REINSTATING REAL ECONOMICS - WISH YOU WERE HERE?

April 23, 2022interest rates,Central Banks,UK Politics,supply chains,Economy

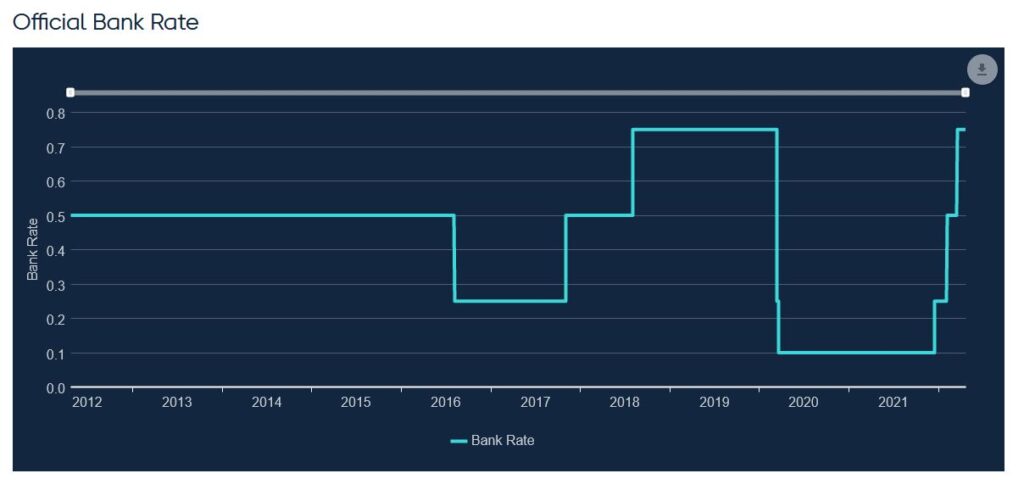

A return to the real world, where money has a time value is a great achievement. Inflation is after all transitory. At long last the most important of all price signals (interest rates) can break free, allowing for growth to resume. That is a cause for optimism.

Let’s look at the basics and start with food and fuel. Cereals are a critical foodstuff; we should remember they are almost automatically in surplus. All the great famines in history have been caused by logistical and storage failures, not an absence of global grain. Nor is energy a problem; our self-imposed constraints on its use are. Those are political, not physical.

Cold Comfort for Change - inflation, voters and price trends

Inflation, as we all keep hearing, is a supply side issue, which if true will always get sorted by either demand destruction, substitution, or new supply. But sorted it will be. The good thing about energy and food is that they are universally available, we favour one source or another because of price, convenience, fashion or dogma.

So, at some point they stabilise, it all depends on where the greater political heat is from; currently most Western governments fear lost “green” votes more than high prices. Or indeed they may be simply locked into the Orwellian power surge of a foreign villain to fight, using young men’s lives.

However, history says that at some point jam tomorrow is less attractive to voters, than simply living today. We are not there yet. But either prices will ease, or we will ultimately take a pragmatic route and use our abundant low-cost resources.

These problems are not like microchips, with genuine supply issues; the extra chips simply don’t exist; extra food and energy supplies do.

For grain there are vast swathes of the planet where it could be grown and is not, from the field margin just over my hedge, to parts of every other continent, outside the polar regions. The rest of the neighbouring field has spring wheat, an early sign of switching (a winter wheat crop would have to have been pre-planted). Yields may not be great, machines may not be efficient, but that’s what price discovery does, if the cheapest producer drops out, the marginal one steps in.

In global terms lost planting land in Ukraine is trivial. And every year land is left fallow due to warfare or natural disaster, that’s why markets exist. As for Russian surpluses, they will simply get stored or eaten in the half of the globe, that does not think as we do.

So, prices will sort themselves out.

Blue Skies from Pain - insurance and government borrowing

To reiterate, the big win is the defeat of the zero or negative interest rate world. The effect of that is quite tangible, in some cases: we won’t have insurance companies forced into a negative discounting of their liabilities anymore, nor will every defined benefit buyout be able to pretend there is no time value for money, releasing a fatal burden on pension schemes. Discounting will be back.

