats? Let’s say he does. He will still continue the headlong wealth destruction of punitive taxation and the assault on business investment. He will over-regulate (that’s his background). The sole variable therefore feels like any plausible capacity to reform.

He is not afraid of hard choices, or of thinking long, both good points and incidentally he is not Blairite enough to be America’s poodle and get involved in picking pointless foreign wars. Although he will likely dismember the United Kingdom, either of political necessity or by accident. We really can’t see much support for sterling in that package.

Central Banks - are they signalling a hard landing?

Inflation is spiking into double figures, and Central Banks are explaining

1) it is really not their fault

2) they are only responsible for “core inflation” (so without the important stuff)

3) but anyway they must still raise rates to offset the malign effects of other state policies.

It is looking truly absurd.

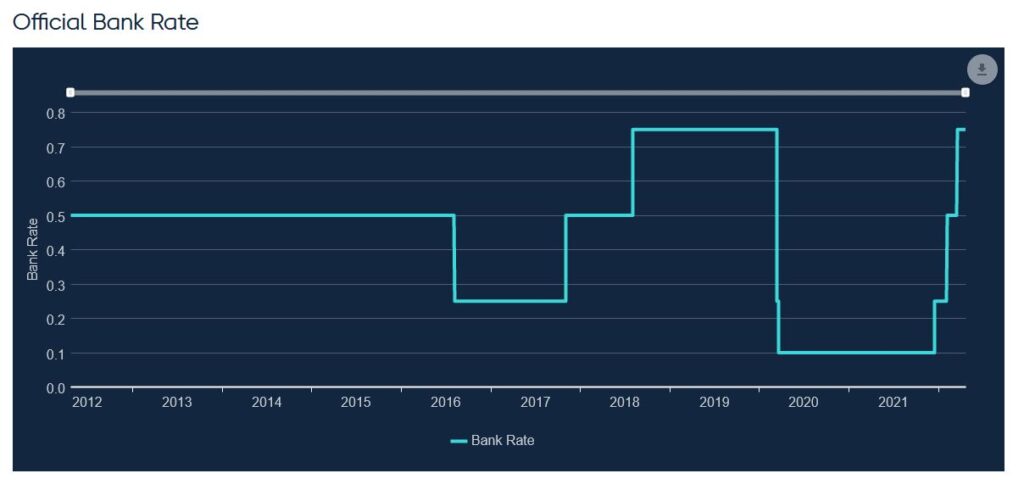

Not that interest rates are off the floor yet, although the US bond market seems convinced rates over 3% are now nailed on, while oddly the UK Gilt-edged market seems unconvinced of exactly the same thing. This of course is helping an on-going collapse in Sterling.

Meanwhile the possibility of ending negative rates in Europe has caused great excitement and the Euro to strengthen, at least against sterling. The divergence is related to a belief that the Fed which raised three months after the Bank of England is now more hawkish, a belief which seems more about wishful thinking than anything the Fed has actually done so far.

We are less sure on how high interest rates go. All three Central Banks seem to be hoping something will turn up, and inflation will ease. This is a view we share, but we really doubt the trivial rate rises so far, are the “something”.

Market turmoil - how far will they fall?

This leads on to the current market turmoil: With the US feeling very exposed, partly because it went up so high (relative to other markets), it has further to fall. Nor do we see the valuations on quoted US growth stocks as offering good value at these levels. They had become so detached from reality the gap is just too big, and the repeated attempts to buy the dips, just disguises a long-term trend down. The FTSE100 over five years is down, and the NASDAQ climbed over 100% in the same time. A 25% further US fall is at the least plausible.

Other markets will then get sucked down, and in Europe and Japan they are hard hit by their reliance on imported energy (the US is an energy exporter). While for now, their rates are not moving either, the resulting devaluation makes the value gap to US growth stocks, feel even greater. Buying overvalued stock in an overvalued currency, is not always great.

What do our models say about the markets?

