Blowing through the Jasmine

November 19, 2023regulation,Economy,energy

What is happening in the offshore wind market? Come to that what is happening in the onshore hurricane blowing round Westminster? And even after this market rally, arriving much as we expected last time, what should we still worry about? Valuations, recessions and inflation, all matter even if rate rises don't now.

A Feeling of Unreality in Westminster

One year in, Rishi looks incompetent and chaotically inconsistent. I simply can't explain Cameron's grinning re-emergence, it feels like a bad dream or worse joke. I hope he could never be selected again as an MP, after his murky financial dealings. The House of Lords is clearly less constrained. The arrogant indifference and heavy taint of sleaze can't be in the interest of voters.

There is a feel of an echo chamber inside Downing Street, of a puppet leader being strung along by unseen forces. Just last month the whole theme of the Party Conference was a fresh start, the last thirty years were apparently rubbish. Then we have this.

To the country and investors, it does not matter, although a half-awake opposition, or slew of oppositions, will be desirable in future; even if opposition politics is now easiest if you just wait for the other side to foul up and social media to rip them apart.

Zero-carbon? Can't Do it Yesterday?

A lot of notable recent shifts in the offshore wind sector, not surprisingly, as with so many zero carbon panaceas and the rush to do it all yesterday, the wheels are starting to come off. It is nothing like as cheap, or job creating, as the green zealots claimed or hoped. Protectionism is not helping either.

As Platts shows, for September, the more you make, the lower the price, just like real farming. UK offshore wind power is the least desirable in the entire European market.

Nothing wrong with the idea of offshore wind, and experts like SSE in the UK do well on big arrays in shallow waters, planned slowly, at least so far. Although even those are pricey and tend to need massive connecting grid structures.

Both Siemens and Orsted, to a degree newer entrants (at least compared to SSE), have taken a battering. Siemens had acquired a Spanish maker, but during the COVID fall out something came adrift, and it has hit big capacity and quality problems, resulting in billions in write offs – now it is restructuring – with a € 7BN subsidy from a group of banks. Heavy rotating machinery is always engineering hell; sticking it up a windy pole in salt water, is never that wise.

Orsted, the Danish developer, lopped 50% off its share price after ditching projects off Rhode Island and New Jersey - further billions written off. The idea you can put these things up off rocky coasts in areas of strong ocean currents and loads of shipping is quite interesting (and very New York, form over substance).

What torpedoed those projects was funding. The political desire for easy answers to high energy consumption made for poor outcomes (as ever), if everyone rushes to do it all at once, you simply create a cost bubble.

The single unit cost is never the same as for a thousand units; scaling up is always the tough part of any new technology.

Orsted share price - sourced from Yahoo finance - sharp focus on data

So, while Xi and Biden proclaim they will still save the planet, Biden rhetoric meets cost inflation once again, and cost inflation (and higher energy prices, a speciality of his) wins. Toss in protectionism, so that a Danish company is disqualified from his WTO busting subsidies, and the numbers no longer worked.

The Germans meanwhile find their own green funding trick ruled out by their own Constitutional Court, it involved taking a pre COVID funds surplus, and applying COVID emergency rules (on excessive deficit funding) and then spending it all post COVID. Isn't it odd that didn't really work? All three parts seem wrong.

Finally, the UK got no takers for this year's wind farm licences, as the guaranteed power price was too low. Next year the price has shot up, again guaranteeing higher energy prices for UK consumers (and industry) in the process.

Recession, Inflation and Valuations

Of the trio of recession, inflation and valuation, each investor has a particular fear. To me the nasty one remains inflation, and its friend rationing and stagnation. A lot simply can no longer be done. So that the modern solution (see above) of just throwing more money at it, from higher taxation and debt is largely pointless. Indeed, any farmer knows if you quadruple the inputs, it is still quite easy to halve the outputs.

We are deep into public service rationing now; we don't call it that, but persistent planned under delivery is rationing.

So, service sector inflation with declining 'outputs', is the issue. And that's the funny number 'outputs' we still record in GDP, so turning up, and being paid is an output, even if nothing (increasingly the case, both on turning up and doing anything) is actually done.