Time once more exists.

But the greater victory is against Government debt, the intergenerational horror of saying we can incur infinite debt for our children to pay down, because look, it is free! No more. Once more jam today means dry toast tomorrow.

Capitalism cannot work without price disclosure, and without prices, populism can roam free to destroy everything. At last, it is back in chains again, much as it yearns to fracture them.

The political price maybe high; I doubt if both Lagarde and Powell can keep their jobs. They still grandly support ever greater restraints on supply, almost as foolishly as they say they still believe interest rates won’t rise that much. An amusing deceit.

A Cold Steel Rail

Ploughing through the accounts of Glencore, one of the big resource outfits, I realise just how much of their recent good fortune (and it is spectacular) is tied to Governments forcing producing assets off the market and reducing the operational efficiency of installed plant. Demand is up, but supply (so the tonnages mined) is down. The production restrictions are state imposed, but there is little desire to invest anew, while they exist. Indeed, the CEO earns a bonus both for high profits and also for low capital expenditure: a strange way round. A critical supplier for the energy transition, that wants to be smaller, a fine tribute to governmental mishandling of our world.

For all that we still don’t expect Powell to be that aggressive on rate rises; all along he has talked tough but acted soft, it is his comprehension of what “good” market communication means. Many of us have another word for it.

So, we do see rates as having risen too far, too fast, and they now need to stabilise, Powell’s talk and the market need to get back in line. Although the collapse of the Japanese Yen reminds us where the void lies too. And that a host of market decisions all really just come back to your faith in the US Dollar. While sterling has juddered lower at the whisper of cowardice by the Old Lady, but she has talked mild, acted fierce, the right way round, and I expect the UK to keep raising rates.

A Walk on Part in the War

While the UK political scene hots up, two factions in the Tory party are tussling for power, the populists and the realists. Both incidentally dislike Boris as a sell-out and will speak ill of him to the media.

The populists have done very well, loading on taxes and regulations and fluffy aspirations. And they have chanted fiercely in favour of pouring arms into a foreign war, simply because it is what gets approvals on Twitter. As if that ever ends well. Their new-found blood lust is extraordinary. So too is their fierce advocacy of fighting inflation with hand-outs, which is so 1960’s and known to be altogether futile.

The realists meanwhile seem to know that is the path to doom, but lack the nerve or confidence to say so outright. To eject Boris therefore requires two swarms of slightly crazed insects to coalesce, and in a mutual fury sting him fatally, then try not to destroy each other in a fight for the spoils. Are Tory MPs that stupid, mindless or incensed? Interesting question. I suspect like Powell they seek advantage in talking tough, knowing they can’t act.

While aware I may already be wrong as I write this, I feel compelled to say that I wouldn’t expect Macron, a realist, to fall before Le Pen a populist, but you never know.

So, I do feel we are, after a long wait, where we should have been after the GFC; if so that’s a great win for rational investing. It is odd, that one crisis (COVID) is treated with monetary excess, while another (Ukraine) with monetary tightening; to an economist the problems (supply destruction) feel quite similar, the responses feel oddly confused.

But as Churchill noted America usually gets it right, albeit after exhausting all other options.

Perhaps it now has?

Will the March lows now be re-tested?

In dollar terms that looks likely, but sterling investors remain well clear of that point. I suspect (for now) uncertainty is doing the real damage and making it too easy simply to stand aside. But a belief that yields are high enough would draw funds into US bonds (clearly is already) and by definition, the currency. This oddly will then help US equities to find their feet.

That combination of forces, for now, has meant un-hedged S&P 500 has been a clear (and stunningly simple) winner in our flagship MonograM sterling strategy.

The model’s skill is in making that prediction, so that we were already correctly positioned, going into the year.

Were you?

Our performance newsletters give comprehensive details of our portfolio month by month.