Our MonograM momentum models suggest a turning point for both Europe (including within that bundle the UK) and Japan is close. It is only a model, we remind ourselves, and is quite able to give a false signal. It also sees this as true in dollar terms, not sterling. So, there is plenty of noise and last week had all the elements we dislike, a month end, plus a shortened market week, plus Central Bank meetings, created a baffling miasma of signals.

However, on current policies we anticipate a crash; the only issue now is how hard the landing is.

REINSTATING REAL ECONOMICS - WISH YOU WERE HERE?

April 23, 2022Economy,interest rates,Central Banks,UK Politics,supply chains

A return to the real world, where money has a time value is a great achievement. Inflation is after all transitory. At long last the most important of all price signals (interest rates) can break free, allowing for growth to resume. That is a cause for optimism.

Let’s look at the basics and start with food and fuel. Cereals are a critical foodstuff; we should remember they are almost automatically in surplus. All the great famines in history have been caused by logistical and storage failures, not an absence of global grain. Nor is energy a problem; our self-imposed constraints on its use are. Those are political, not physical.

Cold Comfort for Change - inflation, voters and price trends

Inflation, as we all keep hearing, is a supply side issue, which if true will always get sorted by either demand destruction, substitution, or new supply. But sorted it will be. The good thing about energy and food is that they are universally available, we favour one source or another because of price, convenience, fashion or dogma.

So, at some point they stabilise, it all depends on where the greater political heat is from; currently most Western governments fear lost “green” votes more than high prices. Or indeed they may be simply locked into the Orwellian power surge of a foreign villain to fight, using young men’s lives.

However, history says that at some point jam tomorrow is less attractive to voters, than simply living today. We are not there yet. But either prices will ease, or we will ultimately take a pragmatic route and use our abundant low-cost resources.

These problems are not like microchips, with genuine supply issues; the extra chips simply don’t exist; extra food and energy supplies do.

For grain there are vast swathes of the planet where it could be grown and is not, from the field margin just over my hedge, to parts of every other continent, outside the polar regions. The rest of the neighbouring field has spring wheat, an early sign of switching (a winter wheat crop would have to have been pre-planted). Yields may not be great, machines may not be efficient, but that’s what price discovery does, if the cheapest producer drops out, the marginal one steps in.

In global terms lost planting land in Ukraine is trivial. And every year land is left fallow due to warfare or natural disaster, that’s why markets exist. As for Russian surpluses, they will simply get stored or eaten in the half of the globe, that does not think as we do.

So, prices will sort themselves out.

Blue Skies from Pain - insurance and government borrowing

To reiterate, the big win is the defeat of the zero or negative interest rate world. The effect of that is quite tangible, in some cases: we won’t have insurance companies forced into a negative discounting of their liabilities anymore, nor will every defined benefit buyout be able to pretend there is no time value for money, releasing a fatal burden on pension schemes. Discounting will be back.

Time once more exists.

But the greater victory is against Government debt, the intergenerational horror of saying we can incur infinite debt for our children to pay down, because look, it is free! No more. Once more jam today means dry toast tomorrow.

Capitalism cannot work without price disclosure, and without prices, populism can roam free to destroy everything. At last, it is back in chains again, much as it yearns to fracture them.

The political price maybe high; I doubt if both Lagarde and Powell can keep their jobs. They still grandly support ever greater restraints on supply, almost as foolishly as they say they still believe interest rates won’t rise that much. An amusing deceit.

A Cold Steel Rail

Ploughing through the accounts of Glencore, one of the big resource outfits, I realise just how much of their recent good fortune (and it is spectacular) is tied to Governments forcing producing assets off the market and reducing the operational efficiency of installed plant. Demand is up, but supply (so the tonnages mined) is down. The production restrictions are state imposed, but there is little desire to invest anew, while they exist. Indeed, the CEO earns a bonus both for high profits and also for low capital expenditure: a strange way round. A critical supplier for the energy transition, that wants to be smaller, a fine tribute to governmental mishandling of our world.

For all that we still don’t expect Powell to be that aggressive on rate rises; all along he has talked tough but acted soft, it is his comprehension of what “good” market communication means. Many of us have another word for it.

