JENSEITS VON GUT UND BOSE

September 9, 2023valuations,stock markets,interest ratesinterest rates,investment markets,Opinion

We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

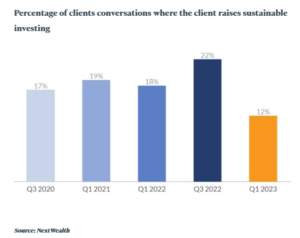

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first - then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

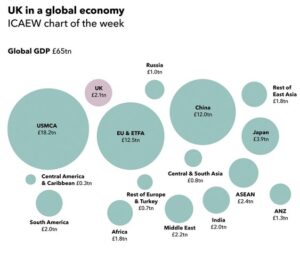

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive - and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

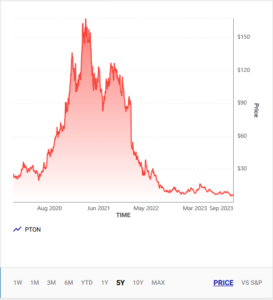

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

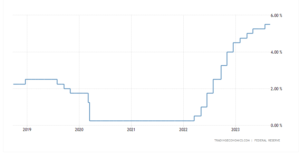

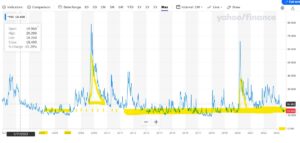

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.

All mimsy were the ‘borrowgoves’

Away from all the shenanigans with base rates and currencies, earnings seem to be showing a pattern. We look at the possibility of an unshackled NatWest and India’s renaissance after the Hindenburg disaster.

START OF EARNINGS SEASON

In so far as reported earnings have a pattern, it reflects the actual position, not the fears of a hidebound analyst community imprisoned by useless economic models. Statistics are not predictive.

There is no recession, whatever all those clever models predicted, never could be one with the extreme fiscal stimulus (quite unlike the private sector fuelled inflationary blow outs of previous downturns), high employment and plenty of liquidity. So, real life earnings are in a purple patch, high and in cases rising demand, with falling or stable costs.

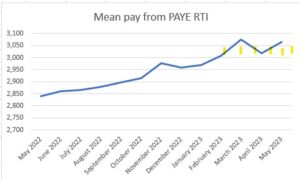

Meanwhile wage costs are perhaps stabilising and the labour supply position seems less frenetic.

In-house graph from published UK Government statistics – real time statistics

But dividends are generally ticking up, a nice bonus to collect when interest rates do start to fall next year, and valuations based on yields look low again.

FLAVEL OF THE MONTH

Nat West really is a sorry tale. The government stupidly sold off the crown jewels at give-away prices, and it now seems to be clinging on to the chaff for no good reason. The dead hand of the state permeates the place, and given the huge interest being paid on the vast national debt, surely a sale of all the government holding is long overdue.

You read the voluminous annual accounts and somewhere about page 180 the PR guff gives way to the reality of declining business lending, a worsening net promoter score and that ultimate civil service fudge, of combining two corporate departments to obfuscate.

Does NatWest actually dislike its customers?

I speak from experience – NatWest seems to dislike small business: we moved the last of our corporate accounts from there this year. Why? In striking contrast to the PR flim-flam that dominates the annual accounts, it seems that making life easy for us, is nowhere on their agenda.

At some point, it was just easier to go than fight – somewhere around the twentieth demand for the same details, and the endless Orwellian (“does not agree with other data”), even after the written confirmation that they were now content; so we quit. Always there was that threat to close the account, but not release our funds, for some arcane procedural reason.

I found the bloated pay packet for the CEO (and CFO) pretty hard to swallow for that performance. It just seems that they don’t attract good staff, and like the slow pacing of caged animals wearing their lives away, those that remain pick away at the residue of their customers.

As for valuation? Nat West would still be cheap, but I felt if it broke above £3.00 (as it did earlier this year) again, on present form – that’s not a terrible exit.

Let’s hope this starts a basic rethink and some real value creation.

RISING IN THE EAST

We noted when the Hindenburg short-selling started in India, and we doubted that it was much more than a clever speculator, despite the sad sight of the neo-colonial British press (and a few Americans) lining up to say “I told you so”.

Friday’s FT was discussing India and still called it “low-growth… dependent on commodities… hampered by political dysfunction and corruption”. Extraordinary – stale, lazy, stereotypical.

The reality is as we predicted: after a pause while stock markets looked for a systemic problem, and the short sellers booked their profits, the Indian market strode on to a new height.

From Tradingeconomics

Not that the biased UK financial press would ever mention that story. Far from the mud hut image they seemingly seek to portray, plenty of IPO (and deal making activity) is showing that India, not Europe is becoming the true challenger in high tech.

The SENSEX started this century at 5,209, the FTSE 100 started at 6,540. The FTSE 100 has made it to 7,694, and the SENSEX? It has powered past to 66,160. One is up some 18% in 23 years, (not enough to even cover advisor and custody costs), the other 1250% in the same time.

No sensible portfolio can have omitted India this century, but the UK press will have worked hard to ensure most UK ones still do.

Well, that’s the half year done, we will resume on the 10th September, expecting markets to be drifting sideways, but that gives plenty of time for the traditional summer bursts of excess or despair.

Although if it is performance you want, getting the big moves right, and the right markets, is far superior to the timing of most individual stocks.