He who pays the piper

April 2, 2022Russian Rouble,China,USA,inflation,EU,UKinflation,Central Banks,interest rates,Economy,Opinion,USA,China,energy,Federal Reserve,UK

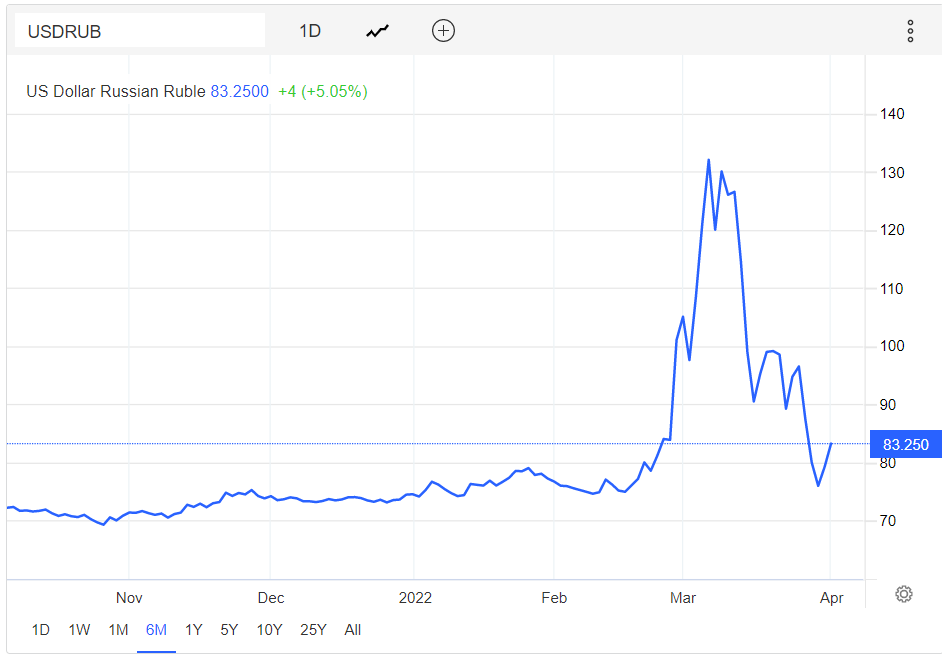

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

Tech Wreck or Much Ado

March 18, 2022valuations,spacs,tech,assetpricesOpinion,Technology sector

Talking Tech today - We think that market cycles are longer and far less repetitive than we like to assume.

Asset price ramps - the tech story

But each speculative ramp up and blow off in assets shares much the same features. Our view is the faster they go up, the less likely they are to recover having come back down. And a lot are pretty well back where they started, in price terms at least.

Yet the avarice of founders and sponsors in exploiting, seemingly without consequences, these destabilizing bubbles seems oddly popular, helped by the vast tax hauls they often create, themselves inflaming the process. The media of course delight in hyping them, somehow immune from the sin of market manipulation, which profits them mightily.

I suspect most investors have a ‘marker stock’, to indicate where we are in the cycle, to me it has been the Amati AIM VCT. It has a fair range of stocks, competent fund managers, a reasonable yield. It topped out first in about April last year, had another go at the top in late August or so, and has been downhill all the way since. About £200m of assets, a discount control in place, generally real companies, not concept stocks.

So not an obvious spoof.

This was unlike the SPACS, which we first highlighted in late 2020, and where they have been far more destructive, in most cases, even when containing a real business (and many did not).

Sometimes governments get pulled in too. All those profits make for flush lobbyists, generous donations. The London Stock Exchange, a quasi-regulator, bends easily to any wind that blows an irregular but ripe bounty to its coffers.

So, of all the myriad useful potential reforms and regulations, making SPACS easier was depressingly to the fore in ministerial recommendations. Likewise funny voting rights, which stop the founders getting hoofed out when it all goes south.

And what about crypto currencies?