So, we do see rates as having risen too far, too fast, and they now need to stabilise, Powell’s talk and the market need to get back in line. Although the collapse of the Japanese Yen reminds us where the void lies too. And that a host of market decisions all really just come back to your faith in the US Dollar. While sterling has juddered lower at the whisper of cowardice by the Old Lady, but she has talked mild, acted fierce, the right way round, and I expect the UK to keep raising rates.

A Walk on Part in the War

While the UK political scene hots up, two factions in the Tory party are tussling for power, the populists and the realists. Both incidentally dislike Boris as a sell-out and will speak ill of him to the media.

The populists have done very well, loading on taxes and regulations and fluffy aspirations. And they have chanted fiercely in favour of pouring arms into a foreign war, simply because it is what gets approvals on Twitter. As if that ever ends well. Their new-found blood lust is extraordinary. So too is their fierce advocacy of fighting inflation with hand-outs, which is so 1960’s and known to be altogether futile.

The realists meanwhile seem to know that is the path to doom, but lack the nerve or confidence to say so outright. To eject Boris therefore requires two swarms of slightly crazed insects to coalesce, and in a mutual fury sting him fatally, then try not to destroy each other in a fight for the spoils. Are Tory MPs that stupid, mindless or incensed? Interesting question. I suspect like Powell they seek advantage in talking tough, knowing they can’t act.

While aware I may already be wrong as I write this, I feel compelled to say that I wouldn’t expect Macron, a realist, to fall before Le Pen a populist, but you never know.

So, I do feel we are, after a long wait, where we should have been after the GFC; if so that’s a great win for rational investing. It is odd, that one crisis (COVID) is treated with monetary excess, while another (Ukraine) with monetary tightening; to an economist the problems (supply destruction) feel quite similar, the responses feel oddly confused.

But as Churchill noted America usually gets it right, albeit after exhausting all other options.

Perhaps it now has?

Will the March lows now be re-tested?

In dollar terms that looks likely, but sterling investors remain well clear of that point. I suspect (for now) uncertainty is doing the real damage and making it too easy simply to stand aside. But a belief that yields are high enough would draw funds into US bonds (clearly is already) and by definition, the currency. This oddly will then help US equities to find their feet.

That combination of forces, for now, has meant un-hedged S&P 500 has been a clear (and stunningly simple) winner in our flagship MonograM sterling strategy.

The model’s skill is in making that prediction, so that we were already correctly positioned, going into the year.

Were you?

Our performance newsletters give comprehensive details of our portfolio month by month.

He who pays the piper

April 2, 2022EU,UK,Russian Rouble,China,USA,inflationUK,inflation,Central Banks,interest rates,Economy,Opinion,USA,China,energy,Federal Reserve