Recession? Well, I guess so, basic logic still says it must arrive some time; yet I still don't see big credit defaults or strain and a cooling labour market is clearly beneficial anyway.

And finally, valuations, well nearly everything looks cheap, outside big cap tech in the US, which somehow always feels pricey.

As rates fall through 2024, and funds flow out of cash and fixed interest, and M&A picks up, valuations still appear attractive. Albeit 2024 will (once more) be politically rather interesting.

Still, we could end up with some big questions answered and indeed big characters finally, finally, leaving the stage.

Maybe a summer breeze does lie ahead.

Charles Gillams

19-11-23

Stop Making Sense

November 5, 2023interest rates,Opinion,Greece

The benign Powell’s fireside chat has left us all very happy, while I have been pondering the Yanis Varoufakis saga from afar. So how did Greece survive the doom and gloom after the Euro crisis?

An apposite topic, as high state debt, unproductive spending, and uncertain or burdensome credit, pretty much all over the West, apparently beckons once more.

The Song of Chairman Powell

We start with Chairman Powell in his recent Q&A: he could hardly have been nicer, the equity markets loved him, the bond markets sweetly retreated, and the dollar fell away.

It was not so much the repetition of ‘data dependent’, a seemingly meaningless phrase, or the deft swerves around repeated questions about the path of rates.

It was more the extra lengths he went to, to dismiss the data outliers, particularly on much faster GDP growth (4.9%) in the US economy, for Q3 and the sharp upward shift in longer term inflation expectations. The bond markets had found both metrics spooky.

The GDP number was dismissed, rather airily, as related to strong consumption, which in turn was linked to high employment and rising real wages on the one side, but more importantly to COVID savings balances. Although he admitted no one really knew what these were, but somehow, they were still contributing.

The inflation expectations got dissed even faster: Powell thought it an outlier, more recent data was far more consistent. Suddenly the evil portents were gone.

It would be wrong to think he knows what he is talking about (why start now?) but right, to know how he is feeling; that’s it. Sure, he keeps the rate rise out in the open, like an old dog, but the chain is lax and rusted, the beast benign.

It would take a lot to make the US raise rates again and he was happy with tighter monetary policies. Even nicer for the long end, while Powell is not sure where the “neutral” funds rate was (who is?), it was certainly a lot lower than where we are now. You might even choose to quantify a gesture; I’d say his was in the 3% area.

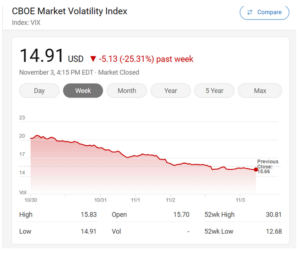

So, I feel like crisis-driven prices should not really apply. While the VIX? Down 25% in five days. Game over?

Search Results from MSN

Yanis, Right or Wrong?

Politically Yanis got lured by the old trap of supporting a party without a history, after sudden promotion, as a technocrat.

A rookie error.

But how does History see the Global Financial Crisis?

I looked at GDP from 2007 to 2022, for Bulgaria, Greece, France, Germany, UK, and the US. Here is the World Bank Chart of GDP growth rates. You can see Greece tumble out of the bundle, but it was also gathered back in, quite fast.

By 2007 the Eurozone was apparently out of control, spending was too high, it needed debt write downs, balanced budgets, selective privatisations and a war on tax evasion.

And Yanis felt Greece was being unfairly picked on to trial that medicine.

Size Counts

So, it is perhaps more instructive to look at levels, not growth rates. Here the damage is clearer, Greece has a GDP still substantially below the 2006 level. Bulgaria a neighbouring Balkan state, has doubled (and more) in the time. So Yanis has a point there.

Elsewhere France grew a shade faster than the UK, but from a slightly smaller base, so really little change.

But the US added almost twelve trillion dollars to its economy, which is like bolting on a new economy the size of the UK, France, Germany and Italy in just two decades.

We could adjust for currencies, population, different data points, calculation bases, of course and it is non-linear, inevitably. But we are looking big picture here.

Was The Left Right?

Gordon Brown was quite keen on the Yanis theory, and to some extent that adoration survived the subsequent dilettante Tory rule. Seizing big banks, attacking tax evasion at any cost, and aiming to balance budgets (Yanis was big on the primary surplus then) all crept into UK policy. The first two are oddly very non-Tory, especially when used to destroy economic growth by over-regulation. The third is quite sensible by comparison, but it was ignored.