We can debate whether crypto was the same, a lot of the crypto universe clearly was, and itself it was inflated by that same goldrush mentality. Indeed, plenty of market professionals tired of the chore of marketing real companies with real data are entranced by the lure of money for nothing.

Bitcoin is almost the perfect vehicle in this hyper speculative world, and yet we are ambivalent on it. It is very clean (once the dirty mining is done) and it produces carbon rather than arsenic (unlike gold) as a by-product. It can’t be tainted or doctored or indeed intercepted, so it is quite a pure asset. Of course, you can mislay it, and once lost it is rather elusive, it slips back into the great money sea and is lost quickly in the waves.

Some say it is too hard to turn into real money, dollars in the main, but nearly every investment is tough to realise, certainly most ‘alternatives’ are and far too often the fees investors are charged are based on inflated values.

Tech valuations

So, back in the tech wreck. We don’t believe the high valuations were ever anything but the flush through of extreme greed, created by an industry still able to sell duff product, to its heart’s content, for colossal fees, along with skilled media manipulation. Or as a recent Henderson’s fund manager report said “investment bankers, greedy management teams and ruthless private equity vendors” are to blame.

Judging the product in tech is always really hard. But judging what a reasonable value for the optionality of many of these shares is, should usually be far easier. A good rule of thumb is see how in “normal times” they are valued, both because that is when you will almost inevitably need to sell, but also it reflects the funder’s ability to keep propping up losses. That is typically not measured in decades, but at most a few years.

COVID did not help, it closed the new issue pipeline, devasted large areas of the existing market and of course washed torrents of hot cash over everything. Less to buy, more to buy it with, a bit of a feeding frenzy and away we went. But that’s now over.

Nor do I really think this vast pump and dump enterprise was undone, as the market wisdom is, just by the threat of rising rates. The idea you can precisely discount some pie in the sky projection also feels slightly odd. The precision of diamond to cut the substance of weak custard, seldom produces a sharp, solid, edge.

How might we regard “concept” tech stocks now?

Seen as driven by supply and demand, bulked up by liquidity and the “greater fool” argument should you unload the stock, means you should beware of the belief that many of these stocks are anywhere near a bottom, until either they produce real cash flow, or a period of years allows them to de-risk their valuations.

Seen in that light, and given the overhang of listing, taxation and scrutiny they now face, it should be more about how much should you discount their cash pile by, not what premium to NAV do they merit. Oh, and I’m talking about real Net Asset Value, not capitalized losses, (however you bottle it), a loss is not an asset, whatever the craven auditor says.

Nor is looking for a trade buyer sensible, buyers have to buy the whole thing, not a little slice where the value can easily be frothed up.

My preference is good active specialist tech managers. There are a few, at a nice discount, but pick your entry point with care, at this stage of the game.

A lot of the late 2020 and 2021 excitement turns out to be Much Ado About Nothing, a startling production (above) of which closed recently at the RSC.

LOCATING THE ELUSIVE BASE

March 6, 2022french rebuilding,levelling up,interest rates,inflation,UkraineDebt,Federal Reserve,interest rates,Opinion,Central Banks,Economy,USA

the investment impact of recent events

CRANES

I spent last Sunday in the elusive pursuit of grus grus, in the upper Marne basin, East of Paris. For some reason the Common Crane had already left in a bid to cross Central Europe, heading for the Artic, weeks earlier than in most seasons. Clearly, they knew something about the airspace ahead of them.

While the largely empty Lac du Der, also had lessons on levelling up; here was a vast and disruptive engineering scheme, it seemed executed without too much controversy, operating well and with the surrounding villages wealthy, quietly prosperous and largely content. Or so it looked in the February sunshine. It was all in pretty harmonious concord with nature too.

THE FRENCH MODEL

It seems the French can see the grand scope of government, the need to provide top class infrastructure. Here is their France Relance plan up to 2030. Up to 3-4 billion Euro is likely to be spent in 2022 alone.