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

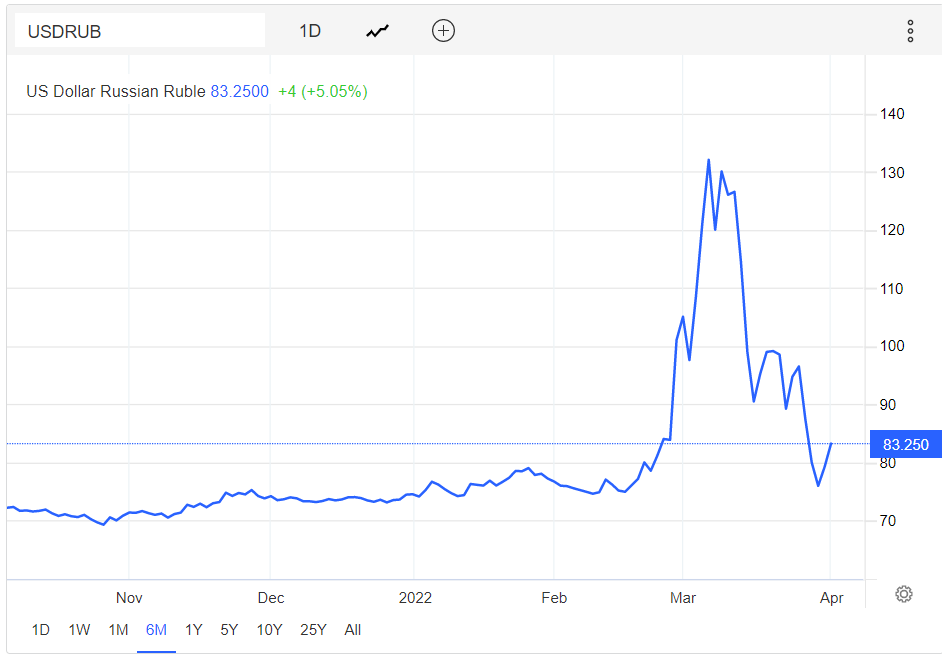

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

Tech Wreck or Much Ado

March 18, 2022valuations,spacs,tech,assetpricesTechnology sector,Opinion

Talking Tech today - We think that market cycles are longer and far less repetitive than we like to assume.

Asset price ramps - the tech story

But each speculative ramp up and blow off in assets shares much the same features. Our view is the faster they go up, the less likely they are to recover having come back down. And a lot are pretty well back where they started, in price terms at least.

Yet the avarice of founders and sponsors in exploiting, seemingly without consequences, these destabilizing bubbles seems oddly popular, helped by the vast tax hauls they often create, themselves inflaming the process. The media of course delight in hyping them, somehow immune from the sin of market manipulation, which profits them mightily.

I suspect most investors have a ‘marker stock’, to indicate where we are in the cycle, to me it has been the Amati AIM VCT. It has a fair range of stocks, competent fund managers, a reasonable yield. It topped out first in about April last year, had another go at the top in late August or so, and has been downhill all the way since. About £200m of assets, a discount control in place, generally real companies, not concept stocks.

So not an obvious spoof.

This was unlike the SPACS, which we first highlighted in late 2020, and where they have been far more destructive, in most cases, even when containing a real business (and many did not).

Sometimes governments get pulled in too. All those profits make for flush lobbyists, generous donations. The London Stock Exchange, a quasi-regulator, bends easily to any wind that blows an irregular but ripe bounty to its coffers.

So, of all the myriad useful potential reforms and regulations, making SPACS easier was depressingly to the fore in ministerial recommendations. Likewise funny voting rights, which stop the founders getting hoofed out when it all goes south.

And what about crypto currencies?

We can debate whether crypto was the same, a lot of the crypto universe clearly was, and itself it was inflated by that same goldrush mentality. Indeed, plenty of market professionals tired of the chore of marketing real companies with real data are entranced by the lure of money for nothing.

Bitcoin is almost the perfect vehicle in this hyper speculative world, and yet we are ambivalent on it. It is very clean (once the dirty mining is done) and it produces carbon rather than arsenic (unlike gold) as a by-product. It can’t be tainted or doctored or indeed intercepted, so it is quite a pure asset. Of course, you can mislay it, and once lost it is rather elusive, it slips back into the great money sea and is lost quickly in the waves.

Some say it is too hard to turn into real money, dollars in the main, but nearly every investment is tough to realise, certainly most ‘alternatives’ are and far too often the fees investors are charged are based on inflated values.

Tech valuations

So, back in the tech wreck. We don’t believe the high valuations were ever anything but the flush through of extreme greed, created by an industry still able to sell duff product, to its heart’s content, for colossal fees, along with skilled media manipulation. Or as a recent Henderson’s fund manager report said “investment bankers, greedy management teams and ruthless private equity vendors” are to blame.

Judging the product in tech is always really hard. But judging what a reasonable value for the optionality of many of these shares is, should usually be far easier. A good rule of thumb is see how in “normal times” they are valued, both because that is when you will almost inevitably need to sell, but also it reflects the funder’s ability to keep propping up losses. That is typically not measured in decades, but at most a few years.