Greece has since taken its medicine, with a steady swing to the Centre Right. Yanis finally lost his seat (for his new party) early this summer.

If the pain was indeed all inflicted to help the struggling IMF, no one told the US. If it was all done to save the Euro, I ask myself why did France go nowhere fast? It didn’t obviously hurt other Eastern European countries.

So, Greece remains an outlier, vastly reduced in wealth by the whole episode. It saved the Euro; it did not save Greece.

Where Next?

In the end, all national budgets work better with a growing economy, and in the long term that is essential. Flat or declining economies are the real crisis, especially without flat or declining state spending.

My highly selective period – (2007 being the pre-crash high) finds considerable upsides in both Trump and Biden’s expansion and in Obama’s reconstruction.

While if you need to know why the US stock market dominates in that period after the GFC, it is because GDP growth was twice that of Germany, and on course to double from 2007 quite soon.

Elephants can’t dance, they say, but when they do, the world shakes.

Insert Media here

Although Yanis, indeed has stopped making sense.

Charles Gillams

4.11.23

Not what it seems?

October 22, 2023Technology sector,China,Property

Housing, China and Big Tech – all are regarded as ‘un-investable’ - ending last year the above three sectors were all under a cloud, but one broke free, why?

Plus, Powell scares the market by thinking too loudly.

HOUSE PRICES

Well let’s start with housing. UK residential property prices are holding up fairly well given the magnitude of rate rises, while UK housebuilder share prices look fairly awful. There is a confusing mix of income and capital issues to examine.

Housing itself holds up well – many reasons: demand of course, high levels of employment, heavy net migration and the normal new household formation provide a base demand level well above new build levels. At a time when it is unattractive to fund speculative new build (so units not pre-sold before commencement) because of finance charges, and with a planning system that is both over prescriptive and under resourced, supply will stay slow.

So, the logic of fairly steady prices for existing housing stock holds, buyers will need more cash, but with (in real terms) falling house prices, that can be done. It moves funds from (largely UK) borrowers to (largely UK) savers, but leaves total disposal income in the country (after HMRC takes a cut) largely unaltered.

While rising rentals, reflecting pent up demand and the pressure on debt funded landlords, adds to new build demand and provokes more supply at the institutional level, at least. So, we don’t see a price crash (however desirable in some areas) at these levels.

So why then are housebuilders so disliked? Sales of houses will indeed slow, so reducing dividend cover, but the core business itself is fine and the capital value holds steady, albeit discounted by more.

CHINA TRAPS

China? Here we have almost the same issue, fundamentally sound, but politically hard to justify investment. That taint spreads to companies that sell into China too. It is very hard to ignore this vast market, and the undoubted speed of innovation and high productivity of a command economy. When so many other places fall back, China is tempting.

China has the size, finance skills and levers to deliberately act counter-cyclically, stepping out of sync with the global economy. So (on that narrative) it has ducked the blight of post COVID reopening inflation, by a deliberately slow exit, stockpiling commodities, and then stepping out of the market to defuse price spikes.

Arguably even with foreign capital, it was happy to load up when it was cheap with few restrictions, on both equity and debt, but equally happy to step back when prices and restrictions start to apply. Choice or circumstance? In an opaque system who really knows. . . But a China slowdown is not the same in type or duration as a free market one.

Like housebuilders it remains uninvestable, but for all that, there is value.