Reserve in Reverse

July 16, 2023inflation,investments,USD-GBP exchange ratesFederal Reserve,investment markets,Economy,USA

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).

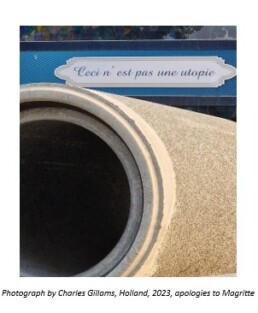

It is Not a Pipe

July 2, 2023interest rates,UK,Economy,Debt

A long view this time : Has the price of capital changed for good? How bad is the UK position? Oh, and the unusual universality of colonialism.

A Far Off Galaxy

Let’s start with colonialism. I have been reading about the benighted past of Bulgaria (R.J. Crampton, 2nd Ed, CUP). A Bulgarian I know said that the country ‘has a knack for picking the wrong side’ - a little harsh, I thought. However, it has always existed as a colony, aside from a brief imperial phase around the last millennium but one, and before that when it equated to Thrace, almost as far back again.

Given the option, Bulgaria recently opted to join the Western European empires’ current formulation as the EU and NATO - the latter being the armed wing of Western thought. Bulgaria had suffered horribly under the Soviets, with a steady and ruthless coercion of an existing multiparty democracy, at a speed just enough to keep outsiders ignorant, or if not, passive.

That history gives me a whole new viewpoint, on the string of broadly similar states. The Balkans and The Middle East all appear in a new light, and indeed I start to comprehend the bitter sideshows (as they seem now) in both World Wars, over that same terrain.

The collapsing empires (Russian, Ottoman, Roman,) seem more influential than the current rulers in so many former colonial states. They are really not, as we think now, a series of nations fighting for ‘independence’. In most cases that independence is fragile to the point of being mythical, while the internal fissures are enduring. The cracks of nations within empires, not of states within a world.

Now You See It

One passage in Crampton’s work stood out “by mid-summer social and industrial unrest were widespread with strikes by civil servants. On transport networks, and despite the provisions of the law, in the ports and medical services. The government was forced to grant a 26% wage increase to all state employees, an action which weakened its attempts to control the budget deficit and inflation and which did little to impress the international financial organisations.”

Written about conditions just before another wrenching Balkan realignment last century, this rather made me stop and reflect.

A parallel with the UK?

Just how close are we in the UK to that edge? Lost in a warm feeling for individual strikers and their causes, and a very British willingness just to plough on, there still seems to be a real danger.

I am well aware of our great national strengths, in the arts, our language, higher education, science, heritage, even logistics and retailing - they are enduring causes for optimism. But long-term investors need to weigh up the recent damage, especially the loss of political capital by the “responsible” right, the high levels of debt and taxation, which coupled with low productivity, could also spell trouble, the certainty of ongoing nationalism and the unhealed rift of Brexit.

There is danger too in the probability of a Labour government, which however centrist the leader is, will have left wing factions to assuage. It is equally dangerous to continue our recent experience of minimal ministerial experience. I hope the change won’t be as bad as I fear, but it will probably be worse than I hope.

This remains a reason for the FTSE to be anchored to late 20th Century levels, despite almost every stock I research looking cheap. The fear of being still cheaper tomorrow rules.

Do Markets Care?

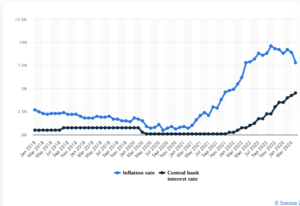

On the other hand, re-pricing capitalism after the decade of populist nonsense by central bankers does feel pretty good. If you have no cost of money and no reward for savers, financial gambling prevails.

All of this raises a key issue: is the apparent resurgence of speculation (the greater fool theory of investing) permanent? In which case investors should probably just watch momentum. Or is this most recent re-run of the last decade’s speculative phase, really transient?

For a better view, see this page on Statista

As long as inflation exceeds the cost of money, assets will likely rise; the widespread return of real interest rates (a point we are almost at) should slow that down.

After that point what matters is cash flow, and whereas gambling will favour growth stocks, real returns come about when interest rates are high, but inflation is also falling. The gap matters and we are not there yet.

This is probably the crux of the next two years, and we doubt that having had a serene and slow drift towards recession, there is any reason either to expect a suddenly faster descent now, or really to expect the corollary, a sudden fall in interest rates, to offset a deep recession.

If rates stay high, but have indeed peaked and inflation declines, value investors should be in a better place. If they get it wrong, they are at least paid to wait.

As we have seen in the last twelve months, growth investors fuelled by borrowed money really do need a rising market, they get hit twice if it falls: both through a loss of capital and then the need to fund loss-making assets at real rates.

The Monogram View

Overall, our position has been that fundamentals should win, but we suspect momentum will win. Spotting the next momentum shift early, therefore remains a powerful driver of returns.

One narrative of 2023 (so far) is that the SVB crisis and stronger growth combined led to far more liquidity than markets expected. This fed into the gambling stocks, giving them momentum.

So, although the first half was not what we expected, the second half might still be. But it is just one narrative, and it may still be the wrong one.

Note : Further reading, for those interested in Bulgaria :

See also, The Bogomils: A Study in Balkan Neo-Manichaeism, Obolensky, Dmitri.

Skipping along

June 16, 2023UK government policy,banks,interest rates,monogram modelOpinion,Economy,inflation,interest rates,Central Banks

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).