COVID did not help, it closed the new issue pipeline, devasted large areas of the existing market and of course washed torrents of hot cash over everything. Less to buy, more to buy it with, a bit of a feeding frenzy and away we went. But that’s now over.

Nor do I really think this vast pump and dump enterprise was undone, as the market wisdom is, just by the threat of rising rates. The idea you can precisely discount some pie in the sky projection also feels slightly odd. The precision of diamond to cut the substance of weak custard, seldom produces a sharp, solid, edge.

How might we regard “concept” tech stocks now?

Seen as driven by supply and demand, bulked up by liquidity and the “greater fool” argument should you unload the stock, means you should beware of the belief that many of these stocks are anywhere near a bottom, until either they produce real cash flow, or a period of years allows them to de-risk their valuations.

Seen in that light, and given the overhang of listing, taxation and scrutiny they now face, it should be more about how much should you discount their cash pile by, not what premium to NAV do they merit. Oh, and I’m talking about real Net Asset Value, not capitalized losses, (however you bottle it), a loss is not an asset, whatever the craven auditor says.

Nor is looking for a trade buyer sensible, buyers have to buy the whole thing, not a little slice where the value can easily be frothed up.

My preference is good active specialist tech managers. There are a few, at a nice discount, but pick your entry point with care, at this stage of the game.

A lot of the late 2020 and 2021 excitement turns out to be Much Ado About Nothing, a startling production (above) of which closed recently at the RSC.

LOCATING THE ELUSIVE BASE

March 6, 2022Ukraine,french rebuilding,levelling up,interest rates,inflationUSA,Debt,Federal Reserve,interest rates,Opinion,Central Banks,Economy

the investment impact of recent events

CRANES

I spent last Sunday in the elusive pursuit of grus grus, in the upper Marne basin, East of Paris. For some reason the Common Crane had already left in a bid to cross Central Europe, heading for the Artic, weeks earlier than in most seasons. Clearly, they knew something about the airspace ahead of them.

While the largely empty Lac du Der, also had lessons on levelling up; here was a vast and disruptive engineering scheme, it seemed executed without too much controversy, operating well and with the surrounding villages wealthy, quietly prosperous and largely content. Or so it looked in the February sunshine. It was all in pretty harmonious concord with nature too.

THE FRENCH MODEL

It seems the French can see the grand scope of government, the need to provide top class infrastructure. Here is their France Relance plan up to 2030. Up to 3-4 billion Euro is likely to be spent in 2022 alone.

The issue is perhaps not just politics, but the unspeakably low quality and lack of vision of the UK governing class. The French cities have retained their great buildings, the administration is a high profile and visible force, not something to park in the burbs, having ejected them from city centres to grab their assets for still more rentier housing. Nor does the state foolishly aim to do everything, the peage (and TGV) enable high class fast communication, but certainly not always for the lowest price. Nor is health care completely and absurdly free, irrespective of demand. But it is effective.

Power is cheap and plentiful, no hysteria about nuclear there, and the military proud and visible, even the transport police are packing heat. So, watch that off peak ticket schedule.

Of course, not all is rosy. COVID hysteria still ruled, masks and vaccine passes were required for everyone, for everything.

Yet if any UK government is serious about leveling up, (as in the recent White Paper) here is both a lesson, and an indication that Gove’s piffling attempts are a mockery; he needs more like £48 billion to start it, not £4.8 billion.

You feel they just picked up the easy option from the choices their tired civil servants had suggested. Perhaps it was the one that said, “No real impact, but sounds OK for now”.

UKRAINE - Did Putin miscalculate the West’s indifference?

Ukraine? Not a lot to add to that. We were wrong that Putin was not stupid enough to do it. Wrong too that it would be over in hours. So, treat our topical ignorance with care. Also, wrong that the West would shilly-shally over piecemeal sanctions. Whether we are wrong yet again in assuming that without a quick win, the sanctions will now damage the global economy quite badly, remains to be seen. I also suspect seizing Central Bank assets can only be done once and once done, global finance and investment will become far more fractured, forever.

But in truth, it was going that way already.