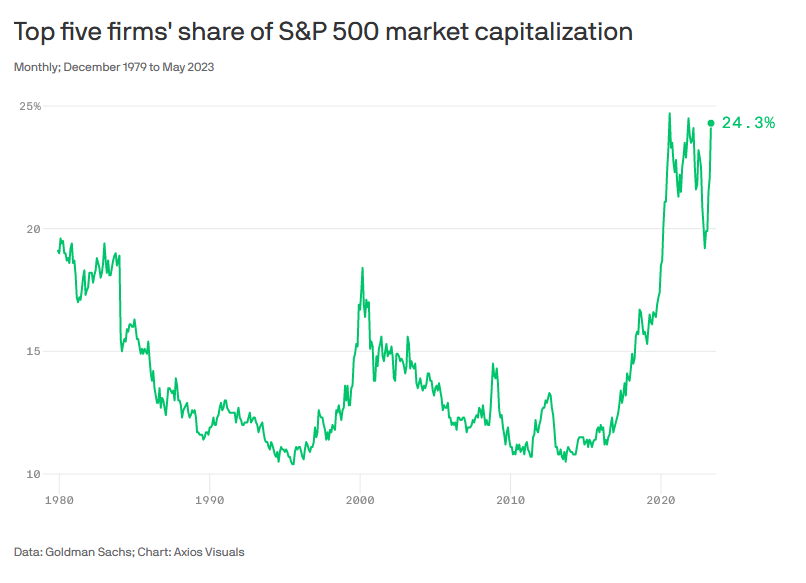

MEGA CAP VALUATIONS

So, to the third of the trinity, large cap tech. These are all US based, highly profitable, with not a lot of debt, but typically appear overvalued. In the old free money days, fast growing tech was enough, so the layer just below, also profitable, simply fed off the reflected glory of the mega caps, and so on all the way down to the start-ups and chronic loss makers. That link has broken, values are now about both size and sector. This is odd. Normally if you broke (say) Microsoft into ten equal parts the total value would go up. This year suggests it would now fall.

So, what are investors doing, if they are ignoring fundamentals? It seems the cash generating highly liquid stocks do enjoy excess market demand in tough times. Some of it is momentum following, some is a falling share count, but mainly it seems investors just really like the name recognition and deep liquidity, to trade the market.

From this website.

If so, it may be dangerous to write this group off. In a market going sideways they provide the price action, and it seems they are so big, so well entrenched and global, that the typical stock specific risk can almost be ignored. You need to be nimble; they fell hard in 2022, but their dominant recovery this year, providing nearly all of global equity performance might be the true reversion to the mean, rather than their sudden collapse when everything was being sold off last year. But that process does guarantee future volatility for them too, and history suggests it will not last.

DECLINE AND FAIL

We have nothing to add on what seems a be a new set of forever wars, beyond sadness and dismay. While whoever wins the 2024 elections on either side of the Atlantic, will be forced to do an “Erdogan turn”, or 360 spin. This could happen fairly soon after the polls close.

WHAT POWELL SAID

The markets seem not to like Jerome Powell’s musings on the vast range of things he does not know, at The Economic Club in New York this week. Does his calendar suddenly show his exit date, albeit over two years away? You could almost hear the soft polish of his resume to concede errors and some failed guesses. He even, twice, called US fiscal policy “unsustainable” although he was careful to say that was not now, but only in the future (after he’s left office that is.)

But the long run neutral rate? No idea. The Philipps Curve? No idea. Interest rate transmission rates? No idea. That’s not new, though - it is pretty much what “Data Dependent” always has meant, and markets were previously fine with that.

We will know soon enough, if rates are still rising globally. It certainly makes markets jittery, especially on Friday afternoons.

Sweet Dreams

October 7, 2023uk tax,inflation,central banks,UK government policy,inflation modelsCentral Banks,inflation,interest rates,Opinion,UK Politics

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

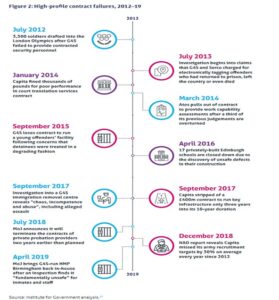

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

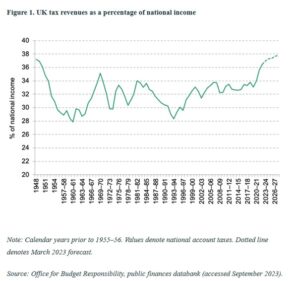

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

By their works . . .

September 24, 2023economy,valuations,opinion,USD-GBP exchange ratesIndia,Federal Reserve,investment markets,inflation

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

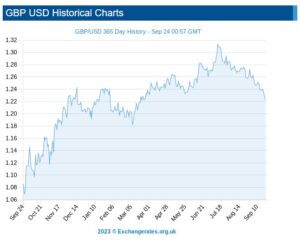

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?