The issue is perhaps not just politics, but the unspeakably low quality and lack of vision of the UK governing class. The French cities have retained their great buildings, the administration is a high profile and visible force, not something to park in the burbs, having ejected them from city centres to grab their assets for still more rentier housing. Nor does the state foolishly aim to do everything, the peage (and TGV) enable high class fast communication, but certainly not always for the lowest price. Nor is health care completely and absurdly free, irrespective of demand. But it is effective.

Power is cheap and plentiful, no hysteria about nuclear there, and the military proud and visible, even the transport police are packing heat. So, watch that off peak ticket schedule.

Of course, not all is rosy. COVID hysteria still ruled, masks and vaccine passes were required for everyone, for everything.

Yet if any UK government is serious about leveling up, (as in the recent White Paper) here is both a lesson, and an indication that Gove’s piffling attempts are a mockery; he needs more like £48 billion to start it, not £4.8 billion.

You feel they just picked up the easy option from the choices their tired civil servants had suggested. Perhaps it was the one that said, “No real impact, but sounds OK for now”.

UKRAINE - Did Putin miscalculate the West’s indifference?

Ukraine? Not a lot to add to that. We were wrong that Putin was not stupid enough to do it. Wrong too that it would be over in hours. So, treat our topical ignorance with care. Also, wrong that the West would shilly-shally over piecemeal sanctions. Whether we are wrong yet again in assuming that without a quick win, the sanctions will now damage the global economy quite badly, remains to be seen. I also suspect seizing Central Bank assets can only be done once and once done, global finance and investment will become far more fractured, forever.

But in truth, it was going that way already.

However, this blind market panic seems absurd. I really doubt if Putin, at this point, wants to line his battalions up on a border to provoke NATO, who are I suspect closer to an aerial counter strike than he thinks, and would indeed now love the excuse of any incursion on NATO soil.

He has made it into a popular potential war for the West, the most dangerous sort.

War Tactics

It looks to me as if Russia wants a pincer movement, to isolate Ukraine’s forces in the Donbass, plus a threat to Kiev to topple the government, but has he the muscle to take and hold all of the vast country? Even if he does, that does not suggest he will go further than Ukraine, just now.

While his aims are so blatantly false, success can be easily claimed for almost any outcome. So, a collapse in currencies, and stock markets across Eastern Europe, looks an exaggerated response. True, this is Germany’s worst nightmare come true, no competent military and a gun-shy US, so they must now realign fast, and where Germany goes, so goes the EU. It is not going to fold or fissure in the face of this explicit threat. Although Germany at heart is much more like the UK than France; rapid execution will not be quite as easy as simple announcements. Remember the farce over moving Tempelhof airport?

As yet, the final step of directly locking in Russian energy supplies, large parts of which go to German consumers, has not been taken, but that would, in the short term, be very costly.

Although high taxes on energy give governments a great incentive to let prices rip, (and demand destruction is great for the climate lobby too), but they are rather less popular at the ballot box.

Interest Rates

Meanwhile Powell remains determined to stay behind the curve on rate rises, it is as if the received wisdom on rates, indeed on Central Bank power, has been quietly ditched, and instead he is hoping inflation burns itself out through demand destruction/supply creation. Well, an interesting experiment, but if that’s the game, as we have predicted for a while, inflation will remain gently smouldering, but rate rises will still be very gradual.