However, this blind market panic seems absurd. I really doubt if Putin, at this point, wants to line his battalions up on a border to provoke NATO, who are I suspect closer to an aerial counter strike than he thinks, and would indeed now love the excuse of any incursion on NATO soil.

He has made it into a popular potential war for the West, the most dangerous sort.

War Tactics

It looks to me as if Russia wants a pincer movement, to isolate Ukraine’s forces in the Donbass, plus a threat to Kiev to topple the government, but has he the muscle to take and hold all of the vast country? Even if he does, that does not suggest he will go further than Ukraine, just now.

While his aims are so blatantly false, success can be easily claimed for almost any outcome. So, a collapse in currencies, and stock markets across Eastern Europe, looks an exaggerated response. True, this is Germany’s worst nightmare come true, no competent military and a gun-shy US, so they must now realign fast, and where Germany goes, so goes the EU. It is not going to fold or fissure in the face of this explicit threat. Although Germany at heart is much more like the UK than France; rapid execution will not be quite as easy as simple announcements. Remember the farce over moving Tempelhof airport?

As yet, the final step of directly locking in Russian energy supplies, large parts of which go to German consumers, has not been taken, but that would, in the short term, be very costly.

Although high taxes on energy give governments a great incentive to let prices rip, (and demand destruction is great for the climate lobby too), but they are rather less popular at the ballot box.

Interest Rates

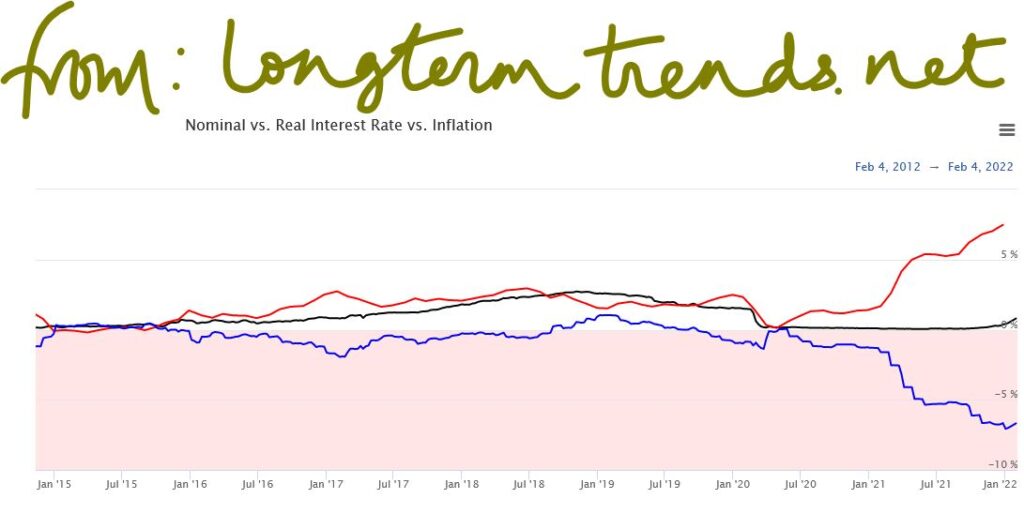

Meanwhile Powell remains determined to stay behind the curve on rate rises, it is as if the received wisdom on rates, indeed on Central Bank power, has been quietly ditched, and instead he is hoping inflation burns itself out through demand destruction/supply creation. Well, an interesting experiment, but if that’s the game, as we have predicted for a while, inflation will remain gently smouldering, but rate rises will still be very gradual.

The Fed should have turned off the monetary stimulus and reset to ‘normal’ six months ago, by the time they finally move, it will be a full twelve months late. Real rates are deeply negative, levels not seen in decades, and moving fast, this is really not quarter point stuff.

All of the above implies on-going nominal economic growth, ongoing share price appreciation (at least in nominal terms) and an ongoing reward for borrowing to excess.

But despite the rush to safety currently supporting the US dollar (and US assets) the danger to markets is not just from the noisy, tragic, East but also from experimental monetary policy in the US.