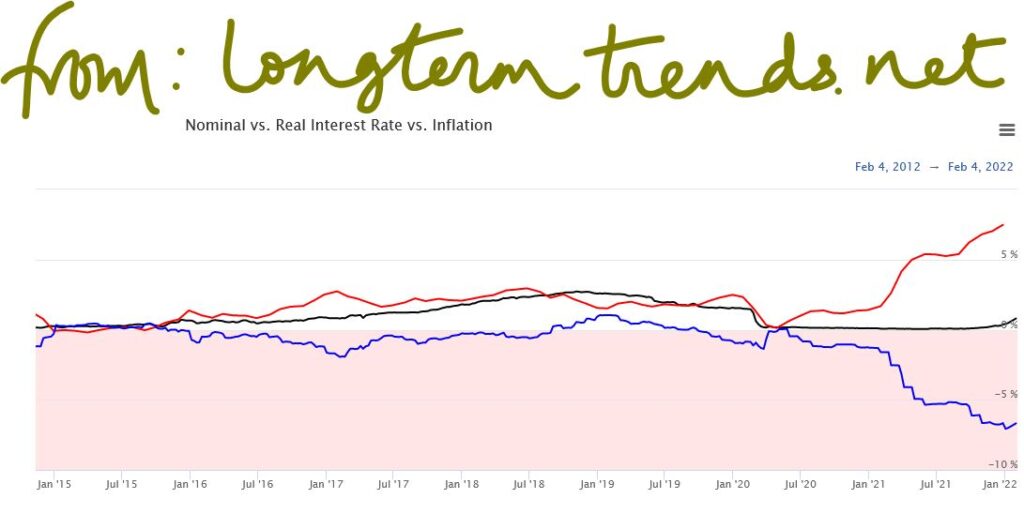

The Fed should have turned off the monetary stimulus and reset to ‘normal’ six months ago, by the time they finally move, it will be a full twelve months late. Real rates are deeply negative, levels not seen in decades, and moving fast, this is really not quarter point stuff.

All of the above implies on-going nominal economic growth, ongoing share price appreciation (at least in nominal terms) and an ongoing reward for borrowing to excess.

But despite the rush to safety currently supporting the US dollar (and US assets) the danger to markets is not just from the noisy, tragic, East but also from experimental monetary policy in the US.

DETONATION OR ROTATION

February 19, 2022inflation,energy,investment markets,Economy,interest rates,USA

Two big market forces are at work just now, one is rotation out of the low interest rate winners, to wherever we go next, the other might be something more spectacular.

Enough of the market still sits in the “don’t know” category, to make everyone uneasy. The VIX is high.

So, what would cause the more explosive outcome? Traditionally higher rates divert more of the profits of indebted companies to banks and bondholders, so the theory goes, reducing dividends. Or at the more extreme level, this also makes refinancing debt harder.

This comes with a ‘second order’ impact, in that consumers or buyers also shovel more towards the banks, less towards the producers.

But none of this seems remotely likely yet, the world is awash with cash, and savings levels and interest rates have barely stirred from their COVID slumber.

Markets seem to be just talking about normalising, not slamming the brakes on.

Will we grow regardless of inflation?

The other big risk would be a failure of non-inflationary growth, which also seems unlikely. There are few practical signs of governments enacting the type of supply side restraint needed, we know. We still look for some self-restraint on how much governments seize in taxation; with high inflation taxes should be being cut, or thresholds systematically raised, but that’s also not happening.

The ‘idiot populace’ as curated by the media, constantly wants more supply side restrictions, greater consumption and lower prices, as if this was all somehow available; it is not. The worry here is that governments having messed up the big issues, give way to yet more populist demands for the impossible. At the same time, markets are also getting a little less keen to finance such nonsense or, being markets, raising the price at which they do so.

Well, all that is possibly true and has been happening for a while, but the old theory was that innovation was too fleet footed for any of that stuff to matter much. This is getting a bit tired, but broadly still seems to hold.

What if Ukraine does erupt?

So, the third detonator is in Vlad’s hands. Is a reverse Barbarossa coming down an autobahn near you? Well let’s assume yes, because he’s finally lost it. It is still fairly clear that if he steps onto NATO territory his army is in trouble, US and NATO airpower will rapidly outgun him. So, I discount that. But perhaps Ukraine does indeed end up like Belarus. China will support Putin, so the UN is irrelevant.

Then what? Well, a nation the size of Spain gets locked out of European commerce. Not important. Defence spend goes up? Well, some would say ‘about time’. Germany can decide to burn coal or nuclear or freeze, see previous answer. Come to that, so can we.

Given Russian gas must go somewhere, a bit like Iranian oil, it probably goes to China, which then trades it or cuts back its own Far East imports. Gas as we all know, can’t be stored for any useful length of time. Russia needs the earnings from it, so it will emerge on the market somewhere, at pretty much the current price.

It will be messy, it will create hard choices, but Russia is well on its way to autarky already, it can certainly live without dollars. Is this really a detonator? On its own, I doubt it.

Where is the rotation?

So, we still conclude all this market reaction is rotation, and it is out of overpriced US equities, where Biden created the biggest inflation bubble by far, and where interest rates are rising faster than elsewhere in the OECD. Hence, we see the hazard as mainly still on Wall Street, and to a lesser degree to the US economy. We’re looking at rising rates, a strong dollar, increased detachment from the global economy, and none of it helps earnings, but nothing is catastrophic either. The US (unlike the UK) wisely seized the chance to be energy independent.

But even so, we are not yet that concerned, valuations in the US are still extreme, as many sets of earnings seem to show, once the market looks at forward guidance, it shudders, and prices fall. A lot of built-in growth is needed to get price earnings ratios back down to earth, and that’s what’s being hit just now. To use a forty or fifty times earnings multiple, needs a lot of confidence about the future. That stretched temporal certainty is now lacking.

This is not that unusual for a rotation, but in that case, markets will bounce, and that will suddenly move a lot of funds off the side lines and back in. Where is that process now? Well going back to the Jan 27th low is causing some excitement. But we are not sure even that’s a disaster. Overall, the taking out of that and the October 2021 S&P low, won’t be fun, but the market still had a heck of a run up last year.

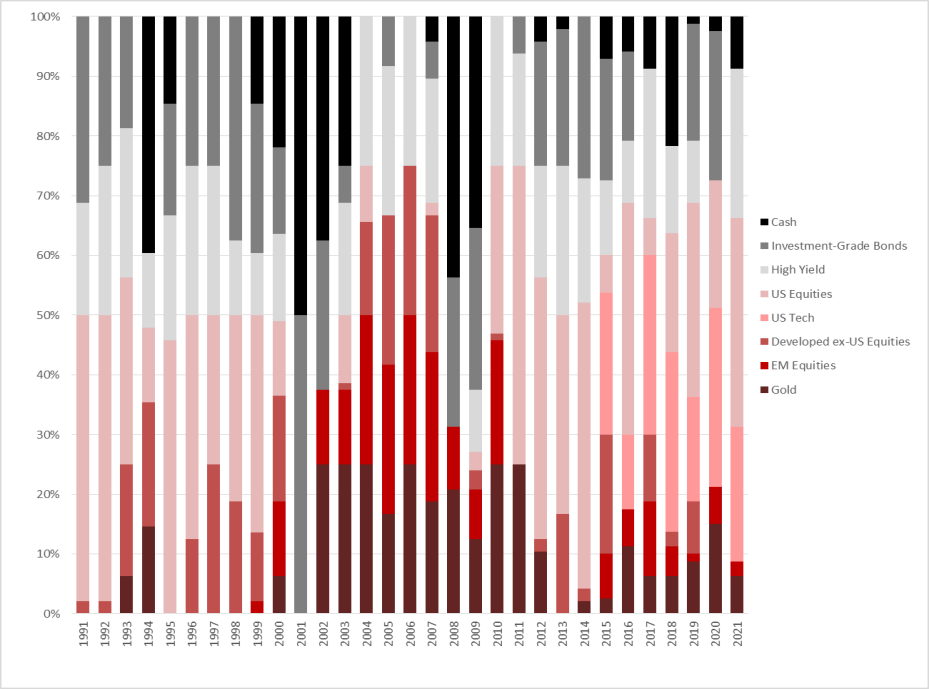

Have a look at where our MonograM investment model allocates funds based on momentum, over the last three decades, the US is absent for significant stretches. We rebalance monthly, the next one will be most interesting.

And inevitably, we do feel cautious too, but it is about levels, not wipe outs. Rotation not detonation.

Charles A R Gillams

Monogram Capital Management Ltd